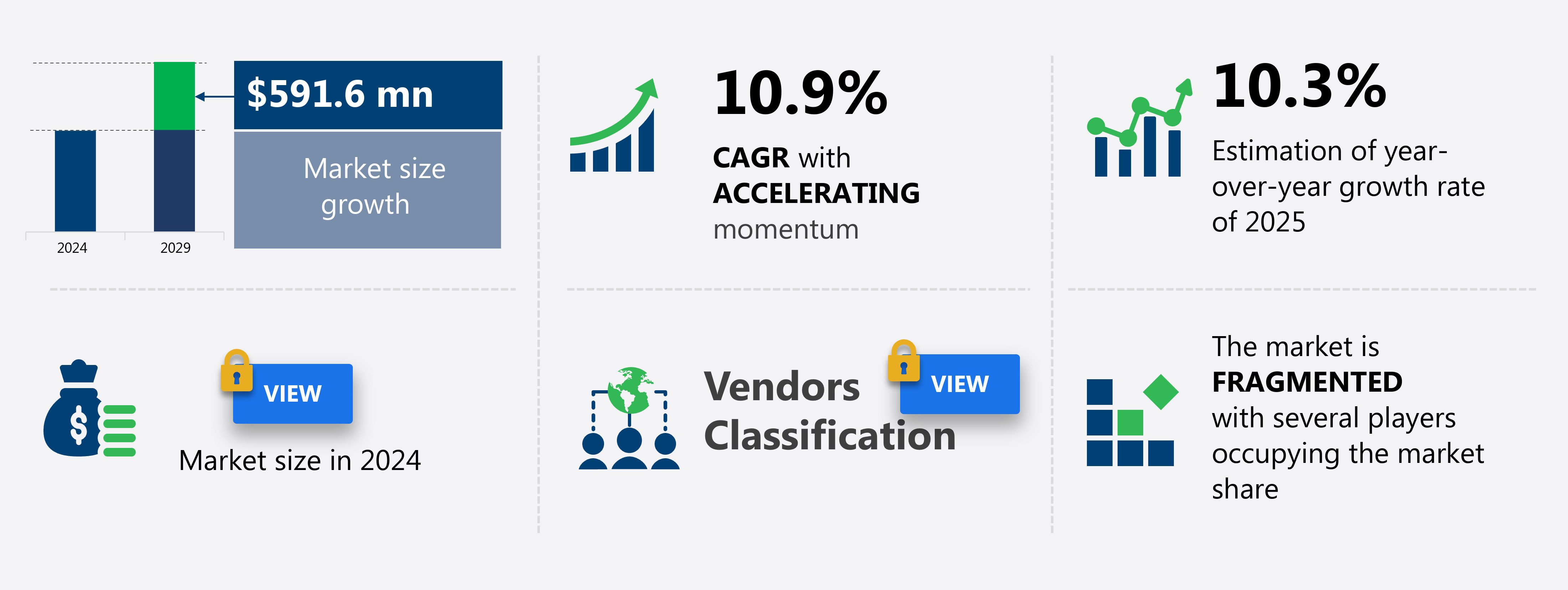

India Online Lingerie Market Size 2025-2029

The India online lingerie market size is forecast to increase by USD 591.6 million, at a CAGR of 10.9% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. The increasing popularity of athleisure wear and sports bras has led to a rise in demand for comfortable and functional intimate apparel. Furthermore, the influx of luxury lingerie brands In the market is catering to the growing preference for high-quality and stylish lingerie. Additionally, the use of innovative materials such as cotton, yarn, silk, led, and wool in lingerie production is attracting consumers. The trend toward direct-to-consumer (DTC) strategies by lingerie manufacturers is also driving growth In the online market. Consumers are increasingly turning to e-commerce platforms for the convenience and accessibility they offer. Shapewear and lingerie with smart features, such as bras with built-in LED lights or watches that sync with bras, are also gaining popularity. Overall, the online lingerie market is poised for continued growth In the coming years.

What will be the Size of the market During the Forecast Period?

- The market represents a significant and growing segment of the global intimate wear industry. With an increasing number of women In the workforce and a desire for both stylish and comfortable undergarments, the market has experienced strong growth. The labor force's spending capacity has fueled the demand for a wide range of products, including bras, knickers, and innerwear lingerie. Creative designs featuring fabric, lace, embroidery, and luxury materials continue to captivate consumers.

- Online sales have increased, driven by the convenience and accessibility of e-commerce platforms. Commercial advertisements and social media have become essential marketing tools, reaching younger targets through social networks. Digitalization and the integration of design technology have transformed the industry, with an emphasis on stretchable fabrics, athleisure, and sports bra collections. Per capita spending on intimate wear remains strong, reflecting the market's ongoing appeal and direction.

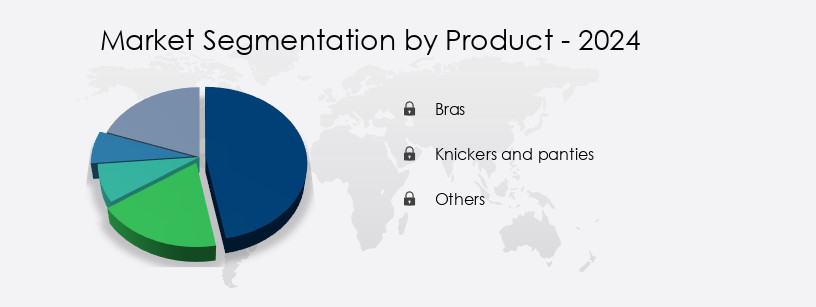

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Bras

- Knickers and panties

- Others

- Type

- Natural

- Synthetic

- Material

- Cotton

- Satin

- Muslin

- Silk

- Others

- Geography

- India

By Product Insights

- The bras segment is estimated to witness significant growth during the forecast period.

The market, specifically bras, has experienced significant growth in India due to the increasing popularity of e-commerce platforms. Brands offer a wide range of bras catering to various sizes and shapes, addressing the needs of women. The emergence of young consumers, influenced by Western fashion trends, drives demand for new and stylish bra products. Comfort and confidence are essential factors for women, making innovative fabrics, lace, embroidery, and luxury materials crucial In the market.

Online sales of lingerie, including knickers, panties, shapewear, and multi-brand stores, are on the rise due to the convenience and accessibility they offer. Consumer preferences for creative designs, hygiene, appearance, and product innovation continue to shape the innerwear lingerie industry. Digitalization, including 3D printing technology, celebrity endorsements, and consumer trust, further contribute to market growth. Millennials and Generation Z, with their increasing spending capacity, are key target demographics for this sector. Sustainable variants, organic cotton, anti-bacterial, and anti-microbial properties are emerging trends In the industry.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our India Online Lingerie Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Online Lingerie Market?

Increased penetration of organized retail driving demand for lingerie is the key driver of the market.

- The market has experienced substantial growth due to shifting consumer preferences and technological innovations. Women, particularly working women, have shown an increased spending capacity on stylish and comfortable undergarments, leading to the expansion of the market. Multi-brand stores and e-commerce platforms have capitalized on this trend, offering a wide selection of innerwear, including bras, knickers, panties, shapewear, and more. Retailers have responded to this demand by incorporating creative designs using fabric, lace, embroidery, and luxury materials. Consumer preferences for hygiene, appearance, and product innovation have driven the use of 3D printing technology and the development of sports bra collections, as well as online bra-fitting services.

- Social media and commercial advertisements have played a significant role in building consumer trust and identity development. The younger target demographic, including millennials and Generation Z, have embraced the digitalization of the lingerie market, with sustainable variants made from organic cotton, anti-bacterial, and anti-microbial materials gaining popularity. Design technology and celebrity endorsements have further fueled the market's growth. Despite challenges, the sector's competitiveness is maintained through strategic interventions and government support, such as the Production Linked Incentive (PLI) for Textiles and the National Textile Policy.

What are the market trends shaping the India Online Lingerie Market?

The influx of luxury lingerie brands is the upcoming trend In the market.

- The market is experiencing significant growth, driven by various socio-cultural factors and technological advancements. The entry of international luxury lingerie brands, such as Victoria's Secret, into the Indian market has expanded the market's potential. In 2019, Parfait, a US-based inclusive lingerie brand, collaborated with leading e-commerce platforms and lingerie websites to cater to Indian women's demand for stylish, comfortable, and affordable undergarments. Consumer preferences for high-quality innerwear and the increasing relevance of Western fashion trends have fueled the market's growth. The arrival of premium brands offering creative designs using fabric, lace, embroidery, and luxury materials has further boosted demand.

- The integration of design technology, such as 3D printing, has led to product innovation in this sector. The younger demographic, including millennials and Generation Z, are increasingly turning to e-commerce for their intimate wear needs. Digitalization and social media have played a crucial role in shaping consumer behavior, with platforms like Instagram and Facebook influencing purchasing decisions. Brands are leveraging consumer trust by offering online bra-fitting services and celebrity endorsements. Body-inclusive and sustainable variants have gained popularity, with organic cotton, anti-bacterial, and anti-microbial materials becoming essential features. The market's future growth is expected to be driven by consumer preferences for stretchable and athleisure-inspired innerwear.

What challenges does India Online Lingerie Market face during the growth?

Increased use of DTC strategy by lingerie manufacturers is a key challenge affecting the market growth.

- The market has witnessed significant growth due to the direct-to-customer (DTC) strategy, which brings companies closer to consumers and enhances shopper loyalty. Eliminating intermediaries allows for better customer engagement and a swifter response to evolving needs. With a strong online presence on their website, mobile app, and major e-commerce platforms, these brands cater to the increasing spending capacity of women, particularly working women. Creative lingerie designs incorporate fabric innovations such as lace, embroidery, and luxury materials.

- Consumer preferences for product innovation, hygiene, appearance, and fashion trends are met through design technology, 3D printing, and sustainable variants. Millennials and Generation Z seek body-inclusive options and organic cotton, anti-bacterial, and anti-microbial materials. Social media and commercial advertisements influence identity development and trust, while online bra-fitting services and celebrity endorsements add to the market's appeal. The DTC model's success is driven by digitalization, catering to the younger target market's preferences for sports bras, athleisure, and stretchable innerwear.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Fast Retailing Co. Ltd. - The company offers lingerie such as women wireless bra active square neck, women wireless bra among others which have ventilation holes placed in areas prone for sweating and is useful for activities such as yoga and walking.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bodycare Creations Ltd.

- Da Intimo

- Genxlead Retail Pvt. Ltd.

- H and M Hennes and Mauritz GBC AB

- Hunkemoller B.V.

- Jockey International Inc.

- Juliet India Pvt. Ltd.

- La Maison Lejaby SASU

- Lovable Lingerie Ltd.

- Lovebird Lingerie

- Lux Industries Ltd.

- Marks and Spencer Group plc

- Modenik Lifestyle Pvt. Ltd.

- Reliance Industries Ltd.

- Rupa and Co. Ltd.

- Triumph Intertrade AG

- V Star Creations Pvt. Ltd.

- Victorias Secret and Co.

- Wacoal Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market catering to women has experienced significant growth in recent years. This trend is driven by various factors, including the increasing labor force of working women and their expanding spending capacity. The demand for creative lingerie that combines both fashion and comfort has led to innovations in fabric, lace, and embroidery, making these items desirable for consumers. Luxury materials such as silk, satin, and lace have long been staples In the innerwear market. However, the industry is now embracing sustainable variants, including organic cotton, and incorporating technology such as 3D printing to create unique designs.

Further, hygiene and appearance continue to be key considerations for consumers, leading to the popularity of shapewear and seamless undergarments. Online sales of bras, knickers, panties, and shapewear have increased due to the convenience and accessibility offered by e-commerce platforms. Multi-brand stores allow consumers to compare prices and product offerings from various brands, while online bra-fitting services ensure a perfect fit. Consumer preferences for fashion trends such as athleisure and sports bras have also contributed to the growth of this market. Digitalization has played a significant role in the online lingerie market, with social media platforms and commercial advertisements driving awareness and sales.

In addition, celebrity endorsements and influencer marketing have also become popular strategies for brands to build consumer trust and identity development. Body-inclusive and sustainable variants are increasingly important to younger target demographics, including millennials and Generation Z. The inner sense of women, their desire for comfort, and the need for functional undergarments have led to the innovation of stretchable and anti-bacterial materials. Design technology has advanced to include moisture-wicking and anti-microbial properties, making lingerie not only stylish but also practical for everyday wear.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.9% |

|

Market Growth 2025-2029 |

USD 591.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch