Oil Field Bio-Solvents Market Size 2025-2029

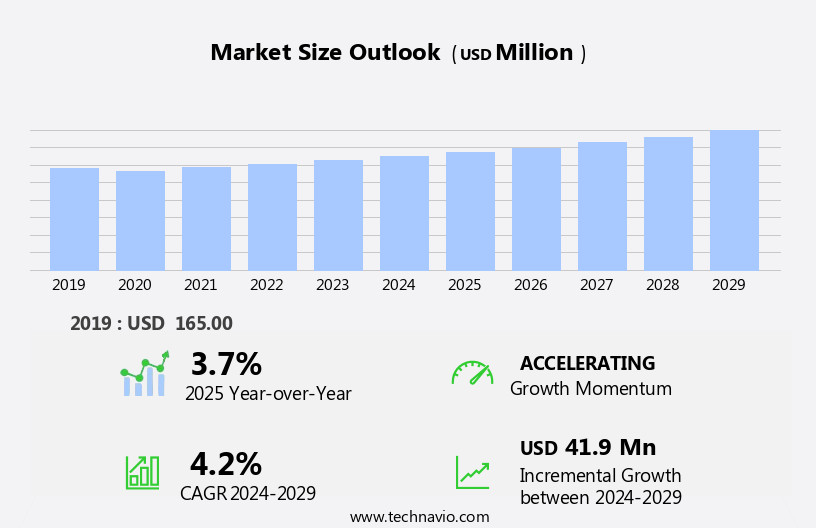

The oil field bio-solvents market size is forecast to increase by USD 41.9 million, at a CAGR of 4.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for environmentally friendly products in the oil and gas industry. Bio-solvents, derived from renewable sources, offer a sustainable alternative to traditional petroleum-based solvents. This shift towards eco-friendly solutions aligns with global efforts to reduce carbon footprints and minimize environmental impact. Another key factor fueling market expansion is the commercialization of bio-solvents. As technology advances and production processes become more efficient, bio-solvents are becoming increasingly cost-competitive with their petroleum counterparts.

- However, the market faces challenges related to the availability of raw materials for bio-based solvents. Sourcing sufficient quantities of feedstocks, such as vegetable oils and biomass, can be a significant hurdle for market participants. Addressing this challenge through strategic partnerships, research collaborations, and sustainable farming practices will be crucial for companies looking to capitalize on the opportunities presented by the market.

What will be the Size of the Oil Field Bio-Solvents Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, driven by the ongoing pursuit of sustainable and eco-friendly solutions in various sectors of the oil and gas industry. Bio-solvents derived from renewable resources have gained significant traction in recent years, offering advantages in areas such as reservoir stimulation, downhole applications, production optimization, and water purification. These bio-solvents are finding increasing applications in supply chain management, as they serve as effective alternatives to traditional petroleum-based chemicals in various processes. For instance, they are used as performance evaluators in bioprocess engineering to assess the efficiency of enzyme technology in oilfield applications.

Moreover, bio-solvents are being employed in risk assessment and safety protocols to mitigate the risks associated with hydrocarbon degradation and corrosion inhibitors. They are also used in environmental remediation efforts, such as oil spill cleanup and soil decontamination, as they pose a lower carbon footprint compared to their petroleum counterparts. The use of bio-solvents in drilling fluids and completion fluids is another growing trend in the market. These fluids are essential in ensuring efficient drilling and completion operations while minimizing environmental impact. Additionally, bio-solvents are being used in lifecycle assessment studies to evaluate the sustainability of various oilfield processes and practices.

Despite the numerous benefits of bio-solvents, their adoption in the oil and gas industry faces challenges, including cost competitiveness and regulatory compliance. However, as the market continues to evolve, it is expected that advancements in green chemistry and waste management will help overcome these challenges and drive the growth of the bio-solvents market. The integration of bio-solvents into various oilfield applications requires careful consideration of their application methods and topside applications. Proper field testing and evaluation are crucial to ensure their effectiveness and compatibility with existing processes. In conclusion, the market is a dynamic and evolving space, driven by the ongoing pursuit of sustainable and eco-friendly solutions in the oil and gas industry.

The market's continuous unfolding is characterized by the integration of bio-solvents into various applications, including supply chain management, reservoir stimulation, downhole applications, production optimization, occupational safety, safety protocols, water purification, carbon footprint reduction, hydrocarbon degradation prevention, drilling fluids, completion fluids, environmental remediation, and lifecycle assessment studies. The market's future growth is expected to be driven by advancements in green chemistry, waste management, and regulatory compliance.

How is this Oil Field Bio-Solvents Industry segmented?

The oil field bio-solvents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hydrocarbons

- Alcohols

- Glycols

- Others

- Application

- Oil and gas

- Transportation

- Others

- Product Type

- Surfactants

- Emulsifying agents

- Viscosity modifiers

- Solubilizing agents

- Grade Type

- Industrial grade

- Technical grade

- High purity grade

- Food grade

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The hydrocarbons segment is estimated to witness significant growth during the forecast period.

In the oil and gas industry, alcohols, as a type of bio-solvent, play a significant role in cleaning, degreasing, and solubilizing crude oil. Preferred for their low toxicity, biodegradability, and minimal volatility, alcohol solvents are increasingly utilized as additives to enhance the performance of drilling mud and other drilling fluids. The market is driven by the growing emphasis on environmentally friendly and sustainable alternatives. Methanol, propanol, butanol, and ethanol are the most commonly used bio-solvents in oilfields. Bioprocess engineering leverages renewable resources to produce these bio-solvents, while enzyme technology and microbial consortia are employed in their production.

Risk assessment is crucial in the application of bio-solvents, ensuring safety in production chemicals, corrosion inhibitors, and downhole applications. Performance evaluation is essential in the selection and optimization of bio-solvents for topside applications, completion fluids, and reservoir stimulation. Wastewater treatment and water purification are integral parts of the bio-solvents' lifecycle assessment, as well as supply chain management and occupational safety. The carbon footprint of bio-solvents is a critical consideration in the context of green chemistry and sustainable development. Additionally, bio-solvents are applied in oil spill cleanup, soil decontamination, hydrocarbon degradation, drilling fluids, and environmental remediation. Compliance with environmental regulations and minimizing environmental impact are ongoing concerns in the market.

The Hydrocarbons segment was valued at USD 113.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth in the Americas, particularly in North America, due to increasing environmental regulations on volatile organic compound (VOC) emissions of synthetic solvents. This region is witnessing a heightened adoption of eco-friendly oilfield bio-solvent products. The expansion of oilfield drilling and production, driven by the development of shale oil in North America, is further fueling market demand. The US, as one of the world's largest oil producers, holds the third position in oil production. Notable oilfields in the US, known for their size and production extent, include Wattenberg, Eagleville, Spraberry, Briscoe Ranch, and Prudhoe Bay.

Bioprocess engineering, renewable resources, and enzyme technology are key areas of focus in the production of these bio-solvents. Risk assessment, performance evaluation, and application methods are crucial factors in the selection and implementation of bio-solvents for topside applications, completion fluids, and oilfield chemicals. Downhole applications, reservoir stimulation, production optimization, and occupational safety also benefit from the use of these bio-solvents. Additionally, bio-solvents play a significant role in environmental remediation, wastewater treatment, hydrocarbon degradation, oil spill cleanup, soil decontamination, water purification, and carbon footprint reduction. Lifecycle assessment, supply chain management, and safety protocols are essential considerations in the market.

Green chemistry principles guide the production of these bio-solvents, ensuring sustainability and minimizing environmental impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents a significant and growing segment in the global chemicals industry. These eco-friendly alternatives to traditional petroleum-based solvents are gaining traction due to their environmental benefits and cost-effectiveness in oil and gas production. Bio-solvents, derived from renewable sources, offer superior performance in various applications such as enhanced oil recovery, drilling, and completion processes. They are biodegradable, reducing the environmental impact of oil field operations. Key players in the market include producers and suppliers of bio-based solvents like ethanol, methanol, and glycols. These bio-solvents enhance oil recovery by reducing viscosity, improving solubility, and increasing the efficiency of water flooding. Additionally, they exhibit excellent cleaning properties, making them ideal for removing asphaltene deposits and reducing paraffin wax build-up. The market is driven by factors such as increasing environmental regulations, rising crude oil prices, and the need for sustainable and cost-effective solutions in the oil and gas industry.

What are the key market drivers leading to the rise in the adoption of Oil Field Bio-Solvents Industry?

- The escalating consumer preference for eco-friendly products serves as the primary market catalyst.

- The market is experiencing significant growth due to the increasing demand for eco-friendly materials and products in the oil and gas industry. Green and bio-solvents, derived from renewable feedstocks, are gaining popularity as sustainable alternatives to traditional oilfield chemicals. These bio-solvents can be produced from various sources, including plants and waste materials, making them an essential step towards a more sustainable chemicals industry. Microbial consortia are increasingly being used in the production of bio-solvents through application methods such as topside applications and completion fluids. Alkylphenols, a type of bio-solvent, have shown great potential as a solvent for future biorefineries due to their ideal properties.

- The use of bio-solvents in oil spill cleanup and soil decontamination is another significant application area. The environmental benefits of using bio-solvents in these applications are substantial, as they reduce the carbon footprint and minimize the risk of secondary contamination. A lifecycle assessment of bio-solvents shows that they have a lower carbon footprint and fewer negative environmental impacts compared to traditional oilfield chemicals. As such, the adoption of bio-solvents is expected to continue growing as the industry moves towards more sustainable practices. In conclusion, The market is poised for growth due to the increasing demand for eco-friendly materials and the potential environmental benefits of using bio-solvents in various applications.

- The development of new production methods and the use of renewable feedstocks are driving innovation in this market, making it an exciting area for investment and research.

What are the market trends shaping the Oil Field Bio-Solvents Industry?

- The commercialization of bio-solvents is gaining significant traction in the market, becoming an emerging trend. This trend is driven by the increasing demand for sustainable and eco-friendly alternatives to traditional solvents in various industries.

- The oilfield biocides and bio-solvents market is experiencing growth due to the increasing adoption of these products in various applications, including reservoir stimulation and production optimization. One of the prominent oilfield biocides, chlorine dioxide (ClO2), is gaining popularity for its effectiveness in microbiological control technology. The surge in hydraulic fracturing and unconventional shale gas production has fueled the demand for ClO2, particularly for frac water disinfection. Its advantages, such as the prevention of hydrocarbon degradation, enhanced flow assurance, and optimal solution for hydraulic fracturing and water fly treatment, make it a preferred choice. ClO2's lower dosage requirements, real-time control and monitoring capabilities, improved safety, and minimal environmental footprint further add to its appeal.

- In the context of supply chain management, the use of ClO2 contributes to safety protocols by addressing water contamination caused by spores and bacteria. Additionally, its water purification properties help reduce the overall carbon footprint of oilfield operations.

What challenges does the Oil Field Bio-Solvents Industry face during its growth?

- The availability of raw materials for producing bio-based solvents poses a significant challenge and significantly impacts the growth of the industry.

- The market is influenced by several factors, primarily the availability and production of feedstock. Crops such as sugar cane, corn, oranges, tapioca, and wheat are commonly used in the production of bio-solvents. However, the production of these crops is subject to external factors like climatic conditions, which can lead to fluctuations in availability and impact the market negatively. For instance, excess rainfall, plagues of locusts, frost, and hurricanes can affect the growth of crops and hinder the production of bio-solvents. Consequently, the non-availability or inconsistent availability of raw materials can result in increased production costs and hinder market growth during the forecast period.

- Additionally, environmental regulations and the emphasis on sustainable development, environmental remediation, health and safety, and waste management are driving the demand for bio-solvents in the oil and gas industry. Field testing is also crucial in ensuring the effectiveness and safety of bio-solvents in drilling fluids.

Exclusive Customer Landscape

The oil field bio-solvents market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil field bio-solvents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil field bio-solvents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AkzoNobel - The company specializes in providing advanced bio-solvents for various industries, including automotive, aerospace, and transportation. These innovative solutions offer significant benefits, such as improved performance, enhanced sustainability, and reduced environmental impact. Our bio-solvents are meticulously engineered to meet the stringent requirements of these sectors, ensuring optimal results. By leveraging cutting-edge research and development, we deliver high-quality, eco-friendly alternatives to traditional solvents. Our commitment to originality and excellence sets us apart in the market, elevating our clients' operations and boosting their competitive edge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AkzoNobel

- Albemarle

- Ashland

- BASF SE

- Chemex

- Chevron Phillips Chemical

- Clariant

- Croda International

- Dow

- DuPont

- Eastman Chemical Company

- Evonik Industries

- Halliburton

- Huntsman Corporation

- Kemira

- Nalco Champion

- Sasol

- Solvay

- Stepan Company

- The Lubrizol Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oil Field Bio-Solvents Market

- In January 2024, LanzaTech, a global leader in gas fermentation technology, announced the successful demonstration of their bio-solvent, ethanol, as a viable alternative to traditional oil-based solvents in oil field applications. This breakthrough was a significant technological advancement in the market (Source: LanzaTech Press Release).

- In March 2024, BASF, the world's largest chemical producer, entered into a strategic partnership with BioAmber, a leading biotech company, to produce bio-based succinic acid, a key building block for bio-solvents, at BASF's Verbund site in Ludwigshafen, Germany. This collaboration marked a significant expansion in the production capacity and geographic reach of bio-solvents in the oil industry (Source: BASF Press Release).

- In July 2024, Myriant, a biotechnology company specializing in the production of bio-based chemicals, raised USD50 million in a Series C funding round, led by Vinod Khosla's Khosla Ventures. The funds were earmarked for the commercialization of Myriant's bio-solvent, Mirel, in the oil field sector, marking a significant investment in the future of bio-solvents in the industry (Source: Myriant Press Release).

- In May 2025, the U.S. Environmental Protection Agency (EPA) approved the use of bio-based solvents, including those derived from corn sugar and sugarcane, as substitutes for oil-based solvents in oil field applications. This approval marked a significant regulatory milestone, paving the way for the wider adoption of bio-solvents in the oil industry (Source: EPA Press Release).

Research Analyst Overview

- The market is experiencing significant activity and trends, driven by advancements in technology and increasing market adoption. Remote monitoring and data logging enable real-time process optimization and quality assurance, while data analytics and predictive modeling offer valuable insights for price strategies and competitive advantage. Performance indicators are crucial for measuring economic impact and identifying areas for process control improvement. Technology transfer and academic collaborations foster innovation in biosurfactant production, leading to product differentiation and enhanced customer relations. Industry partnerships and intellectual property protection are essential for securing a competitive edge. Enzyme immobilization and metabolic engineering contribute to efficient production processes and improved product quality.

- Data acquisition and field data analysis are vital for ensuring technical support and maintaining high standards. Investment opportunities abound in this sector, with potential for job creation and continued growth in the industry. Market dynamics are shaped by ongoing advancements in data analytics, process optimization, and quality control.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oil Field Bio-Solvents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

252 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 41.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil Field Bio-Solvents Market Research and Growth Report?

- CAGR of the Oil Field Bio-Solvents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil field bio-solvents market growth of industry companies

We can help! Our analysts can customize this oil field bio-solvents market research report to meet your requirements.