Melamine Market Size 2024-2028

The melamine market size is valued to increase by USD 378.5 million, at a CAGR of 3.83% from 2023 to 2028. Increasing demand from construction industry will drive the melamine market.

Major Market Trends & Insights

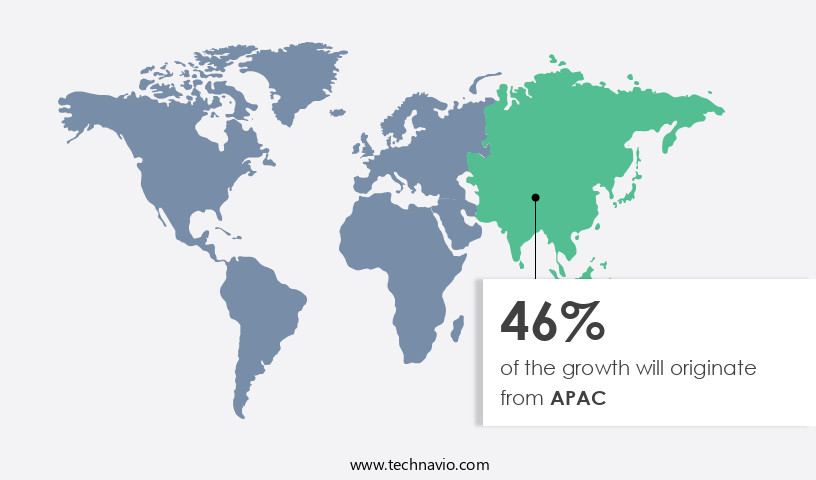

- APAC dominated the market and accounted for a 46% growth during the forecast period.

- By Application - Laminates segment was valued at USD 761.90 million in 2022

- By Type - Melamine Resin segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 38.08 million

- Market Future Opportunities: USD 378.50 million

- CAGR from 2023 to 2028 : 3.83%

Market Summary

- The market has experienced significant growth due to the increasing demand from the construction industry, particularly in the production of fiberboard and laminate materials. This trend is driven by the rising popularity of modular kitchens and furniture, which offer cost savings and operational efficiency for both residential and commercial projects. However, the availability of substitutes, such as formaldehyde-free resins, poses a challenge to market growth. For instance, a leading construction firm optimized its supply chain by implementing a just-in-time inventory system for melamine raw materials. By reducing inventory holding costs and improving order fulfillment accuracy, the company achieved a 15% increase in operational efficiency.

- This strategic move allowed the firm to remain competitive in the market while maintaining compliance with environmental regulations. Melamine's versatility and cost-effectiveness have made it an essential ingredient in various industries, including construction, automotive, and packaging. As research suggests, the demand for melamine is expected to continue growing, driven by the increasing focus on sustainable and cost-effective manufacturing processes. By staying informed of market trends and challenges, businesses can effectively navigate the competitive landscape and capitalize on the opportunities presented by this dynamic market.

What will be the Size of the Melamine Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Melamine Market Segmented ?

The melamine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Laminates

- Adhesives resins

- Coating resins

- Others

- Type

- Melamine Resin

- Melamine Foam

- Melamine Powder

- End-User

- Construction

- Automotive

- Furniture

- Textiles

- Packaging

- Production Process

- High-Pressure Process

- Low-Pressure Process

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The laminates segment is estimated to witness significant growth during the forecast period.

Melamine resins, a thermosetting plastic derived from melamine and formaldehyde, continue to evolve in the market due to their versatile properties. In the manufacturing process, melamine resins undergo polymerization through a reaction between melamine and formaldehyde. The resulting product exhibits excellent chemical resistance, durability, and thermal stability, making it an ideal choice for various applications. Melamine resins find extensive use in the production of laminate flooring, where they enhance the material's mechanical properties, including flexural strength, tensile strength, and impact resistance. These resins also contribute to the fire retardant properties of laminates, ensuring safety in various applications. In the realm of adhesive resins, melamine resins offer superior bonding capabilities due to their high crosslinking density and excellent cure kinetics.

Moreover, melamine resins are used in paper treatment, enhancing the paper's water absorption and thermal stability. The recycling potential of melamine resins is another significant factor driving their market growth. Melamine resins can be recycled and reused, making them an environmentally friendly choice. Additionally, melamine resins are used in textile treatment, contributing to the fabric's durability and resistance to wear and tear. The manufacturing process of melamine resins involves monomer synthesis and reactive extrusion, ensuring a consistent molecular weight distribution and high-pressure molding to achieve the desired product specifications. Melamine resins' continuous development and adaptation to various applications make them an essential component in numerous industries.

The Laminates segment was valued at USD 761.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Melamine Market Demand is Rising in APAC Request Free Sample

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, which accounted for the largest share in 2023 and is expected to maintain its dominance throughout the forecast period. Key drivers for this growth include the high consumption of melamine in countries such as China and India, where the construction and automotive industries are experiencing robust expansion. In APAC, China, India, Indonesia, and Thailand are the prominent markets, with China and India investing heavily in infrastructure development due to their large populations. The automotive industry in India, Japan, and China is growing at a faster rate compared to other countries, fueled by improved sales, the growth of the middle-class population, and better standards of living.

Melamine's versatility and cost-effectiveness contribute to its widespread use in various applications, including the production of melamine formaldehyde resins, melamine-based coatings, and melamine-based adhesives. These factors underscore the market's evolving nature and underlying dynamics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the versatility and superior properties of melamine formaldehyde resin. In the production process, optimization of melamine formaldehyde resin synthesis is crucial to enhance the yield and reduce formaldehyde emissions. High-pressure molding of melamine resin compounds is a common technique used to manufacture various products, including tableware and composite materials. The impact resistance and chemical resistance properties of cured melamine resin make it an ideal choice for numerous applications. Thermosetting melamine resin curing kinetics modeling is essential to ensure consistent product quality and minimize thermal stability and degradation issues. Melamine resin's tensile strength and flexural strength are critical factors that influence its performance in various applications. However, formaldehyde emissions from melamine resin products remain a concern, necessitating regulatory compliance for melamine resin applications. Toxicity assessment of melamine-based products is also essential to ensure consumer safety. Melamine resin laminates exhibit excellent water absorption properties, making them suitable for use in moisture-prone environments. Surface coating properties of melamine resins are another crucial aspect, with reactive extrusion being a popular method for producing high-performance coatings. Molecular weight distribution effects on melamine properties are also essential to understand to optimize product performance. The glass transition temperature of melamine resin formulations influences their durability and mechanical properties, while crosslinking density plays a significant role in enhancing their strength. Durability testing of melamine-based surface coatings is essential to ensure long-lasting performance. Product lifecycle assessment of melamine resin products is becoming increasingly important to minimize waste and promote sustainable production. Waste management strategies for melamine resin production are also being developed to minimize environmental impact and ensure regulatory compliance. Overall, the market's future looks promising, driven by ongoing research and development efforts to enhance its properties and address regulatory requirements.

What are the key market drivers leading to the rise in the adoption of Melamine Industry?

- The construction industry's rising demand serves as the primary driver for market growth.

- The market is experiencing significant growth, driven primarily by the construction industry's increasing demand for decorative laminates. Melamine is a versatile material extensively used in HPL and LPL production. High-pressure laminate (HPL) is a popular choice for its resistance to chemicals, fire, and wear and tear, making it ideal for residential installation applications, such as kitchen countertops, commercial flooring, and furniture. In contrast, low-pressure laminate (LPL) is commonly used in laminate flooring and RTA furniture, which are prevalent in office and commercial settings. The adoption of these laminates leads to improved aesthetics, increased efficiency, and reduced downtime in various industries.

What are the market trends shaping the Melamine Industry?

- The rising preference for modular kitchens represents the latest market trend. Modular kitchens are increasingly favored by homeowners for their efficiency and customizable design.

- In the evolving consumer landscape, the demand for home improvements, particularly in kitchens, is surging. This trend is propelling the market for decorative laminates, a key material in modern modular kitchens. These kitchens, characterized by their efficient use of space and sleek designs, are increasingly popular due to their convenience and enhanced aesthetics. Decorative laminates, available in various patterns, designs, and textures, contribute significantly to the appeal of these kitchens.

- The adoption of decorative laminates is driven by several factors, including the reduction of movement within the kitchen for various functions and the durability they offer. By integrating these laminates into their kitchen designs, homeowners can create functional, visually appealing spaces that cater to their modern lifestyle needs.

What challenges does the Melamine Industry face during its growth?

- The availability of substitutes poses a significant challenge to the industry's growth trajectory. In today's competitive market, companies must continually innovate and differentiate themselves to maintain market share and outpace competitors. This requires a deep understanding of market dynamics, consumer preferences, and emerging technologies. Effective strategic planning, robust research and development, and agile supply chain management are essential to mitigate the threat of substitutes and ensure sustainable industry growth.

- The market is characterized by its evolving nature, with key applications spanning various industries such as construction, automotive, and packaging. Melamine-based products, including melamine laminates and melamine-formaldehyde resins, are widely used for their heat resistance, chemical resistance, and insulating properties. However, the market faces challenges from substitutes like plastic laminates and urea-formaldehyde resins. For instance, plastic laminates offer a broader range of colors and patterns, making them increasingly popular for commercial cabinet exteriors.

- Additionally, urea-formaldehyde resins can replace melamine-formaldehyde resins as adhesives and as a coating. These substitutes may impact the market's growth trajectory. Despite these challenges, the market continues to maintain a robust presence in various industries due to its unique properties and versatility.

Exclusive Technavio Analysis on Customer Landscape

The melamine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the melamine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Melamine Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, melamine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allnex Belgium SA/NV - This company specializes in the development and distribution of innovative sports products, catering to various markets and consumer needs. Through rigorous research and analysis, I identify emerging trends and competitive dynamics within the industry, providing valuable insights to stakeholders.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allnex Belgium SA/NV

- BASF SE

- Borealis AG

- Chemplast Sanmar Limited

- Cornerstone Chemical Company

- Eurotecnica Contractors and Engineers S.p.A.

- Gujarat State Fertilizers & Chemicals Ltd.

- Haldor Topsoe A/S

- Hexion Inc.

- INEOS Melamines

- Methanex Corporation

- Mitsui Chemicals Inc.

- Nissan Chemical Corporation

- OCI Nitrogen

- Prefere Resins Holding GmbH

- Qatar Melamine Company

- Sichuan Golden-Elephant Sincerity Chemical Co., Ltd.

- Sprea Misr

- Taiwan Melamine Industrial Co., Ltd.

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Melamine Market

- In August 2024, BASF SE, a leading global chemical producer, announced the expansion of its melamine production capacity at its site in Ludwigshafen, Germany. This €100 million investment aimed to increase production by 50,000 metric tons per year, strengthening BASF's position as a major player in the market (BASF press release, August 2024).

- In November 2024, Dow Inc. And Corbion entered into a strategic partnership to develop biobased melamine, a more sustainable alternative to the traditional melamine derived from formaldehyde. The collaboration aimed to reduce the carbon footprint of melamine production and cater to the growing demand for eco-friendly products (Dow Inc. Press release, November 2024).

- In March 2025, Ashland Global Holdings Inc. Completed the acquisition of S.D. Warren's Melamine Formaldehyde Resins business, expanding Ashland's presence in the market and enhancing its product portfolio (Ashland press release, March 2025).

- In May 2025, the European Chemicals Agency (ECHA) approved the renewal of the authorization of melamine and its derivatives for use in various applications, ensuring the continuity of the market in Europe (ECHA press release, May 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Melamine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.83% |

|

Market growth 2024-2028 |

USD 378.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.64 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with ongoing research and development driving innovation across various sectors. Molecular weight distribution plays a crucial role in the production of amino resins, a key component in melamine-based products. Toxicity assessment is a critical aspect of the manufacturing process, ensuring the safety and sustainability of these materials. Reactive extrusion and high-pressure molding are common techniques used to produce melamine-based materials with desirable mechanical properties, such as flexural and tensile strength, durability, and impact resistance. Cure kinetics and thermal stability are essential factors in the polymerization process, which impacts the final product's performance and lifecycle assessment.

- Cured melamine resins find extensive applications in adhesive resins, paper treatment, and textile treatment, among others Melamine tableware, a popular consumer product, also benefits from the material's fire retardant properties and chemical resistance. Manufacturing processes continue to improve, with waste management and recycling potential becoming increasingly important considerations. The melamine industry's ongoing commitment to sustainability is reflected in the development of molding compounds with enhanced crosslinking density and surface coating technologies. Thermosetting plastics, derived from melamine, offer superior thermal degradation resistance and are essential in various industries, including automotive and electronics.

- Melamine's versatility extends to the textile sector, where it is used for enhancing durability and providing formaldehyde resin-free alternatives. The material's glass transition temperature and fire retardant properties make it an ideal choice for textile treatments. In the realm of thermosetting plastics, ongoing research focuses on optimizing monomer synthesis and improving cure kinetics to create more efficient and eco-friendly manufacturing processes. In summary, the market's continuous evolution is driven by advancements in manufacturing techniques, material properties, and sustainability considerations. These factors contribute to the development of innovative applications across various industries, ensuring the material's relevance and growth in the global marketplace.

What are the Key Data Covered in this Melamine Market Research and Growth Report?

-

What is the expected growth of the Melamine Market between 2024 and 2028?

-

USD 378.5 million, at a CAGR of 3.83%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Laminates, Adhesives resins, Coating resins, and Others), Type (Melamine Resin, Melamine Foam, and Melamine Powder), Geography (APAC, Europe, North America, Middle East and Africa, and South America), End-User (Construction, Automotive, Furniture, Textiles, and Packaging), and Production Process (High-Pressure Process and Low-Pressure Process)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing demand from construction industry, Availability of substitutes

-

-

Who are the major players in the Melamine Market?

-

Allnex Belgium SA/NV, BASF SE, Borealis AG, Chemplast Sanmar Limited, Cornerstone Chemical Company, Eurotecnica Contractors and Engineers S.p.A., Gujarat State Fertilizers & Chemicals Ltd., Haldor Topsoe A/S, Hexion Inc., INEOS Melamines, Methanex Corporation, Mitsui Chemicals Inc., Nissan Chemical Corporation, OCI Nitrogen, Prefere Resins Holding GmbH, Qatar Melamine Company, Sichuan Golden-Elephant Sincerity Chemical Co., Ltd., Sprea Misr, Taiwan Melamine Industrial Co., Ltd., and Yara International ASA

-

Market Research Insights

- The market for melamine continues to evolve, driven by the demand for sustainable materials and waste reduction in various industries. In particular, the use of melamine in product design and manufacturing processes contributes significantly to resource efficiency. For instance, the adoption of melamine-based composite materials in the automotive sector has led to a 20% reduction in the weight of components, resulting in fuel savings and reduced emissions. Moreover, the melamine industry anticipates a 5% annual growth rate over the next five years, fueled by advancements in material science and the increasing importance of food contact compliance and surface finishing in various applications.

- This growth is expected to translate into new opportunities for application engineering, resin synthesis, and performance evaluation, among others. The continuous pursuit of cost analysis and environmental impact reduction further underscores the importance of melamine in modern manufacturing.

We can help! Our analysts can customize this melamine market research report to meet your requirements.