Methicillin-Resistant Staphylococcus Aureus Testing Market Size 2024-2028

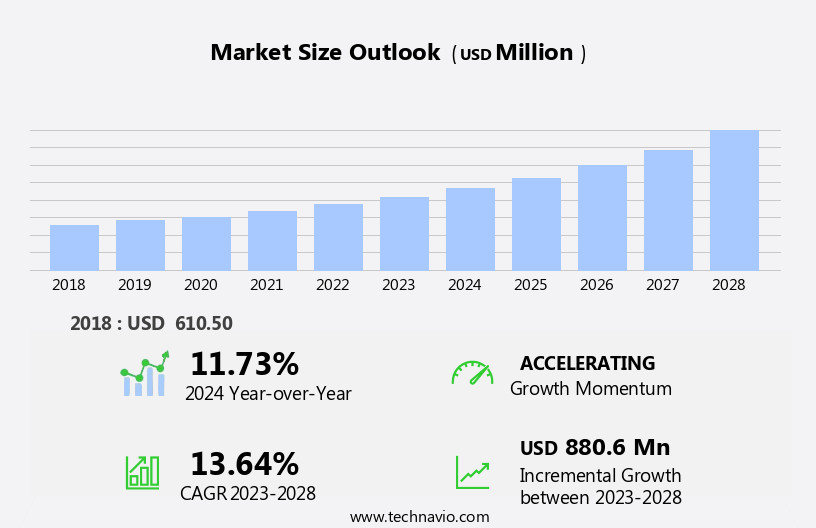

The methicillin-resistant staphylococcus aureus (MRSA) testing market size is forecast to increase by USD 880.6 million at a CAGR of 13.64% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing incidence of staphylococcal infections, particularly MRSA, is a major factor fueling market growth. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being integrated into MRSA testing systems to enhance automation and improve diagnostic accuracy. According to the Centers for Disease Control and Prevention (CDC), approximately 80,000 invasive MRSA infections occur in the United States each year. Moreover, the demand for infection control committees in hospitals is on the rise as healthcare facilities strive to prevent the spread of MRSA and other healthcare-associated infections.

- Additionally, advancements in molecular diagnostic technologies, such as PCR (polymerase chain reaction) and nucleic acid amplification tests, are enabling faster and more accurate MRSA diagnosis, further boosting market growth. Risk factors related to HA-MRSA (healthcare-associated MRSA) and CA-MRSA (community-associated MRSA) infections, such as prolonged hospital stays, invasive medical procedures, and crowded living conditions, further contribute to the market growth.

What will be the Size of the Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Market During the Forecast Period?

- The market is a significant sector in the life sciences industry, focusing on detecting and identifying MRSA infections. Various testing methods are employed, including culture-based techniques and molecular techniques such as PCR (Polymerase Chain Reaction) and nucleic acid amplification tests (NAATs). Key components of MRSA testing include inspection equipment, such as microbiology media and automation systems, and equipment for designing, manufacturing, and supply chain services. Passive components, like culture plates and swabs, and active components, like automated systems and robotics, are crucial for efficient and accurate testing.

- The healthcare sector is a major end-user, with consumer electronics, IT & telecommunication, industrial, aerospace & defense, and other industries also utilizing MRSA testing. The antibiotic resistant strain of MRSA presents a significant public health threat, prompting the development of novel MRSA diagnostic tests that leverage automation and systems to improve accuracy. Surgical infections and chronic diseases, including skin diseases, require effective treatment strategies, such as next-generation antibiotics like vancomycin and daptomycin, which are central to MRSA therapy. Glycopeptides remain a key class of drugs for treating skin and soft tissue infections, while beta lactam antibiotics like Zevtera, and other drug classes like lipopeptide, oxazolidinone, cephalosporin, tetracycline, and lipoglycopeptide, continue to play vital roles in combatting bacterial infections. Folate antagonists are also being explored for their potential in fighting resistant strains.

How is this Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and diagnostic laboratories

- Academic and research institutes

- Type

- Molecular diagnostics

- Immunodiagnostics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

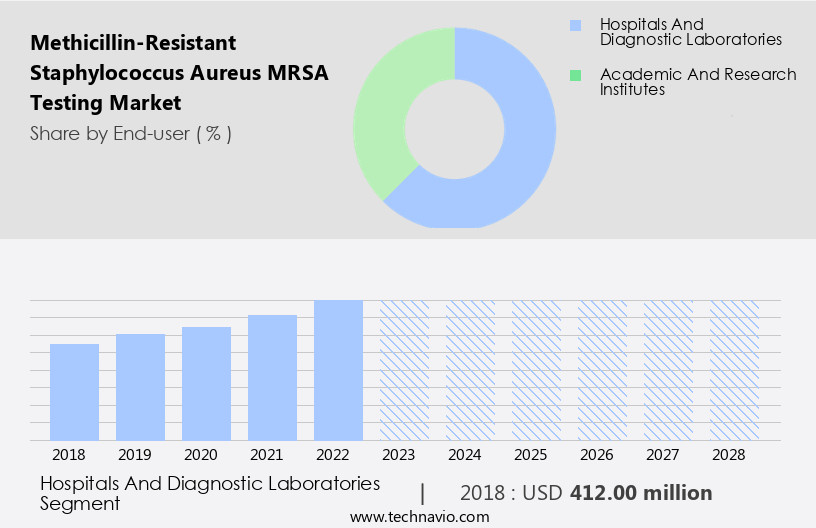

- The hospitals and diagnostic laboratories segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for advanced Electronic Devices (EDs), PCBs (Printed Circuit Boards), and components such as Active Components and Passive Components. Automation, Robotics, Artificial Intelligence (AI), and Machine Learning (ML) are key trends driving the market, with inspection equipment, soldering equipment, screen printing equipment, placement equipment, and cleaning equipment being essential tools for SMT manufacturing. Designing services, supply chain services, manufacturing services, and aftermarket services are also integral parts of the SMT ecosystem. Key industries driving the MRSA testing market include Consumer Electronics, IT & Telecommunication, Industrial, Aerospace & Defense, and Healthcare.

New product launches in these sectors, such as Micron Technology's latest DRAM products, Defense spending, and the rise of new technologies like Silicon Carbide (SiC) in Electric Vehicles (EVs) and Solar panels, are expected to fuel market growth. IPC standards and regulations also play a crucial role in ensuring quality and safety in SMT manufacturing.

Get a glance at the Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Industry report of share of various segments Request Free Sample

The hospitals and diagnostic laboratories segment was valued at USD 412.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

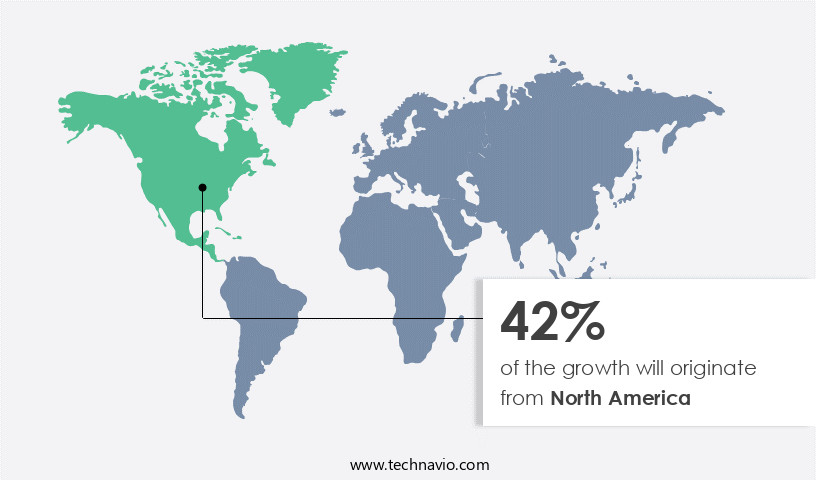

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand for Electronic Devices (EDs), Printed Circuit Boards (PCBs), and advanced components such as active components and passive components. Automation, robotics, artificial intelligence (AI), and machine learning (ML) are revolutionizing the manufacturing process, leading to the adoption of advanced inspection equipment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Industry?

The increasing incidence of staphylococcal infections is the key driver of the market.

- The rise of antibiotic-resistant bacteria, particularly methicillin-resistant Staphylococcus aureus (MRSA) and vancomycin-resistant Staphylococcus aureus (VRSA), has led to a significant increase in staphylococcal infections, predominantly in healthcare settings such as hospitals, dialysis centers, and nursing homes. Prolonged hospital stays and exposure to open body surfaces due to invasive medical procedures contribute to this trend. For instance, the NHS in the UK reported 846 cases of hospital-acquired MRSA bloodstream infections between April 2017 and March 2018. The Centers for Disease Control and Prevention (CDC) estimates that approximately one in three (33%) people carry Staphylococcus aureus, with a significant portion being resistant to antibiotics.

- This issue extends beyond healthcare, as the electronics industry, including sectors like consumer electronics, IT & telecommunication, industrial, aerospace & defense, and healthcare, relies heavily on surface mount technology (SMT) for manufacturing electronic devices, PCBs, and various components such as active and passive components. The integration of automation, artificial intelligence (AI), and machine learning (ML) in manufacturing processes, including inspection equipment, soldering equipment, screen printing equipment, placement equipment, and cleaning equipment, has streamlined production and improved quality. However, the presence of MRSA and other bacteria in manufacturing environments poses a significant threat to product quality and worker health. As manufacturing environments become more automated and advanced, maintaining cleanliness and reducing bacterial contamination remains a crucial aspect of ensuring the reliability and safety of the products being produced across these sectors. New product launches in the semiconductor industry, such as Micron Technology's SiC-based products for Electric Vehicles (EVs) and Solar panels, require stringent manufacturing processes to ensure product integrity and consumer safety.

What are the market trends shaping the Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Industry?

Increasing demand for infection control committees in hospitals is the upcoming market trend.

- MRSA, or Methicillin-resistant Staphylococcus aureus, is a significant concern in healthcare settings, with an estimated 1 in 25 hospital patients contracting a healthcare-associated infection. To combat this issue, hospitals have established infection control committees, which prioritize measures to prevent MRSA. These committees focus on evidence-based practices, resource allocation, and infection control planning. In the realm of electronics manufacturing, similar attention to detail is essential to ensure the production of high-quality products. Surface Mount Technology (SMT) is a common method used in the assembly of electronic devices and printed circuit boards (PCBs). This process involves the placement of active components and passive components using automation and advanced equipment such as inspection equipment, soldering equipment, screen printing equipment, and placement equipment.

- Cleaning Equipment is also crucial to maintaining a hygienic manufacturing environment. The electronics industry comprises various sectors. New product launches in these sectors drive the demand for advanced manufacturing services. Aftermarket Services are also essential for maintaining the functionality and longevity of these products.

What challenges does the Methicillin-Resistant Staphylococcus Aureus (MRSA) Testing Industry face during its growth?

Risk factors related to HA-MRSA and CA-MRSA infections is a key challenge affecting the industry growth.

- MRSA (Methicillin-resistant Staphylococcus aureus) infections pose significant challenges in various industries, particularly in healthcare, where vulnerable patient populations, such as pediatrics and geriatrics, are at risk. The spread of MRSA can occur through invasive medical devices like intravenous lines or catheters, prolonged hospital stays, or contact sports and activities. In healthcare settings, MRSA can lead to hospitalization and complications, making effective prevention and detection crucial. Outside of healthcare, MRSA can impact various sectors, including consumer electronics, IT & telecommunication, industrial, aerospace & defense, and healthcare. For instance, in the electronic devices industry, surface mount technology (SMT) and PCBs (printed circuit boards) are susceptible to MRSA contamination during manufacturing.

- Active and passive components, inspection equipment, soldering equipment, screen printing equipment, and placement equipment are all potential carriers of MRSA. To mitigate these risks, advanced technologies like automation, robotics, artificial intelligence (AI), and machine learning (ML) are increasingly being employed in manufacturing services, designing services, supply chain services, and aftermarket services. New product launches in sectors like consumer electronics, IT & telecommunications, and industrial are incorporating these technologies to improve production efficiency, product quality, and infection control. Defense spending on military and aerospace applications is driving the demand for MRSA testing and prevention in silicon carbide (SiC) components, electric vehicles (EVs), and solar panels.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Abbott Laboratories

- ALIFAX Srl

- Arlington Scientific Inc.

- Becton Dickinson and Co.

- bioMerieux SA

- Bio Rad Laboratories Inc.

- Bruker Corp.

- Creative Diagnostics

- Danaher Corp.

- DiaSorin Spa

- Eurofins Scientific SE

- F. Hoffmann La Roche Ltd.

- GENSPEED Biotech GmbH

- OpGen Inc.

- Puritan Medical Products Co.

- R Biopharm AG

- Sekisui Diagnostics LLC

- Uniogen Oy

- ZeptoMetrix LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

MRSA testing is a crucial process in the electronics industry to ensure the quality and reliability of surface mount technology (SMT) applications in various sectors. The market for MRSA testing is witnessing significant growth due to the increasing demand for electronic devices (EDs), printed circuit boards (PCBs), and components such as active and passive components. The integration of automation, robotics, artificial intelligence (AI), and machine learning (ML) in manufacturing processes has led to an increased focus on MRSA testing for improved efficiency and accuracy. Inspection equipment and soldering equipment are essential tools for MRSA testing, ensuring the proper placement and connection of components on PCBs.

Cleaning equipment is also vital to maintain the cleanliness of the manufacturing environment and prevent contamination. Designing services, supply chain services, manufacturing services, and aftermarket services are other key areas where MRSA testing plays a significant role. Hospital pharmacy, retail pharmacy, and online pharmacy are key components of the pharmaceutical and healthcare industry, providing essential antiseptics and therapeutic solutions to patients. Clinical assessment and laboratory tests, including cultures, play a crucial role in diagnosing infections and determining the most effective medical therapies. With the rise of antibiotic resistance, alternative antibiotics like linezolid are becoming critical in treating resistant strains. Epidemiology helps identify the patient pool and track the spread of infections, guiding the development of late-stage pipeline drugs and clinical trials. Understanding the pharmacological action of these treatments ensures their efficacy and safety in addressing complex infections.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.64% |

|

Market Growth 2024-2028 |

USD 880.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.73 |

|

Key countries |

US, Germany, UK, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.