Motorsport Transmission Market Size 2025-2029

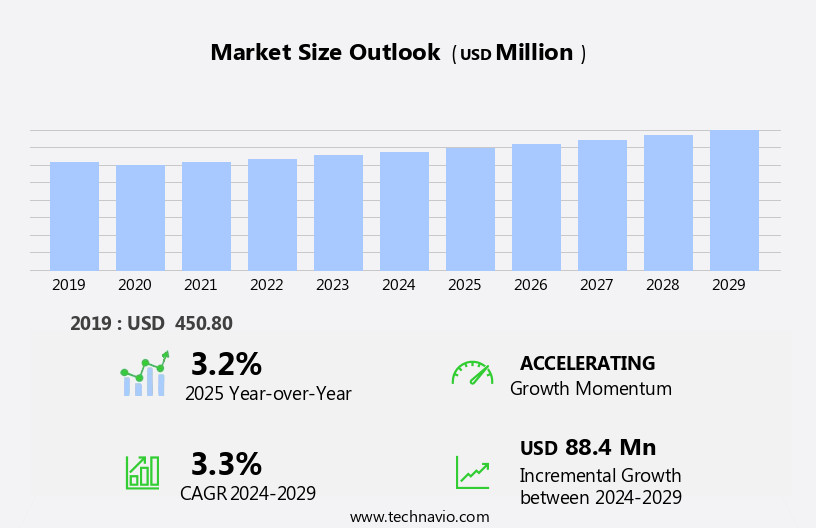

The motorsport transmission market size is forecast to increase by USD 88.4 million, at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by substantial investments from sponsors in the racing industry. This financial influx is fueling the development of advanced transmission technologies, enabling teams to gain a competitive edge on the track. However, the market faces a notable challenge in the form of the increasing adoption of electric cars in motorsport industry. As racing series transition towards sustainability, the high cost of designing and manufacturing electric motorsport transmissions poses a significant hurdle for market participants. To capitalize on this dynamic market, companies must invest in research and development to create cost-effective, high-performance electric transmission solutions while adhering to the evolving regulations.

- Navigating this landscape requires a strategic approach, with a focus on innovation and collaboration to stay ahead of the competition.

What will be the Size of the Motorsport Transmission Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by advancements in materials science, design optimization, and manufacturing processes. Electric vehicles (EVs) are increasingly integrating sequential gearboxes, utilizing carbon fiber components for weight reduction and enhanced torque capacity. In racing applications, pneumatic and hydraulic actuators are employed for efficient gear shifting mechanisms and precise shift speed. Carbon fiber gearboxes are gaining popularity due to their lightweight properties, while gear ratios are being optimized for various sectors, including motorcycle transmissions and off-road applications. Gear synchronizers ensure smooth gear selection, while output shafts and shift forks facilitate seamless power transfer.

Casting processes and heat treating are essential for enhancing the durability and reliability of gearboxes. Surface treatments and bearing systems contribute to improved performance and longevity. Lightweight materials, such as aluminum alloys, are being extensively used in the production of gearbox housings and other transmission components. In the realm of high-performance vehicles, dual-clutch transmissions (DCT) and paddle shifters have revolutionized gear selection, offering quicker shift times and enhanced driver control. Shifting algorithms and clutch assemblies are being optimized for improved efficiency and reliability. The market's dynamic nature is further emphasized by the ongoing development of advanced testing procedures, including endurance testing, heat treating, and quality control measures, ensuring the highest standards of performance and durability.

The supply chain management of critical components, such as gear teeth and axle shafts, plays a crucial role in maintaining the competitiveness of market players.

How is this Motorsport Transmission Industry segmented?

The motorsport transmission industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- H-gearbox

- Sequential gearbox

- Application

- F1

- NASCAR

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- Australia

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

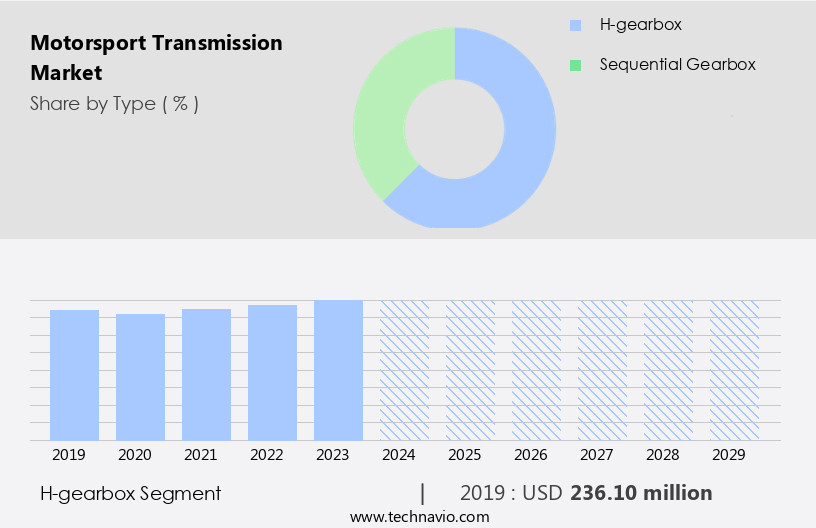

The H-gearbox segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the increasing popularity of H-gearboxes in racing applications. These manual transmissions, characterized by their distinctive H-shaped gear pattern, offer racers precise control over vehicle speed and performance. The demand for H-gearboxes is driven by their ability to facilitate sequential gear shifting, allowing drivers to make split-second decisions on the track. Additionally, the tradition and skill involved in operating H-gearboxes contribute to their allure in motorsports. Advancements in materials science, such as the use of aluminum alloys and carbon fiber, contribute to the lightweight and durable nature of H-gearboxes. Forging processes and machining techniques enable the production of high-strength components, enhancing torque capacity and endurance.

Design optimization and heat treating ensure optimal gear ratios and shift speed, while gear lubrication maintains smooth operation. Pneumatic and hydraulic actuators facilitate efficient gear shifting mechanisms, ensuring reliable and consistent performance. Quality control measures, such as shaft alignment and testing procedures, ensure the durability and reliability of H-gearboxes. The market also caters to various motorsport sectors, including ATVs, go-karts, rally applications, and high-performance vehicles. The integration of advanced technologies, such as sequential gearboxes, dual-clutch transmissions, and shifting algorithms, further enhances the capabilities of H-gearboxes. Lightweight materials, bearing systems, and supply chain management ensure efficient production and delivery. The market also caters to emerging trends, such as hybrid and electric vehicles, by developing specialized transmissions to meet their unique requirements.

The H-gearbox segment was valued at USD 236.10 million in 2019 and showed a gradual increase during the forecast period.

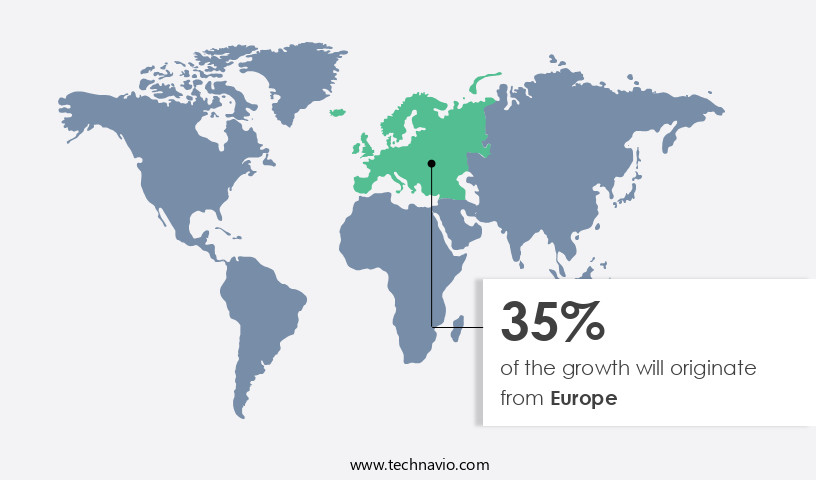

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing growth due to the presence of prominent automotive and supercar manufacturers, such as McLaren, Lamborghini, Porsche, and Ferrari, which have a significant impact on the global automotive industry. Europe's popularity as a racing destination, with renowned tracks like Ascari in Spain, Knockhill in Scotland, Anglesey in Great Britain, Monza in Italy, Silverstone in England, and Zandvoort in The Netherlands, is fueling market expansion. These tracks host numerous events, with Formula One (F1) being the most prominent, witnessing steady growth. However, the number of sponsors is increasing while yearly viewership is declining. Manufacturers are focusing on advanced technologies to enhance transmission performance, including the use of differential units made from aluminum alloys, pneumatic actuators, and forging processes for improved torque capacity.

Design optimization, materials science, and machining processes are essential for producing lightweight and durable gearbox housings. Racing applications demand high-quality transmissions, ensuring rigorous testing procedures, such as endurance testing, shaft alignment, and heat treating, to ensure reliability and durability. Innovations like carbon fiber components, sequential gearboxes, and dual-clutch transmissions (DCT) are gaining popularity in high-performance vehicles, motorcycle transmissions, and even electric vehicles (EVs). Advanced technologies like gear lubrication, gear synchronizers, and gear selection systems are crucial for optimal performance. Additionally, surface treatments, axle shafts, and bearing systems contribute to the overall efficiency and longevity of motorsport transmissions. Supply chain management, shifting algorithms, and paddle shifters are essential elements in the market, ensuring seamless integration and efficient operation.

As the market evolves, it continues to prioritize lightweight materials, such as steel alloys, and advanced testing procedures, including performance testing, reliability testing, and durability testing, to meet the demands of racing applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative sector, characterized by the design and production of high-performance transmissions for racing applications. These advanced systems enable vehicles to harness and optimally transfer power, enhancing acceleration, efficiency, and reliability. Motorsport transmissions incorporate cutting-edge technologies such as paddle-shift systems, sequential gearboxes, and dual-clutch transmissions. Manufacturers focus on materials like carbon fiber and titanium to reduce weight and improve durability. Racing conditions demand precise control and quick response times, making features like adjustable shift patterns and active clutch systems essential. The market is driven by the constant pursuit of competitive edge and the relentless evolution of motorsport technology.

What are the key market drivers leading to the rise in the adoption of Motorsport Transmission Industry?

- The market's growth is primarily fueled by substantial investments made by sponsors.

- Motorsport transmissions play a crucial role in optimizing vehicle performance in racing applications. Differential units, a significant component of these transmissions, are often manufactured using advanced materials like aluminum alloys for weight reduction and enhanced durability. The forging processes and machining techniques used in their production ensure superior torque capacity. Pneumatic actuators are increasingly being integrated into gearbox housings to improve gear shifting mechanisms. Design optimization and materials science contribute to the development of more efficient and reliable transmissions. Quality control measures are stringently implemented to ensure consistency and precision in manufacturing. ATV transmissions also benefit from these advancements, with an emphasis on durability and power transfer efficiency.

- Companies focus on utilizing advanced manufacturing techniques and materials to cater to the unique demands of off-road racing applications. The market dynamics of motorsport transmissions are driven by the constant pursuit of performance enhancement and technological innovation. Companies invest in research and development to create robust and high-performing transmissions that cater to the evolving needs of racing teams and enthusiasts.

What are the market trends shaping the Motorsport Transmission Industry?

- Electric car racing is gaining significant momentum as the next big market trend. This emerging sector is poised for growth, reflecting increasing consumer interest and advancements in technology.

- The market is experiencing significant growth due to the increasing popularity of electric vehicles in racing events. The Formula E Championship, initiated in 2014, showcases high-tech electric cars racing against each other for 50 minutes. Each team is required to have two electric cars, and the battery cannot be changed during the event but can be recharged. To cater to the racing demands, manufacturers focus on providing fast charging capacity for E-racing cars. Traditional motorsport transmissions, including go-kart transmissions and rally applications, continue to undergo advancements. Input shafts, shaft alignment, endurance testing, and heat treating are essential components that ensure reliability and durability.

- Shift speed, dog boxes, and H-pattern shifters are other critical aspects of motorsport transmissions. Moreover, the evolution of hybrid vehicles has introduced new challenges and opportunities for transmission manufacturers. Clutch assemblies and hybrid transmission systems require rigorous reliability and durability testing to meet the demanding racing conditions. As the market continues to grow, innovation in transmission technology is expected to remain a key driver.

What challenges does the Motorsport Transmission Industry face during its growth?

- The exorbitant expense of motorsport transmissions poses a significant challenge to the industry's growth trajectory.

- Motorsport transmissions play a significant role in the high-performance automotive industry, particularly in electric vehicles (EVs) and various off-road applications. The cost of motorsport vehicles, such as racing cars, is substantial, with around 11% to 12% of the total replacement cost allocated for transmissions and engines. Sequential gearboxes, a common type of motorsport transmission, utilize carbon fiber components for lightweight construction and optimal gear ratios. These transmissions incorporate shift forks, output shafts, and gear teeth, all manufactured through casting processes for durability and precision.

- Motorcycle transmissions also employ similar technologies for efficient gear lubrication and gear synchronizers to ensure seamless gear selection. In the realm of off-road applications, robust transmissions are essential for handling the rigors of challenging terrain and extreme conditions.

Exclusive Customer Landscape

The motorsport transmission market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorsport transmission market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorsport transmission market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Beagle Engineering Ltd. - The Elite Autograss Transmissions division specializes in manufacturing Autograss-specific transmission components, elevating performance and search engine visibility in the global motorsport industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beagle Engineering Ltd.

- Drexler Automotive GmbH

- Hewland Engineering Ltd.

- Holinger Engineering Co. Pty Ltd.

- Ricardo Plc

- RT Quaife Engineering Ltd.

- SAS SADEVA

- Tractive AB

- Xtrac Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motorsport Transmission Market

- In January 2024, Magneti Marelli, a leading automotive technology provider, announced the launch of its new advanced motorsport transmission system, the "Quasar," at the annual Autosport International show in Birmingham, UK. This transmission system is designed to provide improved power transfer and efficiency for high-performance racing applications (Magneti Marelli press release).

- In March 2024, Schaeffler, a global automotive and industrial supplier, entered into a strategic partnership with Red Bull Racing to develop and supply advanced transmission systems for the Formula One team. This collaboration aims to enhance Schaeffler's motorsport technology and boost its market presence in the competitive racing industry (Schaeffler press release).

- In May 2024, ZF Friedrichshafen AG, a leading global transmission supplier, announced a significant investment of â¬100 million in its transmission plant in Saarbrücken, Germany. This expansion will increase the plant's capacity and enable ZF to meet the growing demand for advanced transmission systems in the motorsport sector (ZF Friedrichshafen AG press release).

- In April 2025, the Fédération Internationale de l'Automobile (FIA) announced the approval of new regulations for Formula One transmissions, allowing teams to use a maximum of 13 gears instead of the previous limit of 8. This change is expected to significantly impact the design and development of motorsport transmissions, with teams focusing on optimizing gear ratios and improving overall efficiency (FIA press release).

Research Analyst Overview

- The market experiences dynamic interactions between various factors, shaping its growth and trends. Warranty claims arising from high-performance applications necessitate continuous innovation in motorsport technology transfer for improved reliability. Road car applications influence the development of transmission systems, driving manufacturing costs down through economies of scale. Oil cooling and thermal management are crucial for optimizing transmission efficiency and extending service life. Customer requirements for lighter weight and reduced noise, vibration, and harshness (NVH) necessitate advanced manufacturing techniques and materials. Maintenance intervals and repair costs are significant concerns for teams participating in global motorsport events. Compliance with industry standards and performance specifications is essential to ensure safety and adherence to emission regulations.

- Innovation in materials and manufacturing processes is vital for reducing power loss and improving transmission efficiency. Weight reduction and safety regulations also influence the development of transmissions for commercial vehicle applications. Supply chain resilience and certification processes are increasingly important for ensuring the reliability and quality of transmissions used in various applications, including agricultural vehicles and marine applications. Transmission efficiency and innovation remain key drivers in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motorsport Transmission Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 88.4 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Germany, UK, France, Australia, Canada, China, Japan, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorsport Transmission Market Research and Growth Report?

- CAGR of the Motorsport Transmission industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorsport transmission market growth of industry companies

We can help! Our analysts can customize this motorsport transmission market research report to meet your requirements.