Managed Security Services (MSS) Market Size 2024-2028

The managed security services (MSS) market size is valued to increase USD 33.86 billion, at a CAGR of 13.87% from 2023 to 2028. Increase in adoption of cloud-based services will drive the managed security services (mss) market.

Major Market Trends & Insights

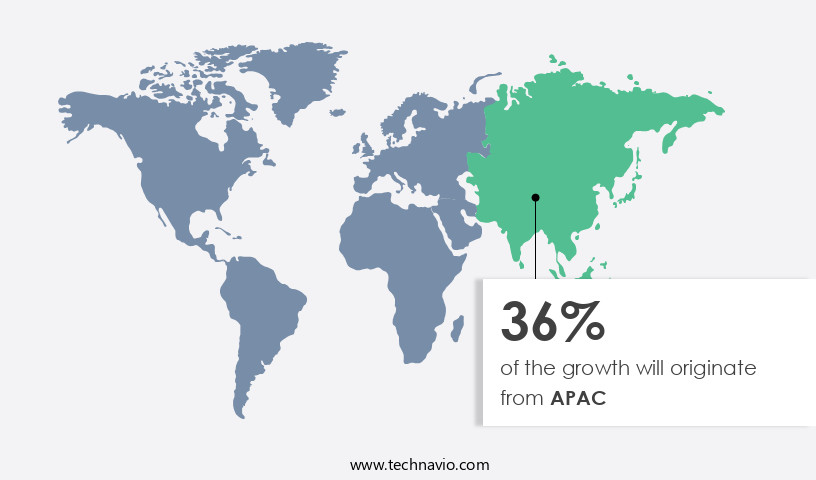

- APAC dominated the market and accounted for a 36% growth during the forecast period.

- By End-user - SMEs segment was valued at USD 14.03 billion in 2022

- By Deployment - Cloud-based segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 205.85 million

- Market Future Opportunities: USD 33860.20 million

- CAGR from 2023 to 2028 : 13.87%

Market Summary

- The market represents a dynamic and continually evolving landscape, underpinned by advancements in core technologies and applications. With the increasing adoption of cloud-based services, the market has witnessed a significant shift towards remote management and automation. According to recent studies, cloud-based MSS is projected to account for over 35% of the total MSS market share by 2025. Service providers are increasingly incorporating predictive analytics into their offerings, enabling proactive threat detection and response. This trend is driven by the growing complexity of cyber threats and the need for real-time threat intelligence. However, the implementation of managed security services comes with its own set of challenges.

- Reports suggest that up to 25% of MSS engagements experience some form of failure during implementation, highlighting the importance of effective project management and company selection. Regulations such as GDPR and HIPAA continue to shape the market, driving demand for robust security solutions. In the Asia Pacific region, countries like China and India are expected to contribute significantly to the growth of the MSS market due to their increasing digitalization and rising cybersecurity concerns. As the market continues to unfold, stakeholders must stay informed of the latest trends, challenges, and opportunities to make informed business decisions.

What will be the Size of the Managed Security Services (MSS) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Managed Security Services (MSS) Market Segmented ?

The managed security services (mss) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- SMEs

- Large enterprises

- Deployment

- Cloud-based

- On-premises

- Service Type

- Managed Firewall

- Managed Intrusion Detection/Prevention Systems (IDP/IPS)

- Managed Endpoint Security

- Managed Threat Detection and Response (MDR)

- Managed Security Information and Event Management (SIEM)

- Vulnerability Management

- Managed Compliance Services

- Identity and Access Management (IAM)

- Managed Antivirus/Anti-Malware

- Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Data Security

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The SMEs segment is estimated to witness significant growth during the forecast period.

Managed Security Services (MSS) have gained significant traction among Small and Medium Enterprises (SMEs) due to escalating cyber threats, including DDoS and ransomware attacks. These incidents can disrupt SMEs' businesses, causing severe consequences. Consequently, SMEs are increasingly turning to MSS providers to mitigate these risks. Complex cybersecurity landscapes and the growing use of Internet of Things (IoT) devices further fuel the demand for MSS. However, SMEs often grapple with budget constraints, making it challenging for them to establish in-house IT security infrastructure. According to recent studies, around 40% of SMEs have experienced a cyberattack in the past year.

Meanwhile, the managed security services market is projected to expand by 25% in the upcoming year. Furthermore, the penetration of MSS in the SME sector is expected to reach 35% by 2025. Key components of MSS include security architecture, multi-factor authentication, threat intelligence, threat modeling, business continuity, patch management, security operations center, security auditing, security metrics, risk assessment, access control, penetration testing, zero trust security, data encryption, intrusion detection system, incident response, network security monitoring, compliance management, security awareness training, data loss prevention, vulnerability scanning, data backup, disaster recovery, vulnerability management, security monitoring, and system hardening.

In conclusion, the ongoing threat landscape and the growing complexities of cybersecurity are driving SMEs to adopt managed security services. The market for these services is poised for substantial growth, with a projected expansion of 25% in the upcoming year. SMEs represent a significant market opportunity for MSS providers, as their penetration in this sector is expected to reach 35% by 2025.

The SMEs segment was valued at USD 14.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Managed Security Services (MSS) Market Demand is Rising in APAC Request Free Sample

The North American region dominates the global managed security services market, fueled by the escalating number of cyber threats against enterprise data. Compliance with government regulations, particularly in Canada and the US, is another significant factor driving market expansion. Despite this growth, the market's expansion rate in North America is projected to decrease due to market saturation, as many organizations in the region have already adopted managed security services.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of offerings designed to help organizations fortify their cybersecurity posture. These services span Soc as a Service capabilities, Security Information and Event Management (SIEM) systems, Vulnerability Assessment and Remediation, Incident Response Planning and Execution, Threat Intelligence Platform integration, Data Loss Prevention best practices, Endpoint Detection and Response solutions, Security Awareness Training Programs design, Cloud Security Posture Management tools, Security Orchestration Automation and Response platforms, Zero Trust Security Architecture implementation, Identity and Access Management solutions, Data Encryption methods and standards, Multi-Factor Authentication implementation, Access Control Management systems, Vulnerability Scanning tools and techniques, Security Metrics and Reporting, Threat Modeling methodologies, and Security Architecture Design principles.

One notable trend in the MSS market is the increasing focus on advanced security solutions. For instance, the adoption of Security Orchestration Automation and Response (SOAR) platforms has seen significant growth, with these tools enabling organizations to streamline their security operations and respond more effectively to threats. In fact, studies suggest that over 70% of enterprises have already adopted or plan to adopt SOAR solutions in the next two years, marking a substantial shift in the security landscape. Moreover, the importance of Zero Trust Security Architecture has gained considerable traction, as organizations recognize the need to minimize the attack surface and protect against insider threats.

Implementing Zero Trust Security Architecture involves strict access control policies, continuous verification of user identity, and the segregation of networks and applications. By 2025, it is projected that over 60% of large enterprises will have adopted Zero Trust Security Architecture, underscoring its growing significance. Another critical aspect of the MSS market is the continuous evolution of threat intelligence and incident response capabilities. With cyber threats becoming increasingly sophisticated, organizations require real-time threat intelligence and the ability to respond effectively to incidents. In this regard, MSS providers are investing heavily in advanced threat intelligence platforms and incident response services to help clients stay ahead of emerging threats and minimize the impact of breaches.

In summary, the MSS market is witnessing robust growth, driven by the increasing adoption of advanced security solutions such as SOAR platforms, Zero Trust Security Architecture, and threat intelligence services. These trends reflect the evolving cybersecurity landscape and the growing recognition of the need for comprehensive, proactive security measures.

What are the key market drivers leading to the rise in the adoption of Managed Security Services (MSS) Industry?

- The significant rise in the adoption of cloud-based services serves as the primary growth driver for the market.

- Enterprises are confronted with the expanding population of mobile workers and remote teams, who require access to identity and access management (IAM) systems and private networks. Simultaneously, the escalating occurrences of data breaches and fraud incidents, coupled with concerns over VPNs, email security, and web services, propel enterprises towards managed security services. The proliferation of cloud computing and the management of vast data volumes are trends prevalent among both large corporations and small to medium-sized enterprises (SMEs).

- Consequently, enterprises prioritize information security. However, the intricacy of implementing security infrastructure in-house and the ensuing maintenance costs pose challenges.

What are the market trends shaping the Managed Security Services (MSS) Industry?

- The integration of predictive analytics is becoming a mandatory trend in managed security services. This approach enhances security capabilities by utilizing advanced data analysis techniques to anticipate potential threats and vulnerabilities.

- Predictive analytics plays a pivotal role in managed security services by employing statistical algorithms, data mining, artificial intelligence, and machine learning to anticipate unforeseen threats. This proactive approach enables real-time analysis of potential security risks, allowing enterprises to take preventive measures against advanced malware and cyberattacks. companies offering managed security services must collect, correlate, and analyze data from diverse sources to generate valuable insights for their clients. Predictive analytics transforms raw data into actionable information, empowering enterprises to make informed decisions in a security context. The importance of predictive analytics in managed security services is evident from its continuous application across various sectors.

- Its ability to provide early warnings about potential threats makes it an indispensable tool for businesses seeking to protect their digital assets. Predictive analytics enhances threat detection capabilities by analyzing patterns and trends in data, offering insights into emerging threats and vulnerabilities. This data-driven approach enables managed security service providers to offer customized solutions tailored to their clients' unique needs. In conclusion, predictive analytics is a game-changer in managed security services, providing an effective solution for detecting and mitigating advanced threats in real-time. Its ability to analyze data from multiple sources and generate actionable insights makes it an essential tool for businesses seeking to fortify their cybersecurity posture.

What challenges does the Managed Security Services (MSS) Industry face during its growth?

- The implementation of managed security services is beset by significant challenges, with a high risk of failure being a major impediment to the industry's growth.

- The implementation phase in the managed security services market is a critical yet challenging process that can hinder growth due to the risk of failures. Prospective clients' skepticism towards managed security services may lead them to prefer traditional security solutions. Implementation is a multifaceted process that involves various tasks, such as project management, vulnerability management, compliance, content management, event monitoring, access management, and managed devices. During the planning stage, Managed Security Service Providers (MSSPs) must determine the necessary devices, their placement in the client's infrastructure, and proper configuration. The complexity of implementation necessitates meticulous execution.

- A single misstep can lead to significant issues, such as security vulnerabilities or operational inefficiencies. Moreover, the implementation process can take an extended period, as it involves various interconnected tasks. For instance, vulnerability management requires continuous assessment and remediation, while compliance involves adhering to industry regulations and standards. To mitigate implementation risks and ensure a smooth transition, MSSPs must adopt a structured approach. This includes thorough planning, clear communication, and robust project management. By addressing potential challenges proactively and maintaining transparency with clients, MSSPs can build trust and confidence in their services. In conclusion, the implementation phase in the managed security services market presents both opportunities and challenges.

- While it can be a significant growth inhibitor due to the risk of failures, a structured approach can help mitigate risks and ensure a successful transition for clients.

Exclusive Technavio Analysis on Customer Landscape

The managed security services (mss) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the managed security services (mss) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Managed Security Services (MSS) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, managed security services (mss) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture Plc - This company specializes in managed security services, including the Accenture Managed Secure Cloud Foundation solution, providing clients with advanced cybersecurity protection and threat mitigation strategies. The solution ensures robust security for cloud environments, enabling businesses to focus on core operations with peace of mind.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- AT and T Inc.

- Atos SE

- Capgemini Service SAS

- CrowdStrike Holdings Inc.

- Dell Technologies Inc.

- DXC Technology Co.

- F5 Inc.

- Fortra LLC

- Furukawa Electric Co. Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Kroll LLC

- Kudelski SA

- Kyndryl Inc.

- Lumen Technologies Inc.

- Nippon Telegraph And Telephone Corp.

- Orange Cyberdefense SA

- ProSOC Inc.

- Singapore Telecommunications Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Managed Security Services (MSS) Market

- In January 2024, IBM Security announced the acquisition of Reason Software, a leading threat intelligence and incident response company, to enhance its Managed Security Services portfolio. This acquisition aimed to strengthen IBM's ability to help clients respond effectively to advanced cyber threats (IBM Press Release, 2024).

- In March 2024, Microsoft Corporation unveiled its Azure Sentinel Managed Detection and Response (MDR) service, expanding its Azure Security Center offerings. This new service aimed to provide advanced threat detection and response capabilities to help businesses protect their hybrid cloud environments (Microsoft Tech Community, 2024).

- In May 2024, Cisco Systems and Google Cloud announced a strategic partnership to integrate Cisco's SecureX platform with Google Cloud's security services. This collaboration aimed to provide joint customers with a more comprehensive and integrated security solution (Cisco Press Release, 2024).

- In January 2025, Accenture Security, a leading managed security services provider, announced a significant expansion of its Security Operations Centers (SOCs) in Europe and Asia Pacific. This expansion aimed to help clients in these regions address the growing cybersecurity threats and comply with local data protection regulations (Accenture Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Managed Security Services (MSS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.87% |

|

Market growth 2024-2028 |

USD 33860.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.9 |

|

Key countries |

US, Germany, China, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving landscape of managed security services (MSS), businesses confront a complex array of cybersecurity challenges. This market encompasses a range of offerings, including security architecture, multi-factor authentication, threat intelligence, and more. Security architecture refers to the design and implementation of an organization's security infrastructure. MSS providers help businesses optimize their security architecture, ensuring robust protection against threats. Multi-factor authentication, a critical component of this infrastructure, adds an extra layer of security, reducing the risk of unauthorized access. Threat intelligence and threat modeling are essential for proactive security measures. MSS providers continuously monitor and analyze emerging threats, enabling businesses to respond effectively.

- Business continuity and disaster recovery solutions ensure data protection and system availability, while patch management and vulnerability management keep systems up-to-date and secure. Security operations centers (SOCs) serve as the nerve center for security monitoring and incident response. MSS providers staff these centers with skilled security analysts, providing businesses with round-the-clock protection. Security auditing, risk assessment, access control, and penetration testing are additional services that help businesses identify vulnerabilities and mitigate risks. Zero trust security, data encryption, intrusion detection systems, and compliance management are other key areas where MSS providers add value. They help businesses maintain regulatory compliance, protect sensitive data, and detect and respond to security incidents.

- Security awareness training, data loss prevention, and vulnerability scanning are essential components of a comprehensive security strategy. Network security monitoring, system hardening, and security metrics are crucial for maintaining a strong security posture. MSS providers leverage advanced technologies and expertise to help businesses stay ahead of evolving threats and maintain a competitive edge in the digital landscape.

What are the Key Data Covered in this Managed Security Services (MSS) Market Research and Growth Report?

-

What is the expected growth of the Managed Security Services (MSS) Market between 2024 and 2028?

-

USD 33.86 billion, at a CAGR of 13.87%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (SMEs and Large enterprises), Deployment (Cloud-based and On-premises), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Service Type (Managed Firewall, Managed Intrusion Detection/Prevention Systems (IDP/IPS), Managed Endpoint Security, Managed Threat Detection and Response (MDR), Managed Security Information and Event Management (SIEM), Vulnerability Management, Managed Compliance Services, Identity and Access Management (IAM), Managed Antivirus/Anti-Malware), and Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Others)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in adoption of cloud-based services, Chances of failure during managed security services implementation

-

-

Who are the major players in the Managed Security Services (MSS) Market?

-

Accenture Plc, AT and T Inc., Atos SE, Capgemini Service SAS, CrowdStrike Holdings Inc., Dell Technologies Inc., DXC Technology Co., F5 Inc., Fortra LLC, Furukawa Electric Co. Ltd., Infosys Ltd., International Business Machines Corp., Kroll LLC, Kudelski SA, Kyndryl Inc., Lumen Technologies Inc., Nippon Telegraph And Telephone Corp., Orange Cyberdefense SA, ProSOC Inc., and Singapore Telecommunications Ltd.

-

Market Research Insights

- The market encompasses a range of offerings designed to help organizations fortify their cybersecurity posture. Two significant aspects of this market are log management and security automation. According to industry estimates, the global log management market size is projected to reach USD36.7 billion by 2027, growing at a compound annual growth rate (CAGR) of 14.3% during the forecast period. In contrast, the security automation market is anticipated to reach USD35.8 billion by 2025, expanding at a CAGR of 14.2% over the same timeframe. These figures underscore the importance of these services in the evolving cybersecurity landscape. Log management solutions enable organizations to collect, store, and analyze log data to detect and respond to security threats, while security automation tools streamline repetitive tasks and improve incident response times.

- The integration of Security Information and Event Management (SIEM) systems, firewall management, and security policy enforcement further enhances the value proposition of MSS providers. Other key offerings include data classification, threat hunting, vulnerability remediation, network segmentation, and compliance frameworks, among others. The continuous development and integration of these services underscore the dynamic nature of the MSS market.

We can help! Our analysts can customize this managed security services (mss) market research report to meet your requirements.