Mobile Food Services Market Size 2024-2028

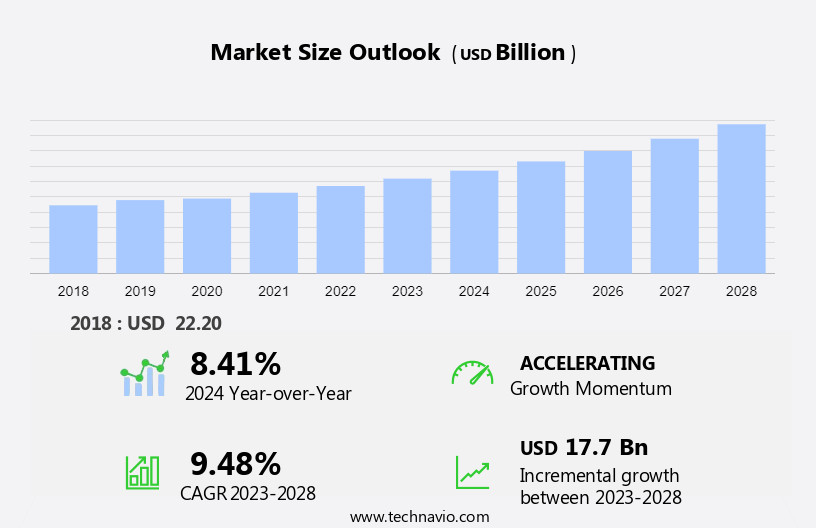

The mobile food services market size is forecast to increase by USD 17.7 billion at a CAGR of 9.48% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. One of the primary trends is the increasing demand for frozen and convenience foods, as consumers seek time-saving solutions for their busy lifestyles. Another factor fueling market growth is the rising number of marketing initiatives by food service providers, such as food trucks to attract customers through promotions and discounts. Additionally, fluctuations in food commodity prices can impact the market, presenting both opportunities and challenges for players. Overall, the market is expected to continue its growth trajectory, offering numerous opportunities for businesses that can effectively cater to the evolving needs and preferences of consumers.

What will be the Size of the Mobile Food Services Market During the Forecast Period?

- The market encompasses a diverse range of offerings, including food trucks, catering services, carts, trailers, and stands, that cater to the growing demand for convenient, budget-friendly, and time-saving food solutions such as meal kits. Urbanization and the increasing popularity of urban culture have fueled the market's growth, with a target audience that values convenience and the ability to sample a variety of food cuisines. Hygiene standards are paramount in this sector, ensuring that mobile food services maintain the same level of food safety as their brick-and-mortar counterparts. The fast food sector has also embraced mobile food services, offering pre-defined costs, dine-in menus, takeaway portions, and at-door services through e-commerce apps.

- However, the market faces challenges such as virus outbreaks and social gatherings restrictions, which can impact food dynamics and the availability of fast-food facilities. Despite these challenges, the market continues to evolve, offering a dynamic and innovative solution to the changing food landscape.

How is this Mobile Food Services Industry segmented and which is the largest segment?

The mobile food services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Food

- Beverages

- Application

- Food truck

- Removable container

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

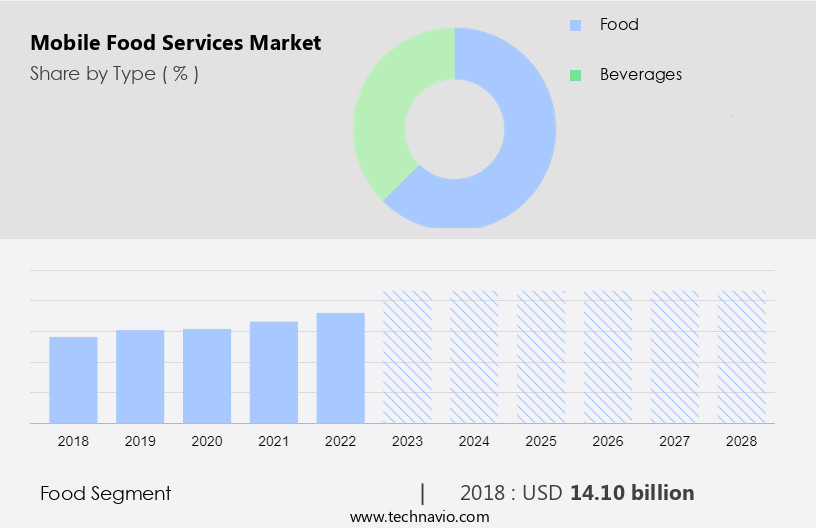

- The food segment is estimated to witness significant growth during the forecast period.

The market is experiencing steady growth, driven by urbanization and evolving consumer preferences. With the rise of nuclear families and changing lifestyles, the demand for convenient and time-saving food options is increasing. Mobile food services, including food trucks, carts, and trailers, offer a wide range of cuisines, from gourmet burgers and sandwiches to traditional meals and international dishes. Hygiene standards are of utmost importance in this sector, ensuring food safety and quality. Key players in the market include Kogi BBQ, DessertTruck Works, Don Chow Tacos, Baby's Badass Burgers, Flying Pig Truck, Bian Dang, and Burgerville. Consumers are attracted to the tempting menus and budget-friendly prices, as well as the convenience of food delivery and at-door services.

Get a glance at the Mobile Food Services Industry report of share of various segments Request Free Sample

The food segment was valued at USD 14.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing significant growth due to urbanization and the increasing preference for convenience food. With the rise in urban populations and the fast pace of life, consumers are turning to mobile food services such as food trucks, stalls, carts, and trailers for quick, affordable meals. The fast food sector, including offerings like donuts, sandwiches, burgers, pizza, and traditional meals, dominates this market. Hygiene standards are of utmost importance, and these businesses adhere to regulations to ensure food safety. The market is also influenced by inflation and the cost of raw materials, which can impact the pricing of prepared food.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Food Services Industry?

Rising demand for convenience foods is the key driver of the market.

- The market has experienced significant growth due to various market dynamics. Urbanization and the increase in disposable incomes have led to an increase in demand for convenient and easily prepared food options. With more women entering the workforce, the need for time-saving and budget-friendly food solutions has become essential. According to The World Bank Group, the global labor force's female proportion was over 45% in 2022. Mobile food services, including mobile stalls, carts, trailers, and food trucks, offer consumers a wide range of options from fast food to gourmet cuisine. Hygiene standards are of utmost importance in this sector, ensuring food safety and consumer satisfaction.

- Moreover, the fast food sector, in particular, has seen a rise in popularity, with offerings such as sandwiches, burgers, pizza, and traditional meals. The convenience food market, including prepared food and takeaway options, has gained momentum due to the busy lifestyles of consumers. E-Commerce apps have further facilitated food delivery, allowing consumers to order their favorite meals online and have them delivered to their doorstep. The food cuisine offered by mobile food services caters to various target audiences, including millennials and those who prefer gourmet cuisine. The food business has been impacted by inflation and the rising costs of raw materials.

What are the market trends shaping the Mobile Food Services Industry?

Increasing marketing initiatives is the upcoming market trend.

- In the dynamic world of mobile food services, companies employ various marketing strategies to reach their target audience. Newspapers, magazines, and social media platforms, such as Twitter and Facebook/Instagram, are integral to their communication efforts. Twitter enables companies to share location updates and engage with customers in real-time, fostering a sense of community and urgency. Facebook and Instagram, with their vast and diverse user bases, offer an opportunity to showcase tempting menus and cater to consumers' preferences. These platforms play a pivotal role in promoting convenience food services, including donuts, sandwiches, burgers, pizza, and traditional meals, in the fast food sector.

- Furthermore, as urbanization continues to influence socio-economic conditions and food dynamics, the demand for mobile food services, including food trucks, carts, trailers, and catering businesses, increases. companies prioritize hygiene standards and sustainable practices to maintain consumer trust and appeal to millennials and gourmet cuisine enthusiasts. The food delivery segment, with its budget-friendly, time-saving offerings, complements the market. E-commerce apps and at-door services further enhance the convenience factor, making these services an attractive alternative to brick-and-mortar stores. Inflation and the cost of raw materials pose challenges, but companies remain resilient, exploring joint ventures and foreign investments to navigate these hurdles. The food business landscape continues to evolve, with companies adapting to changing consumer preferences and food cuisine trends.

What challenges does the Mobile Food Services Industry face during its growth?

Fluctuations in food commodity prices is a key challenge affecting the industry growth.

- The market is significantly influenced by urbanization and the growing preference for convenience food. Mobile stalls, including food trucks, carts, and trailers, offer tempting menus that cater to various consumer preferences, such as fast food, gourmet cuisine, and traditional meals. Hygiene standards are crucial in this sector to ensure food safety and maintain the trust of customers. The fast food sector and brick-and-mortar store competition have led to the emergence of e-commerce apps and online food delivery services. Inflation and socio-economic conditions impact the pricing of raw materials and food commodities, which in turn affect the food business dynamics.

- In addition, the food truck segment, a key player in the market, has seen an increase in demand due to its budget-friendly and time-saving offerings. Gastronomy and innovative food cuisine have become essential components of urban culture, attracting millennials and foodies. The food delivery segment, including at-door services, takeaway options, and catering facilities, has gained popularity due to the convenience it offers. Sustainable practices and packaging processes are becoming increasingly important in the market to reduce the propensity of substitutes and maintain consumer loyalty. The market faces challenges from adverse weather conditions and natural calamities, which can disrupt the supply of raw materials and negatively impact production.

Exclusive Customer Landscape

The mobile food services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile food services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile food services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Belgo Holdings LLC

- Chick fil A Inc.

- Chipotle Mexican Grill Inc.

- Cocoa Forte Franchising LLC

- Courageous Bakery and Cafe

- Darden Restaurants Inc

- Eat Drink Collective

- Kogi BBQ

- KoJa Kitchen LLC

- Lukes Seafood LLC

- McDonald Corp.

- Ms Cheezious

- Phat Cart

- Restaurant Brands International Inc.

- The Grilled Cheeserie

- The Subway Group

- Waffle Bus

- World Famous House of Mac

- YUM Brands Inc.

- Yumbii

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of businesses that cater to consumers' preferences for convenient, budget-friendly, and time-saving culinary options. This sector includes food trucks, carts, trailers, and stands that offer various cuisines, from traditional meals to gourmet offerings. The market dynamics of this industry are shaped by several factors. Urbanization and the rise of urban culture have significantly contributed to the growth of the market. The fast-food sector, in particular, has seen an increase in demand due to the convenience it provides to consumers, especially millennials. These consumers seek out tempting menus that cater to their diverse palates and are often drawn to the unique offerings of food trucks and carts.

Furthermore, the convenience food trend is further fueled by the increasing popularity of e-commerce apps and online orders for food delivery. The food delivery segment has experienced significant growth, with consumers opting for at-door services to save time and avoid the hassle of cooking or dining out. The market for mobile food services is also influenced by socio-economic conditions and food dynamics. Inflation and raw material costs can impact the pre-defined costs of mobile food businesses, affecting their profitability. However, sustainable practices, such as the use of eco-friendly packaging and energy-efficient vehicles, can help mitigate these costs and appeal to environmentally-conscious consumers.

In addition, the food business landscape is constantly evolving, with new players entering the market and existing ones adapting to changing consumer preferences. Joint ventures and foreign investments are becoming increasingly common as businesses seek to expand their reach and offerings. Despite the challenges, the market remains a promising sector for entrepreneurs and investors. The market offers opportunities for innovation, from gourmet cuisine offerings to sustainable practices, and caters to a wide range of consumers, from those seeking budget-friendly options to those looking for unique dining experiences. The market for mobile food services is expected to continue growing, driven by the convenience and flexibility it offers consumers. The trend towards urbanization and the increasing popularity of e-commerce and food delivery are likely to further fuel this growth. As the market evolves, businesses that can adapt to changing consumer preferences and socio-economic conditions will be well-positioned to succeed.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.48% |

|

Market growth 2024-2028 |

USD 17.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.41 |

|

Key countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Food Services Market Research and Growth Report?

- CAGR of the Mobile Food Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile food services market growth of industry companies

We can help! Our analysts can customize this mobile food services market research report to meet your requirements.