Metallurgical Coal Market Size 2025-2029

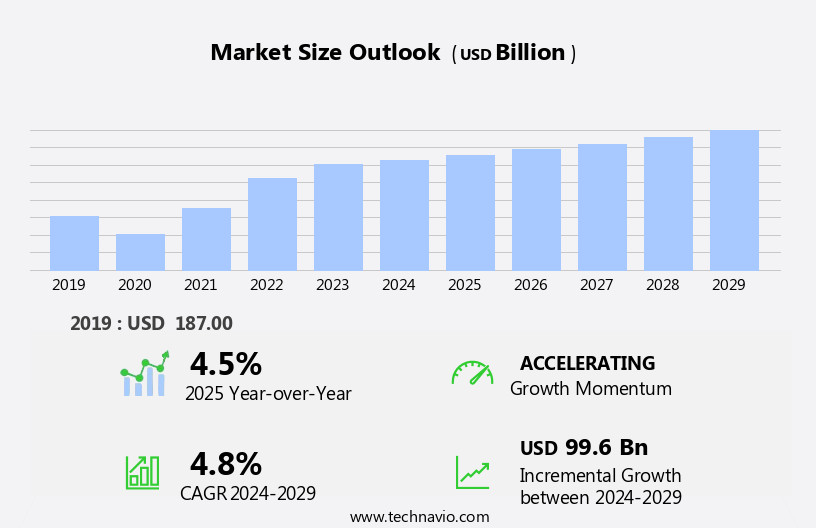

The metallurgical coal market size is forecast to increase by USD 99.6 billion at a CAGR of 4.8% between 2024 and 2029.

-

The metallurgical coal market is propelled by rising global steel demand, particularly in Asia Pacific, where infrastructure projects and smart city initiatives drive significant consumption. Technological advancements, such as 3D mine visualizers and proximity detection systems, enhance mining efficiency, supporting market growth. In North America, steady demand stems from automotive and construction sectors, while Europe's market thrives due to steel production in countries like Germany and Russia. Sustainability trends push for high-quality coal to support efficient, eco-friendly steel production. However, the volatility in prices of metallurgical coal, influenced by supply and demand dynamics and geopolitical factors, poses a significant risk for market participants.

- Companies seeking to capitalize on the opportunities presented by this market must adopt strategic sourcing and pricing strategies. Additionally, investments in technological advancements, such as automation and mechanization, can help improve operational efficiency and reduce costs. Overall, the market offers substantial growth potential for companies able to navigate the price volatility and adapt to evolving market conditions.

What will be the Size of the Metallurgical Coal Market during the forecast period?

- The market encompasses the production and trade of coal used primarily in steel manufacturing. This market exhibits dynamic behavior, influenced by various factors. High-sulphur utilization and medium-ash applications in iron ore smelting remain significant drivers, while price fluctuations in thermal coal markets can impact metallurgical coal demand. Environmental concerns, including air pollution and mining safety, necessitate continued innovation in mining industry practices and technologies. Mining resources and reserves, mining sustainability, and mining equipment automation are essential considerations for market participants. Steel industry outlook, infrastructure development, and sustainable infrastructure projects, such as bridge construction and commercial space development, shape demand for metallurgical coal.

- Renewable energy alternatives and sustainable mining practices are gaining traction, potentially impacting the market's future direction. Mining project management, equipment maintenance, and mining investment are crucial elements in the metallurgical coal supply chain. Steel production technology advancements and iron ore smelting processes continue to evolve, influencing the market's size and direction. The transportation and logistics sector plays a vital role in delivering coal to consumers, ensuring efficient and cost-effective solutions. Mining industry outlook remains positive, driven by the ongoing demand for steel and infrastructure development.

How is this Metallurgical Coal Industry segmented?

The metallurgical coal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Steel making

- Non-steel making

- Type

- Hard coking coals

- Semi-soft coking coals

- Pulverized coal injection

- Medium Coking Coal

- End-User

- Iron and Steel Industry

- Chemical and Pharmaceutical

- Foundry Industry

- Non-Steel Production

- Power Industry

- Geography

- APAC

- China

- India

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- Middle East and Africa

- UAE

- South America

- Brazil

- Rest of World

- APAC

By Application Insights

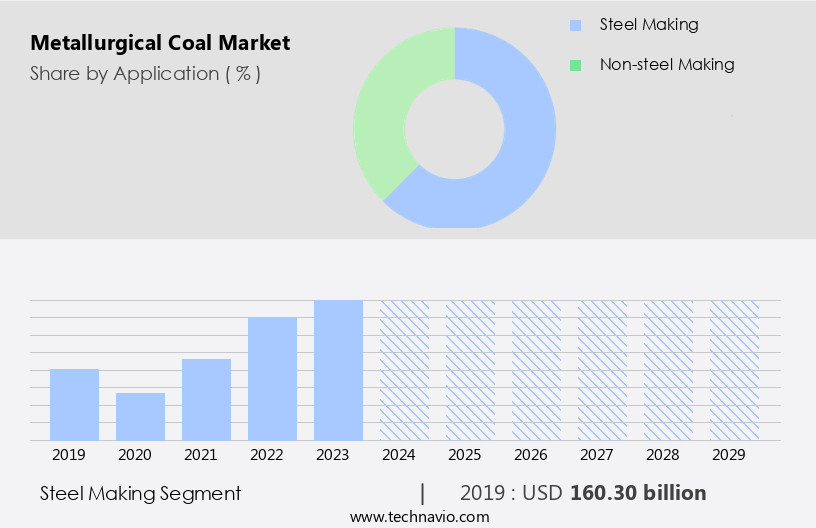

The steel making segment is estimated to witness significant growth during the forecast period.

Metallurgical coal plays a crucial role in steel manufacturing as it is the primary input for coke production in the blast furnace process and the electric arc furnace (EAF) route. Steel production, a key indicator of economic development, saw a 3.3% increase in global crude steel output to 145.5 million tons (Mt) in November 2023, according to the World Steel Association. Concurrently, the global apparent steel use per capita surpassed 200 kilograms, marking an over 10% rise. Both steel manufacturing processes, BF-BOF and EAF, necessitate metallurgical coal. While the former requires substantial volumes, the latter demands lower quantities.

The steel industry's growth is driven by infrastructure development, urbanization, and the increasing demand for construction, high-grade steel for various industries, and premium hard coking coal for medical applications. The market dynamics are influenced by factors such as coal quality standards, sustainable mining practices, carbon footprint reduction, and price reduction through mining technology advancements and automation. Additionally, environmental degradation and air quality concerns have led to stricter emissions regulations and a focus on low-sulfur and low-ash coal. The market also faces challenges from the volatile rank, moisture control, and heat value of coal, which impact coke quality, blast furnace efficiency, and coke oven efficiency.

The market is further influenced by macroeconomic factors, trade policies, and the commercialization of carbon capture, utilization, and storage technologies.

Get a glance at the market report of share of various segments Request Free Sample

The Steel making segment was valued at USD 160.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

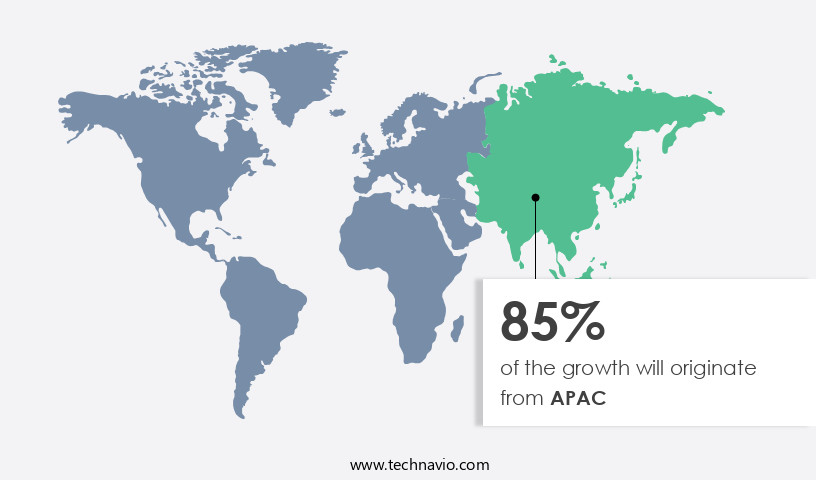

APAC is estimated to contribute 85% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific region is projected to expand significantly due to the robust demand from steel manufacturers. The steel industry relies heavily on metallurgical coal as a primary input in the blast furnace process for iron production. Rapid industrialization and infrastructure development, particularly in countries like China and India, are driving the demand for steel. Urbanization in these nations is leading to an increase in construction activities, further boosting the need for steel. Asia is the largest consumer of seaborne metallurgical coal imports, accounting for over 60% of the global market share. In 2023, China, Australia, Indonesia, and India were the major contributors to the growth of the market in the Asia Pacific region.

The demand for high-quality coking coal blends is increasing due to the need for improved coke quality, coke oven efficiency, and blast furnace fuel properties. The market is influenced by various factors, including coal quality standards, production capacity expansion, and environmental concerns. Low-sulfur coal and low-ash metallurgical coal are preferred due to their improved environmental performance and reduced emissions. Coal carbonization technology and pulverized coal injection are gaining popularity in the steelmaking process for improved energy efficiency and reduced carbon footprint. Mining technology advancements, such as 3D data visualization, automated fleet management, and fleet tracking, are contributing to cost reduction and improved machine performance in mining operations.

Macroeconomic factors, including trade policies and market trends, also impact the market dynamics. Safety measures and emission control are essential considerations for sustainable coal mining practices.

Market Dynamics

The Metallurgical Coal Market remains pivotal for steel production, with coking coal and specifically Hard Coking Coal (HCC) being essential for Blast Furnace Steel processes. The global metallurgical coal landscape is continually influenced by seaborne metallurgical coal trade dynamics. While PCI Coal adoption continues to grow, driven by coal blending advancements, the industry faces increasing scrutiny from environmental regulations coal related to its carbon footprint. Looking ahead, Metallurgical Coal Demand will be shaped by the growth of Asia-Pacific metallurgical coal markets and the long-term impact of Green Steel Production initiatives. Innovations in coal mining technology and the future of metallurgical coke and coke oven by-products are key discussion points among metallurgical coal suppliers.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Metallurgical Coal Industry?

- Increasing demand for steel is the key driver of the market. Metallurgical coal plays a vital role in the global economy as it is a critical input for steel production.

- Steel, an essential element in infrastructure and building development, is used extensively in various manufacturing activities. The socio-economic development of a country is often measured by its per capita steel consumption. Two primary methods, Blast Furnace-Basic Oxygen Furnace (BF-BOF) and Electric Arc Furnace (EAF), are used for steel production. Metallurgical coal is a key component in both processes. The BF-BOF method uses coal as a reducing agent to remove impurities from iron ore, while the EAF process relies on coal as a source of energy.

- The demand for steel and, consequently, metallurgical coal, is driven by numerous factors, including population growth, urbanization, and industrialization. The steel industry's growth significantly contributes to the economies of major industrial nations.

What are the market trends shaping the Metallurgical Coal Industry?

- Increase in number of smart city projects is the upcoming market trend. In today's rapidly advancing world, the integration of digital technology into urban infrastructure is becoming increasingly essential to address the challenges of population growth, climate change, and economic stress.

- A smart city leverages digital communication and technology to optimize resource usage and enhance overall productivity and well-being. The primary focus areas for smart cities include governance, transportation, healthcare, and waste management. By utilizing tools such as smartphones, the Internet of Things, and cloud-based services, cities can effectively manage resources and improve their performance.

- The shift towards smart cities is driven by the need for sustainable and efficient urban development. This trend is expected to gain momentum in the coming years as more cities embrace the benefits of digital technology to enhance their infrastructure and services.

What challenges does the Metallurgical Coal Industry face during its growth?

- Volatility in prices of metallurgical coal is a key challenge affecting the industry growth. Metallurgical coal plays a vital role in the production of coke, an essential component in smelting iron ore to manufacture steel.

- Consequently, the price of energy and eventually the metallurgical coal is significantly influenced by global demand for Iron and Steel, as the industry relies heavily on this type of coal and has limited substitute options. Despite thermal coal experiencing a declining demand due to the decommissioning of coal-fired power plants worldwide, metallurgical coal prices remain elevated.

- However, these prices are subject to fluctuations due to macroeconomic factors, including global steel demand and the trading policies of major metallurgical coal-consuming nations, such as China.

Exclusive Customer Landscape

The metallurgical coal market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metallurgical coal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metallurgical coal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alpha Metallurgical Resources Inc. - This company specializes in providing high-quality metallurgical coal to a global customer base.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Metallurgical Resources Inc.

- Anglo American plc

- Arch Resources Inc.

- ARLP

- Bharat Coking Coal Ltd

- BHP Group Ltd.

- China Shenhua Energy Co. Ltd.

- Coal India Ltd.

- CONSOL Energy Inc

- Coronado Global Resources Inc.

- EVRAZ Plc

- Glencore Plc

- Harman Fuels LLC

- Peabody Energy Corp.

- Prairie State Energy Campus.

- Shanxi Coking Coal Xishan Coal and Electricity group Co Ltd

- Teck Resources Ltd.

- Warrior Met Coal Inc.

- Whitehaven Coal Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Developments and News in Metallurgical Coal Market

- In January 2025, the global metallurgical coal market saw significant growth projections, driven by rising steel demand, particularly in emerging economies like China and India.

- In May 2025, SunCoke Energy acquired Phoenix Global for USD 325 million, reshaping the metallurgical coke landscape. This strategic merger enhances SunCoke's production capacity and strengthens its position in supplying high-quality coke for the steel industry, aligning with growing global demand.

- In December 2024, technological advancements gained traction as companies invested in clean coal technologies to address environmental concerns. The U.S. Department of Energy launched initiatives to support carbon capture and storage for coal-fired plants, aiming to reduce emissions while maintaining metallurgical coal's role in steelmaking.

- In October 2024, the market saw geographic expansion with new coal mining projects in Asia-Pacific, particularly in India, to meet rising steel demand.

Research Analyst Overview

Metallurgical coal plays a crucial role in various industries, primarily in steel manufacturing and power generation. The demand for metallurgical coal is driven by the need for iron production in blast furnaces, a fundamental process in steel manufacturing. The manufacturing sector's reliance on blast furnaces is significant, as they convert iron ore into molten iron, which is then used to produce steel. The sulphur content of metallurgical coal is a critical factor in its suitability for blast furnace operations. Blast furnaces require coal with specific sulphur levels to maintain efficient and effective iron production. Medium-sulphur and high-sulphur coals are commonly used, depending on the specific requirements of the blast furnace.

Construction and infrastructure development are other major industries that utilize metallurgical coal. The production of cement, for instance, necessitates the use of coal as a fuel in the manufacturing process. The quality of the coal, in terms of its ash content, is essential to ensure the desired properties of the final cement product. The environmental implications of metallurgical coal use are a significant concern. The high carbon emissions from the combustion of coal in blast furnaces contribute to air pollution and environmental degradation. The push for carbon footprint reduction and sustainability has led to the exploration of Alternative Fuels and coal processing technologies.

The mining of metallurgical coal involves both surface and underground methods. Surface mining, which includes methods like open-pit and strip mining, is often used for large-scale operations due to its cost-effectiveness. Underground mining, on the other hand, is employed when the coal deposit is located at significant depths. Cost reduction is a significant factor in the market. Mining technology advancements, such as automated fleet management, vehicle durability improvements, and fleet tracking, have led to increased efficiency and cost savings. Additionally, the optimization of mining operations, such as dust suppression, moisture control, and energy density, further contributes to cost reduction. The market is influenced by various macroeconomic factors, including trade policies and infrastructure development.

Rapid industrialization in developing countries and the expansion of infrastructure projects have led to increased demand for steel and cement, driving up the demand for metallurgical coal. The quality of metallurgical coal is crucial in various applications. Coke quality, for instance, is essential in the steelmaking process. High-quality coking coals are used to produce coke, which is then used as a reducing agent in the blast furnace. The volatile rank, ash content, and moisture control of the coal are critical factors in coke quality. The coal beneficiation process plays a significant role in improving the quality of metallurgical coal. Technologies like coal carbonization and pulverized coal injection help to reduce sulfur levels, ash content, and improve coke strength metrics.

The market is dynamic, with constant fluctuations in demand and supply driven by various factors. The volatile nature of the market makes it essential for stakeholders to stay informed about market trends, technological advancements, and regulatory developments. The market is a critical component of various industries, including steel manufacturing and power generation. The market's dynamics are influenced by various factors, including the quality of the coal, environmental concerns, cost reduction measures, and macroeconomic factors. Understanding these factors is essential for stakeholders to make informed decisions and stay competitive in the market.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metallurgical Coal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 99.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

China, India, US, Germany, Russia, UK, France, Canada, Saudi Arabia, Brazil, UAE, and Rest of World (RoW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metallurgical Coal Market Research and Growth Report?

- CAGR of the Metallurgical Coal industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metallurgical coal market growth of industry companies

We can help! Our analysts can customize this metallurgical coal market research report to meet your requirements.