Middle Ear Implants Market Size 2024-2028

The middle ear implants market size is forecast to increase by USD 61.8 million, at a CAGR of 10.04% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing incidence of hearing loss. This trend is further fueled by rising government initiatives aimed at improving access to healthcare services, including those related to hearing implants. However, the high cost of middle ear implants poses a substantial challenge for both patients and healthcare providers. Despite this obstacle, opportunities abound for companies seeking to innovate and offer cost-effective solutions. By focusing on research and development of more affordable implant technologies, businesses can capitalize on the growing demand for hearing solutions and differentiate themselves in a competitive market. Additionally, collaborations with healthcare providers and insurers could help expand market reach and ensure broader access to these life-changing devices.

- In summary, the market is poised for growth, with a significant population suffering from hearing loss and supportive government initiatives. However, the high cost of implants remains a significant challenge, necessitating innovative solutions and strategic partnerships. Companies that successfully navigate these dynamics will be well-positioned to capitalize on the market's potential and make a meaningful impact on the lives of those with hearing loss.

What will be the Size of the Middle Ear Implants Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The middle ear implant market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Middle ear effusion, a common condition causing conductive or mixed hearing loss, presents an opportunity for implant solutions. Implant candidacy criteria, influenced by individual patient needs and middle ear anatomy, are continually refined. Bone conduction implants and prosthetic middle ear devices offer alternatives to traditional hearing aids for certain patient profiles. Sensorineural hearing loss, another prevalent condition, drives demand for cochlear implant surgery. Implant failure rates remain a focus, with ongoing research into electroacoustic stimulation and implant longevity.

Middle ear anatomy, including the ossicles and their functions, informs the development of auditory implant technology. Surgical implantation techniques and post-operative care are crucial components of successful implantation. Speech perception testing and complication management are essential aspects of the patient selection process. Audiological evaluation plays a pivotal role in determining the most suitable implant for each patient. Stapes prosthesis and malleus replacement are examples of implant solutions for specific conditions. Ongoing advancements in programming software and implant activation processes enhance hearing outcomes assessment. Device longevity and mapping parameters are key considerations for both patients and healthcare providers.

How is this Middle Ear Implants Industry segmented?

The middle ear implants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Electromagnetic middle ear implants

- Piezoelectric middle ear implants

- Application

- Sensorineural hearing loss

- Conductive hearing loss

- Mixed hearing loss

- Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

- End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Technology Specificity

- Active Implants

- Passive Implants

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

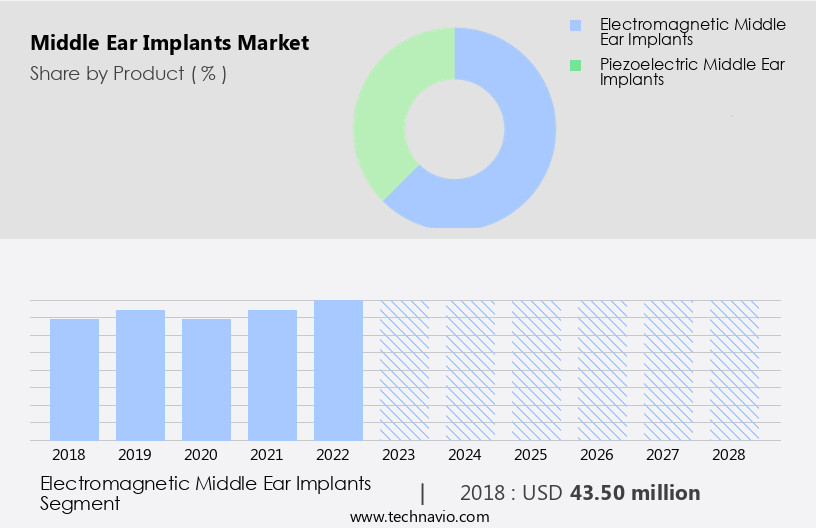

The electromagnetic middle ear implants segment is estimated to witness significant growth during the forecast period.

Middle Ear Implant Market encompasses innovative solutions designed to address various types of hearing loss, including conductive, sensorineural, and mixed. Middle ear implants offer alternatives to traditional hearing aids, particularly for individuals with hearing loss due to damaged middle ear ossicles or otosclerosis. These implants can be categorized into two main approaches: electromagnetic and piezoelectric. The electromagnetic approach utilizes an external microphone that sends signals through an inductive coil, generating a magnetic field. The implanted receiving coil then picks up this signal and transfers it to a transducer, resulting in synchronized vibration. The sound is ultimately transduced to the inner ear.

Although bulkier and partially implantable, the electromagnetic approach can provide substantial gains and output, making it suitable for severe hearing loss cases. Ototronix's MAXUM middle ear implant is an example of a semi-implantable device, featuring an implanted transducer and an external audio processor. Middle ear implant candidates undergo extensive audiological evaluation, implant candidacy criteria assessment, and surgical implantation techniques. Post-operative care, speech perception testing, and complications management are crucial components of the patient selection process. Middle ear implants can address various hearing loss conditions, such as conductive, sensorineural, and mixed. They offer potential solutions for hearing restoration through advanced auditory implant technology.

The market is driven by advancements in surgical techniques, implant longevity, and hearing outcomes assessment. Middle ear implant failure rates, programming software, implant activation process, malleus and incus replacement, ossicular chain reconstruction, and stapes prosthesis are essential considerations in the evolving market landscape.

The Electromagnetic middle ear implants segment was valued at USD 43.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, hearing loss, the third most prevalent physical condition after arthritis and heart disease, affects individuals of all ages, leading to a rising trend in the market for hearing solutions. For instance, approximately 0.1% of children in North America are born with hearing loss above 40 decibels (dB), while about 2.5 children per 1,000 in the US are affected. Furthermore, one in four Americans report some degree of hearing loss. Adult men, aged 20-69 years, are more likely to experience hearing loss than women of the same age. The hearing loss market encompasses various solutions, including hearing aids, cochlear implants, and middle ear implants.

Middle ear implants offer an alternative to traditional hearing aids for individuals with conductive hearing loss or mixed hearing loss. These implants are designed to restore hearing by bypassing damaged middle ear structures, such as the ossicular chain or the stapes. Middle ear implants include solutions like ossicular chain reconstruction, incus replacement, malleus replacement, and stapes prosthesis. The implant candidacy criteria, which determine eligibility for these procedures, depend on factors like the extent of hearing loss, the presence of middle ear disease, and the patient's overall health. The implant rehabilitation process involves programming software and the implant activation process to optimize the device for the individual's hearing needs.

Post-operative care, including speech perception testing and complications management, is crucial to ensure successful hearing outcomes. Middle ear effusions, which can obstruct the implant's function, may necessitate additional procedures. Hearing outcomes assessment and patient selection processes are essential to ensure the best possible outcomes for each patient. Auditory implant technology continues to evolve, with advancements in surgical implantation techniques and device longevity. Mapping parameters and electroacoustic stimulation play a significant role in optimizing the implant's performance. Middle ear anatomy and the middle ear ossicles are essential considerations in the design and implementation of middle ear implants.

Treating conditions like otosclerosis and sensorineural hearing loss with these implants can significantly improve patients' quality of life. In summary, the middle ear implant market in North America is witnessing growing demand due to the increasing prevalence of hearing loss and the availability of advanced solutions to address various types and degrees of hearing loss. The market's evolution is driven by advancements in technology, improving surgical techniques, and a growing focus on patient-centric care.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B hearing solutions emphasize piezoelectric implant innovations and electromagnetic hearing devices for enhanced auditory outcomes. Middle ear implants prospects 2024 highlight ossicular replacement prostheses and minimally invasive implant surgery. Hearing implant supply chains and implant market analytics optimize distribution. Cochlear Ltd market strategies lead, with personalized hearing implants gaining traction. Implant regulations 2024-2028 boost North America implant demand. Pediatric hearing solutions and adult implant innovations address diverse needs. Implant cost optimization and sustainable hearing technologies tackle barriers. ENT clinic implant trends and implant R&D investments drive expansion. Middle ear implant challenges like high costs are offset by innovative hearing restoration and global implant supplier networks, fueling market momentum.

What are the key market drivers leading to the rise in the adoption of Middle Ear Implants Industry?

- The increasing prevalence of hearing loss serves as the primary catalyst for market growth. The global hearing loss population is projected to double between 2018 and 2050, with approximately 91% of those affected being adults. A significant number of affected individuals reside in low and middle-income countries. In developed regions like North America and Europe, around 0.1% of children experience hearing loss exceeding 40 decibels. Middle ear implants have emerged as a promising solution for various hearing loss conditions, including otosclerosis, ossicular chain reconstruction, and incus replacement. These implants offer hearing aid compatibility and undergo an implant activation process using programming software.

- Malleus and incus replacements are also viable options. The market dynamics for middle ear implants are driven by the increasing prevalence of hearing loss, advancements in technology, and growing awareness and acceptance of implant rehabilitation solutions.

What are the market trends shaping the Middle Ear Implants Industry?

- Government initiatives are gaining momentum as the prevailing market trend. This upward trend in government involvement signifies a significant shift in business dynamics.

- The global market for middle ear implants is driven by initiatives from various governments to ensure early detection and treatment of hearing loss among their populations. For instance, in the US, the Early and Periodic Screening, Diagnosis and Treatment (EPSDT) Program mandates early hearing screenings for children from birth to age 21. Similarly, in Canada, initiatives involving both governmental and non-governmental organizations aim to raise awareness about the importance of early diagnosis and treatment for various types of hearing loss, including sensorineural and conductive. Middle ear implants, such as bone conduction implants and prosthetic middle ears, offer viable solutions for individuals with hearing loss who do not benefit from traditional hearing aids.

- These implants use different technologies, such as electroacoustic stimulation, to improve hearing ability. While cochlear implant surgery is a common solution for severe sensorineural hearing loss, middle ear implants may be a more suitable option for those with conductive hearing loss or those who are not candidates for cochlear implant surgery due to implant failure rates or other reasons. Middle ear implants can provide immersive and harmonious sound experiences, making daily activities, such as listening to music or engaging in conversations, more enjoyable and effective. As the demand for improved hearing solutions continues to grow, the market for middle ear implants is expected to expand, offering significant opportunities for innovation and advancement in this field.

What challenges does the Middle Ear Implants Industry face during its growth?

- The escalating costs of middle ear implants pose a significant challenge and hinder the growth of the industry.

- Middle ear implants are hearing restoration devices that involve surgical implantation techniques for individuals with conductive hearing loss or mixed hearing loss. The middle ear anatomy consists of the middle ear ossicles, which can be damaged, leading to hearing loss. Middle ear implants, such as the Carina Middle-ear Implant from Otologics, are fully implantable devices indicated for these types of hearing losses. The implantation procedure, carried out under general anesthesia, takes approximately two hours. The internal battery of the device can function for ten years, with only the electronic capsule needing replacement after this period.

- The cost of middle ear implants is significant, with an average price of around USD27,000 per ear. Although Medicare does not cover the cost in the US, some private insurers may provide coverage. Hearing outcomes assessment plays a crucial role in determining the success of the implantation procedure.

Exclusive Customer Landscape

The middle ear implants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the middle ear implants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, middle ear implants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Bionics - This company specializes in advanced middle ear implant solutions, including prostheses, revolutionizing the hearing health industry with innovative technology and exceptional design. Their offerings cater to various hearing loss needs, enhancing the quality of life for countless individuals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Bionics

- Cochlear Limited

- Demant A/S

- Envoy Medical

- Grace Medical

- MED-EL Medical Electronics

- Medtronic

- Microson

- Nurotron Biotechnology

- Olympus Corporation

- Oticon Medical

- Otologics

- Phonak

- Sentronix

- Sivantos

- Sonova Holding

- Starkey Hearing Technologies

- Vibrant MED-EL

- Widex

- William Demant

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Middle Ear Implants Market

- In January 2024, Cochlear Limited, a leading provider of implantable hearing solutions, announced the FDA approval of its new Nucleus Profile Cochlear Implant System. This advanced technology offers improved sound quality and wireless connectivity, expanding the company's product offerings and enhancing its competitive position in the market (Cochlear Limited Press Release).

- In March 2024, Advanced Bionics, a leading manufacturer of cochlear and bone-anchored hearing systems, entered into a strategic partnership with Sonova Holding AG, the world's leading hearing aid producer. This collaboration aimed to combine Advanced Bionics' implant technology with Sonova's hearing aid expertise, creating a comprehensive hearing solution portfolio (Advanced Bionics Press Release).

- In May 2024, Med-El, a leading manufacturer of cochlear implant systems, secured a significant investment of â¬150 million from its parent company, Sonova Holding AG. The funds were allocated towards research and development, production capacity expansion, and marketing efforts to strengthen Med-El's market position and drive growth (Med-El Press Release).

- In April 2025, the European Commission granted marketing authorization for the new Baha Connect bone-anchored hearing system from Cochlear Limited. This innovative solution allows direct streaming of sound from smartphones, TVs, and other devices, making it a significant advancement in bone-anchored hearing technology and expanding Cochlear's product portfolio (Cochlear Limited Press Release).

Research Analyst Overview

- The middle ear implant market encompasses innovative technologies designed to address various hearing loss conditions. Ossicular chain repair and cochlea implant interfaces are key areas of focus, with electrode impedance and microphone sensitivity playing crucial roles in optimizing signal processing algorithms. Biocompatibility testing is essential to ensure implant material properties align with regulatory approvals, while clinical trial data informs long-term device efficacy and patient satisfaction. Tympanoplasty procedures and middle ear infections necessitate effective hearing loss solutions. Speech audiometry and audiological device results and acoustic reflex testing provide valuable insights into implant performance. Technical specifications, such as power consumption metrics and magnetic coupling systems, influence device maintenance and surgical complications.

- Auditory training programs and rehabilitation protocols are integral to post-implantation care. Hearing threshold levels and auditory nerve stimulation are essential considerations in implant fitting procedures. Patient satisfaction surveys and troubleshooting guides are essential resources for addressing any potential issues. Regulatory approvals and implant material properties shape market trends, while technical advancements in electrode array placement and signal processing algorithms continue to drive innovation. Overall, the middle ear implant market demonstrates a dynamic landscape, with a strong emphasis on improving patient outcomes and addressing the diverse needs of those with hearing loss.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Middle Ear Implants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.04% |

|

Market growth 2024-2028 |

USD 61.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.83 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Middle Ear Implants Market Research and Growth Report?

- CAGR of the Middle Ear Implants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the middle ear implants market growth of industry companies

We can help! Our analysts can customize this middle ear implants market research report to meet your requirements.