Offshore Oil And Gas Pipeline Market Size 2025-2029

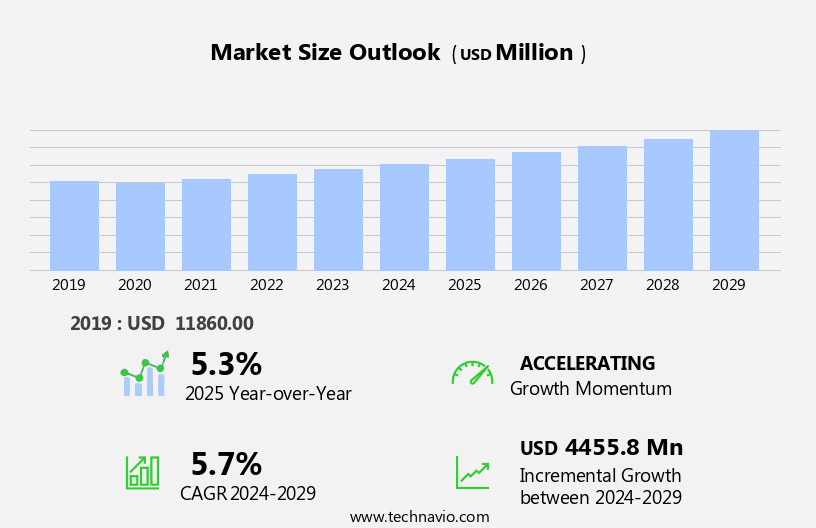

The offshore oil and gas pipeline market size is forecast to increase by USD 4.46 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is driven by the economic benefits it offers over other transportation modes for oil and gas. The vast reserves of hydrocarbons located offshore necessitate long-distance transportation, making pipelines a cost-effective solution compared to other methods like tankers or LNG carriers. Furthermore, advancements in offshore pipeline inspection technologies have significantly improved safety and efficiency, enabling operators to extend the life of existing pipelines and reduce maintenance costs. However, the market faces challenges from the volatility in global crude oil and natural gas prices. Fluctuations in prices can impact the profitability of pipeline projects, making it essential for companies to maintain operational flexibility and adapt to market conditions.

- Additionally, the increasing complexity of offshore pipeline infrastructure, coupled with the harsh marine environment, presents unique challenges in terms of construction, maintenance, and safety. Effective risk management strategies and continuous technological innovation are crucial for companies to capitalize on the market opportunities and navigate these challenges successfully.

What will be the Size of the Offshore Oil And Gas Pipeline Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market conditions and advancing technologies. Pipeline modeling plays a crucial role in optimizing pipeline design and routing, taking into account various factors such as flow measurement, safety, and environmental impact. Pipeline corrosion is a persistent challenge, necessitating continuous monitoring and maintenance, including pipeline repair and rehabilitation. Plastic pipe offers an alternative to steel, bringing cost savings and sustainability benefits. Pipeline SCADA systems enable real-time monitoring and automation, enhancing pipeline control and safety. Pipeline integrity is a top priority, with data analytics and certification playing essential roles in ensuring pipeline sustainability.

Leak detection technologies are continually advancing, reducing response times and minimizing environmental impact. Pipeline installation and burying require meticulous planning and execution, with engineering and asset management playing key roles. Pipeline economics are influenced by various factors, including funding, regulations, and investment. Pipeline abandonment and decommissioning present unique challenges, requiring careful planning and execution. Pipeline construction and development are ongoing processes, with ongoing research and innovation shaping pipeline materials, coatings, and installation techniques. Pipeline trenching and laying are critical steps in pipeline construction, with safety and environmental considerations at the forefront. Pipeline inspection and maintenance are ongoing requirements, with regulations and standards guiding best practices.

Subsea pipelines present unique challenges, requiring specialized expertise and technologies for installation, maintenance, and inspection. Pipeline risk assessment and optimization are essential components of pipeline asset management, ensuring the safe and efficient operation of pipelines. Concrete pipe offers an alternative to steel and plastic, bringing benefits such as durability and cost savings. Pipeline simulation and pipeline flow measurement are crucial tools for pipeline optimization and efficiency. Pipeline regulations and standards are continually evolving, reflecting the latest technological advancements and best practices. Pipeline pigging is a critical maintenance activity, ensuring pipeline cleanliness and efficiency. Pipeline rehabilitation and pipeline design are ongoing processes, with a focus on sustainability, safety, and cost savings.

Pipeline environmental impact is a growing concern, with ongoing research and innovation aimed at reducing environmental footprints. Pipeline life cycle management is a holistic approach to pipeline management, encompassing all stages from design to decommissioning. In the market, dynamism and innovation are the norm. From pipeline modeling and corrosion to pipeline automation and sustainability, ongoing research and technological advancements are shaping the market landscape. Pipeline fabrication, welding, routing, monitoring, safety, trenching, laying, flow measurement, development, abandonment, funding, maintenance, regulations, control systems, engineering, asset management, burying, materials, coating, optimization, surveys, modeling, certification, leak detection, automation, installation, economics, environmental impact, life cycle, construction, investment, inspection, standards, subsea pipelines, pigging, design, rehabilitation, concrete pipe, and risk assessment all play essential roles in this complex and evolving market.

How is this Offshore Oil And Gas Pipeline Industry segmented?

The offshore oil and gas pipeline industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Sector

- Up stream

- Mid stream

- Down stream

- Product

- Oil

- Gas

- Refined products

- Type

- Transport lines

- Export lines

- Others

- Product Type

- Below 24 inches

- Greater than 24 inches

- Geography

- Europe

- Italy

- Norway

- Russia

- Spain

- Middle East and Africa

- UAE

- Turkey

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- Europe

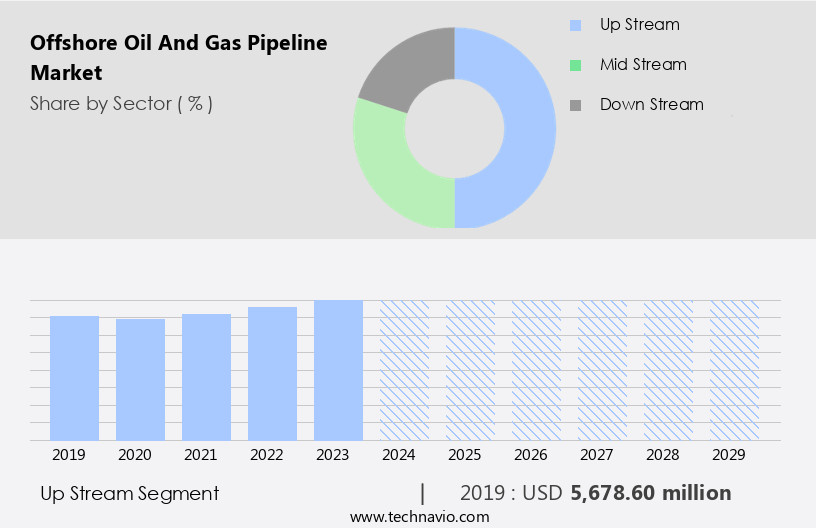

By Sector Insights

The up stream segment is estimated to witness significant growth during the forecast period.

The market encompasses various stages from pipeline development to abandonment. Pipeline fabrication is a crucial process involving the manufacturing of steel pipes for transportation infrastructure. Pipeline welding ensures the pipes' integrity through robust joining techniques. Pipeline routing requires careful planning, considering factors like depth, water currents, and proximity to other structures. Pipeline monitoring systems ensure safety and efficiency through real-time data analytics and pipeline integrity management. Regulations mandate stringent safety measures, including pipeline safety protocols and regular inspections. Pipeline trenching and laying involve careful placement to prevent damage and ensure optimal flow measurement. Pipeline optimization uses advanced modeling and simulation to maximize efficiency and minimize environmental impact.

Pipeline materials, including steel and plastic, undergo rigorous testing and certification processes. Pipeline corrosion is mitigated through protective coatings and regular maintenance. Pipeline rehabilitation and pipeline design are essential for extending the life cycle of existing infrastructure. Pipeline burying and pipeline installation require specialized equipment and techniques. Pipeline economics and environmental impact assessments are critical considerations throughout the pipeline's life cycle. Subsea pipelines face unique challenges, including high pressure, deep water, and harsh environmental conditions. Pipeline pigging and pipeline rehabilitation techniques address these challenges, ensuring the continued safe and efficient transportation of resources. Pipeline risk assessment is an ongoing process to minimize potential hazards and ensure regulatory compliance.

The Up stream segment was valued at USD 5.68 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

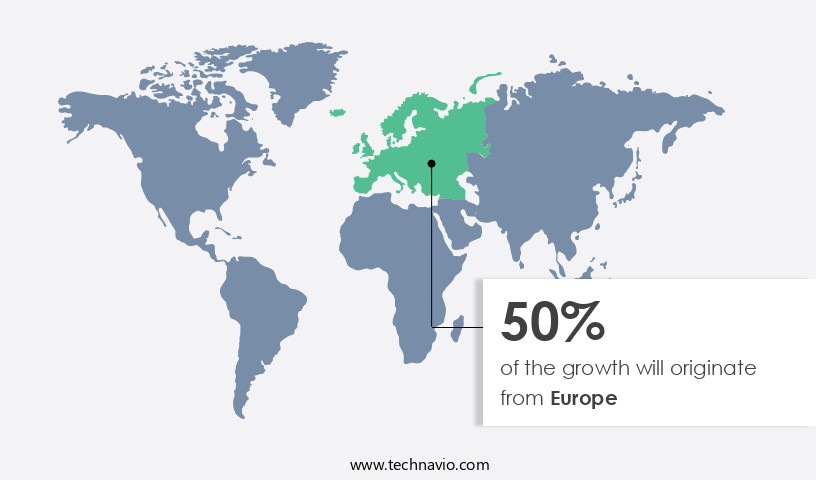

Europe is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Europe is significantly shaped by Western Europe and Russia, with numerous projects in the North Sea driving its growth. For instance, BP PLC, a leading global oil and gas company, invested USD150 billion in May 2022 to develop the Murlach oil field in the North Sea, set for completion by the end of 2025. This investment, among others, presents continuous opportunities for upstream players, generating substantial revenue for market participants. Furthermore, several oil and gas E&P development projects are slated for completion in Russia by H2 2025, with capital investments surpassing USD150 billion. These projects will contribute to the market's expansion during the forecast period.

Pipeline fabrication and welding are crucial processes in constructing these offshore pipelines. Pipeline routing and trenching are essential for ensuring the pipelines' safety and efficiency. Monitoring, maintenance, and repair are ongoing requirements to ensure pipeline integrity and sustainability. Regulations and control systems play a vital role in ensuring pipeline safety and compliance. Pipeline engineering, asset management, optimization, and modeling are essential aspects of pipeline development and rehabilitation. Materials, coatings, and corrosion management are critical factors in pipeline longevity. Pipeline surveys, leak detection, and automation are essential for pipeline inspection and maintenance. Pipeline economics, environmental impact, and certification are significant considerations in pipeline investment decisions.

Subsea pipelines, pigging, and rehabilitation are integral parts of pipeline infrastructure. Concrete pipe and risk assessment are also essential components of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Offshore Oil And Gas Pipeline Industry?

- The primary factor driving the market is the significant economic advantages of offshore pipelines over other modes of oil and gas transportation.

- Offshore oil and gas pipelines serve a crucial role in transporting crude oil, natural gas, and petroleum products from offshore production sites to onshore consumption centers. Compared to marine vessels, offshore pipelines offer several advantages. They require less energy consumption and have a lower carbon footprint, making them a more sustainable choice for long-distance transportation. Additionally, offshore pipelines boast lower operational and maintenance costs, making them a more economical option than other transportation modes. Pipeline engineering, pipeline asset management, pipeline simulation, pipeline repair, pipeline control systems, pipeline optimization, pipeline surveys, pipeline burying, and pipeline materials, including pipeline coating, play essential roles in ensuring the efficient and safe operation of offshore pipelines.

- Pipeline regulations also play a significant part in maintaining the integrity and safety of these vital infrastructure assets.

What are the market trends shaping the Offshore Oil And Gas Pipeline Industry?

- Offshore pipeline inspection is currently experiencing significant advancements, making it a noteworthy market trend for professionals in the industry. The adoption of innovative technologies, such as autonomous underwater vehicles and non-destructive testing methods, is driving this progression.

- Offshore oil and gas pipelines play a crucial role in transporting hydrocarbons from remote locations to refineries and markets. However, ensuring their safety and integrity is a significant challenge due to the harsh marine environment and operational complexities. Advanced pipeline modeling and SCADA systems enable remote monitoring, enhancing pipeline integrity and sustainability. Pigging, a maintenance practice involving the use of scrapers or pigs, is essential for inspecting pipelines. However, smaller diameter or bent pipelines may not be piggable, leading to undetected corrosion, metal loss, or cracks.

- Pipeline data analytics and automation are vital for proactive leak detection and certification. Plastic pipes offer potential solutions due to their resistance to corrosion. The pipeline industry continues to invest in research and development to improve pipeline economics and reduce environmental risks.

What challenges does the Offshore Oil And Gas Pipeline Industry face during its growth?

- The volatility in global crude oil and natural gas prices poses a significant challenge to the growth of the industry.

- The market is a critical infrastructure sector that faces significant challenges due to the volatility of global crude oil and gas prices. This market dynamics can significantly impact pipeline investment, construction, and maintenance. Pipeline environmental impact is a crucial consideration throughout the pipeline life cycle, from design and construction to inspection and rehabilitation. Pipeline standards and regulations play a vital role in ensuring safety and minimizing risks. Pipeline inspection is essential to identify potential issues and maintain optimal performance. Technologies such as pipeline pigging and subsea pipeline inspection are increasingly being used to enhance pipeline integrity. Pipeline design and rehabilitation may involve the use of advanced materials like concrete pipe to improve durability and reduce environmental impact.

- Pipeline risk assessment is an ongoing process to identify and mitigate potential hazards, ensuring the safe and efficient operation of pipelines. Overall, the market requires a robust and harmonious approach to pipeline investment, construction, and maintenance to mitigate risks and optimize performance.

Exclusive Customer Landscape

The offshore oil and gas pipeline market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the offshore oil and gas pipeline market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, offshore oil and gas pipeline market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allseas Group SA - The company specializes in providing offshore oil and gas pipeline solutions, including Solitaire and Pioneering Spirit pipelay services for both deepwater and shallow-water pipeline installations. Our expertise lies in delivering advanced pipelay capabilities, ensuring project efficiency and safety. Solitaire, a state-of-the-art pipelay vessel, boasts a high-capacity pipelay system and versatile capabilities for various pipeline projects. Pioneering Spirit, a heavy-lift vessel, offers unparalleled installation capacity for large offshore structures, including pipelines and platforms. By combining technical innovation with operational excellence, we enable our clients to optimize their offshore energy infrastructure projects.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allseas Group SA

- ArcelorMittal SA

- Atteris Pty. Ltd.

- Fugro NV

- JFE Holdings Inc.

- John Wood Group PLC

- Larsen and Toubro Ltd.

- McDermott International Ltd.

- National Petroleum Construction Co.

- Nippon Steel Corp.

- PAO Severstal

- Saipem S.p.A.

- Salzgitter AG

- Sapura Energy Berhad

- Shengli Oil and Gas Pipe Holdings Ltd.

- Subsea 7 SA

- TechnipFMC plc

- Tenaris SA

- TMK

- United Metallurgical Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Offshore Oil And Gas Pipeline Market

- In February 2023, Royal Dutch Shell and its partners announced the final investment decision for the Hollandse Kust (Noord) offshore wind farm project, which includes the construction of a 1,100-megawatt wind farm and a 150-kilometer-long high-voltage direct current (HVDC) subsea power cable system to connect the wind farm to the Dutch electricity grid (Shell, 2023). This development signifies a significant expansion in the offshore renewable energy sector's integration with offshore oil and gas pipelines.

- In March 2024, Equinor and bp signed a strategic collaboration agreement to jointly develop and operate the Rosebank oil and gas field in the UK North Sea. The partnership aims to reduce carbon emissions by integrating carbon capture, utilization, and storage (CCUS) technologies into the project. This collaboration represents a major strategic move towards decarbonizing the offshore oil and gas industry (Equinor, 2024).

- In May 2024, TotalEnergies and Adani Group announced the formation of a joint venture to develop the D6 Block offshore oil and gas field in the Bay of Bengal. The partnership involves a USD2.5 billion investment in the development of the field, which is expected to produce 1.2 billion cubic meters of natural gas per year. This geographic expansion underscores the growing demand for offshore oil and gas resources in emerging markets (TotalEnergies, 2024).

- In October 2025, Saipem and Technip Energies announced the successful deployment of a new flexible pipelay system, the S-lay 10,000, capable of installing pipelines up to 10,000 tons in water depths of up to 3,000 meters. This technological advancement significantly increases the feasibility of developing offshore oil and gas fields in deeper waters, expanding the market's potential (Saipem, 2025).

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of innovative technologies and the need for emissions reduction and operational efficiency. Pipeline carbon capture solutions are gaining traction, aiming to minimize greenhouse gas emissions from offshore operations. Anodic protection and predictive maintenance are crucial for pipeline longevity, reducing the need for costly repairs and downtime. Rov operations and subsea production systems enable efficient deepwater pipeline management, while pipeline artificial intelligence and machine learning optimize performance and predict potential failures. Pipeline blue economy initiatives promote sustainable practices, aligning with the offshore industry's shift towards renewable energy. Offshore platforms are adopting green technologies, such as cathodic protection systems, to minimize environmental impact.

- Non-destructive testing, hydrostatic testing, and stress analysis ensure pipeline integrity, while pipeline renewable energy integration supports the transition to cleaner energy sources. Pipeline decommissioning and remediation are essential aspects of the market, addressing the challenges of aging infrastructure. Riser systems and ultra-deepwater pipelines require advanced technologies like fatigue analysis and digital twin simulations for safe and cost-effective maintenance. Cloud computing and pipeline remote monitoring enable real-time data analysis, enhancing operational efficiency and safety.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Offshore Oil And Gas Pipeline Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 4455.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

Russia, Norway, Turkey, Saudi Arabia, China, Italy, UAE, Spain, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Offshore Oil And Gas Pipeline Market Research and Growth Report?

- CAGR of the Offshore Oil And Gas Pipeline industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, Middle East and Africa, APAC, South America, and North America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the offshore oil and gas pipeline market growth of industry companies

We can help! Our analysts can customize this offshore oil and gas pipeline market research report to meet your requirements.