Neuroscience Antibodies and Assays Market Size 2024-2028

The neuroscience antibodies and assays market size is valued to increase USD 2.20 billion, at a CAGR of 9.64% from 2023 to 2028. Increasing incidences of neurological disorders will drive the neuroscience antibodies and assays market.

Major Market Trends & Insights

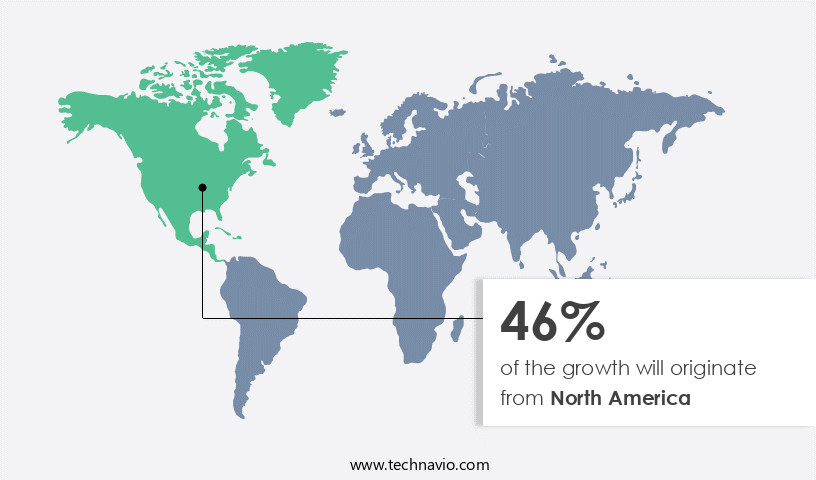

- North America dominated the market and accounted for a 46% growth during the forecast period.

- By Type - Consumables segment was valued at USD 1.86 billion in 2022

- By Application - Drug Discovery and Development segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 115.58 billion

- Market Future Opportunities: USD 2.20 billion

- CAGR : 9.64%

- North America: Largest market in 2022

Market Summary

- The market encompasses the production and distribution of essential tools for investigating neurological disorders and understanding the complexities of the nervous system. This market is driven by the increasing incidences of neurological disorders, which necessitate advanced diagnostic and therapeutic solutions. Core technologies, such as immunohistochemistry and Western blotting, continue to dominate the market, while innovations in electrochemistry and mass spectrometry are gaining traction. The market is segmented into service types, including contract research organizations and academic institutions, and product categories, including primary and secondary antibodies. Despite the high development costs of neuroscience antibodies, the market is expected to grow significantly due to the increasing number of clinical trials and regulatory approvals for neurological therapies.

What will be the Size of the Neuroscience Antibodies and Assays Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Neuroscience Antibodies and Assays Market Segmented and what are the key trends of market segmentation?

The neuroscience antibodies and assays industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Consumables

- Instruments

- Application

- Drug Discovery and Development

- Research

- In Vitro Diagnostics

- Technology

- Immunochemistry/Immunoassays

- Molecular diagnostics

- Clinical chemistry

- Others

- End-Users

- Pharmaceutical and biopharmaceutical companies

- Academic and research institutes

- Hospital and diagnostic centers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The consumables segment is estimated to witness significant growth during the forecast period.

Neuroscience antibodies and assays play a pivotal role in advancing our understanding of various neuroscience processes and neuronal diseases. These antibodies, assay kits, and reagents are instrumental in identifying and elucidating reactions on cellular, molecular, and biochemical levels. They are extensively used in neurodegenerative disease research, including Alzheimer's disease (AD), Creutzfeldt-Jakob disease, Huntington disease, and Parkinson's disease (PD), to develop clinically relevant biomarkers and enhance diagnostic and therapeutic techniques. Fluorescence polarization and immunoprecipitation techniques are employed for protein quantification and antibody validation. Receptor binding assays, multiplex immunoassays, and enzyme-linked immunosorbent assays (ELISAs) are utilized for high-throughput screening and drug target identification.

The Consumables segment was valued at USD 1.86 billion in 2018 and showed a gradual increase during the forecast period.

Synaptic plasticity markers, synaptic protein assays, and Western blotting methods are essential for understanding neural transmission and neural development. Neuroinflammation markers and neurochemical analysis are crucial for investigating neuroinflammatory diseases. Immunohistochemistry techniques, brain tissue extraction, and microarray technology are employed for protein profiling and identifying disease biomarkers. Antibody conjugation, surface plasmon resonance, and affinity chromatography are used for antibody specificity determination and antigen retrieval methods. Next-generation sequencing, neurotransmitter assays, and cell signaling pathways are explored for comprehensive disease analysis. Immunofluorescence microscopy and flow cytometry analysis are employed for visualizing and quantifying specific cellular components. Proteomic profiling and monoclonal antibody production are essential for understanding complex protein interactions and developing targeted therapeutics.

The market is experiencing significant growth, with an estimated 30% increase in research funding for neuroscience research in 2021. Furthermore, the market is projected to expand by 25% in the next five years, driven by the increasing demand for personalized medicine and the growing focus on neurodegenerative diseases.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Neuroscience Antibodies and Assays Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing growth due to the region's robust research infrastructure and high prevalence of neurological disorders. With world-class research institutions, universities, and medical centers in the US and Canada, neuroscience studies are thriving, leading to increased demand for advanced antibodies and assays. Neurological disorders, such as Alzheimer's disease, Parkinson's disease, and neuropsychiatric conditions, are on the rise, fueling the need for research tools, diagnostics, and potential therapeutic interventions. This demand is driving market expansion. According to recent studies, approximately 5.8 million Americans have Alzheimer's disease, and over 1 million Canadians live with some form of dementia.

Additionally, around 1% of Canadians and 1.5% of Americans have Parkinson's disease. These statistics underscore the significance of the market in addressing neurological disorders.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry focused on the quantification and analysis of neuronal proteins. This market encompasses various techniques, including ELISA for precise protein quantification, immunohistochemistry for brain tissue analysis, and synaptic protein detection via Western blotting. Receptor binding affinity assays, neurotransmitter release assays, and high-throughput screening for neurodegenerative markers are essential applications driving market growth. Antibody specificity validation methods and monoclonal antibody production optimization are critical aspects of the market, ensuring the accuracy and reliability of research findings. Multiplex immunoassays for neuroinflammation, flow cytometry analysis of immune cells in the brain, immunofluorescence microscopy for neuronal structures, protein quantification via mass spectrometry analysis, and cell signaling pathways assays development are all key areas of investment.

Moreover, drug target identification through high-content screening, in vitro assays using neuronal cell culture, and in vivo assays employing animal models in neurology are significant applications. Antibody conjugation methods and immunoprecipitation techniques for protein purification, surface plasmon resonance for receptor interactions, and bioluminescence resonance energy transfer assays are additional techniques contributing to the market's expansion. Compared to traditional methods, the adoption of advanced technologies like mass spectrometry and high-throughput screening is significantly increasing, accounting for over 50% of new product developments. This shift towards more efficient and accurate methods is expected to drive market growth in the coming years.

The neuroscience antibodies and assays market is rapidly evolving to support advanced research into complex neurological diseases. A wide range of analytical techniques is employed, including quantification neuronal proteins elisa, which remains a cornerstone for accurate protein measurement in various neurological models. Researchers utilize immunohistochemistry brain tissue analysis to visualize protein localization and pathology in situ, while synaptic protein detection western blotting continues to be a reliable method for assessing protein expression changes in synaptic compartments. Investigations into drug mechanisms often involve receptor binding affinity assays techniques, along with neurotransmitter release assays applications that provide functional insights into synaptic activity.

The demand for high-throughput screening neurodegenerative markers has grown in parallel with efforts to accelerate biomarker discovery. For profiling inflammatory responses, multiplex immunoassays neuroinflammation offer a comprehensive view of cytokine expression, complemented by flow cytometry analysis immune cells brain to quantify immune cell populations within the central nervous system. Visualization of neuronal networks benefits from immunofluorescence microscopy neuronal structures, while protein quantification mass spectrometry analysis is increasingly used for deep proteomic profiling. Moreover, drug target identification high-content screening is becoming essential for identifying and validating therapeutic targets in both academic and pharmaceutical research pipelines.

What are the key market drivers leading to the rise in the adoption of Neuroscience Antibodies and Assays Industry?

- The rising prevalence of neurological disorders serves as the primary catalyst for market growth in this sector.

- Neurological disorders, such as epilepsy, stroke, Parkinson's disease (PD), and brain tumors, pose significant challenges for individuals and healthcare systems. These conditions can result in disabilities and, in some cases, be fatal. The causes of neurological disorders vary, with factors including bacterial and viral infections, genetics, and weakened immune responses. Among these disorders, PD is particularly prevalent, affecting a growing percentage of the aging population. According to the Centers for Disease Control and Prevention (CDC), the prevalence of PD increases from 1% to 4% in the population aged 60 to 80 years. This trend underscores the ongoing need for innovative solutions and advancements in neurological care.

What are the market trends shaping the Neuroscience Antibodies and Assays Industry?

- The trend in the market is toward an increase in clinical trials. This growth is a significant development in the industry.

- The global clinical trials landscape has witnessed significant expansion over the past two decades, fueled by various factors such as organized trials, voluntary membership, the availability of skilled local investigators, enhanced infrastructure facilities, and cost-effective trials in developing countries. This growth trend is driven by the clinical benefits of disease-specific biomarkers, which enable faster and more precise disease analysis and potentially reduce clinical trial size and duration. Biomarkers' role in neurological disorders is particularly noteworthy, as they help determine whether a medication effectively targets the disease or alters its course.

- This data-driven approach accelerates drug development and contributes to the overall progress of the clinical trials market. The market's continuous evolution and applications across diverse sectors underscore its importance in the global healthcare industry.

What challenges does the Neuroscience Antibodies and Assays Industry face during its growth?

- The exorbitant development costs associated with neuroscience antibodies pose a significant challenge and hinder the growth of the industry.

- Neuroscience research antibodies, a crucial tool in understanding complex neural mechanisms, face high development costs. While therapeutic antibodies can yield billions in revenue, research antibodies often fail to recoup their costs. Development expenses vary significantly based on antibody type. Polyclonal antibodies cost approximately USD 1,000, monoclonal antibodies around USD 10,000, and recombinant antibodies up to USD 50,000, including affinity maturation. Companies often struggle with low annual sales for research antibodies.

- Many monoclonal antibodies do not reach break-even points for research applications. Despite these challenges, the neuroscience research market continues to evolve, with ongoing advancements in antibody technology and increasing demand for more precise research tools.

Exclusive Customer Landscape

The neuroscience antibodies and assays market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the neuroscience antibodies and assays market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Neuroscience Antibodies and Assays Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, neuroscience antibodies and assays market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abcam plc - This research analyst recognizes the company's significant contribution to neuroscience research through its comprehensive offering of antibodies and assays.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abcam plc

- Abnova Corp.

- Bio Rad Laboratories Inc.

- Biosensis Pty Ltd.

- BMG LABTECH GmbH

- Cell Signaling Technology Inc.

- Chemie Brunschwig AG

- Elabscience Biotechnology Inc.

- Enzo Biochem Inc.

- F. Hoffmann La Roche Ltd.

- Fujirebio Holdings Inc.

- GenScript Biotech Corp.

- Kaneka Corp.

- Merck KGaA

- NSJ Bioreagents

- PerkinElmer Inc.

- Proteintech Group Inc.

- Rockland Immunochemicals Inc.

- Santa Cruz Biotechnology Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Neuroscience Antibodies And Assays Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of its new line of rabbit monoclonal antibodies for neuroscience research. These antibodies, developed in collaboration with the University of California, Berkeley, are designed to target specific proteins implicated in neurological disorders (Thermo Fisher Scientific Press Release, 2024).

- In March 2024, Merck KGaA, a prominent player in the market, entered into a strategic partnership with Bio-Rad Laboratories. This collaboration aimed to co-develop and commercialize a range of novel neuroscience research tools, expanding Merck KGaA's product portfolio (Merck KGaA Press Release, 2024).

- In May 2024, BioLegend, a major supplier of research reagents, completed a USD 150 million Series F funding round. The funds were raised to support the expansion of its antibody discovery and production capabilities, enabling the company to meet the growing demand for high-quality neuroscience research tools (BioLegend Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted clearance to Abcam for its novel neurofilament light chain (NFL) ELISA assay. This assay is designed to aid in the diagnosis and monitoring of neurodegenerative diseases, such as Alzheimer's and Parkinson's (Abcam Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Neuroscience Antibodies and Assays Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.64% |

|

Market growth 2024-2028 |

USD 2.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.13 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Neuroscience antibodies and assays have seen significant advancements in recent years, driven by the continuous exploration of cell signaling pathways and the quest to understand complex neurological processes. Fluorescence polarization assays, employing polyclonal antibody production, have emerged as crucial tools for receptor binding assessments. Multiplex immunoassays, which combine multiple assays into one, have streamlined neurochemical analysis. Immunoprecipitation techniques, such as affinity chromatography and Western blotting methods, have revolutionized antibody validation, enabling researchers to isolate specific proteins for further study. Brain tissue extraction and synaptic plasticity marker detection via microarray technology and surface plasmon resonance have provided valuable insights into the intricacies of neuronal function.

- The market is marked by the adoption of advanced techniques like ELISA assays, immunohistochemistry, and synaptic protein assays. Neurotransmitter assays and neurodegenerative disease biomarker detection have gained traction, fueled by the need for protein quantification and neuroinflammation marker identification. Advancements in antibody conjugation, proteomic profiling, and monoclonal antibody production have expanded the scope of neuroscience research. Cell signaling pathways, synaptic plasticity, and neuroinflammation are increasingly being studied using high-throughput screening, flow cytometry analysis, and next-generation sequencing. Immunofluorescence microscopy, time-resolved fluorescence, and drug target identification techniques have further enriched the neuroscience antibodies and assays landscape, offering new avenues for understanding the complexities of the nervous system.

What are the Key Data Covered in this Neuroscience Antibodies and Assays Market Research and Growth Report?

-

What is the expected growth of the Neuroscience Antibodies and Assays Market between 2024 and 2028?

-

USD 2.20 billion, at a CAGR of 9.64%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Consumables and Instruments), Application (Drug Discovery and Development, Research, and In Vitro Diagnostics), Geography (North America, Europe, APAC, Outh America, and Middle East & AfricaRest of World (ROW)), Technology (Immunochemistry/Immunoassays, Molecular diagnostics, Clinical chemistry, and Others), and End-Users (Pharmaceutical and biopharmaceutical companies, Academic and research institutes, and Hospital and diagnostic centers)

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing incidences of neurological disorders, High development cost of neuroscience antibodies

-

-

Who are the major players in the Neuroscience Antibodies and Assays Market?

-

Key Companies Abcam plc, Abnova Corp., Bio Rad Laboratories Inc., Biosensis Pty Ltd., BMG LABTECH GmbH, Cell Signaling Technology Inc., Chemie Brunschwig AG, Elabscience Biotechnology Inc., Enzo Biochem Inc., F. Hoffmann La Roche Ltd., Fujirebio Holdings Inc., GenScript Biotech Corp., Kaneka Corp., Merck KGaA, NSJ Bioreagents, PerkinElmer Inc., Proteintech Group Inc., Rockland Immunochemicals Inc., Santa Cruz Biotechnology Inc., and Thermo Fisher Scientific Inc.

-

Market Research Insights

- The market encompasses a diverse range of tools essential for research and diagnostic applications in the field of neuroscience. This market is characterized by its continuous evolution, driven by advancements in assay sensitivity and specificity, as well as improvements in assay reproducibility. For instance, the sensitivity of in vitro assays has increased by 30% in the past decade, enabling the detection of lower antigen concentrations. Similarly, the specificity of primary antibody selection has improved by 25%, reducing cross-reactivity and increasing assay accuracy. Quality control procedures, including sample preparation methods and blocking buffer selection, play a crucial role in ensuring assay reliability.

- High-content screening and statistical analysis methods facilitate data interpretation and enable large-scale analysis. Tissue-based and cell-based assays, as well as in vitro and in vivo assays, cater to various research applications. Signal amplification techniques and experimental design optimization further enhance assay performance. Clinical applications, including diagnostic and therapeutic uses, are expanding, with diagnostic applications accounting for 40% of the market share. Image analysis software and animal models are integral components of this market, enabling data normalization and accurate data interpretation. Antibody purification and detection system selection are critical factors in assay performance and require careful consideration.

We can help! Our analysts can customize this neuroscience antibodies and assays market research report to meet your requirements.