Online Apparel Retailing Market Size 2025-2029

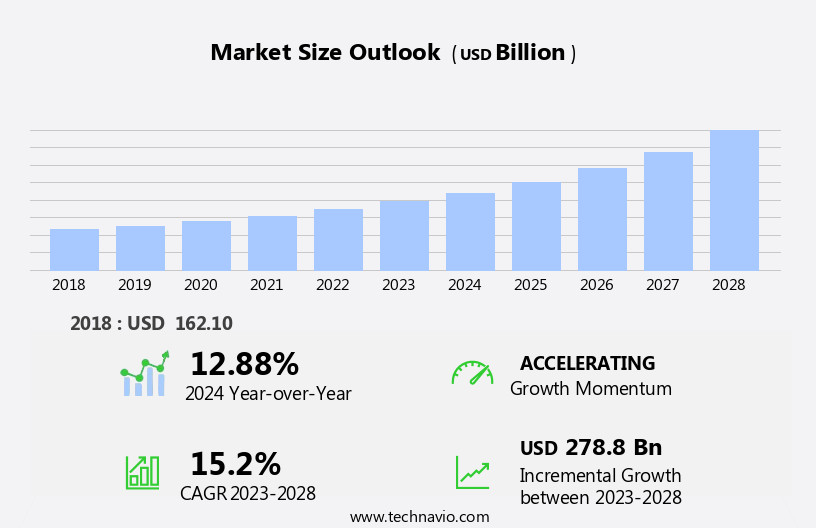

The online apparel retailing market size is forecast to increase by USD 343.2 billion, at a CAGR of 16.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of mobile commerce and network marketing. Consumers preference for the convenience and accessibility of shopping online, coupled with the widespread adoption of digital payment systems, is fueling this trend. However, the market faces challenges as well. The presence of counterfeit products poses a significant threat, requiring robust measures to ensure authenticity and consumer trust. Retailers must navigate this issue carefully to maintain their brand reputation and customer loyalty. As the market continues to evolve, companies must stay agile and adapt to these dynamics to capitalize on opportunities and mitigate risks effectively.

- By focusing on customer experience, innovation, and brand protection, retailers can differentiate themselves and thrive in the competitive online apparel retailing landscape.

What will be the Size of the Online Apparel Retailing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various sectors. Product photography plays a crucial role in showcasing merchandise, while order fulfillment ensures timely delivery. Social media integration enhances brand visibility, and ethical sourcing addresses sustainability concerns. Online storefronts and website optimization attract customers, reducing carbon footprint through e-commerce platforms. Customer retention is fostered through personalization algorithms, interactive shopping experiences, and mobile commerce. Mobile app development caters to on-the-go consumers, and 3D modeling offers virtual try-on technology. Security protocols and customer data protection maintain trust, while fair trade practices and customer segmentation cater to diverse demographics. E-commerce platforms employ machine learning for predictive analytics, subscription services, and fraud detection.

Omnichannel strategy integrates physical and digital channels, and recycled materials and upcycled products cater to the growing demand for sustainability. Content marketing, payment gateways, and shipping logistics further streamline operations. Virtual assistants, returns processing, and virtual styling offer enhanced customer service, while loyalty programs and data analytics provide valuable insights. Augmented reality (AR) and virtual reality (VR) create immersive shopping experiences, and influencer marketing expands reach. Continuous innovation in technology and consumer preferences keeps the market in a constant state of flux.

How is this Online Apparel Retailing Industry segmented?

The online apparel retailing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

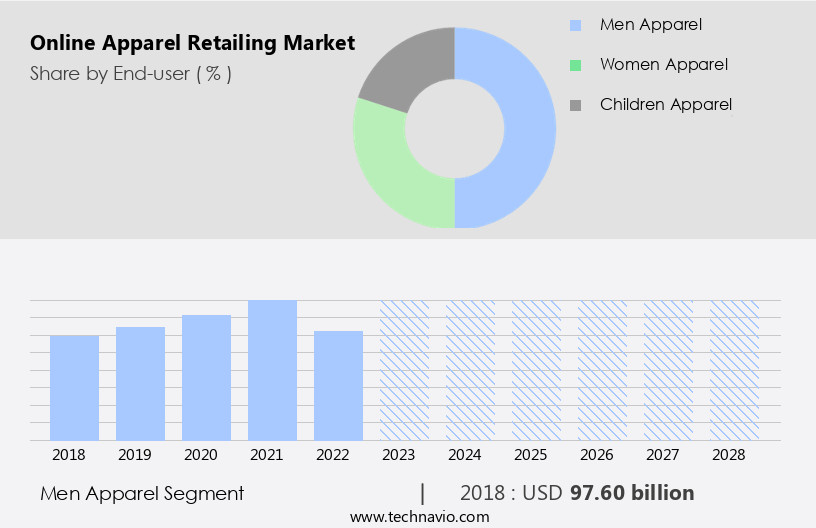

- End-user

- Men apparel

- Women apparel

- Children apparel

- Product

- Upper wear apparel

- Bottom wear apparel

- Others

- Business Segment

- Business-to-consumer (B2C)

- Business-to-business (B2B)

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By End-user Insights

The men apparel segment is estimated to witness significant growth during the forecast period.

The market is witnessing dynamic trends, with sustainable fashion gaining prominence. Consumers are increasingly seeking eco-friendly and ethically sourced clothing, leading retailers to prioritize ethical sourcing and fair trade practices. Inventory management plays a crucial role in ensuring stock availability and reducing wastage, while personalization algorithms offer customized shopping experiences. Pay-Per-Click (PPC) advertising and social media marketing are key digital marketing strategies, driving customer engagement and sales. Interactive shopping experiences, such as virtual try-on technology and augmented reality, enhance the customer journey. Mobile commerce and mobile app development cater to the growing preference for convenient, on-the-go shopping. Fashion trends influence buying behavior, with product reviews and influencer marketing shaping customer decisions.

Email marketing and loyalty programs foster brand loyalty and customer retention. Product photography, order fulfillment, and shipping logistics ensure a seamless shopping experience. Data privacy and security protocols protect customer data, while machine learning and predictive analytics optimize operations and improve customer engagement. Subscription services and fraud detection systems streamline business processes. An omnichannel strategy and 3D modeling offer immersive shopping experiences. Recycled materials and upcycled products contribute to reducing the carbon footprint, aligning with the growing demand for sustainable practices. Content marketing and influencer collaborations strengthen brand image and reach. Payment gateways and returns processing simplify transactions and customer service.

Artificial intelligence (AI) and virtual assistants offer personalized recommendations and customer support, while data analytics and predictive analytics provide valuable insights for business growth. The market continues to evolve, with virtual styling, loyalty programs, and cross-channel marketing strategies shaping the future of online apparel retailing.

The Men apparel segment was valued at USD 106.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic world of online apparel retailing, various trends and technologies are shaping the market's evolution. Sustainable fashion is gaining traction as consumers prioritize ethical sourcing and reduced carbon footprint. Inventory management systems ensure stock availability, while personalization algorithms offer tailored shopping experiences. Pay-Per-Click (PPC) advertising and social media marketing boost brand visibility. Data privacy and customer data protection are crucial, with secure protocols and AI-driven fraud detection safeguarding transactions. Mobile commerce and mobile app development cater to the increasing use of smartphones for shopping. Fashion trends are identified through data analytics and predictive analytics, with product reviews influencing purchasing decisions.

Email marketing and loyalty programs foster brand loyalty, while order fulfillment and shipping logistics ensure timely delivery. Content marketing, influencer marketing, and virtual try-on technology enhance the customer experience. Recycled materials and upcycled products contribute to the industry's sustainability efforts. E-commerce platforms employ machine learning and subscription services for seamless user experiences. Omnichannel strategy integrates online and offline channels, providing a cohesive shopping journey. Returns processing and virtual styling offer personalized solutions for customers. Data analytics and customer segmentation help retailers target their audience effectively, while predictive analytics informs strategic decision-making. The APAC region's rapid urbanization fuels the growth of online apparel retailing, with consumers increasingly adopting digital marketing strategies and embracing immersive technologies like AR and VR.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Online Apparel Retailing Industry?

- The surge in the usage and acceptance of digital payment systems serves as the primary catalyst for market growth.

- Online apparel retailing has experienced significant growth due to the convenience and accessibility it offers. Sustainable fashion is a growing trend in this market, with consumers increasingly seeking eco-friendly and ethically produced clothing. Inventory management is crucial for online retailers to ensure they have the right products in stock and available for customers. Pay-Per-Click (PPC) advertising and style guides help retailers reach potential customers and showcase their offerings. Data privacy is a major concern for consumers, and retailers must prioritize this issue to build trust. Personalization algorithms provide tailored shopping experiences, while interactive shopping experiences and mobile commerce cater to the growing use of mobile devices.

- Mobile app development is essential for retailers to offer a seamless shopping experience across all devices. Fashion trends and product reviews influence purchasing decisions, making these features valuable for retailers. Email marketing is an effective tool for building brand loyalty and retaining customers. Consumers have several payment options, including credit cards, cash-on-delivery, internet banking, demand drafts, and cash-on-order. Payment service providers like PayPal offer secure payment methods, ensuring customer data privacy. Despite the popularity of online shopping, concerns around data security and trust remain, particularly in developing countries. Retailers must address these concerns to continue growing in this market.

What are the market trends shaping the Online Apparel Retailing Industry?

- Network marketing and mobile commerce are emerging as significant market trends. The former involves the sale of products or services through a network of distributors, while the latter refers to buying and selling goods or services through mobile devices. Both sectors are experiencing robust growth and are expected to shape the future of business transactions.

- The market is experiencing significant growth due to the increasing use of mobile devices for shopping. Consumers are purchasing new smartphones, and retailers are creating more opportunities for buyers to shop via mobile applications and optimized websites. This trend is expected to continue, with retail sales through mobile devices projected to increase. A key focus for online retailers is providing high-quality product photography, ensuring efficient order fulfillment, and integrating social media platforms. Additionally, ethical sourcing, fair trade practices, and website optimization are essential for customer retention.

- Retailers are also investing in advanced technologies such as 3D modeling and security protocols to enhance the shopping experience and protect customer data. Reducing the carbon footprint is another priority, as consumers become more environmentally conscious. Customer segmentation and personalized marketing strategies are also crucial for success in the competitive the market.

What challenges does the Online Apparel Retailing Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory. This issue undermines consumer trust, distorts market competition, and potentially harms brand reputation. Addressing this concern requires collaborative efforts from industry stakeholders, regulatory bodies, and law enforcement agencies.

- The market has experienced significant growth and transformation in recent years, driven by advancements in technology and shifting consumer preferences. E-commerce platforms have become the go-to destination for shoppers seeking convenience and a wide selection of products. Machine learning algorithms and AI are being employed to enhance the customer experience through personalized recommendations and fraud detection. Subscription services offer a convenient and cost-effective way for consumers to receive regular deliveries of their favorite items. Omnichannel strategies, which integrate online and offline channels, are becoming increasingly popular. Sustainability is also a key trend, with an increasing demand for clothing made from recycled materials.

- Virtual try-on technology and content marketing are other innovative strategies being used to engage customers and drive sales. Payment gateways and shipping logistics have become critical components of the online retail experience. Customer feedback is also being leveraged to improve products and services. Influencer marketing and AI-powered chatbots are effective tools for reaching and engaging with consumers. Despite these advancements, the market faces challenges, including counterfeit products that can damage brand reputations and undermine consumer trust. Ensuring the authenticity of products and maintaining high-quality standards are essential for retailers to succeed in this competitive landscape.

Exclusive Customer Landscape

The online apparel retailing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online apparel retailing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online apparel retailing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in e-commerce, retailing a diverse range of apparel including sports wear, footwear, and women's clothing, online. Our product offerings cater to various consumer preferences, ensuring a comprehensive shopping experience. By utilizing advanced digital marketing strategies and search engine optimization techniques, we expand our reach and attract a global audience. Our commitment to quality and customer satisfaction drives US to continually source innovative and stylish designs from reputable brands. Through our user-friendly website, shoppers can easily browse and purchase items at their convenience. Our dedication to delivering exceptional value and service sets US apart in the competitive online retail market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- ASOS Plc

- Banggood Technology Co. Ltd.

- Cotton On Group

- Dolce and Gabbana Srl

- Gildan Activewear Inc.

- Giordano International Ltd.

- JD.com Inc.

- Kering SA

- Levi Strauss and Co.

- LVMH Moet Hennessy Louis Vuitton SE

- M. H. Alshaya Co. WLL

- OTB Spa

- Ralph Lauren Corp.

- SSENSE

- Staples Inc.

- The Gap Inc.

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Apparel Retailing Market

- In March 2024, Amazon Fashion announced the launch of its new sustainable clothing line, "Lakefront," which aims to reduce carbon emissions and water usage in apparel production (Amazon PR, 2024). This strategic move positions Amazon as a key player in the growing market for eco-friendly fashion.

- In July 2024, Walmart and Microsoft Corporation entered into a strategic partnership to enhance Walmart's e-commerce capabilities, including its apparel retailing business. This collaboration will leverage Microsoft's cloud technology to improve Walmart's online shopping experience and better compete with Amazon (Microsoft News Center, 2024).

- In October 2024, Shein, the Chinese fast-fashion e-tailer, raised USD1 billion in a funding round led by Coatue Management. This significant investment will support Shein's expansion into new markets and the development of its technology and logistics infrastructure (Bloomberg, 2024).

- In February 2025, Zara, the Spanish fashion retailer, launched its new virtual fitting room technology, allowing customers to try on clothes virtually using their smartphones. This innovative solution, which uses augmented reality, is expected to revolutionize the online apparel shopping experience (Industry Europe, 2025).

Research Analyst Overview

- In the dynamic the market, market research and business intelligence (BI) play crucial roles in staying competitive. Disruptive technologies, such as personalized recommendations powered by big data and customer journey mapping, are shaping consumer behavior. Emerging trends, like visual search and customer support automation, enhance product discovery and improve customer experience. Competitive benchmarking, retail analytics, and sales funnel optimization help businesses stay ahead. Price optimization, logistics optimization, and supply chain management ensure efficient distribution networks and dynamic pricing. Fashion industry trends and fashion forecasting are integral to keeping up with emerging styles and consumer preferences.

- Trend analysis, quality assurance, and live chat support further strengthen customer engagement. Dynamic pricing and data visualization facilitate effective decision-making, while distribution networks and supply chain management streamline operations. Overall, the market is driven by technological innovation and a customer-centric approach.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Apparel Retailing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.2% |

|

Market growth 2025-2029 |

USD 343.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.8 |

|

Key countries |

US, China, UK, Germany, Spain, India, France, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Apparel Retailing Market Research and Growth Report?

- CAGR of the Online Apparel Retailing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online apparel retailing market growth of industry companies

We can help! Our analysts can customize this online apparel retailing market research report to meet your requirements.