Oolong Tea Market Size 2024-2028

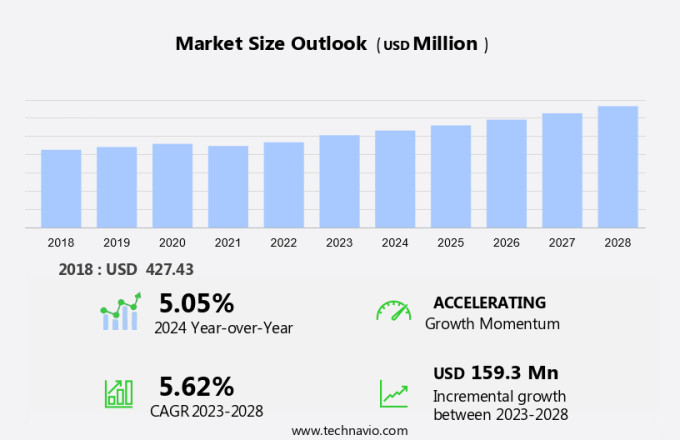

The oolong tea market size is forecast to increase by USD 159.3 million at a CAGR of 5.62% between 2023 and 2028. The global market is witnessing significant growth due to increasing awareness regarding the health benefits associated with consuming Oolong tea. This tea, which undergoes a partial fermentation process, is rich in antioxidants and is known to aid in weight loss and improve heart health. Another trend driving market growth is the rising popularity of artisanal and specialty teas, as consumers seek unique and high-quality tea experiences.

However, the impact of overconsumption of tea, particularly in relation to caffeine intake, may pose a challenge to market growth. Producers and suppliers must ensure they address consumer concerns around health and sustainability to maintain market traction.

Oolong tea, a partially fermented tea originating from China, has gained significant popularity in the global market due to its numerous health benefits. The market for oolong tea is driven by the increasing consumer awareness towards weight control and digestion enhancement. The tea is rich in antioxidants, making it an ideal choice for consumers seeking functional beverages. Premium and specialty teas, including oolong, are witnessing a wave in demand due to their refreshing and invigorating properties. Cultural influence and digital marketing campaigns, along with celebrity endorsements, have contributed to the growth of the market. Price volatility and retail market pricing are crucial factors influencing the market's growth.

Furthermore, organic oolong teas, known for their health benefits, such as immune function and cholesterol level management, are gaining traction among health-conscious consumers. The market for oolong tea includes various forms, such as loose leaf, powder, and tea bags. Wuyi Oolong and Phoenix Oolong are popular varieties, with milk oolong tea gaining popularity due to its unique taste. The market caters to various segments, including restaurants, hotels, and cafes, among others. Herbal teas and functional beverages continue to face competition from oolong tea due to its superior taste and health benefits.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Leaf and powder

- Tea bag

- Liquid

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

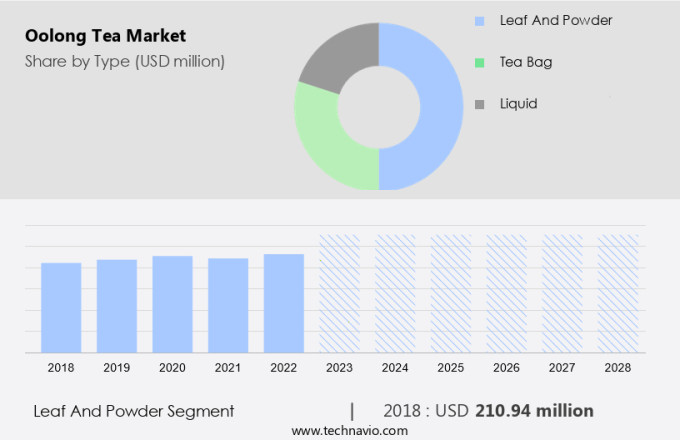

The leaf and powder segment is estimated to witness significant growth during the forecast period. Oolong tea, a premium and specialty type of tea, is recognized for its significant health benefits, including weight control and digestion enhancement. The tea's antioxidant properties make it a refreshing and invigorating beverage, popular among health-conscious consumers. Oolong tea's cultural influence extends beyond traditional tea-drinking countries, with digital marketing campaigns and celebrity endorsements contributing to its growing popularity. Distinguished from other teas by its unique processing methods, oolong tea leaves are hand-picked and undergo partial oxidation. This results in a diverse range of flavors, from light and floral to dark and strong, such as those found in Tie Guan Yin, Da Hong Pao, and Dong Ding.

Moreover, Oolong tea is available in various forms, including loose leaf and tea bags, catering to both traditional tea enthusiasts and modern consumers. Its versatility extends to flavored varieties infused with fruits, flowers, herbs, and spices. Price volatility, retail pricing, and sustainability concerns are crucial factors influencing the market. Environmental and social sustainability are increasingly important, with concerns over deforestation, water usage, food safety, and labeling specifications shaping consumer preferences. Seasonal variability and weather conditions also impact production and availability. Caffeine level and form are essential considerations for consumers, with some preferring the lower caffeine content of oolong tea compared to coffee and other functional beverages. Offline distribution channels, including specialty tea shops, convenience stores, and tea houses, continue to dominate the market, while online sales and e-commerce platforms gain traction.

Get a glance at the market share of various segments Request Free Sample

The leaf and powder segment was valued at USD 210.94 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

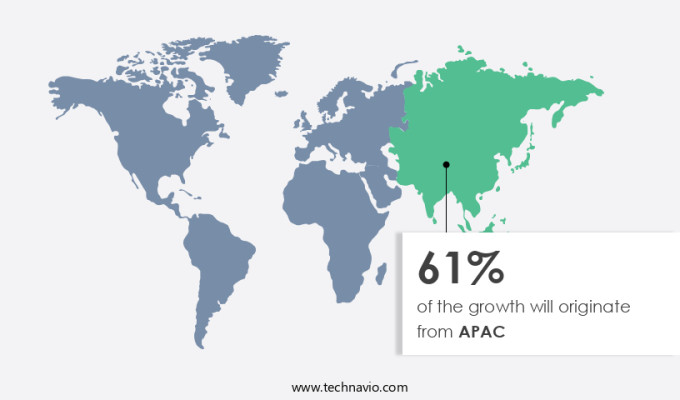

APAC is estimated to contribute 61% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Asia-Pacific (APAC) region, the market for oolong tea is experiencing substantial growth due to the increasing consumer preference for health and wellness. The putative health benefits of oolong tea, including its natural antioxidants and components, are driving its demand. Oolong tea consumption is on the rise, particularly in countries such as China, India, Japan, and South Korea. For instance, China's market has been expanding rapidly as consumers favor traditional organic teas like oolong, white, and green tea in their organic forms. India's Darjeeling and Assam regions are renowned for producing exceptional oolong tea. As the demand for oolong tea in the APAC area increases, the market growth is anticipated to continue during the forecast period.

In addition, e-commerce platforms and online distribution channels are increasingly popular for purchasing oolong tea. Online marketplaces offer a wide range of oolong tea products, including tea bags, powder, and organic herbal tea blends with flavors such as blueberry, chocolate, banana, and digestive power seeds. In addition, oolong tea is widely used in the foodservice industry, with restaurants and hotels incorporating it into their menus for its unique taste and health benefits. Both store-based and non-store-based retailers are capitalizing on this trend, offering oolong tea in various forms to cater to the growing consumer base. Overall, the market for oolong tea in the APAC region is poised for significant growth due to its health advantages and increasing popularity.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Oolong Tea Market Driver

Increasing awareness regarding the health benefits of oolong tea is the key driver of the market. Oolong tea, a premium and specialty beverage derived from the Camellia Sinensis plant, has gained significant popularity worldwide due to its numerous health benefits. This refreshing and invigorating beverage is renowned for its potential role in weight control and digestion enhancement. The unique fermentation process of oolong tea produces a distinct blend of antioxidants, making it a popular choice for consumers seeking functional beverages that promote overall health and wellness. The market has experienced remarkable growth as consumers increasingly prioritize health-conscious choices. Traditional oolong teas, such as Tie Guan Yin, Da Hong Pao, and Dong Ding, continue to be highly sought after, while flavored oolong teas infused with fruits, flowers, herbs, and spices have also gained popularity.

Furthermore, the market for oolong tea is influenced by various factors, including cultural traditions, digital marketing campaigns, and celebrity endorsements. However, price volatility, retail pricing, and sustainability concerns, such as environmental and social sustainability, deforestation, water usage, food safety, and labeling specifications, also play a significant role. Seasonal variability and weather conditions impact the production and availability of oolong tea, while the form of the tea, such as loose leaf or tea bags, and distribution channels, including offline distribution through specialty tea shops, convenience stores, and tea houses, further influence market trends. The caffeine level and form of oolong tea cater to diverse consumer preferences, making it a versatile and dynamic market.

Oolong Tea Market Trends

The rising popularity of artisanal and specialty teas is the upcoming trend in the market. The market has experienced significant growth due to the rising preference for premium and specialty teas. Consumers are increasingly seeking out weight control and digestion enhancement benefits, making oolong tea an attractive choice. Antioxidant-rich oolong tea is gaining popularity as a refreshing and invigorating beverage, setting it apart from coffee and herbal teas. Cultural influence and digital marketing campaigns, as well as celebrity endorsements, have contributed to the market's expansion. Price volatility and retail pricing remain key challenges for producers, but environmental and social sustainability are becoming increasingly important considerations. Issues such as deforestation, water usage, food safety, and labeling specifications are driving demand for sustainable practices.

In addition, seasonal variability and weather conditions also impact production, while the caffeine level and form, including traditional oolong tea varieties like Tie Guan Yin, Da Hong Pao, and Dong Ding, as well as flavored oolong teas with fruits, flowers, herbs, and spices, cater to diverse consumer preferences. The market encompasses loose leaf and tea bags, with offline distribution through specialty tea shops, convenience stores, and tea houses, in addition to online sales. Functional beverages and oolong tea blends continue to gain traction, offering a wealth of opportunities for producers and consumers alike.

Oolong Tea Market Challenge

The impact of overconsumption of tea is a key challenge affecting the market growth. Oolong tea, a premium and specialty beverage, is renowned for its numerous health benefits, including weight control, digestion enhancement, and the presence of antioxidants. This refreshing and invigorating beverage, with its rich cultural influence, has gained popularity in the functional beverage market, competing with coffee and herbal teas. Digital marketing campaigns and celebrity endorsements have contributed to its increasing demand. However, the market is subject to price volatility due to factors such as retail pricing, environmental sustainability, and social sustainability. These considerations include deforestation, water usage, food safety, and labeling specifications. Seasonal variability and weather conditions also impact the production and availability of oolong tea.

In addition, traditional varieties like Tie Guan Yin, Da Hong Pao, and Dong Ding, as well as flavored oolong teas with fruits, flowers, herbs, and spices, are available in various forms, including loose leaf and tea bags. Distribution channels include offline distribution through specialty tea shops, convenience stores, and tea houses. Despite its benefits, it is essential to maintain moderate consumption due to the caffeine level, which can lead to health issues with excessive intake.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arbor Teas: The company offers oolong tea such as organic Ti Kuan Yin, WuYi and organic plum oolong.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- adagio teas

- Chado Tea

- COFCO International

- Dilmah Ceylon Tea Co. Plc

- East West Tea Company LLC

- generation tea

- Harada Tea Processing Co Ltd.

- Harney and Sons Fine Teas

- International Coffee and Tea LLC

- Mighty Leaf Tea Canada

- R. Twining and Co. Ltd.

- Ren Lifestyle Solutions Pvt.Ltd

- Rishi Tea and Botanicals

- Starbucks Corp.

- Tata Consumer Products Ltd.

- Te Co.

- The Republic of Tea Inc.

- Unilever PLC

- ITO EN Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Oolong tea, a partially fermented tea originating from Taiwan and China, holds a significant market position in the global beverage industry due to its numerous health benefits. The demand for oolong tea is driven by its ability to aid in weight control and enhance digestion, making it a popular choice among consumers seeking functional beverages. Premium and specialty oolong teas, including Tie Guan Yin, Da Hong Pao, and Dong Ding, are in high demand due to their unique flavors and cultural influence. Oolong tea is also known for its antioxidant properties, making it a refreshing and invigorating beverage that caters to the growing trend of functional beverages.

Moreover, digital marketing campaigns, celebrity endorsements, and cultural influence have contributed to the growth of the market. However, price volatility, retail pricing, and seasonal variability pose challenges to market growth. Environmental and social sustainability, food safety, and labeling specifications are also crucial factors influencing consumer preferences. Oolong tea is available in various forms, including loose leaf and tea bags, and is distributed through offline channels such as specialty tea shops, convenience stores, and tea houses. Coffee and herbal teas are major competitors, but oolong tea's unique taste and health benefits set it apart. The market also offers flavored oolong teas with fruits, flowers, herbs, and spices to cater to diverse consumer preferences.

Further, weather conditions and caffeine level are essential factors influencing the production and quality of oolong tea. Price volatility and retail pricing are significant challenges, but environmental and social sustainability initiatives, along with labeling specifications, can help mitigate these issues. The market is expected to continue growing due to increasing consumer awareness of the health benefits of oolong tea and the growing trend of functional beverages.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.62% |

|

Market growth 2024-2028 |

USD 159.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.05 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 61% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

adagio teas, Arbor Teas, Chado Tea, COFCO International, Dilmah Ceylon Tea Co. Plc, East West Tea Company LLC, generation tea, Harada Tea Processing Co Ltd., Harney and Sons Fine Teas, International Coffee and Tea LLC, Mighty Leaf Tea Canada, R. Twining and Co. Ltd., Ren Lifestyle Solutions Pvt.Ltd, Rishi Tea and Botanicals, Starbucks Corp., Tata Consumer Products Ltd., Te Co., The Republic of Tea Inc., Unilever PLC, and ITO EN Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch