Online Beauty And Personal Care Products Market Size 2024-2028

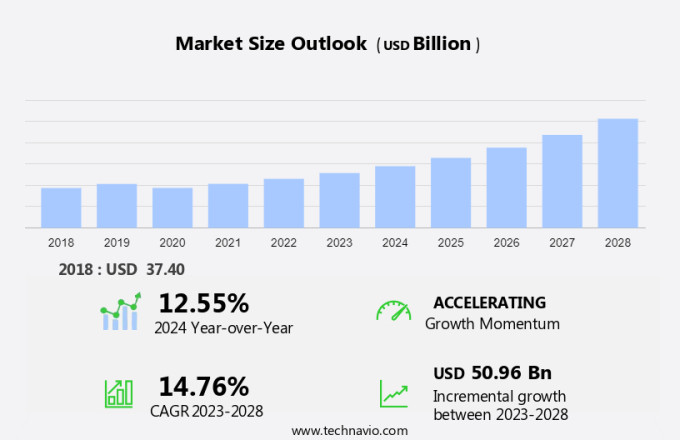

The online beauty and personal care products market size is forecast to increase by USD 50.96 billion at a CAGR of 14.76% between 2023 and 2028. The market is experiencing significant growth due to several key factors. The increasing penetration of the internet and smart devices has made product delivery more convenient, with many consumers opting for third-party delivery services for hassle-free and quick purchases. Consumer lifestyle changes, including a focus on health and hygiene, self-esteem, and physical appearance, have also driven demand for a wide range of products, from moisturizers and soaps to cleansers and toothpaste. However, logistics remains a challenge for e-retailers in this sector, as ensuring timely and accurate delivery of perishable and fragile products, including skincare and hair care products, is crucial to maintaining customer satisfaction. In response, brands are increasing their online presence and offering discounts and promotions to boost customer loyalty. Male grooming is another growing segment, as men increasingly prioritize their personal care routines. Logistics remains a concern for e-retailers, as they strive to provide efficient and reliable delivery services to meet consumer expectations.

What will be the Size of the Market During the Forecast Period?

The market continues to experience significant growth, with digital channels playing a pivotal role in driving sales. According to market research, e-commerce sales in this sector are projected to expand at a steady pace, fueled by various factors. One of the primary factors contributing to the growth of online sales is the increasing preference for convenience. In today's fast-paced world, consumers seek to save time and effort by purchasing their favorite skincare, haircare, makeup, fragrances, personal hygiene, and other personal care products from the comfort of their homes.

Furthermore, another factor driving the growth of online sales is the availability of free delivery options. Many retailers offer free shipping, making it more appealing for consumers to shop online. Additionally, the wide range of premium products available at competitive prices further attracts consumers to make their purchases online. Physical appearance, health, and hygiene are essential aspects of self-care, and consumers are increasingly recognizing the importance of investing in high-quality personal care products. This trend is particularly prevalent among millennials, who are known for their preference for non-toxic and natural products. The beauty and personal care market encompasses a diverse range of product categories, including moisturizers, soaps, cleansers, toothpaste, hair dyes, perfumes, facial tissues, and more.

Moreover, these products cater to both male and female consumers, with specialized offerings for each gender. The market landscape for beauty and personal care products is diverse, with various distribution channels such as specialty stores, pharmacies, and beauty salons. However, e-commerce platforms have emerged as a significant player in this market, offering consumers a wide range of products, competitive pricing, and the convenience of doorstep delivery.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Skincare products

- Haircare products

- Color cosmetics

- Fragrances

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Product Insights

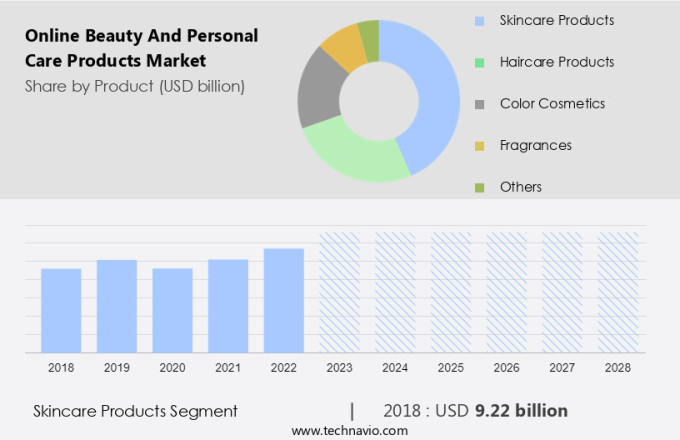

The skincare products segment is estimated to witness significant growth during the forecast period. The market for beauty and personal care products is experiencing significant growth, with an increasing number of consumers turning to e-commerce platforms for product delivery. Third-party delivery services have become increasingly popular, allowing for convenient and efficient product acquisition. In this market, there is a rising demand for organic and herbal products, as well as eco-friendly packaging, reflecting consumer lifestyle changes and a focus on health and hygiene. Male grooming is also a growing segment, with an expanding range of products available, including moisturizers, soaps, cleansers, and toothpaste. The trend towards multifunctional skincare products that cater to both facial and body care needs is gaining traction.

Furthermore, consumers are increasingly seeking products that offer multiple benefits in one application. Social media plays a significant role in shaping beauty trends and influencing consumer preferences. Beauty influencers and online communities share tips, reviews, and recommendations, driving consumer interest and demand for skincare products. Discounts and offers are also effective marketing strategies for increasing brand awareness and customer loyalty. In the realm of personal care, appearance and self-esteem are key factors influencing consumer behavior. Brands that prioritize natural, organic, and eco-friendly ingredients, as well as sustainable packaging, are resonating with consumers. As the trend towards online sales channels continues to grow, it is essential for brands to maintain a strong online presence and engage with their audience through digital marketing and social media.

Get a glance at the market share of various segments Request Free Sample

The skincare products segment accounted for USD 9.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

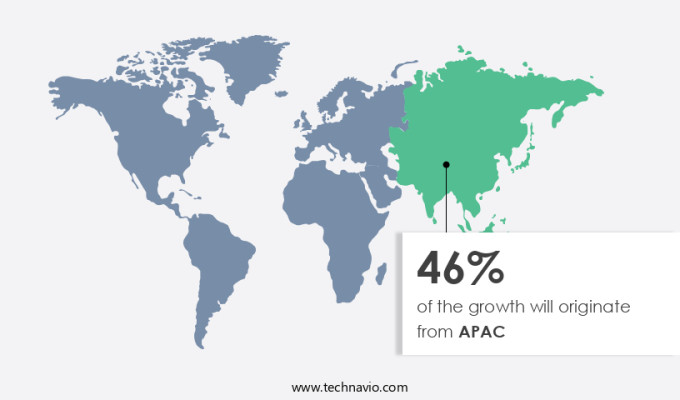

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region dominated the global online market for beauty and personal care products. The region's growth can be attributed to the increasing use of the internet and advanced technologies, enabling easy access to e-retailers for purchasing these items. Discounts, bundle pricing, and seasonal sales are effective marketing strategies that attract customers to buy various beauty and personal care products online. One of the major segments driving the market's revenue growth is online skincare products. The high demand for anti-aging, skin-whitening creams, and sun protection products in APAC is a significant factor contributing to this segment's popularity.

Furthermore, the growing consciousness towards personal hygiene and wellness, coupled with the expanding middle-income population base, is fueling the demand for skin care products in the region. Hair care products, including hair styling and hair coloring, are another popular segment in the market. In addition, hair care products catering to men's grooming needs are gaining traction due to the increasing trend of metrosexuality. Online payments and easy navigation are crucial factors that enhance the customer experience when shopping for personal care products online. Hair care products, such as shampoos, conditioners, and hair styling products, are readily available on various e-retailing platforms.

Similarly, oral care products, including toothpaste, mouthwash, and dental floss, are easily accessible for consumers. Makeup products, including facial cosmetics, eye cosmetics, lip makeup, and nail makeup, are also popular among consumers in APAC. The convenience of shopping for these items online, along with the availability of a wide range of brands and products, makes e-retailers a preferred choice for customers. In conclusion, the market in APAC is thriving due to the increasing adoption of technology, growing awareness towards personal hygiene and wellness, and the availability of various product categories on e-retailing platforms. E-retailers offering easy navigation, secure online payments, and fast delivery services are likely to attract and retain customers in this market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rise in penetration of Internet and smart gadgets is the key driver of the market. The market has experienced significant growth due to the increasing use of the Internet and advanced technology. With the widespread adoption of smartphones and tablets, customers have become more tech-savvy and prefer shopping online for convenience. According to recent statistics, global Internet penetration reached approximately 67% in 2023, indicating a large consumer base for online retailers and manufacturers of beauty and personal care products. Hair coloring products, skin care, color cosmetics, and hair care are popular categories in this market, catering to both male and female consumers. Online platforms offer a wide range of options, including mass products and premium brands, organic and synthetic ingredients, vegan cosmetics, and eco-friendly alternatives.

Online sales channels, such as specialty stores, pharmacies, and beauty salons, have become essential for reaching a broader customer base. As consumers become more health-conscious and demand non-toxic products, the market is witnessing a shift towards organic and natural ingredients. Millennials, in particular, are driving this trend, as they prioritize ethical and sustainable products. With the widespread adoption of smartphones and tablets, customers have become more tech-savvy and prefer shopping online for convenience. Large consumer base for online retailers and manufacturers of beauty and personal care products. Hair coloring products, skin care, color cosmetics, and hair care are popular categories in this market, catering to both male and female consumers. Online platforms offer a wide range of options, including mass products and premium brands, organic and synthetic ingredients, vegan cosmetics, and eco-friendly alternatives. Online sales channels, such as specialty stores, pharmacies, and beauty salons, have become essential for reaching a broader customer base.

Market Trends

Hassle-free and one-day or two-day delivery is the upcoming trend in the market. In today's digital age, the personal care market in developed regions like the US has witnessed significant growth through e-commerce channels. Consumers increasingly prefer the convenience of shopping for skincare, haircare, makeup, fragrances, and personal hygiene products online. E-retailers cater to this demand by offering competitive prices, free delivery, and personalized recommendations.

The use of social proof, such as customer reviews and product feedback, plays a crucial role in influencing purchasing decisions. Natural ingredients and health awareness are also key factors driving the market's growth. Influencer marketing and mobile commerce further expand the reach of these products to a wider audience. As a result, e-commerce platforms have become the go-to destination for customers seeking hassle-free shopping experiences and swift delivery services, even offering same-day options for an additional fee.

Market Challenge

Logistics as a concern for e-retailers is a key challenge affecting market growth. The market faces logistical challenges that increase operational expenses, resulting in narrow profit margins for e-retailers. These complications include the absence of precise delivery addresses and intricate routing systems, leading to delayed product delivery. For international retailers, these issues escalate due to cross-border transactions. To mitigate these challenges, companies hire additional staff for secure and efficient delivery services, which further decreases their profits. Gen Z, the young population, and working women are driving the demand for clean-labeled products in the skincare and haircare markets. Biotechnology and nanotechnology innovations are revolutionizing the industry with DIY beauty treatments and cruelty-free, ethically derived goods.

Organic cosmetics are gaining popularity, and innovative packaging designs are attracting consumers. In the US, the health and beauty sector is growing, with specialty store sales increasing. Consumers are increasingly concerned with the ingredients in their personal care products and are opting for eco-friendly, sustainable options. They should also focus on catering to the evolving consumer preferences for clean-labeled, organic, and ethically derived products. By adhering to these trends, companies can build a loyal customer base and maintain a strong brand image.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Church and Dwight Co. Inc. - The company offers online beauty and personal care products under the brands such as Batiste, Toppik, Orajel, and Flawless.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amorepacific Corp.

- Chanel Ltd.

- Church and Dwight Co. Inc.

- CLARINS France

- Coty Inc.

- Henkel AG and Co. KGaA

- Johnson and Johnson Services Inc.

- Kao Corp.

- Koninklijke Philips N.V.

- LOreal SA

- MacAndrews and Forbes Inc.

- Mary Kay Inc.

- maxingvest AG

- Natura and Co Holding SA

- Oriflame Cosmetics S.A.

- Reckitt Benckiser Group Plc

- Shiseido Co. Ltd.

- The Estee Lauder Companies Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The online personal care market is experiencing significant growth due to the increasing popularity of digital channels and e-commerce platforms. Consumers are now preferring the convenience of shopping for skincare, haircare, makeup, fragrances, personal hygiene products, and more from the comfort of their homes. Free delivery, competitive prices, and personalized recommendations are some of the key factors driving this trend. Natural ingredients and health awareness are also major influences on consumer purchasing decisions. Brands are focusing on offering organic, herbal products with eco-friendly packaging to cater to this demand. Influencer marketing and customer reviews play a crucial role in shaping consumer choices.

Moreover, social proof, mobile commerce, and product delivery through third-party services are also essential elements of the online shopping experience. Urbanization, internet penetration, and changing consumer lifestyles have led to an increase in online sales channels. Discounts and offers, brand awareness, and customer loyalty programs are effective marketing strategies for e-retailers. Premium product variants, exotic brands, and signature collections cater to the diverse needs of consumers. Cross-category shopping, Social media influence, and promotional campaigns further enhance the shopping experience. Millennials and Gen Z are major consumers of personal care products, with a preference for non-toxic, vegan cosmetics, and eco-friendly, clean-labeled products.

Furthermore, biotechnology and nanotechnology have led to innovative product offerings, including DIY beauty treatments and conventional vs. Organic cosmetics. The skincare and haircare markets are particularly strong, with a focus on catering to different skin and hair types. Male grooming products, deodorants, antiperspirants, and male-specific offerings are also gaining popularity. Overall, the online personal care market is expected to continue growing, driven by consumer preferences, technological advancements, and changing lifestyles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.76% |

|

Market growth 2024-2028 |

USD 50.96 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.55 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

US, China, UK, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amorepacific Corp., Chanel Ltd., Church and Dwight Co. Inc., CLARINS France, Coty Inc., Henkel AG and Co. KGaA, Johnson and Johnson Services Inc., Kao Corp., Koninklijke Philips N.V., LOreal SA, MacAndrews and Forbes Inc., Mary Kay Inc., maxingvest AG, Natura and Co Holding SA, Oriflame Cosmetics S.A., Reckitt Benckiser Group Plc, Shiseido Co. Ltd., The Estee Lauder Companies Inc., The Procter and Gamble Co., and Unilever PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch