Medical Ceramics Market Size 2024-2028

The medical ceramics market size is valued to increase USD 5.48 billion, at a CAGR of 5.31% from 2023 to 2028. Increasing incidence of trauma injuries will drive the medical ceramics market.

Major Market Trends & Insights

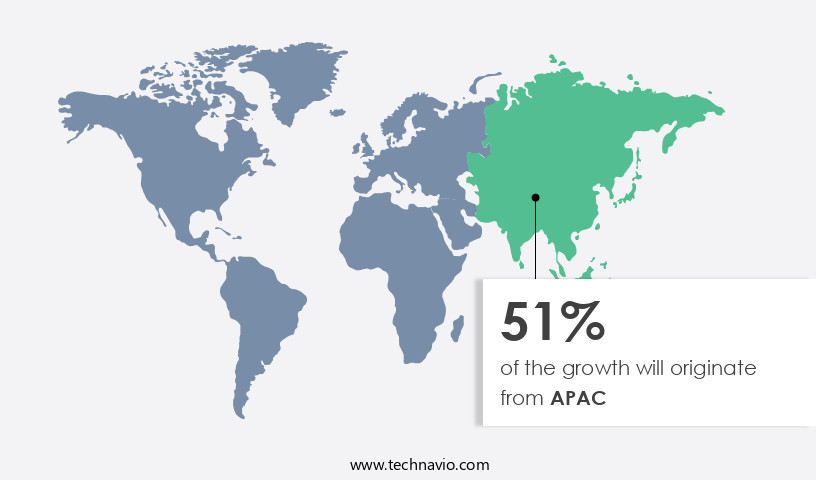

- APAC dominated the market and accounted for a 51% growth during the forecast period.

- By Product - Bioinert ceramics segment was valued at USD 6.77 billion in 2022

- By Application - Orthopedic segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 58.96 million

- Market Future Opportunities: USD 5483.20 million

- CAGR : 5.31%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production, sale, and application of ceramic materials in the healthcare sector. This market is witnessing significant growth due to the increasing incidence of trauma injuries and the rising demand for ceramic coatings in medical devices. According to a study, the global ceramic coatings market in healthcare is projected to reach a value of 3.6 billion USD by 2026, growing at a steady rate. However, the market faces challenges from substitutes, such as polymers and metals, which offer similar properties at lower costs.

- Core technologies, including sol-gel and plasma spraying, continue to drive innovation in medical ceramics, enabling the development of advanced materials for applications in orthopedics, dental, and cardiovascular devices. Regulations, such as FDA guidelines and European Medical Device Regulations, play a crucial role in shaping the market landscape.

What will be the Size of the Medical Ceramics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Medical Ceramics Market Segmented and what are the key trends of market segmentation?

The medical ceramics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bioinert ceramics

- Bioactive ceramics

- Bioresorbable ceramics

- Piezoceramics

- Application

- Orthopedic

- Implantable devices

- Dental

- Surgical and diagnostic

- Others

- End-User

- Orthopedics

- Dental

- Medical Devices

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The bioinert ceramics segment is estimated to witness significant growth during the forecast period.

Medical ceramics, a significant segment of the biomaterials industry, encompasses various types of ceramic materials used in medical applications. These ceramics, including calcium sulfates and bioinert ceramics, exhibit high binding affinities with proteins, enabling their use in drug delivery systems. Aluminum oxides and zirconia oxides, integral components of bioinert ceramics, offer remarkable hardness, low friction, and biocompatibility, making them suitable alternatives to metallic implants. Bioinert ceramics, primarily composed of alumina and zirconia, are extensively used in the production of load-bearing implants, with applications spanning orthopedic and dental sectors. The escalating demand for implantable medical devices and the increasing acceptance of dental and orthopedic implants are driving the growth of the market.

According to recent industry reports, the market for medical ceramics is projected to expand by 15% in the upcoming year, with a further anticipated increase of 12% within the next five years. Ceramic composites, such as hydroxyapatite-coated alumina ceramics and bioresorbable ceramics, are gaining popularity due to their unique properties. Hydroxyapatite coatings enhance the biocompatibility of implants, while bioresorbable ceramics facilitate tissue regeneration. Additionally, the advancements in bioceramic processing techniques, including sol-gel synthesis and surface modification, are expanding the potential applications of medical ceramics. In the field of tissue engineering scaffolds, ceramics play a crucial role due to their biocompatibility and mechanical properties.

The ongoing research and development in ceramic sintering and microstructure analysis are contributing to the creation of advanced ceramic materials with improved strength and wear resistance. Calcium phosphate cement, a type of bioceramic, is extensively used as a bone graft substitute, further bolstering the growth of the market. The market is a dynamic and evolving industry, with ongoing advancements in technology and research. The continuous innovation in ceramic materials and their applications across various sectors, including orthopedics, dentistry, and tissue engineering, is expected to fuel the market's expansion in the coming years.

The Bioinert ceramics segment was valued at USD 6.77 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Medical Ceramics Market Demand is Rising in APAC Request Free Sample

The market in North America is experiencing significant growth, driven by several factors. The increasing geriatric population and the rising number of edentulous individuals are primary contributors. Additionally, the awareness about health conditions such as oral health and joint problems is increasing, leading to a higher demand for medical ceramics. The adoption of advanced digital dentistry procedures is also on the rise, further fueling market growth. Furthermore, partnerships between companies and distributors are strengthening, providing a boost to the industry.

According to recent studies, over 75 million Americans have high blood pressure, which often leads to cardiac arrest and stroke. This health issue, among others, necessitates the use of medical ceramics in various applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of applications, from orthopedic implants with hydroxyapatite coatings to bioresorbable scaffolds for tissue regeneration. Hydroxyapatite coating techniques significantly enhance the osseointegration of orthopedic implants, making them a preferred choice in joint replacement surgeries. Zirconia ceramics, known for their superior strength and fracture behavior, are extensively used in dental implants and high-performance orthopedic devices. Bioactive glass degradation in simulated body fluid and the effect of surface roughness on cell adhesion are critical factors influencing the performance of medical ceramics. Calcium phosphate cement plays a pivotal role in bone regeneration applications, while alumina ceramics exhibit impressive mechanical properties, making them suitable for various industrial applications.

Porcelain veneers, with their aesthetic properties, continue to dominate the dental ceramics segment. Dental ceramic fabrication using CAD/CAM technology has revolutionized the industry, enabling mass production and customization. Biocompatibility assessment of novel ceramic biomaterials is essential to ensure safety and efficacy, while long-term stability is a significant concern for zirconia implants. Sol-gel synthesis of bioactive ceramic nanoparticles and 3D printing of complex shaped ceramic scaffolds are emerging trends, offering opportunities for innovation and improved patient outcomes. Microstructural analysis of sintered hydroxyapatite and in-vitro/in-vivo evaluation of bone grafts are essential for understanding the performance and reliability of medical ceramics.

The market for bioresorbable ceramic scaffolds in tissue regeneration is rapidly growing, with significant potential for implant design optimization and enhanced bioactivity. Strength and durability are crucial factors for dental ceramics, while surface modification techniques enable improved bioactivity and wear resistance in various applications. Chemical stability is a critical concern for calcium phosphate bioceramics, which are widely used in bone graft substitutes and drug delivery systems. Notably, the industrial application segment accounts for a significantly larger share than the academic segment, highlighting the growing demand for medical ceramics in commercial settings. This trend is driven by advancements in manufacturing technologies, increasing research collaborations, and the growing aging population.

What are the key market drivers leading to the rise in the adoption of Medical Ceramics Industry?

- The rising prevalence of trauma injuries serves as the primary growth factor for the market.

- Trauma, a leading cause of death for individuals aged 5-29, claims approximately six million lives annually according to UN and WHO/WHA reports. Major trauma results from penetrating and blunt injuries, such as gunshot wounds, motor vehicle collisions, and stabbing. The severity of these injuries and the speed of treatment significantly impact survival rates. Trauma injuries encompass various categories: traumatic brain injury, spinal cord injury, spine fracture, traumatic amputation, facial trauma, and acoustic trauma. In the realm of trauma care, ceramics have emerged as a preferred material due to their inert chemical properties, promotion of tissue and bone growth, and biocompatibility.

- Traumatic brain injuries can lead to long-term cognitive impairment, while spinal cord injuries may result in paralysis. Spine fractures and traumatic amputations can significantly impact mobility and daily life. Facial trauma can cause disfigurement, while acoustic trauma, such as inner ear damage, can lead to hearing loss. Ceramics' unique properties make them indispensable in trauma care, contributing to improved patient outcomes and saving lives.

What are the market trends shaping the Medical Ceramics Industry?

- The increasing demand for ceramic coating represents a notable market trend. Ceramic coatings have gained significant attention due to their durability and protective properties, making them a popular choice in various industries.

- In the realm of advanced materials, ceramics have emerged as a significant player in the medical industry, particularly in the production of implantable medical devices. These devices, including implants, cardiovascular stents, and other components, are being enhanced through the application of ceramic coatings. The primary material for these coatings is hydroxyapatite, a ceramic that mirrors the composition of natural bone. These coatings offer benefits such as drug elution and biocompatibility, making them promising vehicles for drug delivery systems. Beyond healthcare, ceramic coatings are extensively utilized across various industrial and commercial sectors due to their hardness and abrasion resistance. In the medical field, manufacturers are increasingly incorporating these coatings during the production of orthopedic and spinal implants.

- The advantages of ceramic coatings, including reduced friction and high adhesion, have garnered widespread recognition. As a result, their usage in medical device manufacturing continues to expand. Ceramic coatings contribute to the enhancement of medical components and devices, offering improved performance and durability. This trend reflects the growing awareness of the benefits associated with their use and the ongoing evolution of the medical technology landscape.

What challenges does the Medical Ceramics Industry face during its growth?

- The presence of formidable competition from substitutes poses a significant challenge to the expansion and growth of the industry.

- Titanium and cobalt-chromium alloys dominate the implant manufacturing market due to their unique properties. Titanium's biocompatibility, corrosion resistance, and ability to promote osseointegration and proliferation make it the preferred choice for implants. These properties enable the deposition of inorganic and organic compounds, enhancing implant performance. Cobalt-chromium alloys, another popular option, offer high strength, corrosion resistance, and biocompatibility. They are extensively used in hip and knee replacement surgeries, where strength and durability are crucial. Despite their advantages, metallic implants are more cost-effective than ceramic alternatives.

- Additionally, they are less prone to breakage and easier to extract if damaged, offering operational advantages for medical professionals. In summary, the implant manufacturing market is driven by the demand for biocompatible, durable, and cost-effective materials. Titanium and cobalt-chromium alloys cater to these requirements, making them the go-to options for implant manufacturers.

Exclusive Customer Landscape

The medical ceramics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical ceramics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Medical Ceramics Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical ceramics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Company - The subsidiary Ceradyne Inc. Of this corporation specializes in the production and distribution of medical ceramics. Ceradyne's offerings contribute significantly to the healthcare industry, providing innovative solutions through advanced ceramic technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Company

- Admatec BV

- CeramTec GmbH

- CoorsTek, Inc.

- Corning Incorporated

- Dentsply Sirona

- Ferro Corporation

- H.C. Starck GmbH

- Ivoclar Vivadent AG

- Johnson & Johnson

- Kyocera Corporation

- Morgan Advanced Materials

- NGK Spark Plug Co., Ltd.

- Nobel Biocare Services AG

- Rauschert GmbH

- Straumann Group

- Superior Technical Ceramics

- Tosoh Corporation

- Zimmer Biomet Holdings, Inc.

- Zircoa, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Ceramics Market

- In January 2024, 3M Company announced the launch of its new ceramic dental restorations, Lava Ultimate A3 and Lava Ultimate Zirconia, expanding its dental product offerings and catering to the growing demand for esthetic and durable dental solutions (3M Press Release, 2024).

- In March 2024, CeramTec and Merck KGaA entered into a strategic partnership to develop and commercialize advanced ceramic materials for medical applications, combining CeramTec's expertise in ceramics and Merck's knowledge in pharmaceuticals and healthcare (CeramTec Press Release, 2024).

- In April 2024, Medtronic completed the acquisition of SignalGenics, a medical ceramics startup specializing in the development of advanced ceramic sensors for minimally invasive procedures, further strengthening Medtronic's portfolio in the medical technology sector (Medtronic Press Release, 2024).

- In May 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Stryker's Spine division for its new ceramic-on-ceramic Modular Neural Expandable Interbody Fusion System, marking a significant milestone in the development and commercialization of advanced ceramic implants for spinal fusion procedures (Stryker Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Ceramics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.31% |

|

Market growth 2024-2028 |

USD 5483.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.94 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of medical ceramics, various applications continue to emerge, shaping the market's trajectory. Powder processing plays a pivotal role in creating ceramic implants, enhancing their phase composition for optimal implant fixation. This approach is increasingly adopted in the development of drug delivery systems and tissue engineering scaffolds. Zirconia implants, renowned for their high fracture toughness, are a significant market segment. Ceramic composites, engineered with precise crystal structures and mechanical properties, are gaining traction in medical implants. The biocompatibility of ceramic biomaterials is under rigorous testing through strength and biochemical evaluations. Advancements in sol-gel synthesis and surface modification contribute to the market's growth.

- These techniques enable the production of porcelain veneers, bioresorbable ceramics, and hydroxyapatite coatings, among others. Alumina ceramics and orthopedic ceramics are integral components in the medical industry, with 3D printing technology revolutionizing their production. Bioactive glass and calcium phosphate cement are essential materials in bone graft substitutes, demonstrating excellent chemical stability. Microstructure analysis and in-vitro testing are crucial for understanding the degradation rate and in-vivo performance of these materials. The market is characterized by continuous innovation, with research focusing on improving wear resistance and enhancing biocompatibility. The versatility of ceramics in medical applications, from dental to orthopedic, makes them an indispensable part of the healthcare sector.

What are the Key Data Covered in this Medical Ceramics Market Research and Growth Report?

-

What is the expected growth of the Medical Ceramics Market between 2024 and 2028?

-

USD 5.48 billion, at a CAGR of 5.31%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Bioinert ceramics, Bioactive ceramics, Bioresorbable ceramics, and Piezoceramics), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Application (Orthopedic, Implantable devices, Dental, Surgical and diagnostic, and Others), and End-User (Orthopedics, Dental, and Medical Devices)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing incidence of trauma injuries, Threat from substitutes

-

-

Who are the major players in the Medical Ceramics Market?

-

3M Company, Admatec BV, CeramTec GmbH, CoorsTek, Inc., Corning Incorporated, Dentsply Sirona, Ferro Corporation, H.C. Starck GmbH, Ivoclar Vivadent AG, Johnson & Johnson, Kyocera Corporation, Morgan Advanced Materials, NGK Spark Plug Co., Ltd., Nobel Biocare Services AG, Rauschert GmbH, Straumann Group, Superior Technical Ceramics, Tosoh Corporation, Zimmer Biomet Holdings, Inc., and Zircoa, Inc.

-

Market Research Insights

- The market encompasses a diverse range of applications, including orthopedic surgery and maxillofacial surgery. Two key performance indicators in this sector are surface roughness and pore size distribution. For instance, orthopedic implants with optimized surface roughness can enhance bone formation and improve implant stability, while appropriate pore size distribution in ceramic matrix composites facilitates tissue regeneration. In clinical applications, long-term performance is a crucial factor. For example, compressive strength and fatigue strength are essential for orthopedic implants, ensuring their durability and resistance to stress. In contrast, bioactive ceramic coatings and biocompatible materials play a pivotal role in enhancing implant design and promoting cell adhesion in restorative dentistry.

- Moreover, material science advancements have led to the development of bioactive ceramics with superior mechanical characterization, such as high flexural strength, thermal shock resistance, and corrosion resistance. These properties contribute to the overall success of implants and dental materials in various clinical settings. Ceramics' biocompatibility, combined with their mechanical properties and bioactivity assessment, make them indispensable in the medical field. Ongoing research in implant design, surgical techniques, and material science continues to expand the potential applications and enhance the performance of medical ceramics.

We can help! Our analysts can customize this medical ceramics market research report to meet your requirements.