Meat And Poultry Processing Equipment Market Size 2024-2028

The meat and poultry processing equipment market size is forecast to increase by USD 5.34 billion at a CAGR of 5.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the rising awareness of the nutritional benefits of meat and poultry products. Consumers are increasingly seeking out high-quality, nutrient-dense foods, leading to increased demand for advanced processing equipment that can ensure the production of safe and consistent products. Another trend influencing the market is the technological advances in meat and poultry processing equipment. Innovations in automation, robotics, and digitalization are enabling manufacturers to improve efficiency, reduce costs, and enhance product quality. Additionally, the increasing adoption of vegan diets is creating opportunities for alternative protein sources and processing technologies. However, the market also faces several challenges. These include the high initial investment costs for advanced processing equipment, stringent regulatory requirements, and the need for traceability and food safety standards. Despite these challenges, the market is expected to continue growing, driven by the increasing demand for high-quality, nutritious meat and poultry products.

What will be the Size of the Meat And Poultry Processing Equipment Market During the Forecast Period?

- The market encompasses a diverse range of machinery used In the production of various meat and poultry products. Key equipment categories include grinders for minced meat and sausages, bone pieces and tendon processing equipment, and muscle meat processing lines for hamburgers and precooked meat products. Fatty tissues are typically removed using specialized equipment, while poultry slaughtering, de-feathering, de-boning, cut-up, evisceration, tumbling, and marinating equipment are essential for poultry processing. Meat quality is a critical factor, with food-safety and hygiene guidelines strictly enforced to ensure consumer safety. The market's size is significant, driven by increasing meat consumption and the growing popularity of fast food chains and pre-processed poultry products.

- Production capacities continue to expand, with advancements in technology enabling higher throughput and improved efficiency. The market's direction is influenced by poultry type, with broilers and turkeys being the most commonly processed poultry types.

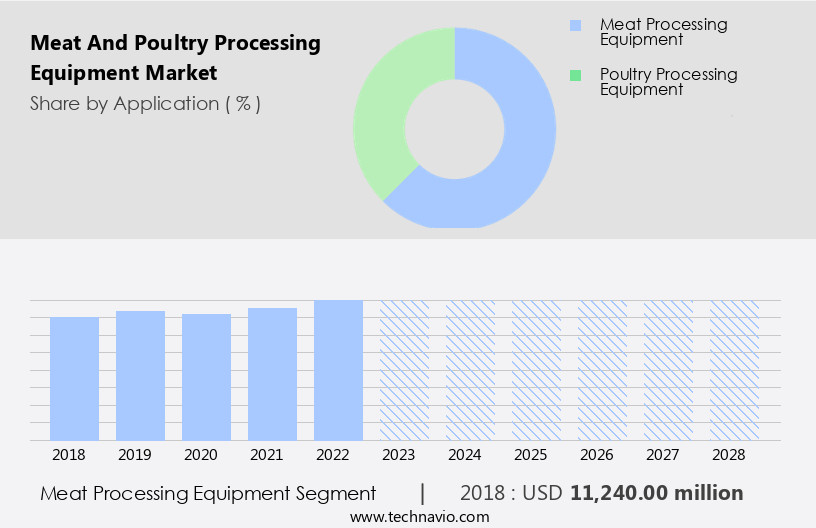

How is this Meat And Poultry Processing Equipment Industry segmented and which is the largest segment?

The meat and poultry processing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Meat processing equipment

- Poultry processing equipment

- Product Type

- Pork

- Beef

- Chicken

- Others

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

- The meat processing equipment segment is estimated to witness significant growth during the forecast period. The market encompasses the revenue generated from the sale of machinery used In the processing of pork, lamb, beef, and poultry. Key companies in this sector include Admix and Bettcher, among others. Admix offers the ROTOSOLVER RXRS, a high-shear mixer designed for meat processing applications. Salt, phosphates, and a blend of spices, hydrocolloids, or honey are commonly used as flavoring, binding, or emulsifying agents in meat processing. Effective meat mixing is crucial in various applications, driving the demand for such equipment. Additionally, Bettcher provides machinery for beef and other meats. The increasing consumption of meat products is expected to boost the market growth for meat processing equipment.

Get a glance at the market report of share of various segments Request Free Sample

The meat processing equipment segment was valued at USD 11.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American region led the market in 2023 due to the rising demand for processed meat and poultry products. The US held the largest market share in North America, driven by changing consumer preferences, the availability of various ready-to-eat food products, and well-established distribution channels. The region's strong economy supports the production of a wide range of meat and poultry products. The market prioritizes increasing production while maintaining food safety and preserving livestock ecosystems. In terms of product categories, Grinders, Bone pieces, Muscle meat, Minced meat, Sausages, Hamburgers, Precooked meat products, and Fatty tissues are processed using specialized equipment.

For more insights on the market size of various regions, Request Free Sample

Meat quality is ensured through Automated processing machines, adhering to Food safety and Hygiene guidelines. The market caters to Fast foods, Veganism, Bird flu, and Chicken processing segment, with increasing production capacities for Poultry type. X-ray scanners and Sensors are used for quality control, while Killing & defeathering, Evisceration, Cut-up, Deboning & skinning, Marinating & tumbling processes are automated. The market serves Ham, Bacon, Processed meat, and Meat processing facilities, catering to Meat processors and Fast food chains. Pre-processed poultry products adhere to Food-safety guidelines and Production capacities continue to expand.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Meat And Poultry Processing Equipment Industry?

- Rising awareness of high sources of nutrition in meat and poultry products is the key driver of the market. The market is driven by the increasing consumption of meat and poultry products due to their nutritional benefits. These foods provide essential nutrients such as proteins, vitamins (B12, B6, niacin, and hydrophilic vitamins), minerals (iodine, iron, phosphorus, copper, and zinc), and omega-3 fatty acids (DHA and EPA). Consumers seek these nutrients to maintain a healthy diet and support various bodily functions, including brain development, growth, and weight management. Meat and poultry processing involves various stages like grinding, bone removal, tendon separation, muscle meat extraction, sausage making, hamburger production, and precooked meat products manufacturing. Processed meat types include processed pork, processed beef, and processed mutton.

- Products like ham, bacon, sausages, and hamburgers are popular In the market. Meat processing facilities utilize machines like grinders, tumbling equipment, marinating equipment, and X-ray scanners to ensure meat quality and food safety. Poultry meat products, including chicken, duck, and their processed forms, are also in high demand. Equipment used in poultry processing includes de-feathering, evisceration, cut-up, deboning, and skinning machines. The market dynamics include increasing processed food consumption, food safety and hygiene guidelines, and production capacities. Market players must adhere to food-safety guidelines and hygiene standards to maintain consumer trust. Poultry type, meat type, and processing techniques like scaling, defeathering, deboning, and skinning influence the market.

What are the market trends shaping the Meat And Poultry Processing Equipment Industry?

- Technological advances in meat and poultry processing equipment is the upcoming market trend. The market is characterized by the adoption of advanced technologies to enhance food quality and ensure food safety. Grinders are utilized to process muscle meat, tendons, and bone pieces into minced meat for hamburgers, sausages, and precooked meat products. Non-thermal processing technologies, such as high-pressure processing (HPP), pulsed electric field (PEF), and irradiation, are increasingly used to minimize the negative impact of thermal processing on taste and nutrition. Key players In the market, including Duravant, GEA Group, and Marel, employ these technologies to produce a wide range of processed meat types, such as processed pork, processed beef, and processed mutton.

- Meat processing facilities utilize machines for various stages of processing, including poultry slaughtering equipment, de-feathering equipment, de-boning equipment, cut-up machines, evisceration equipment, tumbling equipment, and marinating equipment. Meat quality is ensured through automated processing machines, adherence to food-safety guidelines, and hygiene guidelines. Fast food chains and consumers of pre-processed poultry products demand high production capacities, leading to the use of X-ray scanners and sensors for quality control. The chicken processing segment dominates the market due to high consumption of poultry meat products. Food safety and meat consumption trends, such as veganism and bird flu, influence market dynamics.

What challenges does the Meat And Poultry Processing Equipment Industry face during its growth?

- Increasing adoption of vegan diet is a key challenge affecting the industry growth. The market is influenced by various factors. Consumers' increasing awareness towards health and the environment is driving the demand for plant-based food alternatives, including veganism. According to the United Nations (UN) and the Environmental Protection Agency (EPA), animal agriculture contributes significantly to greenhouse gas emissions and environmental degradation. As a result, there is a growing trend towards reducing meat and poultry consumption. In the Meat Processing sector, equipment for processing muscle meat, minced meat, sausages, hamburgers, and precooked meat products is in high demand. This includes grinders for mincing meat and machines for producing sausages and hamburgers. For poultry processing, equipment for defeathering, evisceration, cut-up, deboning, and skinning is essential.

- Tumbling equipment and marinating equipment are also used for enhancing meat quality. Processed meat products such as ham, bacon, and processed pork, beef, and mutton are popular. Meat processing facilities require various machines for automated processing, including X-ray scanners and sensors for ensuring food safety and hygiene guidelines. Production capacities are a crucial factor in meeting the demand for these products. Meat consumption continues to be high, particularly In the fast food industry. However, food safety and hygiene guidelines are stringent to prevent the spread of diseases such as bird flu. Chicken processing is a significant segment of the market, with demand for fresh, raw, cooked, and pre-cooked chicken products.

Exclusive Customer Landscape

The meat and poultry processing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the meat and poultry processing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, meat and poultry processing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Admix Inc.

- Baader Global SE

- BAYLE SA

- Berkshire Hathaway Inc.

- Bettcher Industries Inc.

- Brower Equipment

- Buhler AG

- C.G MFG and DIST INC.

- Cantrell Gainco Group

- Deccan Automation Technology

- Duravant LLC

- Foodmate US Inc.

- GEA Group AG

- Heat and Control Inc.

- John Bean Technologies Corp.

- Marel Group

- Poultry Processing Equipment Worldwide Ltd.

- The Middleby Corp.

- Tomra Systems ASA

- Zaftech India

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of machinery and technologies employed In the transformation of raw animal protein sources into edible products. This sector plays a crucial role In the global food industry, supplying essential components for various end-use applications, including the production of minced meat, sausages, hamburgers, precooked meat products, and processed pork, beef, and mutton. Meat processing facilities utilize an array of machines to handle different meat parts, such as muscle meat, bone pieces, tendons, head meat, liver, animal skin, fatty tissues, and edible parts. These facilities cater to the demands of various industries, including foodservice, retail, and manufacturing.

In addition, the meat processing industry's technological advancements have led to the development of automated processing machines, which have revolutionized the sector by increasing production capacities and improving meat quality. These machines include grinders, de-feathering equipment, de-boning equipment, cut-up machines, evisceration equipment, tumbling equipment, and marinating equipment. The poultry meat products segment represents a significant portion of the meat processing equipment market. Poultry slaughtering facilities employ various machines to process chickens, ducks, and other poultry types. The process involves several stages, including killing and defeathering, evisceration, cut-up, deboning and skinning, marinating, and tumbling. Fast food chains and the growing consumption of processed meat products have fueled the demand for advanced processing technologies.

Moreover, pre-processed poultry products, such as raw cooked, raw fermented sausages, cured, scalded, and pre-cooked, are increasingly popular due to their convenience and longer shelf life. Food safety and hygiene guidelines are essential considerations In the meat processing industry. Meat processors must adhere to strict regulations to ensure the safety and quality of their final products. Meat consumption continues to rise, driven by population growth and changing dietary preferences. However, factors such as veganism, bird flu, and other animal diseases pose challenges to the industry's growth. X-ray scanners and sensors are essential tools used in meat processing facilities to ensure the safety and quality of the final product.

Furthermore, these technologies help detect contaminants, such as bones, metal, and other foreign objects, ensuring that the meat meets the required standards. The industry's technological advancements, increasing demand for processed meat products, and stringent food safety regulations are key drivers of growth. Meat processors must continually adapt to changing market conditions and consumer preferences to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2024-2028 |

USD 5.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.12 |

|

Key countries |

US, China, Brazil, Germany, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Meat And Poultry Processing Equipment Market Research and Growth Report?

- CAGR of the Meat And Poultry Processing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the meat and poultry processing equipment market growth of industry companies

We can help! Our analysts can customize this meat and poultry processing equipment market research report to meet your requirements.