MPoS Terminals Market Size 2024-2028

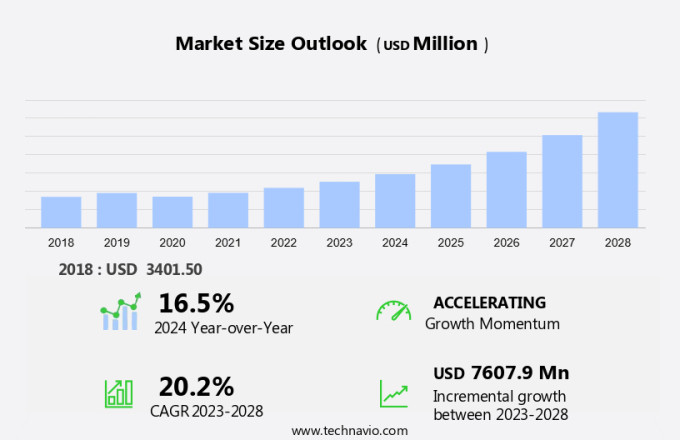

The MPoS terminals market size is forecast to increase by USD 7.61 billion at a CAGR of 20.2% between 2023 and 2028. Mobile-based payment systems, specifically MPoS terminals, have gained significant traction in various industries, particularly in the restaurant and hospitality sectors. The trend towards self-service and cashless payment options continues to grow as responsible business owners seek to enhance customer interaction and streamline transactions. Contactless payment methods, such as NFC and QR codes, are driving the adoption of MPoS terminals, allowing merchants to accept payments anywhere, without the need for a fixed location. This flexibility, combined with the ease of implementation, makes MPoS terminals an attractive option for businesses looking to stay competitive in today's market. Capterra reports that the market for MPoS terminals is expected to continue its growth, with a focus on security and user-friendly interfaces to further boost adoption.

Mobile-based payment systems (MBPS) and MPoS (Mobile Point of Sale) terminals have become essential tools for businesses in the hospitality and retail sectors. These innovative solutions enable contactless payment methods, providing cashless options for customers and enhancing the overall business experience. Responsible business owners in various industries, including restaurants, hospitality, self-service, and delivery services, are increasingly adopting MBPS and MPoS terminals to streamline transactions and improve customer interaction. With the widespread use of smartphones and tablets as portable electronic devices, these terminals offer flexibility and convenience for both businesses and their clients.

Moreover, MBPS and MPoS terminals can be used instead of traditional cash registers or purpose-built payment terminals. They offer a range of benefits, such as scalability, which is crucial for businesses dealing with peak hours, delivery services, transportation, pop-up stores, and other transient operations. Retailers and small-scale merchants can also benefit from MBPS and MPoS terminals, as they provide a personalized customer experience. These systems can be integrated with Capterra, allowing businesses to manage their operations more efficiently and effectively.

However, it is essential to consider the risks associated with MBPS and MPoS terminals, such as security vulnerabilities and potential hardware issues. Businesses must ensure they implement strong security measures to protect their customers' financial information and maintain their reputation. In conclusion, MBPS and MPoS terminals are revolutionizing the way businesses operate in the hospitality and retail industries. They offer contactless payment methods, flexibility, scalability, and a personalized customer experience, making them an essential investment for responsible business owners. By adopting these innovative solutions, businesses can reduce checkout queues, enhance customer satisfaction, and stay competitive in today's market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Retail

- Hospitality

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By End-user Insights

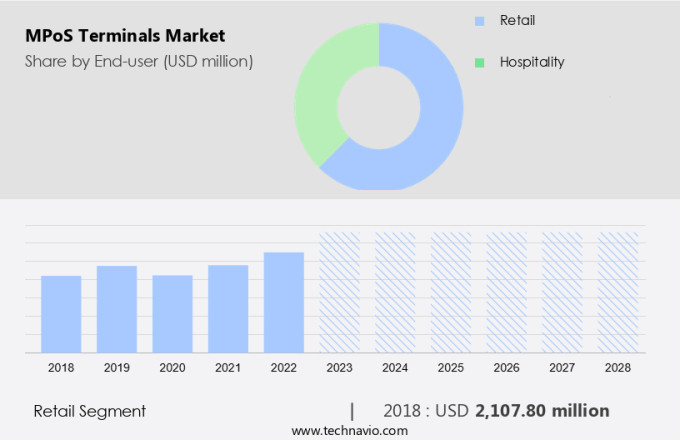

The retail segment is estimated to witness significant growth during the forecast period. The United States retail industry, comprising supermarkets, hypermarkets, specialty stores, mass merchandise retailers, gas stations, and drug stores, has experienced notable changes in the last decade. Factors such as heightened competition, expanding global economies, and foreign investments have driven the sector's evolution. In response, retailers have prioritized the implementation of secure payment technologies, like EMV standards, for Point of Sale (PoS) terminals. Contactless payment methods, such as Near Field Communication (NFC) technology, have gained popularity due to the desire for quicker and more convenient checkout systems. As a result, merchants are increasingly adopting NFC-enabled EMV PoS terminals, which support both mobile and fixed payment systems.

Get a glance at the market share of various segments Download the PDF Sample

The retail segment was valued at USD 2.11 billion in 2018. This shift towards cashless payment options enhances customer interaction, allowing businesses to cater to the demands of tech-savvy consumers. Capterra, a leading software discovery platform, reports that mobile-based payment systems, also known as MPoS, are becoming increasingly common in various industries, including restaurants and hospitality. Self-service kiosks, for instance, are a popular application of MPoS in the foodservice sector. By utilizing contactless EMV PoS terminals, merchants can significantly reduce checkout times, improving overall customer experience. In conclusion, the retail landscape is continually evolving, with businesses embracing advanced payment technologies to cater to the changing needs of consumers. The adoption of contactless EMV PoS terminals, available for both mobile and fixed systems, is a testament to this trend. These innovations not only streamline the checkout process but also enhance customer interaction, making businesses more competitive in today's market.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global market, MPoS terminals are witnessing significant growth, particularly in the Asia Pacific (APAC) region. This expansion is driven by the increasing trend towards cashless transactions and the organization of sectors like retail and hospitality. In India, for instance, the demonetization of larger rupee notes led to a growth in cashless payments, resulting in a boost for the national cashless payment platform. In response, nationalized banks initiated special MPoS campaigns, easing the requirements for merchants to acquire these terminals. Merchants in the region are also prioritizing effective information management and personalized customer experiences to reduce checkout queues. Hardware companies have an opportunity to cater to these needs by providing scalable solutions, such as credit card machines and mobile POS systems. However, there are risks associated with MPoS adoption, including security concerns and the need for reliable internet connectivity. companies must address these challenges to ensure the success of their offerings in the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The ease of implementation is notably driving market growth. The MPoS terminal offers portability and ease of use for merchants, particularly in the foodservice industry. This wireless solution requires a mobile device, such as a smartphone, which is connected to the internet and cloud technology for efficient data storage and processing. MPoS terminals utilize Bluetooth and swipe-and-chip payment devices, along with a payment app, to facilitate transactions.

Furthermore, traditional PoS systems can lead to lengthy customer queues and inflexible checkout locations. MPoS terminals, however, provide flexibility by enabling merchants to accept payments from anywhere in their establishment, enhancing customer service. The MPoS terminal package includes the card reader, software, and payment processing services, all delivered in a turnkey design. This modern technology empowers businesses to streamline operations and improve overall efficiency. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The adoption in contactless transactions is the key trend in the market. Contactless payments offer customers a convenient and secure method for making transactions, enabling merchants to improve the in-store buying experience by reducing checkout lines and providing numerous loyalty benefits. This trend has contributed to the growing popularity of contactless payment systems. Transactions are facilitated through Near-field communication (NFC) technology, which is integrated into various transmitters such as cards, smartphones, and smartwatches. To complete a payment, the card or device should be placed approximately 5cm away from the reader.

Additionally, contactless payment systems offer features like automatic data backup, seamless updates, and integration with accounting software, making them an attractive option for businesses. Wi-Fi connectivity is also a common feature, allowing for real-time transaction processing and reporting. Key peripherals, such as barcode scanners and receipt or kitchen ticket printers, can also be integrated for added functionality. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The no fixed merchant bases is the major challenge that affects the growth of the market. In the dynamic MPoS terminals market, merchants with low transaction volumes and minimal company loyalty present significant opportunities for companies. Merchants are not bound to their initial MPoS terminal providers for maintenance or replacement. Instead, they may seek out more competitive pricing from other companies, leading to heightened competition in the industry.

However, companies must focus on delivering secure payment solutions to remain competitive. This includes offering tablet-based, terminal-based, phone-based, and all-in-one systems, along with compatible POS software and card readers. The MPoS industry's competitive landscape is shaped by various players, each striving to provide innovative, cost-effective solutions to cash-only merchants. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Francisco Partners Management L.P. - The company offers MPoS terminal products such as carbon mobile 5, e280s and e280.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AURES Technologies SA

- Castles Technology Co. Ltd.

- Fiserv Inc.

- Francisco Partners Management L.P.

- Hewlett Packard Enterprise Co.

- NCR Voyix Corp.

- New POS Technology Ltd.

- Newland Digital Technology Co. Ltd.

- Oracle Corp.

- Panasonic Holdings Corp.

- PAX Global Technology Ltd.

- PayPal Holdings Inc.

- Posiflex Technology Inc.

- QVS Software Inc.

- Revel Systems Inc.

- Samsung Electronics Co. Ltd.

- SPECTRA Technologies Holdings Co. Ltd.

- SZZT Electronics Shenzhen Co. Ltd.

- Worldline SA

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Mobile-based payment systems, also known as MPoS or mobile point of sale, have revolutionized the way businesses in various industries process transactions. MPoS terminals, which include contactless payment methods, have become increasingly popular in sectors such as restaurant and hospitality, self-service, and retail. Responsible business owners are embracing cashless payment options to enhance customer interaction, streamline operations, and improve efficiency. MPoS systems allow merchants to use smartphones or tablets as portable electronic devices, replacing traditional cash registers and payment terminals. These systems offer flexibility, scalability, and ease of use, making them suitable for delivery services, transportation, pop-up stores, and small-scale merchants.

In conclusion, MPoS systems provide a personalized customer experience, enabling faster checkout and reducing wait times in checkout queues. They offer hardware components such as card readers, barcode scanners, receipt printers, and kitchen ticket printers, ensuring seamless integration with accounting software and automatic data backup. MPoS industry growth is driven by mobility, adoption, and the ability to offer wireless operations through cloud technology. Tablet-based, terminal-based, phone-based, and all-in-one systems cater to various business needs. Despite the benefits, there are risks associated with MPoS , including security concerns and potential hardware malfunctions. However, the advantages far outweigh the risks, making MPoS an essential tool for businesses looking to stay competitive in today's market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.2% |

|

Market growth 2024-2028 |

USD 7.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.5 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AURES Technologies SA, Castles Technology Co. Ltd., Fiserv Inc., Francisco Partners Management L.P., Hewlett Packard Enterprise Co., NCR Voyix Corp., New POS Technology Ltd., Newland Digital Technology Co. Ltd., Oracle Corp., Panasonic Holdings Corp., PAX Global Technology Ltd., PayPal Holdings Inc., Posiflex Technology Inc., QVS Software Inc., Revel Systems Inc., Samsung Electronics Co. Ltd., SPECTRA Technologies Holdings Co. Ltd., SZZT Electronics Shenzhen Co. Ltd., Worldline SA, and Zebra Technologies Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch