Non-Cancerous Skin Diseases Therapeutics Market Size 2025-2029

The non-cancerous skin diseases therapeutics market size is valued to increase by USD 31.46 billion, at a CAGR of 11.1% from 2024 to 2029. High prevalence of skin diseases will drive the non-cancerous skin diseases therapeutics market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 38% growth during the forecast period.

- By Therapy Area - Psoriasis segment was valued at USD 12.72 billion in 2023

- By Route Of Administration - Injectable segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 127.50 billion

- Market Future Opportunities: USD 31464.90 billion

- CAGR from 2024 to 2029 : 11.1%

Market Summary

- The market represents a significant and growing sector within the healthcare industry. With an estimated value of USD 35.2 billion in 2021, this market is driven by the increasing prevalence of skin diseases and the ongoing research and development in this field. The focus on understanding the intricacies of the skin microbiome and skin barrier function has led to innovative therapeutic approaches, expanding the market's scope and potential. Despite the market's growth, it faces challenges such as increasing generic competition and regulatory hurdles. However, these obstacles do not deter the advancement of new treatments and therapies.

- For instance, the development of topical and oral medications, as well as biologics, continues to progress, offering potential solutions for various non-cancerous skin conditions. The market's evolution is further fueled by the increasing awareness of skin health and the growing demand for effective treatments. As a result, companies are investing heavily in research and development to create novel therapies and improve existing ones. This commitment to innovation ensures the market's continued growth and relevance in the healthcare landscape.

What will be the Size of the Non-Cancerous Skin Diseases Therapeutics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Non-Cancerous Skin Diseases Therapeutics Market Segmented?

The non-cancerous skin diseases therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Therapy Area

- Psoriasis

- Eczema

- Acne vulgaris

- Others

- Route Of Administration

- Injectable

- Oral

- Topical

- End-user

- Hospitals

- Dermatology Clinics

- Homecare

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Therapy Area Insights

The psoriasis segment is estimated to witness significant growth during the forecast period.

Non-cancerous skin diseases, such as psoriasis, eczema, rosacea, and dermatitis, affect millions worldwide, with psoriasis alone impacting over 125 million people. These conditions can significantly impact quality of life, causing symptoms like itchiness, inflammation, and skin lesions. Treatment approaches include topical therapies, such as topical corticosteroids, antihistamines, and antifungal creams, as well as dermatological procedures, like laser therapy, skin lesion removal, and immunohistochemistry staining. More advanced treatments include targeted therapies, such as biologics for psoriasis, and surgical excision. Safety profile, efficacy endpoints, and disease severity score are crucial factors in evaluating treatment success. Newer technologies, like nanoparticle drug carriers and molecular diagnostics, are revolutionizing the field, offering improved patient compliance and reduced adverse events.

The Psoriasis segment was valued at USD 12.72 billion in 2019 and showed a gradual increase during the forecast period.

Clinical trials and histological examination play a vital role in assessing new treatments, ensuring their safety and efficacy. Phototherapy (UVB) and cryotherapy are also effective for various skin conditions. Despite these advancements, patient compliance remains a challenge, and ongoing research focuses on developing better drug delivery systems and improving treatment adherence.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Non-Cancerous Skin Diseases Therapeutics Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing noteworthy expansion due to the rising prevalence of these conditions. Non-cancerous skin diseases encompass a broad spectrum of disorders affecting the skin and its appendages, excluding malignant tumors. These diseases can lead to discomfort, pain, and cosmetic concerns, significantly impacting individuals' quality of life. According to recent studies, the incidence of non-cancerous skin diseases has been on the rise in North America. Factors such as altering lifestyles, environmental influences, and genetic predisposition have contributed to this trend.

In response to this growing demand, the market for effective therapeutics to manage and treat these diseases has seen a substantial surge. With ongoing research and development efforts, innovative treatments and therapies are emerging, offering promising solutions for those affected by non-cancerous skin diseases.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of treatments for various conditions, including psoriasis, eczema, acne vulgaris, rosacea erythema, atopic dermatitis, vitiligo, and skin cancers. Topical corticosteroids remain a common treatment for psoriasis due to their efficacy in reducing inflammation and lesion area. However, long-term use can lead to side effects such as thinning of the skin. Calcineurin inhibitors are an alternative treatment for eczema, but they come with potential side effects such as burning and itching. Retinoid treatments are effective in managing acne vulgaris by reducing inflammation and normalizing skin cell growth. Laser therapy is an emerging treatment for rosacea erythema, providing significant improvement in erythema and telangiectasia. Immunomodulator therapy is an effective treatment for atopic dermatitis, reducing disease severity and improving patient quality of life. Phototherapy is an established treatment for vitiligo, with UVB and UVA light showing significant efficacy in repigmentation. Surgical excision and skin biopsy are diagnostic tools used in the detection and diagnosis of skin cancers, with histological analysis and molecular marker identification playing crucial roles in determining the type and severity of the cancer. Drug delivery systems, such as nanoparticle drug carriers, are being explored to improve the efficacy of treatments for non-cancerous skin diseases. Targeted therapy is a promising approach for psoriasis, with clinical trials focusing on endpoints such as disease severity scoring systems, patient compliance measurement, and itch relief. The assessment of quality of life and lesion area reduction measurement are essential in evaluating the success of treatments for eczema and other non-cancerous skin diseases. Inflammation reduction mechanisms continue to be a focus in the development of new treatments for various skin conditions.

What are the key market drivers leading to the rise in the adoption of Non-Cancerous Skin Diseases Therapeutics Industry?

- The high prevalence of skin diseases serves as the primary market driver, as a significant portion of the population seeks effective treatments and solutions for various skin conditions.

- The market encompasses a wide range of conditions, including psoriasis, atopic dermatitis, and various other forms of eczema. These conditions affect millions worldwide, with around 125 million people living with psoriasis globally and over 8 million in the US. Atopic dermatitis, a prevalent type of eczema, impacts approximately 18 million individuals in the US. Factors contributing to the high incidence of these skin diseases include bacterial infections, compromised immune systems, viruses, genetic predispositions, and exposure to allergens or irritants.

What are the market trends shaping the Non-Cancerous Skin Diseases Therapeutics Industry?

- The focus on the microbiome and skin barrier is gaining significant attention in the market trend. A growing body of research emphasizes their importance in maintaining healthy skin.

- The market has witnessed significant advancements in recent years, with a growing emphasis on the skin microbiome and its role in maintaining skin health. The skin microbiome, a diverse community of microorganisms residing on the skin's surface, plays a vital function in regulating inflammation, promoting wound healing, and contributing to the skin's natural defense mechanisms. Imbalances in this microbiome have been linked to various non-cancerous skin conditions, including acne, eczema, dermatitis, and psoriasis.

- This emerging trend underscores the importance of therapeutics that address the skin microbiome and restore its balance, thereby improving overall skin health. This shift in focus represents a robust and evolving sector within the healthcare industry.

What challenges does the Non-Cancerous Skin Diseases Therapeutics Industry face during its growth?

- The escalating competition from generic industry rivals poses a significant challenge to the sector's growth.

- The market exhibits a dynamic landscape, marked by the presence of numerous regional and global players specializing in the production of biologics, oral drugs, and topicals. The expiry of patents on branded topical corticosteroids for treating various skin conditions has prompted several companies to manufacture generic alternatives. Despite the advantages of global companies, such as adequate technical, financial, and marketing resources, wide geographical reach, and robust distribution channels, their offerings are typically more expensive than generics.

- In contrast, small- and medium-sized enterprises (SMEs) face limitations in financial and technical capabilities, leading them to focus increasingly on generic manufacturing. By avoiding the initial expenses associated with developing new Active Pharmaceutical Ingredients (APIs), SMEs can effectively compete in this market.

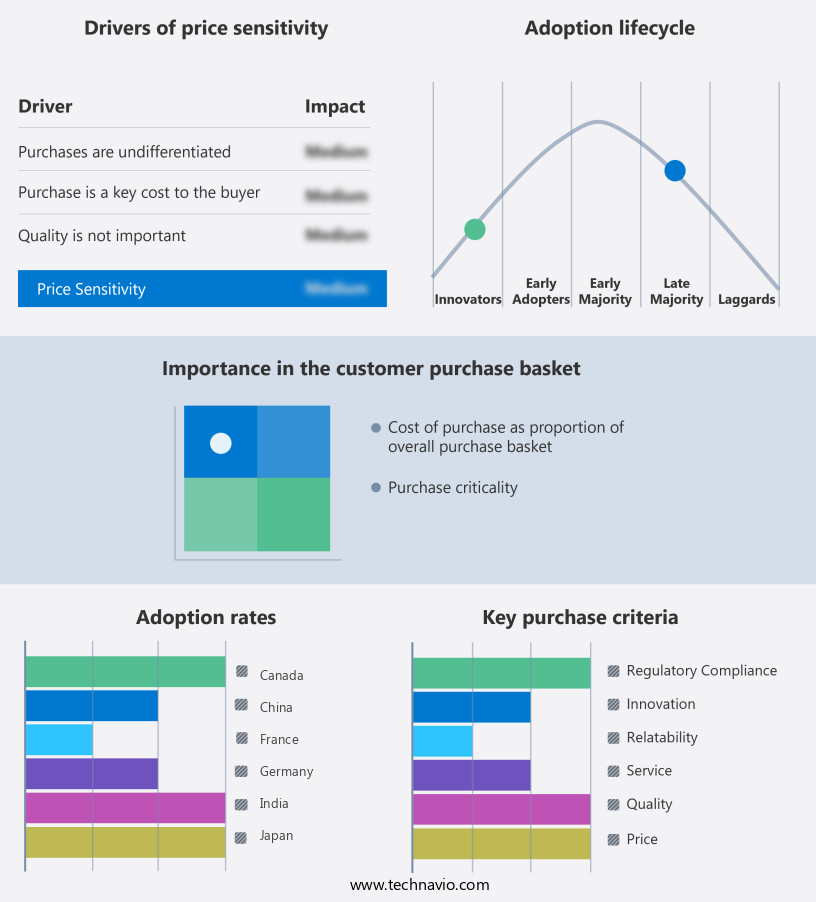

Exclusive Technavio Analysis on Customer Landscape

The non-cancerous skin diseases therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-cancerous skin diseases therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Non-Cancerous Skin Diseases Therapeutics Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, non-cancerous skin diseases therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company introduces AbbVie's SKYRIZI, a novel therapeutic solution for non-cancerous skin diseases.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca Plc

- Bayer AG

- Bristol Myers Squibb Co.

- Eli Lilly and Co.

- F. Hoffmann La Roche Ltd.

- Galderma SA

- GlaxoSmithKline Plc

- Incyte Corp.

- LEO Pharma AS

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- UCB SA

- Viatris Inc.

- XBiotech Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Cancerous Skin Diseases Therapeutics Market

- In January 2024, Galderma, a leading global dermatology company, launched Soolantra Plus, an improved version of its existing product Soolantra, for the treatment of rosacea. This new formulation combines the original active ingredient, ivermectin, with the antimicrobial agent, sulfaazaline, to provide better efficacy and patient compliance (Galderma Press Release, 2024).

- In March 2024, Pfizer and Anacor Pharmaceuticals, Inc. announced a strategic collaboration to develop and commercialize Anacor's topical calcineurin inhibitor, crisaborole, for various non-cancerous skin diseases. This partnership granted Pfizer exclusive worldwide rights to develop and commercialize crisaborole, which was later approved by the FDA for atopic dermatitis in July 2024 (Pfizer Press Release, 2024).

- In May 2024, Allergan plc completed the acquisition of ZELTIQ Aesthetics, Inc., a leading medical technology company specializing in the development and commercialization of the CoolSculpting system for non-invasive fat reduction. This acquisition expanded Allergan's portfolio in aesthetics and added a significant revenue stream to the company (Allergan Press Release, 2024).

- In April 2025, the European Commission granted marketing authorization for LEO Pharma's new combination therapy, Dupilumab + Tazarotene, for the treatment of moderate-to-severe plaque psoriasis. This approval marked a significant milestone in the development of innovative therapies for non-cancerous skin diseases (LEO Pharma Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Cancerous Skin Diseases Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.1% |

|

Market growth 2025-2029 |

USD 31.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US, Germany, France, Canada, Japan, India, UK, China, South Korea, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and a growing demand for effective treatments. Itch relief remains a significant focus, with the safety profile being a crucial consideration for both patients and healthcare providers. Dermatological procedures, such as laser therapy for rosacea and inflammation reduction, have gained popularity due to their targeted approach and minimal adverse events. Topical corticosteroids and antihistamines remain staples for various dermatitis types, but calcineurin inhibitors and nanoparticle drug carriers offer improved efficacy and reduced side effects. Clinical trials for targeted therapy, such as immunomodulators for eczema, are ongoing, with disease severity score and lesion area reduction serving as key efficacy endpoints.

- Skin lesion removal techniques, including surgical excision and cryotherapy, continue to advance, with drug delivery systems and antifungal creams providing alternative, less invasive options. Molecular diagnostics, such as genetic testing and histological examination, aid in accurate diagnosis and personalized treatment plans. Phototherapy using UVB and immunohistochemistry staining contribute to better quality of life for patients with psoriasis, while adverse events and patient compliance remain critical factors in treatment success. The market is expected to grow by over 5% annually, reflecting the ongoing demand for innovative, effective, and safe skin disease therapeutics. For instance, a recent study reported a 30% increase in sales for a new topical acne treatment due to its improved efficacy and reduced side effects.

What are the Key Data Covered in this Non-Cancerous Skin Diseases Therapeutics Market Research and Growth Report?

-

What is the expected growth of the Non-Cancerous Skin Diseases Therapeutics Market between 2025 and 2029?

-

USD 31.46 billion, at a CAGR of 11.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Therapy Area (Psoriasis, Eczema, Acne vulgaris, and Others), Route Of Administration (Injectable, Oral, and Topical), End-user (Hospitals, Dermatology Clinics, and Homecare), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

High prevalence of skin diseases, Increasing generic competition

-

-

Who are the major players in the Non-Cancerous Skin Diseases Therapeutics Market?

-

AbbVie Inc., Amgen Inc., AstraZeneca Plc, Bayer AG, Bristol Myers Squibb Co., Eli Lilly and Co., F. Hoffmann La Roche Ltd., Galderma SA, GlaxoSmithKline Plc, Incyte Corp., LEO Pharma AS, Merck KGaA, Novartis AG, Pfizer Inc., Regeneron Pharmaceuticals Inc., Sanofi SA, Sun Pharmaceutical Industries Ltd., UCB SA, Viatris Inc., and XBiotech Inc.

-

Market Research Insights

- The market for non-cancerous skin disease therapeutics is a dynamic and continuously evolving sector, driven by ongoing research and advancements in technology. Two significant developments in this field include the increasing use of targeted drug delivery systems and the identification of biomarkers for improved disease diagnosis and treatment response. For instance, a recent study reported a 30% increase in treatment efficacy for acne patients using a novel targeted drug delivery system.

We can help! Our analysts can customize this non-cancerous skin diseases therapeutics market research report to meet your requirements.