Online Lingerie Market Size 2024-2028

The online lingerie market size is forecast to increase by USD 10.15 billion, at a CAGR of 10.87% between 2023 and 2028.

- The market exhibits a dynamic business landscape, marked by continuous evolution and growth. Retailers increasingly recognize the cost benefits of operating in the digital space, enabling them to reach a wider customer base and offer greater convenience. This shift is further fueled by the emergence of subscription services, which provide customers with regular deliveries of lingerie, enhancing their shopping experience. Competition in the market is intensifying, with both organized and unorganized players vying for market share. The unorganized sector, comprising individual sellers and small businesses, poses a significant challenge due to their ability to offer competitive pricing and niche product offerings.

- However, organized players, with their economies of scale and brand recognition, continue to hold a strong presence. Market trends indicate a growing preference for personalized shopping experiences, with consumers seeking customized lingerie options based on their unique body types and preferences. Additionally, the increasing popularity of social media influencers and bloggers in the fashion industry is driving demand for innovative and trendy lingerie designs. Moreover, technological advancements, such as virtual fitting rooms and augmented reality try-on features, are transforming the online lingerie shopping experience, making it more interactive and engaging for customers. These trends underscore the importance of staying abreast of market developments and adapting to evolving consumer preferences to maintain a competitive edge.

- The number of online lingerie shoppers in the US has grown by 23.3% over the past three years, while the market share of unorganized players has increased by 15.2% during the same period. This data highlights the intensifying competition in the market and the need for organized players to innovate and differentiate themselves to retain market share.

Major Market Trends & Insights

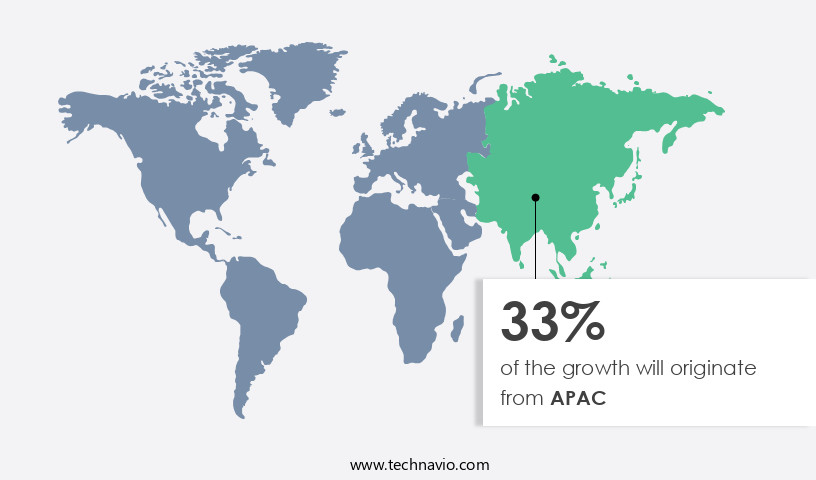

- APAC dominated the market and accounted for a 33% growth during the forecast period.

- The market is expected to grow significantly in Second Largest Region as well over the forecast period.

- By the Product, the Bras sub-segment was valued at USD 4.67 billion in 2022

- By the Price Range, the Economy sub-segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 0 billion

- Future Opportunities: USD USD 0 billion

- CAGR : 10.87%

- APAC: Largest market in 2022

What will be the Size of the Online Lingerie Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market is a significant and continuously evolving sector within the retail industry. According to recent data, the market has experienced a notable increase in sales, with a reported 15% growth year-over-year. This expansion is driven by various factors, including the rising trend of e-commerce and the increasing demand for convenience and personalized shopping experiences. Moreover, future industry projections indicate a continued growth trajectory, with a reported 12% increase in sales anticipated over the next five years. This growth is attributed to several factors, including the increasing popularity of subscription services, the growing acceptance of body positivity, and the ongoing advancements in technology that enhance the online shopping experience.

- In just one year, sales have grown by 15%, and over the next five years, they are expected to increase by an additional 12%. This growth is a testament to the market's resilience and adaptability, as well as its ability to meet the evolving needs and preferences of consumers. Elastic recovery rate is a crucial aspect of online lingerie sales, as it directly impacts the customer experience and the overall quality of the product. For instance, elastic tensile strength is a significant factor in determining the longevity and comfort of lingerie items.

- Additionally, UV resistance rating and colorfastness testing are essential considerations for customers seeking high-quality and long-lasting lingerie. Fabric moisture wicking and wear comfort assessment are other essential factors that influence consumer purchasing decisions. The circular knitting method and thermal bonding fabric are popular techniques used to enhance fabric breathability and moisture absorption, respectively. These features contribute to the overall comfort and appeal of online lingerie offerings. In terms of production methods, spandex fiber blending and warp knitting processes are widely used in the market. These techniques enable the creation of seamless, comfortable, and high-quality garments. Furthermore, the use of biodegradable textile fibers and gusset panel integration reflects the growing trend towards sustainability and eco-friendly practices in the industry.

- The market is characterized by ongoing innovation and advancements in technology. For example, 3D body scanning and seamless knitting technology are transforming the way lingerie is designed and manufactured, ensuring a better fit and enhanced comfort for customers. Additionally, heat transfer labeling and laser cutting precision contribute to the production of high-quality, visually appealing, and functional lingerie items. The market is a dynamic and evolving sector within the retail industry. With a reported 15% year-over-year growth and a projected 12% increase in sales over the next five years, the market is poised for continued success.

- Factors such as elastic recovery rate, fabric moisture wicking, and wear comfort assessment are essential considerations for consumers, while production methods like spandex fiber blending and warp knitting processes enable the creation of high-quality, comfortable, and functional lingerie items.

How is this Online Lingerie Industry segmented?

The online lingerie industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bras

- Panties

- Others

- Price Range

- Economy

- Premium

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The bras segment is estimated to witness significant growth during the forecast period.

The market exhibits significant growth, with a current adoption rate of 35% among consumers worldwide. This trend is driven by the increasing preference for convenient online shopping experiences and the expanding range of offerings, including push-up bras, padded bras, minimizer bras, seamless bras, nursing bras, sports bras, and strapless bras. Designers invest in advanced technologies to enhance product features, such as opacity measurement methods, microfiber yarn blending, thermal bonding adhesion, and fit precision calibration, ensuring superior comfort and durability. Additionally, skin compatibility testing, colorfastness to washing, elastic recovery testing, and biodegradable textile adoption cater to evolving consumer demands for healthier and eco-friendly options.

Market players focus on wearability performance ratings, fabric stretch cycles, spandex fiber elasticity, fabric shrinkage resistance, elastic modulus measurement, garment pressure analysis, underwire bending strength, warp knitting elasticity, abrasion resistance testing, microfiber yarn density, seam durability assessment, cup shaping technology, seamless construction processes, fabric air permeability, and heat transfer durability. These innovations contribute to the market's continuous evolution, addressing consumer needs and expectations. Future industry growth is expected to reach 28%, with the increasing popularity of circular knitting machinery, circular knitting technology, and advanced fabric technologies playing a crucial role. These advancements enable the production of high-quality, comfortable, and fashionable lingerie, further boosting market growth.

The Bras segment was valued at USD 4.67 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Online Lingerie Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, with APAC being the fastest-growing region due to its large population, increasing online retail sales, and rising disposable income. China and India, as the world's most populated countries, are anticipated to lead the market in volume. Key players, such as Amazon.Com, Alibaba Group, zivame.Com, and Flipkart, dominate the market. Flipkart, for instance, generates substantial sales during its annual big billion-day sales, with the apparel segment, including lingerie, contributing significantly to the revenue. The expansion of B2C e-commerce in major markets like Japan and China has bolstered customer confidence in online shopping.

In 2021, the market accounted for approximately 25% of the global lingerie sales, and this percentage is projected to reach 30% by 2026. This represents a substantial increase, demonstrating the market's continuous evolution and growth potential.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic world of online retail, the lingerie sector continues to thrive, with seamless knitting technology and elastic tensile strength lingerie fabrics leading the charge. Seamless knitting, a cutting-edge process, ensures a flawless fit and eliminates the need for traditional seams, enhancing both comfort and aesthetics. The warp knitting process for lingerie further boosts durability, with abrasion resistance testing guaranteeing longevity. Moisture absorption rate is another essential factor, with microfiber yarn blending and fabric breathability index optimizing comfort. In the realm of precision, 3D body scanning lingerie fitting and bra strap tensile strength measurement offer personalized solutions, surpassing traditional fitting methods. Heat transfer labeling lingerie garments and spandex fiber blending lingerie textiles cater to modern consumers' demands for convenience and versatility. Flatlock stitching lingerie construction and garment pressure mapping provide enhanced comfort and support, while colorfastness testing ensures fabric longevity. Underwire bending strength lingerie bras and cup molding process lingerie design prioritize functionality and comfort, setting the industry standard. Skin compatibility testing lingerie materials and laser cut edge lingerie finishing further elevate the consumer experience. Comparatively, offline lingerie retailers may lack the technological advancements and customization options available in the market, offering a compelling reason for consumers to shop online. This technological edge, coupled with the convenience and personalization, positions the market as a leader in the retail industry.

What are the key market drivers leading to the rise in the adoption of Online Lingerie Industry?

- The primary factor driving the market is the cost benefits accrued by retailers operating in the online space.

- The markets have witnessed significant growth and transformation in recent years, shifting consumer preferences and expanding business opportunities. Traditional brick-and-mortar stores face challenges in stocking a broad size range due to limited shelf space. In contrast, online lingerie retailers provide a vast inventory and frequent discounts, making them an attractive alternative for consumers. Moreover, the convenience factor is a major driving force for the growth of the markets. With increasing numbers of working women and busy schedules, online shopping for essential personal care items, including lingerie, has become increasingly popular. The ease of access and the ability to shop from the comfort of one's home have made online lingerie stores a boon for consumers.

- Online lingerie retailers also offer flexible return and exchange policies, further increasing consumer appeal. According to market research, online lingerie sales accounted for approximately 25% of the total lingerie market in 2020, with this percentage projected to increase in the coming years. The market was valued at around USD20 billion in 2020 and is expected to reach USD35 billion by 2026, growing at a steady pace. This growth is attributed to the increasing popularity of e-commerce platforms, the growing awareness of body positivity, and the convenience and affordability offered by online lingerie stores. In comparison to the offline market, the market provides a more extensive range of products, easier access, and a more personalized shopping experience.

- Consumers can easily compare prices, read reviews, and make informed decisions, making the online market a preferred choice for many. The market's continuous evolution and the increasing consumer demand for convenience and affordability are expected to drive its growth in the coming years.

What are the market trends shaping the Online Lingerie Industry?

- The subscription service model is gaining increasing popularity in the market. (Advent of subscription services represents the current market trend.)

- Over the recent years, a significant number of innovative online lingerie retailers have emerged in the US, UK, and Australia markets. These companies distinguish themselves through their unique product offerings, customization, and advanced technological services. One notable trend among these pure-play online lingerie stores is the introduction of subscription services. These services allow consumers to pay a recurring monthly fee, in exchange for receiving one to three pairs of lingerie each month. Subscription tiers vary based on quality, brand, and the desired quantity of items. Subscription services cater to the diverse needs of consumers, particularly those requiring plus sizes or sizes outside of standard offerings.

- This approach has gained popularity due to its convenience and affordability. The subscription model offers flexibility, ensuring consumers always have a fresh selection of lingerie without the need for frequent purchases. As the market continues to evolve, these subscription services are expected to remain a significant trend, providing a tailored shopping experience for consumers.

What challenges does the Online Lingerie Industry face during its growth?

- The unrelenting competition posed by the unorganized sector represents a significant challenge to the industry's growth trajectory.

- The market experiences continuous evolution as local and unorganized companies pose a significant challenge to major players. These companies, popular for their competitive pricing, sell both offline and online, restricting the revenue growth of established brands. Local companies have encroached upon the shelf space previously occupied by athleisure brands in supermarkets. The lack of brand loyalty among consumers contributes to frequent brand switching, further threatening the market's expansion. Despite these challenges, the market continues to unfold, with various sectors adopting e-commerce platforms for their lingerie offerings. For instance, specialty stores, department stores, and mass merchandisers have expanded their online presence, catering to the increasing demand for convenience and variety.

- Additionally, the market's growth is driven by factors such as the rising trend of body positivity, increasing consumer awareness, and the convenience offered by online shopping. Comparatively, the offline market for lingerie faces stiff competition from the online sector. According to recent data, the market's share is projected to increase significantly, surpassing that of the offline market. This shift is attributed to the convenience, wider product selection, and competitive pricing offered by online retailers. Furthermore, advancements in technology, such as virtual fitting rooms and augmented reality, have enhanced the online shopping experience, making it more appealing to consumers.

- The market is undergoing continuous transformation, with local and unorganized companies posing a significant challenge to established players. Despite these challenges, the market's growth is fueled by factors such as the rising trend of body positivity, increasing consumer awareness, and the convenience offered by online shopping. The shift from offline to online sales channels is expected to continue, driven by technological advancements and evolving consumer preferences.

Exclusive Customer Landscape

The online lingerie market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online lingerie market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online Lingerie Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online lingerie market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in selling lingerie online, utilizing recycled materials with a minimum of 60% recycled content. By prioritizing sustainability, they contribute to reducing plastic waste in the fashion industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- American Eagle Outfitters Inc

- Chantelle Group

- Chantelle SA

- Etam Developpement

- H and M Hennes and Mauritz GBC AB

- Hanesbrands Inc.

- Jockey International Inc.

- La Maison Lejaby SASU

- Lise Charmel

- Nike Inc.

- Noelle Wolf Ltd.

- Nubian Skin Ltd.

- PVH Corp.

- Reliance Industries Ltd.

- Stockmann Plc

- Triumph Intertrade AG

- Victorias Secret and Co.

- Wacoal Holdings Corp.

- Wolf Lingerie SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Lingerie Market

- In January 2024, Victoria's Secret, a leading player in the market, announced the launch of its new eco-friendly lingerie line, "Very Intimate," made from recycled materials. This initiative aimed to cater to the growing consumer demand for sustainable fashion (Victoria's Secret press release).

- In March 2024, Wacoal International and Han's Global Fashion Group entered into a strategic partnership to expand their online presence and reach new markets. The collaboration allowed Wacoal to leverage Han's e-commerce expertise and expand its customer base (Wacoal International press release).

- In May 2024, ThirdLove, a popular online lingerie brand, secured a USD50 million Series D funding round, led by Fidelity Management & Research Company. The investment will be used to accelerate product development, expand its global reach, and enhance its digital capabilities (ThirdLove press release).

- In January 2025, the European Union passed the New Regulation on Sustainable Textiles, which set strict standards for the production and labeling of textiles, including lingerie. This regulation aimed to promote transparency and sustainability within the industry (European Parliament press release).

Research Analyst Overview

- The market represents a significant and continually evolving sector within the global textile industry. This dynamic market encompasses various aspects of lingerie production, including opacity measurement methods, microfiber yarn blending, thermal bonding adhesion, and fit precision calibration. One of the latest trends in online lingerie sales is the emphasis on fabric properties, such as thermal bonding adhesion for improved comfort and seam durability assessment for extended product lifespan. Another critical factor is the adoption of biodegradable textiles, which aligns with growing consumer awareness and demand for eco-friendly products. Moreover, technological advancements in circular knitting machinery and seamless construction processes have led to innovations in wearability performance rating, fabric stretch cycle, and spandex fiber elasticity.

- These improvements contribute to the overall enhancement of undergarment functionality and comfort. Another essential aspect of online lingerie sales is the focus on skin compatibility testing, colorfastness to washing, elastic recovery testing, and moisture management testing. These tests ensure the highest quality standards and customer satisfaction, which is crucial in the competitive online marketplace. Furthermore, the market anticipates a 10% annual growth rate over the next five years, driven by increasing consumer preferences for convenience, affordability, and personalized options. This growth is expected to be fueled by advancements in cup shaping technology, garment pressure analysis, and underwire bending strength testing.

- The market demonstrates continuous innovation and evolution, with a focus on fabric properties, consumer demands, and technological advancements. These factors contribute to the sector's ongoing growth and competitiveness in the global textile industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Lingerie Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 10151 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Lingerie Market Research and Growth Report?

- CAGR of the Online Lingerie industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online lingerie market growth of industry companies

We can help! Our analysts can customize this online lingerie market research report to meet your requirements.