Offshore Helicopters Market Size 2024-2028

The offshore helicopters market size is forecast to increase by USD 4.46 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the wave in exploration activities, particularly in the offshore wind industry. The integration of digital technologies, such as big data and digitalization, into helicopter avionics is a key trend driving market growth. This enables more efficient operations and improved safety. However, there are challenges to the adoption of new technology and equipment, including safety concerns and high costs. Offshore rigs require reliable passenger and goods transport solutions, and ecocopters, which prioritize low emissions, are gaining popularity. The market analysis report provides an in-depth examination of these trends and challenges, offering insights into the future growth prospects of the market.

What will be the Size of the Market During the Forecast Period?

The offshore helicopters market is growing due to the increasing demand for reliable aerial support in offshore oil & gas production. Helicopters, including light, medium, and heavy helicopters, are crucial for inspection, monitoring, and surveying in remote offshore rigs. Major oil and gas companies like Enap, Equinor, and Petrobras rely on helicopters for personnel transport and operational logistics. Additionally, passenger transport is a vital service, ensuring efficient movement between offshore platforms and the mainland. Helicopters also play a key role in search and rescue operations and search and rescue services, providing rapid response in emergencies. As environmental considerations become more important, the market is shifting towards more sustainable and efficient helicopter technologies for offshore operations.

Market Segmentation

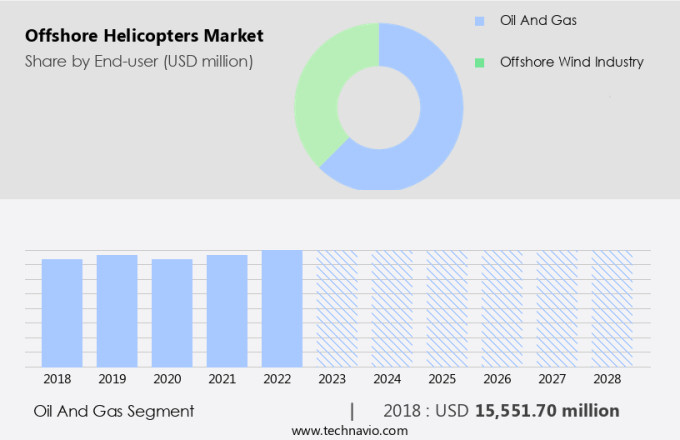

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas

- Offshore wind industry

- Geography

- Europe

- UK

- APAC

- China

- India

- North America

- US

- Middle East and Africa

- South America

- Europe

By End-user Insights

The oil and gas segment is estimated to witness significant growth during the forecast period. Helicopter services are essential in the energy sector, particularly in the offshore oil and gas industry. Offshore helicopters facilitate maintenance and inspection of offshore rigs and transport personnel to and from installations in harsh marine conditions. The market for offshore helicopters is projected to expand due to the increasing exploration and development of new offshore rigs in shallow waters, driven by rising crude oil demand. As shallow drilling becomes less viable, helicopters will continue to be crucial for accessing energy infrastructure located further from land. In the offshore wind industry, helicopters also play a significant role in transporting personnel and goods to and from wind turbines located in remote areas.

Further, safety concerns remain a priority in the offshore helicopter market, with companies investing in advanced technologies and safety protocols to ensure the well-being of passengers and crew. Companies such as Ecocopter are pioneering eco-friendly helicopter designs to reduce the industry's carbon footprint. Digitalization is transforming the offshore helicopter industry, with the integration of advanced technologies like real-time data analytics and predictive maintenance systems to enhance operational efficiency and safety.

Get a glance at the market share of various segments Request Free Sample

The oil and gas segment accounted for USD 15.51 billion in 2018 and showed a gradual increase during the forecast period.

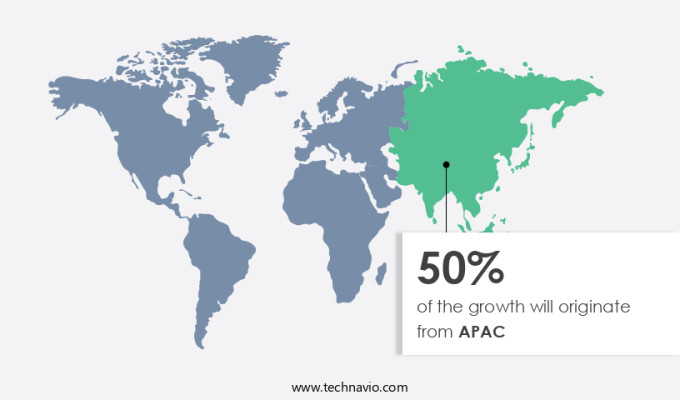

Regional Insights

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Offshore helicopters have seen significant demand in Europe due to the presence of numerous offshore oil and gas platforms and the expanding offshore wind industry. Strict safety regulations in Europe have further fueled market growth. The UK, Germany, and Norway are major contributors to the European market. According to the UK Civil Aviation Authority (CAA), approximately 230 offshore helicopters are operational in Europe, serving 11 countries. Around 22% of the global traffic for offshore helicopters is in the North Sea. In the UK alone, there are 95 helicopters transporting over one million passengers annually to 228 platforms and 100 mobile helidecks. Operational efficiency is crucial in offshore helicopter operations, and fleet capabilities, avionics, and safety features play a vital role in ensuring successful missions.

Further, safety standards are paramount in the offshore helicopter industry, with advanced safety features such as emergency floats, night vision goggles, and collision avoidance systems becoming increasingly common. Offshore helicopter operators prioritize fleet capabilities, including range, endurance, and payload capacity, to meet the unique demands of offshore operations. Avionics, including advanced communication systems and navigation equipment, are essential for ensuring safe and efficient operations. In conclusion, the European market is driven by the need for crew transportation, aerial surveys, and operational efficiency in challenging offshore environments.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased in offshore wind power plants is the key driver of the market. The global economy is expanding at a rate of 3.4% annually, with the world population projected to reach 9 billion by 2040, leading to a heightened demand for energy. Europe and China are major contributors to the growth of the wind power market, particularly in the offshore sector. Offshore wind development has gained traction due to technological advancements, such as sophisticated electronics and efficient planning and management, which have increased the reliability of wind turbine systems and decreased their costs. Furthermore, the availability of systems capable of generating over one megawatt of power has made offshore wind development more economically viable.

However, it is crucial to consider the environmental impact of helicopter operations, including carbon emissions and noise pollution. Operating costs and regulatory complexities are also significant challenges. To address these challenges, large helicopters offer efficient solutions for transporting personnel and equipment to offshore wind farms. As the industry evolves, it is essential to prioritize sustainable practices and innovative technologies to ensure long-term success.

Market Trends

Integration of big data with helicopter avionics is the upcoming trend in the market. Helicopters play a crucial role in transportation and logistics, particularly in challenging environments and for industries such as search and rescue, wind energy, and marine research. With the advent of advanced technologies, helicopter operations can be optimized for enhanced safety and efficiency. For instance, big data analysis enables real-time monitoring of an entire helicopter fleet, allowing early identification of potential safety risks and ensuring a secure journey for passengers. By analyzing flight data from helicopter components during production, potential risks that could impact helicopter performance and cause malfunctions can be detected and addressed proactively. Additionally, weather data collection and analysis, combined with a detailed examination of helicopter components and flight data, can help predict corrosion occurrences on helicopter parts, enabling maintenance schedules to be optimized.

In emergency services, helicopters are indispensable for swift response and rescue operations. Incorporating technology such as unmanned aerial vehicles (UAVs) can further enhance their capabilities, providing real-time data and improving overall mission effectiveness. In conclusion, helicopters are essential for various industries and applications, and the integration of advanced technologies can significantly improve their operational efficiency, safety, and overall value proposition.

Market Challenge

Barriers to adoption of new technology and equipment is a key challenge affecting the market growth. Offshore helicopters, specifically medium-sized models, play a crucial role in providing maneuverability and accessibility in the offshore wind industry. These helicopters are essential for emergency medical assistance and emergency response capabilities in offshore wind farms. companies providing solutions with advanced offshore helicopters must comply with the regulatory requirements set by government agencies and aviation authorities. The integration of new technologies in offshore helicopters can be challenging due to the rapid obsolescence of technology and the associated costs. Adopting new technologies can result in downtime for helicopters, making it difficult for companies to keep up. Moreover, certification requirements and the need for expertise add to the complexity and costs of implementing new technologies.

Innovations in offshore helicopter technology undergo rigorous testing and evaluation processes before certification. Significant financial backing and support from prominent manufacturers and Maintenance, Repair, and Overhaul (MRO) service providers in the aviation market are necessary to bring these innovations to fruition. In conclusion, the offshore helicopter market requires a balance between adopting new technologies and maintaining operational efficiency. companies must navigate the challenges of certification, costs, and expertise while ensuring the safety and regulatory compliance of their solutions. The offshore wind industry relies on these helicopters for critical emergency response and medical assistance, making it essential to invest in continuous innovation while maintaining a strong safety protocol.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abu Dhabi Aviation Co. - The company, based in Europe, provides helicopters under the brand name H145 for various applications. These helicopters are renowned for their reliability and versatility, making them a popular choice for offshore operations in the energy sector.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abu Dhabi Aviation Co.

- Airbus SE

- ASG Helicopter Services

- Babcock International Group Plc

- The Boeing Co.

- Bristow Group Inc.

- Canadian Helicopters Ltd.

- CHC Group LLC

- Cougar Helicopters Inc.

- Gulf Helicopters Co.

- Heligo Charters Private Ltd.

- Leonardo Spa

- Lockheed Martin Corp.

- Omni Helicopter International SA

- PHI Group Inc.

- Shell plc

- Textron Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Offshore helicopters play a crucial role in facilitating transportation and logistics in various industries, including search and rescue, wind energy, marine research, and emergency services. These helicopters are essential for operations at offshore rigs and wind energy installations, providing passenger and goods transport to personnel and supplies. The offshore helicopter market is driven by the increasing demand for logistical support in the offshore wind industry. Safety concerns are a top priority in the offshore helicopter market, with operators focusing on safety standards and operational efficiency. The integration of digitalization, such as avionics and safety features, enhances the capabilities of offshore helicopters.

Unmanned aerial vehicles (UAVs) are also being used in conjunction with offshore helicopters for aerial surveys and emergency medical assistance. The offshore helicopter market faces regulatory complexities and travel restrictions, leading to increased operating costs. Operators are adopting sustainable practices, such as reducing carbon emissions and minimizing noise pollution, to mitigate these challenges. The market is segmented into large and medium helicopters, each with unique maneuverability and emergency response capabilities. Offshore helicopters are integral to maritime operations, providing essential logistical support for offshore locations. They are used in exploration activities, ensuring safety protocols are adhered to and enabling efficient crew transportation.

The market's fleet capabilities continue to evolve, with advancements in technology and safety features enhancing their capabilities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 4.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

UK, US, Australia, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abu Dhabi Aviation Co., Airbus SE, ASG Helicopter Services, Babcock International Group Plc, The Boeing Co., Bristow Group Inc., Canadian Helicopters Ltd., CHC Group LLC, Cougar Helicopters Inc., Gulf Helicopters Co., Heligo Charters Private Ltd., Leonardo Spa, Lockheed Martin Corp., Omni Helicopter International SA, PHI Group Inc., Shell plc, and Textron Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch