MDO-PE Films Market Size 2025-2029

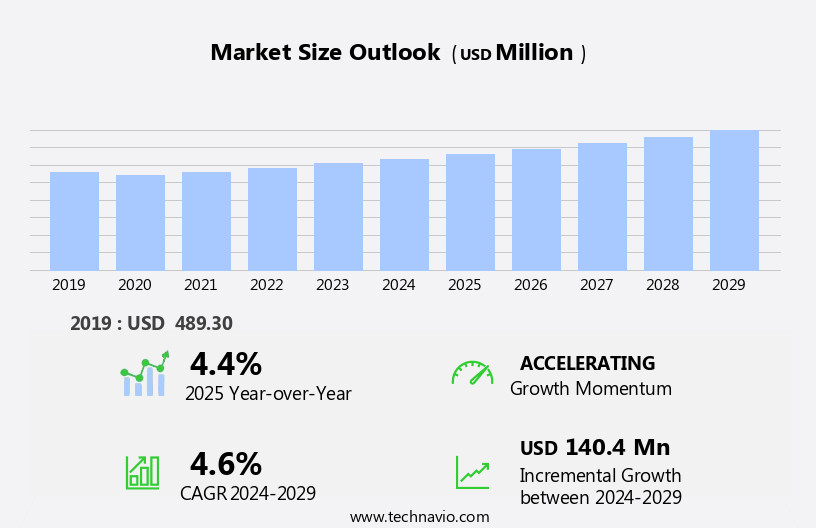

The MDO-PE films market size is forecast to increase by USD 140.4 million, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing consumption of packaging materials in various industries. This trend is particularly evident in the Asia Pacific region, where the number of manufacturers is expanding rapidly. However, market dynamics are not without challenges. Fluctuating crude oil prices pose a significant obstacle, as PE films are derived from petrochemicals. These price fluctuations can impact the cost structure of manufacturers and, in turn, the pricing strategy for their products. As companies navigate this complex market landscape, they must remain agile and responsive to both opportunities and challenges. To capitalize on the growing demand for packaging materials, manufacturers can explore strategic partnerships, innovations in production technology, and diversification into new markets.

- Conversely, to mitigate the impact of crude oil price volatility, they may consider alternative feedstocks, hedging strategies, or supply chain optimization. Overall, the market presents both challenges and opportunities for companies seeking to establish a competitive presence. By staying informed of market trends and proactively addressing challenges, businesses can position themselves for long-term success.

What will be the Size of the MDO-PE Films Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Film properties such as oxygen and high barrier capabilities, gloss, elongation, and seal strength, are paramount in industrial and retail packaging applications. Low barrier films, thickness, and tear strength also play crucial roles in this sector. EU regulations and ISO standards shape the market landscape, influencing film production and application. Flexible packaging, consumer goods, and sustainable packaging are key sectors where MDO-PE films are making a significant impact. The environmental footprint of these films, including carbon footprint, recyclability, and film waste management, is increasingly under scrutiny. Moisture barrier films, cast film extrusion, and circular economy concepts are gaining traction as market trends.

Multilayer films, film lamination, and coating technologies offer enhanced performance and functionality. Film transparency, puncture resistance, and tear strength are essential considerations for various industries, including food safety, medical, and pharmaceutical sectors. Film testing, film quality control, and film regulations ensure product consistency and compliance with FDA and other regulatory bodies. Film width, gauge, and treatment options cater to diverse application requirements. The ongoing development of biodegradable films, compostable films, and aroma barrier films underscores the industry's commitment to innovation and sustainability.

How is this MDO-PE Films Industry segmented?

The mdo-pe films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverages

- Pharmaceuticals

- Cosmetics and personal care

- Homecare

- Others

- Type

- Blown films

- Cast films

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

. By Application Insights

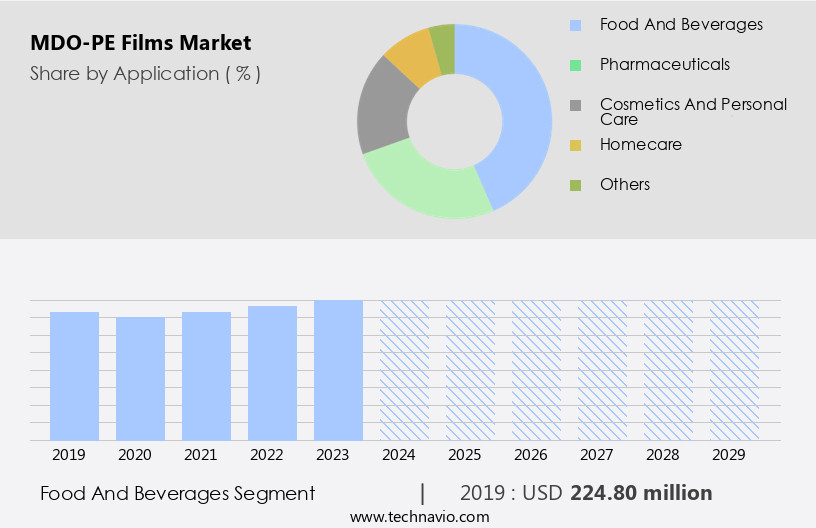

The food and beverages segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for plastic packaging in the global packaged food industry, which was valued at approximately USD3 trillion in 2022. This growth can be attributed to various factors, including the rise in agricultural production, advancements in food processing technology, and changing consumer food consumption patterns in emerging economies such as China and India. MDO-PE films, with their high barrier properties, are increasingly used in food packaging due to their ability to maintain product freshness and enhance aesthetics. These films are also used in industrial and retail packaging applications, such as in the production of ice cream containers and other food products, due to their thermal stability.

The market for MDO-PE films is subject to various regulations and standards, including those set by the EU, ISO, FDA, and ASTM. These regulations ensure food safety and product quality, while also promoting sustainable practices and reducing environmental impact. The circular economy concept is gaining traction in the industry, leading to the development of recyclable films and the implementation of film recycling programs. The market encompasses various types of films, including high and low barrier films, oxygen barrier films, and moisture barrier films. Cast film extrusion and blown film extrusion are the primary manufacturing methods used to produce these films.

Film properties such as elongation, seal strength, thickness, stiffness, color, and flexibility are crucial factors in determining their suitability for various applications. In addition to food packaging, MDO-PE films are used in medical and pharmaceutical packaging, consumer goods packaging, and industrial packaging applications. The market is also witnessing the development of biodegradable and compostable films, as well as films with improved tear strength, puncture resistance, transparency, and film clarity, to meet the evolving needs of various industries. Film testing plays a vital role in ensuring the quality and performance of MDO-PE films. Multilayer films and life cycle assessment are also gaining popularity in the industry, as they offer improved film properties and reduced environmental impact. The market is expected to continue growing, driven by the increasing demand for plastic packaging and the development of innovative film solutions.

The Food and beverages segment was valued at USD 224.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

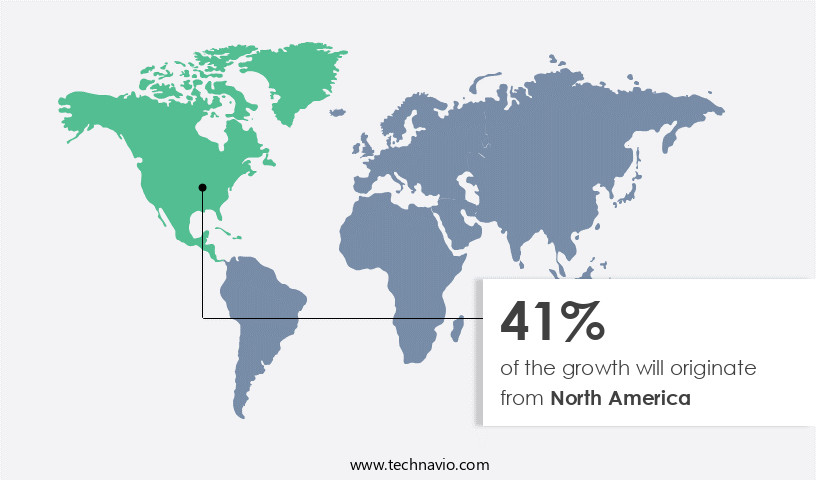

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, where the US and Canada are the major contributors. The region's dominance is driven by the increasing demand for solar installations and the extensive use of MDO-PE films in flexible packaging and insulation for the electrical and electronics industry. The high per capita consumption of packaged goods in the US and Canada compared to other countries is also a significant factor. The market's evolution is largely due to advancements in packaging technology and consumer trends. MDO-PE films offer various benefits, including excellent oxygen and moisture barrier properties, film thickness control, and seal strength.

These films are also essential in medical and pharmaceutical packaging, consumer goods, and industrial applications. Sustainability is a key focus in the market, with an emphasis on recyclable films, circular economy principles, and reducing carbon footprints. The market adheres to stringent regulations, including EU and FDA compliance, as well as ISO and ASTM standards. The market's future looks promising, with ongoing research and development in film technology, including multilayer films, film lamination, and biodegradable films, ensuring the industry remains innovative and responsive to evolving consumer needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of MDO-PE Films Industry?

- The significant rise in the consumption of packaging materials serves as the primary catalyst for market growth.

- MDO-PE films have experienced significant demand due to the increasing importance of product packaging. The packaging industry is the primary consumer of MDO-PE films, and this trend is anticipated to persist during the forecast period. Effective packaging plays a pivotal role in consumer decision-making, as it not only provides essential information about the product but also attracts attention through design and aesthetics.

- Furthermore, MDO-PE films offer benefits such as protection, portability, and reusability, making them an indispensable component in various industries. By enhancing the overall appeal and functionality of packaging, MDO-PE films contribute to the success of the products they encase.

What are the market trends shaping the MDO-PE Films Industry?

- The trend in the Asia-Pacific region is seeing an escalating number of manufacturers emerge. This growth is a significant development in the current market landscape.

- MDO-PE films, a type of plastic packaging material, have gained significant traction due to their excellent oxygen barrier properties. High barrier films, a subset of MDO-PE films, offer superior protection against oxygen and moisture, making them ideal for various applications, including industrial and retail packaging. The market is driven by stringent regulations, such as EU and FDA compliance, which emphasize the need for high-quality film packaging. These regulations require films to meet specific film gloss, film elongation, film seal strength, and film thickness standards. ISO and other industry standards further add to the market's growth.

- The increasing demand for low barrier films, which offer a balance between cost and performance, is also contributing to the market's expansion. The industrial packaging sector is a significant consumer of MDO-PE films due to their ability to protect sensitive products from environmental factors. Despite the challenges posed by supply constraints in Europe, the market is expected to grow due to the establishment of new MDO-PE film production facilities in China. This development will likely reduce production costs and make the product more affordable. APAC, the largest consumer of PE, is expected to continue leading the market due to the growing demand for PE foam materials.

- China, in particular, is a crucial player in this region. The consumption of PE in other regions, such as North America and South America, is also projected to increase during the forecast period. In conclusion, the market is expected to grow due to the increasing demand for high-quality film packaging and the establishment of new production facilities. The market's growth is further driven by the need for compliance with various regulations and the expanding demand from various end-use industries.

What challenges does the MDO-PE Films Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market faces significant challenges due to the volatile prices of crude oil, a key raw material in the production of PE resins used to manufacture these films. The price fluctuations of crude oil are influenced by various factors, including supply and demand, organizational influences, and changes in production costs. This volatility directly impacts the price of PE resins and subsequently, the cost of MDO-PE films. The market's dependence on petroleum-derived raw materials makes it susceptible to price fluctuations, which can affect market growth. The circular economy and sustainability are gaining importance in consumer goods packaging, driving the demand for barrier films, including MDO-PE films.

- These films offer excellent film opacity, film flexibility, film tear strength, and moisture barrier properties, making them ideal for various applications. The market's focus on reducing environmental impact and promoting sustainable packaging solutions is expected to provide significant growth opportunities in the long run. Additionally, advancements in cast film extrusion technology are expected to improve film stiffness and enhance film performance, further boosting market growth.

Exclusive Customer Landscape

The mdo-pe films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mdo-pe films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mdo-pe films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avery Dennison Corp. - The company specializes in providing MDO-PE films for brands and converters aiming to boost the recyclability of rigid high-density polyethylene (HDPE) and flexible polyethylene (PE) plastics. We are the pioneers in offering APR-recognized films for the latter, setting a new standard in sustainable plastic solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avery Dennison Corp.

- Borealis AG

- Camvac Ltd.

- Coveris Management GmbH

- ESTIKO AS

- Lenzing Plastics GmbH and Co KG

- Longdapac

- MJW International

- NOVA Chemicals Corp.

- Novel Inc.

- Nowofol Kunststoffprodukte GmbH and Co. KG

- Plasbel Plasticos S A U

- Polysack Flexible Packaging Ltd.

- Profol GmbH

- RKW SE

- The Dow Chemical Co.

- UAB Umaras

- UPM Kymmene Corp.

- Windmoller and Holscher KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in MDO-PE Films Market

- In February 2023, LyondellBasell, a leading plastics and chemicals company, announced the commercialization of its Metocene PE film technology, which offers improved gas barrier properties and enhanced processability for MDO-PE films. This innovation is expected to cater to the growing demand for sustainable packaging solutions (LyondellBasell Press Release).

- In May 2024, TotalEnergies and Luminescence Technologies, a specialist in high-performance polymers, entered into a strategic collaboration to develop and commercialize advanced MDO-PE films with enhanced optical properties. This partnership aims to address the increasing demand for high-performance films in various industries, including electronics, security, and medical (TotalEnergies Press Release).

- In October 2024, Indorama Ventures, a global chemical producer, completed the acquisition of the MDO-PE films business from SABIC, expanding its portfolio in the high-growth packaging sector. This acquisition is expected to strengthen Indorama Ventures' position in The market and contribute to its revenue growth (Indorama Ventures Press Release).

- In January 2025, the European Union announced the approval of a new regulation on single-use plastics, which includes a ban on certain single-use plastic products, including some types of plastic films. This regulatory development is expected to drive the demand for biodegradable and recyclable MDO-PE films as alternatives to traditional plastic films (European Commission Press Release).

Research Analyst Overview

- The polyethylene (PE) and high-density polyethylene (HDPE) film market exhibits dynamic trends, with film distribution playing a crucial role in delivering these materials to various industries. UV stabilizers and slip agents are essential additives for PE films, enhancing their protective packaging applications and ensuring film durability. Gas permeability and water vapor permeability are key factors influencing film market trends, with low-density polyethylene (LDPE) films offering superior barrier properties in certain applications. Film converting, manufacturing, and supply chain processes are continually evolving, driven by film research and development and the integration of advanced film technology. Film pricing remains a critical consideration, with metallocene polyethylene (MPE) and other specialized film types offering enhanced performance at a premium.

- Film inspection ensures product quality, while antistatic agents mitigate static electricity during film production and application. Film innovation continues to drive growth, with new applications and technologies shaping the future of the PE film industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled MDO-PE Films Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 140.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, China, Japan, India, Germany, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this MDO-PE Films Market Research and Growth Report?

- CAGR of the MDO-PE Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mdo-pe films market growth of industry companies

We can help! Our analysts can customize this mdo-pe films market research report to meet your requirements.