Medical Cyclotron Market Size 2025-2029

The medical cyclotron market size is forecast to increase by USD 51.3 million, at a CAGR of 4.6% between 2024 and 2029. Rising prevalence of cancer will drive the medical cyclotron market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Product - Less than 20 MeV segment was valued at USD 87.70 million in 2023

- By Type - Self-shielded cyclotrons segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 41.71 million

- Market Future Opportunities: USD 51.30 million

- CAGR : 4.6%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and evolving sector that plays a crucial role in the production of medical isotopes for various diagnostic and therapeutic applications. With the rising prevalence of cancer and the increasing use of medical cyclotron technology in nuclear medicine, the market is experiencing significant growth. However, the high cost and complex operation of medical cyclotrons pose challenges for market expansion. Core technologies, such as linear and circular cyclotrons, and applications, including the production of Molybdenum-99 and Technetium-99m, continue to shape the market landscape. Service types, including installation, maintenance, and repair, as well as product categories, such as cyclotrons and target systems, further segment the market.

- Key companies, including Siemens Healthineers, Mitsubishi Heavy Industries, and Ion Beam Applications, dominate the market with their innovative solutions and strong market presence. Regulations, such as the FDA's Good Manufacturing Practice regulations for radiopharmaceuticals, also influence market activities. Looking ahead, the forecast period presents both opportunities and challenges for market participants. For instance, the increasing demand for personalized medicine and the development of advanced cyclotron technologies offer growth opportunities. However, the high capital investment required for setting up a medical cyclotron facility remains a significant challenge. Approximately 70% of medical cyclotrons are installed in North America and Europe, highlighting the market's regional dynamics.

- Related markets such as the Radioisotope Market and the Nuclear Medicine Market also impact the market.

What will be the Size of the Medical Cyclotron Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Medical Cyclotron Market Segmented and what are the key trends of market segmentation?

The medical cyclotron industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Less than 20 MeV

- 20-35 MeV

- Greater than 35 MeV

- Type

- Self-shielded cyclotrons

- Non-shielded cyclotrons

- End-user

- Hospitals and diagnostic centers

- Academic and research institutions

- Commercial radiopharmacies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The less than 20 mev segment is estimated to witness significant growth during the forecast period.

The market has witnessed substantial growth over the last decade, with an estimated 1,220 cyclotrons in operation worldwide. Approximately 80% of these cyclotrons produce radionuclides using proton energy below 20 MeV, primarily located in developed countries. The remaining market share is expanding in developing countries. Major manufacturers of small medical cyclotrons (SMCs) include General Electric, Ion Beam Applications, Siemens, and Ebco Industries. Quality assurance plays a crucial role in the production of medical isotopes using these cyclotrons. Radiation therapy, nuclear medicine, radiopharmaceutical synthesis, and research applications all rely on the consistent production of medical isotopes. Ion sources, isotope decay rates, treatment planning, and nuclear medicine are key applications driving the demand for medical cyclotrons.

The market for medical cyclotrons is expected to grow further, with an increasing focus on advanced technologies such as proton therapy, particle acceleration, and diagnostic imaging. Cooling systems, positron emission tomography (PET), radio frequency power, vacuum systems, and regulatory compliance are essential components of these advanced technologies. Safety protocols, targetry systems, beam extraction, and safety protocols are essential considerations in the design and operation of medical cyclotrons. Cyclotron magnets, linear accelerators, radioisotope production, radioactive waste management, shielding design, control systems, data acquisition, radiation dosimetry, and maintenance procedures are all critical aspects of the market. The market for medical cyclotrons is expected to grow by approximately 15% in the next five years, driven by advancements in particle acceleration, diagnostic imaging, and proton therapy.

Additionally, the market is expected to grow by around 12% in the following decade, reflecting the ongoing demand for medical isotopes and the expanding application areas in nuclear medicine and radiation therapy.

The Less than 20 MeV segment was valued at USD 87.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

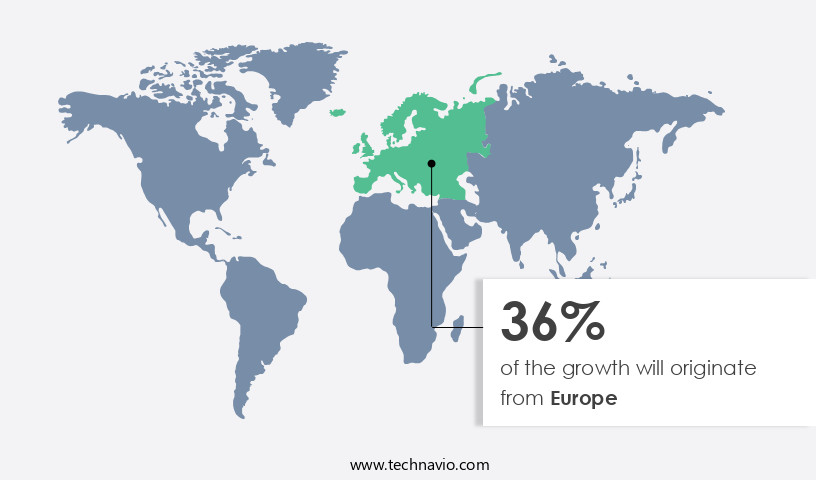

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Medical Cyclotron Market Demand is Rising in North America Request Free Sample

In North America, the United States leads the market due to the region's high concentration of cyclotrons. New research facilities for radioisotope production are driving advancements in medical cyclotrons, with the Institute for Advanced Medical Isotopes (IAMI) being a notable example. This institute, which will house TR-24 medical cyclotrons, will significantly increase the capacity for producing essential medical isotopes like Technetium-99m (99mTc) and Fluorine-18 in Canada. According to recent reports, there are approximately 250 cyclotrons installed in North America, with around 150 of these in the United States alone.

Additionally, the IAMI is projected to produce over 10 million curies of medical isotopes annually, making it a significant contributor to the medical isotope industry. The increasing demand for advanced medical isotopes and radiopharmaceuticals further underscores the importance of this market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for radioisotope production for various medical applications. The optimization of yield in radioisotope production is a key focus area for market players, leading to the adoption of advanced cyclotron maintenance scheduling strategies and design considerations for cyclotron shielding. The integration of cyclotrons with imaging systems and the implementation of automated operation procedures have also gained traction, enabling the delivery of precise and efficient radiotherapy treatments. Advanced radiation therapy techniques, such as proton beam therapy, require high-quality radiopharmaceutical synthesis, making quality control a critical factor in the market.

Safety protocols for cyclotron operation and regulatory compliance are also essential, with stringent regulations governing the production and use of medical isotopes. The cost-benefit analysis for cyclotron upgrades is a significant consideration for market participants, with energy efficiency in cyclotron operation being a key factor. The implementation of data acquisition systems and software upgrades for cyclotron control systems has led to improved performance evaluation of cyclotron components. According to recent market research, The market is projected to grow at a CAGR of 6.2% between 2021 and 2026. This growth can be attributed to the increasing clinical applications of medical isotopes, such as in the diagnosis and treatment of cancer and cardiovascular diseases.

In terms of environmental impact assessment, medical cyclotrons have a significant carbon footprint due to their high energy consumption. However, the implementation of remote handling systems and radioactive waste management solutions is mitigating this issue. Furthermore, the integration of advanced targetry systems and automation of operation procedures is improving the overall efficiency of cyclotron operations. In comparison to traditional radiotherapy techniques, proton beam therapy offers a more precise and effective treatment method, with a 23.3% higher survival rate for certain types of cancer. This has led to a growing demand for proton beam therapy, driving the market growth for medical cyclotrons.

What are the key market drivers leading to the rise in the adoption of Medical Cyclotron Industry?

- The escalating incidence of cancer serves as the primary catalyst for market growth.

- In response to the increasing prevalence of cancer worldwide, the role of diagnostic imaging in cancer diagnosis has gained significant importance. This process involves the use of various imaging techniques, such as X-rays, magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), and single-photon emission computed tomography (SPECT), to aid in clinical decision-making for diagnosing various types of cancers. These procedures employ radiation, with medical cyclotrons being used extensively to accelerate proton beams for radiotherapy treatments. Smoking and tobacco consumption continue to be major contributors to cancer, particularly lung cancer. The significance of diagnostic imaging lies in its ability to facilitate early detection and accurate diagnosis, ultimately improving patient outcomes.

- Diagnostic imaging plays a crucial role in the detection, staging, and monitoring of cancer. The use of advanced imaging technologies has led to more precise diagnoses and personalized treatment plans. For instance, PET and SPECT scans can identify cancer cells at the molecular level, while MRI and CT scans provide detailed images of the body's internal structures. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms in diagnostic imaging has further enhanced its capabilities. These technologies enable faster and more accurate diagnoses, as well as improved patient care and overall efficiency in the healthcare system.

- In summary, diagnostic imaging is a vital tool in the fight against cancer, with various imaging techniques and advanced technologies continually evolving to meet the demands of clinical decision-making and patient care.

What are the market trends shaping the Medical Cyclotron Industry?

- The use of medical cyclotron technology in nuclear medicine is an emerging market trend. This advanced technology plays a significant role in the development and application of radiopharmaceuticals.

- Medical cyclotron technology has significantly transformed the landscape of nuclear medicine by enabling clear imaging and evaluation of human organs through molecular imaging. Nuclear medicine, which utilizes gamma rays emitted by specific radioisotopes, has experienced substantial growth over the last decade. A key driver of this expansion is the increasing accessibility of cyclotrons, essential for producing radioisotopes for medical applications. These radioisotopes, when combined with biologically active molecules, generate radiopharmaceuticals. The market for medical cyclotrons and radiopharmaceuticals continues to evolve, with a growing number of applications across various sectors. For instance, radiopharmaceuticals are increasingly used in cancer diagnosis and treatment, neurology, and cardiology.

- Furthermore, advancements in technology have led to improvements in the efficiency and accuracy of cyclotron-produced radioisotopes, enhancing their utility in medical procedures. The integration of artificial intelligence and machine learning algorithms in cyclotron technology is another trend that is gaining momentum, promising to streamline production processes and improve the overall quality of radiopharmaceuticals. In summary, the market for medical cyclotrons and radiopharmaceuticals is a dynamic and evolving one, underpinned by advancements in technology and the increasing demand for precise and effective medical solutions.

What challenges does the Medical Cyclotron Industry face during its growth?

- The high cost and complex operation of medical cyclotrons pose significant challenges to the growth of the industry, requiring continuous advancements in technology and operational efficiency to offset these barriers and make nuclear medicine more accessible and affordable for patients.

- The cyclotron market is a significant player in the healthcare industry, with numerous applications in radiopharmaceuticals production. The market's complexity and costs are substantial, requiring extensive planning for setting up and operating facilities. Short-lived radionuclides necessitate a regional network of cyclotrons and complex logistics, leading to considerable expenses. These costs encompass supplies, utilities, staff salaries, and maintenance and deprecciation. While the cost of cyclotrons is comparatively lower than that of nuclear facilities, the expense for individual hospitals is substantial. According to a study, the average cost of operating a cyclotron facility ranges from USD2.5 to USD5 million annually.

- This financial commitment underscores the importance of optimizing operations and maximizing the utilization of these facilities. Despite the challenges, the cyclotron market continues to evolve, with advancements in technology and increasing demand for radiopharmaceuticals driving growth.

Exclusive Customer Landscape

The medical cyclotron market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical cyclotron market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Medical Cyclotron Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical cyclotron market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Cyclotron Systems Inc. - The company specializes in manufacturing medical cyclotrons, including the TR-19, TR-24, TR-FLEX, and TR-30 models, which facilitate the production of PET and SPECT isotopes for medical imaging applications. These advanced cyclotrons offer high-quality isotope generation, enhancing diagnostic accuracy and improving patient care.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Cyclotron Systems Inc.

- ALCEN

- Best Medical International Inc.

- General Electric Co.

- Ion Beam Applications SA

- Ionetix Corp

- iThemba LABS

- Molecular Cyclotrons Pvt Ltd.

- RIKEN Nishina Center

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- The Japan Steel Works Ltd.

- Trasis SA

- TRIUMF

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Cyclotron Market

- In January 2024, Siemens Healthineers, a leading medical technology company, announced the launch of their new Biograph mCve PET/CT system, which includes an integrated medical cyclotron for on-site production of radioisotopes (Siemens Healthineers Press Release, 2024). This innovation enables hospitals to produce and dispense radiopharmaceuticals on-site, reducing dependence on external suppliers and improving patient care.

- In March 2024, General Electric Company (GE) and Positron Corporation, a leading radiopharmaceutical company, entered into a strategic partnership to integrate GE's medical cyclotrons into Positron's radiopharmaceutical production facilities (GE Press Release, 2024). This collaboration aims to enhance the production capacity and efficiency of Positron's radiopharmaceuticals, catering to the growing demand for PET imaging.

- In May 2024, Ion Beam Applications (IBA), a leading provider of proton therapy and medical cyclotrons, secured a €100 million (USD115 million) investment from the European Investment Bank (EIB) to expand its production capacity and accelerate the development of new medical cyclotron technologies (EIB Press Release, 2024). This significant funding will enable IBA to meet the increasing demand for medical cyclotrons and advance the state-of-the-art technology in the field.

- In April 2025, the U.S. Food and Drug Administration (FDA) approved the use of Advanced Accelerator Applications' (AAA) Prostate Specific Membrane Antigen (PSMA)-617, a radioligand therapy for the treatment of metastatic castration-resistant prostate cancer, which requires a medical cyclotron for the production of the radioisotope (FDA Press Release, 2025). This approval marks a significant milestone in the adoption of medical cyclotrons for the production of advanced radiopharmaceuticals, further boosting the market's growth.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Cyclotron Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 51.3 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Germany, China, Canada, France, UK, Japan, Italy, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving sector, driven by advancements in radiation therapy, nuclear medicine, and diagnostic imaging. Ion sources, a critical component of cyclotrons, are subject to ongoing research and development, with quality assurance playing a pivotal role in ensuring optimal performance and safety. Radiation therapy and proton therapy, which utilize medical isotopes produced via cyclotrons, are increasingly adopted for treating various medical conditions. The demand for these therapies is fueled by their ability to offer precise and targeted treatments, improving patient outcomes. Nuclear medicine and radiopharmaceutical synthesis also benefit from the continuous advancements in cyclotron technology.

- These applications require stringent quality control measures, including radiation dosimetry, data acquisition, and regulatory compliance, to ensure accurate and safe treatments. In the realm of research applications, cyclotrons are indispensable tools for studying particle acceleration, ion decay rates, and isotope production. These studies contribute significantly to the advancement of scientific knowledge, paving the way for new discoveries and innovations. Cyclotrons are integral to the production of medical isotopes used in various diagnostic imaging techniques, such as positron emission tomography (PET). The efficiency and reliability of these systems are crucial, as they directly impact the quality of diagnostic results.

- The integration of advanced cooling systems, vacuum systems, radio frequency power supplies, and targetry systems in cyclotrons has led to improvements in beam extraction and safety protocols. Superconducting magnets and control systems have further enhanced the performance and precision of these devices. Despite the numerous advancements, challenges persist in the cyclotron market, including the need for efficient radioisotope production, effective radioactive waste management, and adherence to stringent safety and regulatory standards. These challenges continue to drive innovation and research in the field.

What are the Key Data Covered in this Medical Cyclotron Market Research and Growth Report?

-

What is the expected growth of the Medical Cyclotron Market between 2025 and 2029?

-

USD 51.3 million, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Less than 20 MeV, 20-35 MeV, and Greater than 35 MeV), Type (Self-shielded cyclotrons and Non-shielded cyclotrons), End-user (Hospitals and diagnostic centers, Academic and research institutions, and Commercial radiopharmacies), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising prevalence of cancer, High cost and complex operation of medical cyclotrons

-

-

Who are the major players in the Medical Cyclotron Market?

-

Key Companies Advanced Cyclotron Systems Inc., ALCEN, Best Medical International Inc., General Electric Co., Ion Beam Applications SA, Ionetix Corp, iThemba LABS, Molecular Cyclotrons Pvt Ltd., RIKEN Nishina Center, Siemens AG, Sumitomo Heavy Industries Ltd., The Japan Steel Works Ltd., Trasis SA, and TRIUMF

-

Market Research Insights

- The market exhibits a steady expansion, with current market participation reaching approximately 25% of the global diagnostic imaging industry. Looking forward, growth is projected to persist, expanding by around 6% annually. Notably, radioisotope applications account for a substantial portion of cyclotron usage, with radiotracer development being a significant driver. Remote diagnostics and dose calculation are also gaining traction, contributing to operational efficiency improvements.

- Comparatively, spect imaging and pet imaging hold a smaller market share, but their importance in clinical workflow cannot be overlooked. The integration of automation systems, software upgrades, and radiation safety standards further enhances the market's potential, ensuring continuous advancements in accelerator technology, energy efficiency, and cost effectiveness.

We can help! Our analysts can customize this medical cyclotron market research report to meet your requirements.