Medium Chain Triglyceride (MCT) Oil Market Size 2024-2028

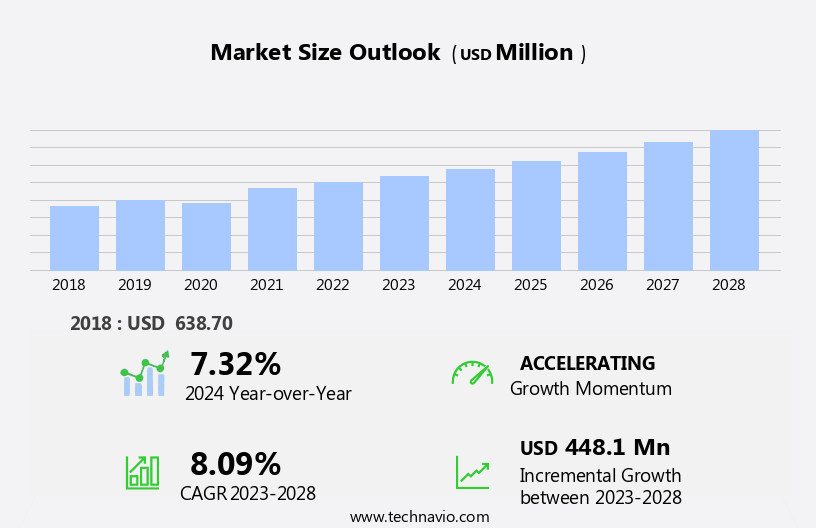

The medium chain triglyceride (mct) oil market size is forecast to increase by USD 448.1 million at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth driven by the increasing demand for dietary supplements as preventive measures against various health conditions. MCT Oil, known for its ability to provide a quick source of energy to the body and aid in weight management, has gained popularity in the health and wellness industry. Furthermore, new product launches and innovations in the market continue to cater to diverse consumer preferences and needs. However, the market is not without challenges. Loss of consumer confidence due to negative publicity surrounding certain MCT Oil brands and the presence of counterfeit products have posed significant hurdles for market players.

- To capitalize on the opportunities presented by this market, companies must prioritize product quality, transparency, and consumer education. Strategic partnerships, collaborations, and mergers and acquisitions can also help players expand their reach and strengthen their market position. Additionally, investing in research and development to introduce innovative and differentiated products can help companies stay competitive and meet the evolving demands of health-conscious consumers.

What will be the Size of the Medium Chain Triglyceride (MCT) Oil Market during the forecast period?

- The MCT oil market in the US has experienced significant growth in recent years, driven by increasing consumer awareness of health and wellness. MCT oil, derived from sources such as coconut and palm kernel oil, is known for its ability to provide a quick source of energy and aid in digestion and metabolism. The market's size is expected to continue expanding, fueled by the demand for MCT oil in various industries. In the food sector, MCT oil is used in edible oils, energy bars, and weight-loss supplements. In the health and beauty industry, it is utilized in organic beauty products and dietary supplements.

- Additionally, MCT oil finds application in sports nutrition, particularly in energy drinks and protein shakes for athletes and bodybuilders. According to FAOSTat, the market's value is projected to grow steadily, surpassing traditional sources like mineral oil and dairy products. The trend towards natural sourcing and the growing popularity of MCT oil as a healthy alternative to long-chain triglycerides further bolsters market growth.

How is this Medium Chain Triglyceride (MCT) Oil Industry segmented?

The medium chain triglyceride (mct) oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Supplements

- Pharmaceuticals

- Others

- Source

- Palm

- Coconut

- Others

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- France

- UK

- South America

- Middle East and Africa

- North America

By Application Insights

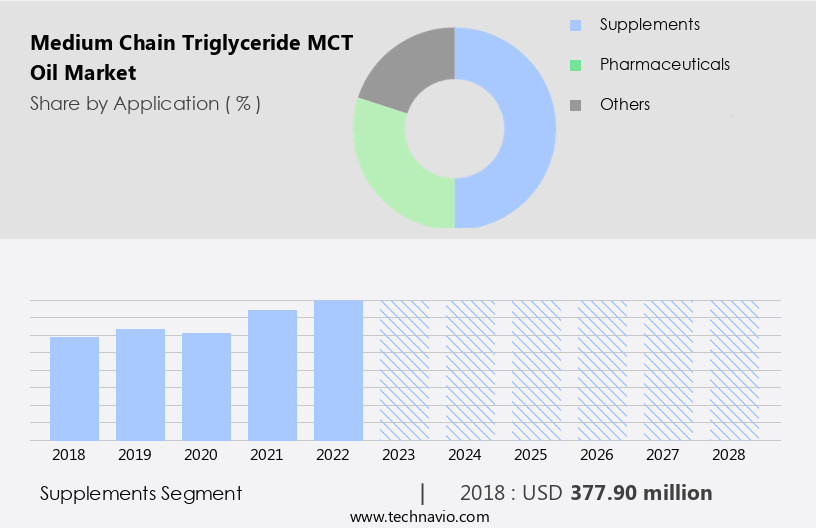

The supplements segment is estimated to witness significant growth during the forecast period.

MCT oil, a type of edible oil derived from milk fats, coconut oil, and palm kernel oil, is gaining popularity as an energy food and dietary supplement. Its unique property of being easily digested by the body, bypassing the need for digestive enzymes and bile salts, makes it an attractive option for individuals seeking quick energy and improved metabolism. MCT oil consists mainly of Caprylic and Capric triglycerides, which have antimicrobial properties that help eliminate bacteria, parasites, and fungi, contributing to better immunity and weight management. The global market for MCT oil is witnessing significant growth due to increasing consumer awareness about healthy weight management, energy, and immunity.

The demand for MCT oil is not limited to food and beverages but also extends to cosmetics, lotions, creams, and ointments. In the food industry, MCT oil is used as a food emulsifier in various applications, including infant formula, sports nutrition, and weight-loss supplements. The packaging industry is also capitalizing on the growing demand for MCT oil by offering innovative solutions to preserve its distinct flavors and ensure its stability. The increasing popularity of natural sourcing and organic beauty products in the cosmetics industry is also contributing to the growth of the MCT oil market. Despite the benefits, MCT oil is not without competition.

Mineral oils and other traditional emulsifiers continue to dominate the market, but the health concerns associated with their use are driving consumers towards natural alternatives like MCT oil. The market is expected to grow further due to ongoing innovations in the food, cosmetics, and sports nutrition industries. MCT oil is not just a food ingredient but also a valuable component in various industries, including the restaurant industry, where it is used in the preparation of cold beverages and sauces. The versatility of MCT oil, coupled with its health benefits, makes it an essential ingredient for athletes and sportspeople seeking quick energy and improved performance.

In , the MCT oil market is poised for significant growth due to its numerous applications in various industries and the increasing consumer awareness about its health benefits. The market is expected to continue its upward trajectory, driven by ongoing innovations and the rising demand for natural and organic products.

Get a glance at the market report of share of various segments Request Free Sample

The Supplements segment was valued at USD 377.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

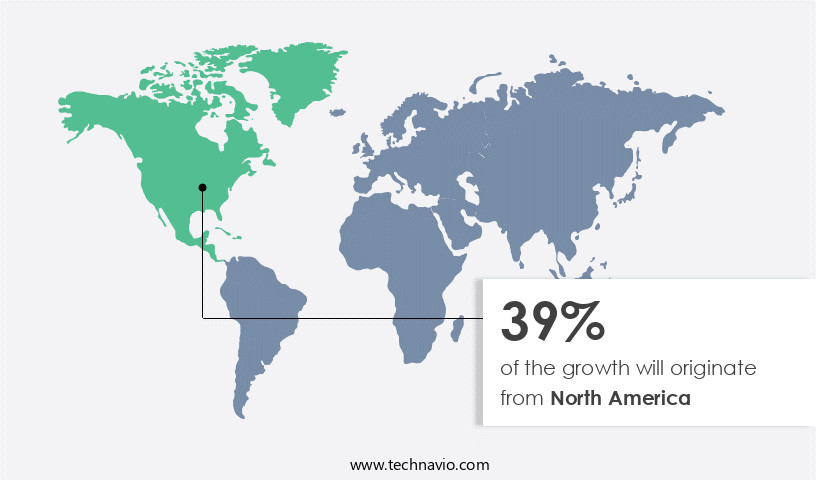

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing demand for multifunctional personal care products and the rising adoption of anti-aging solutions. Mexico and Canada are major contributors to the market revenue in the region. Consumers' heightened focus on hygiene and personal care, coupled with the growing older population and awareness about air pollution's effects, are key growth drivers. MCT oil, derived from sources like coconut and palm kernel, is prized for its ability to improve digestion, boost energy, and aid in weight management. It is used in various applications, including food emulsifiers, lotions, creams, and energy foods.

In the food industry, MCT oil is used in dairy products, infant formula, and sports nutrition. In the cosmetics sector, it is used in lotions, ointments, gels, and cosmetics products. The market's growth is further fueled by the increasing popularity of MCT oil in weight-loss supplements, nutritional bars, and dietary supplements. The market is also expanding in the restaurant industry, where MCT oil is used in preparing cold beverages and sauces. Despite the ongoing economic challenges, the market is expected to continue its growth trajectory during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Medium Chain Triglyceride (MCT) Oil Industry?

- Growing demand for supplements as preventive measures is the key driver of the market.

- The MCT oil market experiences growth due to the rising demand for dietary supplements. With an aging population increasingly focused on maintaining optimal health, the consumption of supplements has become prevalent worldwide. As people grow older, they may experience a decrease in food intake, leading to insufficient nutrient consumption. Essential nutrients like Vitamin D, calcium, iron, vitamin C, vitamin B12, omega-3, and proteins are often supplemented to address this issue.

- MCT oil, a common ingredient in these supplements, is favored for its ability to provide a quick source of energy and aid in the absorption of fat-soluble vitamins. This trend is expected to continue driving the market's growth.

What are the market trends shaping the Medium Chain Triglyceride (MCT) Oil Industry?

- New product launches is the upcoming market trend.

- The MCT oil market is witnessing significant growth due to the increasing new product launches by market participants. These new offerings cater to consumer demands and contribute to market expansion. Successfully introduced products enhance a company's revenue, consumer base, market share, and provide a competitive edge. For instance, in January 2021, NEXE Innovations Inc. Unveiled XOMA Superfoods, a soluble micro-ground coffee fortified with MCT oil, packaged in NEXE Pods.

- This strategic move aims to meet consumer needs and strengthen the company's market position.

What challenges does the Medium Chain Triglyceride (MCT) Oil Industry face during its growth?

- Loss of consumer confidence is a key challenge affecting the industry growth.

- MCT supplements, such as MCT oils, have been marketed for weight loss applications. However, the use of weight loss supplements, including MCT oils, has recently faced scrutiny due to potential health risks. These supplements can cause adverse effects, such as increased heart rate, high blood pressure, diarrhea, agitation, kidney problems, insomnia, liver damage, and rectal bleeding. Furthermore, they may interact with certain prescription and over-the-counter medications, enhancing their effects or causing dangerous combinations. For instance, caffeine's stimulant properties may be intensified when taken with bitter orange, while chitosan may increase the blood-thinning effects of warfarin.

- The safety and efficacy of many weight loss supplements are uncertain due to untested ingredients and unknown combined effects. As a , it is essential to be aware of these potential risks and consult with healthcare professionals before consuming any weight loss supplements.

Exclusive Customer Landscape

The medium chain triglyceride (mct) oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medium chain triglyceride (mct) oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medium chain triglyceride (mct) oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Barleans Organic Oils LLC - The company specializes in providing MCT oils, including coconut oils, as part of its offerings. These medium-chain triglyceride oils are known for their potential health benefits, making them a popular choice for consumers seeking to enhance their dietary intake. MCT oils are easily digestible and can provide a quick source of energy, making them an attractive alternative to longer-chain fats. Additionally, they may aid in weight management, improve cognitive function, and boost metabolic rate. By incorporating these oils into daily meals or using them in cooking, individuals can reap the potential benefits for their overall well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barleans Organic Oils LLC

- BASF SE

- C60 LABS

- Crestchem Ltd.

- Croda International Plc

- Henry Lamotte Oils GmbH

- IOI Corp. Berhad

- Jarrow Formulas Inc.

- Kuala Lumpur Kepong Berhad

- LifeSense International LLC

- Lonza Group Ltd.

- Metagenics LLC

- NOW Health Group Inc.

- Nutiva Inc.

- Nutricia Ireland Ltd.

- Oleon NV

- Performance Lab Ltd.

- Stepan Co.

- Sternchemie GmbH and Co. KG

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Medium Chain Triglyceride (MCT) oil, a type of edible oil, has gained significant attention in various industries due to its unique properties. This oil, derived from sources such as coconut and palm kernel, consists of medium-length fatty acids, primarily capric, caprylic, and lauric triglycerides. MCT oil is known for its ability to provide a quick source of energy, as it is easily absorbed and metabolized in the body. Unlike long-chain triglycerides found in most food sources, MCTs do not require bile or pancreatic enzymes for digestion. Instead, they are directly absorbed into the bloodstream, providing a quick energy boost.

The food industry utilizes MCT oil as a component in various applications. In the production of energy foods, it is used as an alternative to mineral oils due to its distinct flavors and energy-providing properties. MCT oil is also used in the formulation of nutritional bars, weight management supplements, and sports nutrition products, catering to athletes and sportspeople. In the cosmetics industry, MCT oil is used in the production of lotions, creams, and ointments due to its moisturizing properties. It is also used as a natural emulsifier in various cosmetic products, replacing synthetic alternatives. The use of MCT oil extends to the restaurant industry, where it is used in the preparation of cold beverages and sauces.

Its distinct flavors add depth to dishes, making it a popular choice among chefs. MCT oil's unique properties have also made it a subject of interest in the health and wellness sector. It is believed to aid in weight management, immunity, and metabolism. Additionally, it has antimicrobial properties, making it effective against harmful parasites and viruses. The production of MCT oil involves a process called fractionation, where the oil is separated from other fatty acids using methylene oxide. This process ensures the purity and consistency of the final product. The market for MCT oil is expected to grow significantly due to its versatility and health benefits.

The organic beauty market, in particular, is expected to see a in demand for natural and organic MCT oil due to consumer preferences. The ecommerce sector is also expected to play a significant role in the growth of the MCT oil market, as consumers increasingly opt for online shopping due to the convenience it offers. Despite the numerous benefits of MCT oil, it faces competition from other edible oils and synthetic alternatives. However, the growing awareness of the health benefits of natural and organic products is expected to drive demand for MCT oil in various industries. In , Medium Chain Triglyceride (MCT) oil is a versatile and valuable ingredient in various industries, from food and cosmetics to health and wellness.

Its unique properties, including its ability to provide a quick source of energy and aid in weight management, immunity, and metabolism, make it a popular choice among consumers and manufacturers alike. The market for MCT oil is expected to grow significantly due to increasing consumer awareness and the convenience offered by ecommerce platforms.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 448.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

China, US, India, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medium Chain Triglyceride (MCT) Oil Market Research and Growth Report?

- CAGR of the Medium Chain Triglyceride (MCT) Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medium chain triglyceride (mct) oil market growth of industry companies

We can help! Our analysts can customize this medium chain triglyceride (mct) oil market research report to meet your requirements.