Organic Tea Market Size 2024-2028

The organic tea market size is forecast to increase by USD 667.5 million at a CAGR of 9.45% between 2023 and 2028. The market is witnessing significant growth due to the increasing health consciousness among consumers. Ready-to-drink specialty teas, such as those made from nutrient-rich ingredients like yellow turmeric, lemon verbena, and ginger, are gaining popularity. Online retailing has made it easier for consumers to access these products from various tea manufacturers, including startups and entrepreneurs. The global population's increasing preference for superfoods, including organic tea, is another growth factor. However, the presence of pesticides in conventional tea can negatively impact health, leading consumers to opt for organic alternatives. It contains epicatechin, epicatechin gallate, and epigallocatechin gallate, which have antioxidant properties.

The market is witnessing a significant increase in demand due to the rising preference for clean-label products and the recognition of tea as a healthy beverage. Specialty teas, including organic tea, are gaining popularity among consumers in the United States, as they offer various health benefits. Tea production involves the cultivation of tea plants and the processing of tea leaves to create various tea types. Conventional products like probiotics contain good bacteria that support gut health, promoting a balanced microbiome and improving digestive function. It is produced using organic farming methods, ensuring the absence of synthetic fertilizers, pesticides, and other harmful chemicals. This production method is essential for consumers seeking organic food products that prioritize food safety and health.

Moreover, it contains phenols and polyphenols, which are antioxidants that contribute to numerous health benefits. These antioxidants are known to support heart health, aid in the prevention of infections, and boost immunity. Additionally, they help combat harmful bacteria and maintain gut function, contributing to overall digestive health. Flavonoid-based beverages, such as organic tea, have become increasingly popular as nutritional products. The antioxidant properties have been linked to weight management and slimming, making it an attractive option for those seeking to maintain a healthy lifestyle. However, it is essential to ensure that it is free from harmful substances like cadmium, which can have detrimental effects on human health.

Furthermore, the market is committed to addressing this concern by implementing rigorous production standards and testing procedures to ensure the highest quality and safety of their products. In conclusion, the market is experiencing steady growth due to the increasing demand for clean-label specialty teas with enhanced health benefits. It offers various health advantages, including heart health, infection prevention, immunity support, and digestive health. The market prioritizes food safety and quality, ensuring that consumers receive free from harmful substances.

Market Segmentation

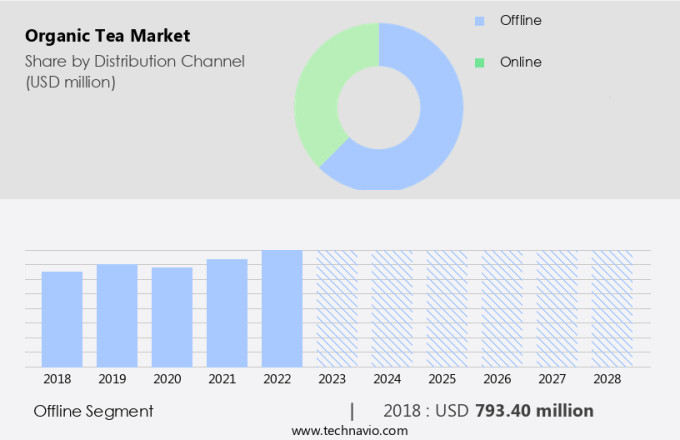

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Leaf and powder

- Tea bag

- Liquid

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, with an increasing number of consumers preferring healthier and more natural beverage options. Matcha tea, Kombucha, and various herbal teas like Lavender, Hibiscus, Sage rooibos, and Lemon tea are gaining popularity. Premiumization is a key trend in the organic tea industry, with consumers willing to pay a premium for high-quality, chemical-free tea. Supermarkets and hypermarkets are the primary offline distribution channels in the US. Supermarkets, which are larger self-service retail stores than traditional grocery stores, are stocking an increasing number of brands and expanding their shelf space for these products.

Furthermore, hypermarkets, on the other hand, offer a wider range of products, including food items, groceries, appliances, and clothing, and are also increasing their offerings. Consumers are increasingly demanding organic tea products free from herbicides, fungicides, and chemical fertilizers. Black organic tea, green organic tea, and oolong organic tea are popular choices among consumers. Organic tea is sold in various packaging formats, including cartons, teabags, and cans. The demand for sustainable and eco-friendly packaging is also driving the growth of the market. The absence of artificial flavors and chemical interactions is a significant selling point for health-conscious consumers.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 793.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

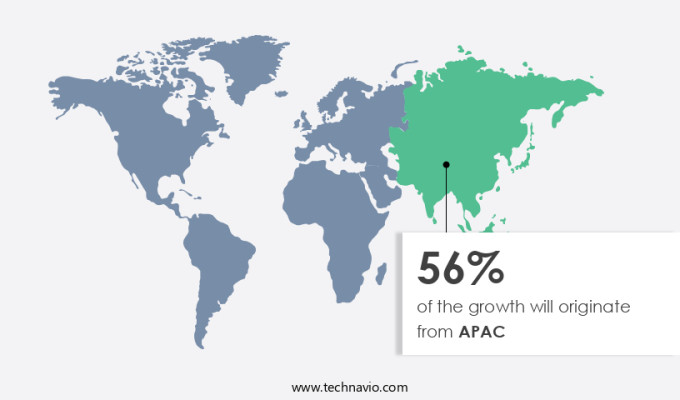

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region is experiencing notable growth due to the rising preference for healthier lifestyle choices. The natural components and antioxidants present in organic tea make it an attractive option for consumers. In countries such as China, India, Japan, and South Korea, the market for organic tea is thriving. For instance, China's market is expanding rapidly as consumers opt for traditional teas like oolong, white, and green tea in their organic forms. India's Darjeeling and Assam regions are renowned for producing high-quality organic tea. In Japan, matcha green tea powder, a popular organic tea variant, is widely consumed.

Furthermore, the demand for organic tea is not limited to traditional tea-drinking nations. Urban professionals, elderly individuals, high-performance athletes, and others in the US and North America are also embracing this health-conscious beverage. Convenience is a significant factor driving the market's growth, with ready-to-drink organic tea beverages and portable tea bags gaining popularity. Innovative tea variants, such as herbal and natural blends, are also contributing to the market's expansion. Safety and quality are crucial factors for organic tea consumers. Proper food-grade tea bags and safe packaging are essential to maintain the tea's freshness and purity. As a result, research and development efforts are focused on improving tea production techniques and creating new, high-performance packaging solutions. Organic tea's growing popularity is a testament to its ability to cater to diverse consumer needs and preferences.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing health benefits of organic tea is the key driver of the market. Organic tea has gained popularity in the US market due to the demand for clean-label products. Specialty teas, such as those infused with hibiscus flower petals and yerba mate, offer health benefits that go beyond conventional tea. These teas contain natural herbs and medicinal plant extracts, which protect against colds, improve digestion, and boost immunity. Hibiscus tea, for instance, is rich in vitamin C and flavonoids, and it helps reduce blood sugar levels, lower blood pressure, aid digestion, and keep the liver healthy. Yerba mate, on the other hand, is rich in antioxidants and nutrients, and it boosts energy and immunity, improves mental focus and physical performance, helps to lose body fat and weight, and lowers the risk of heart diseases.

Furthermore, Tea production follows organic farming practices, ensuring food safety and sustainability. The certification process guarantees that the farming practices meet specific organic standards. The market includes black tea and green tea segments, with tea bags being a significant portion of the market. Supermarkets and hypermarkets are the primary channels for organic tea sales in the US. Consumers are increasingly concerned about the origin and farming practices of their food products, making organic tea a preferred choice. Organic farming practices ensure that the tea is free from synthetic fertilizers and pesticides, making it a healthier option for consumers. Catechins, a type of antioxidant found in tea, contribute to its health benefits. Millennials, in particular, are driving the demand for organic tea due to their focus on health and sustainability.

Market Trends

Rise in demand for organic matcha green tea is the upcoming trend in the market. The market for ready-to-drink organic specialty teas, including Matcha green tea, is experiencing significant growth due to the increasing consumer preference for nutrient-rich and health-conscious beverage options. Matcha green tea, a Japanese-style powdered green tea, is gaining popularity in the US due to its numerous health benefits. This tea contains a balanced combination of theanine and caffeine, which enhances mental alertness and focus. Additionally, it is a rich source of antioxidant catechins, such as epicatechin, epicatechin gallate, and epigallocatechin gallate, providing anti-inflammatory health benefits. Women, in particular, are drawn to organic Matcha green tea for its potential skin health benefits.

Furthermore, online retailing has made it easier for entrepreneurs and startups to reach a global population seeking these health advantages. However, it is essential to ensure that these teas are organic and free from pesticides to maintain their health benefits. Vitamin C and other superfoods, such as yellow turmeric, lemon verbena, and ginger, are often added to organic Matcha green tea to enhance its nutritional value. Brands offer organic Matcha green tea in various flavors, making it an accessible and convenient option for consumers.

Market Challenge

Impact of overconsumption of tea is a key challenge affecting the market growth. Organic tea has gained significant popularity in the US health market due to its numerous health benefits. Associated British Foods, a leading food company, reports that organic tea is rich in phenols and polyphenols, which are essential antioxidants. These antioxidants contribute to heart health, immune system support, and the prevention of bacterial infections. Furthermore, organic tea is beneficial for gut function and can aid in slimming. Tea consumption is a common practice for hydration and fitness enthusiasts. Theanine, an amino acid found in tea, promotes relaxation and mindfulness. However, excessive intake of tea may lead to adverse effects. Nutritionists recommend limiting daily tea consumption to three cups to avoid addiction and potential health risks.

Overconsumption of tea can lead to dehydration due to the diuretic effect of caffeine. Additionally, it may cause bloating due to water retention caused by dehydration. Moreover, excessive tea intake can lead to vital nutrient deficiencies and anxiety. It is essential to maintain a balanced diet and limit tea consumption to ensure optimal health benefits. In conclusion, organic tea is a healthy beverage choice for Americans seeking to improve their well-being. Its antioxidant properties contribute to heart health, immune system support, and the prevention of bacterial infections. However, excessive consumption can lead to dehydration, bloating, and other health risks. Therefore, it is recommended to limit daily tea consumption to three cups to reap the maximum health benefits.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arbor Teas: The company offers organic tea such as organic Japan benifuuki black tea, organic Japan oolong tea, and organic matcha green tea select ceremonial grade.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Big Heart Tea Co.

- Bigelow Tea

- Cup of Te

- Davidsons Organics

- Divinitea

- East West Tea Company LLC

- ECOTONE

- Halssen and Lyon GmbH

- Harney and Sons Fine Teas

- Numi Inc.

- ORGANIC India Pvt. Ltd.

- PepsiCo Inc.

- R. Twining and Co. Ltd.

- Tata Sons Pvt. Ltd.

- The Coca Cola Co.

- The Hain Celestial Group Inc.

- The Republic of Tea Inc.

- Tielka Pty Ltd

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for clean-label products and specialty teas. Tea production is transitioning towards organic farming practices, with a focus on food safety and the production of nutrient-rich organic tea. Consumers, particularly millennials, are prioritizing sustainability and are willing to pay a premium for organic tea. Organic farming practices involve the avoidance of pesticides, herbicides, fungicides, and chemical fertilizers. The certification process ensures that organic tea meets strict standards, providing consumers with peace of mind. Organic tea is rich in catechins, phenols, and polyphenols, which have antioxidant properties and offer numerous health benefits.

Furthermore, black tea and green tea are popular segments in the market. Consumers are turning to organic tea for its potential benefits for heart health, infections, immunity, and gut function. Ready-to-drink specialty teas, herbal teas, and flavonoid-based beverages are gaining popularity due to their convenience and nutritional value. The market is witnessing innovation with the introduction of novel flavors, such as lavender, hibiscus, sage rooibos, and lemon verbena. Consumers are also turning to organic tea for its slimming properties and hydration benefits, making it a popular choice for fitness enthusiasts and those seeking convenience. The market is expected to grow as consumer awareness of the potential harmful effects of pesticides and the importance of organic crops continues to increase. The market is served through various channels, including supermarkets, hypermarkets, convenience stores, and online retailers. Tea manufacturers, startups, and entrepreneurs are investing in research and development to introduce innovative variants and meet the evolving needs of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 667.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

China, India, Germany, UK, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arbor Teas, Big Heart Tea Co., Bigelow Tea, Cup of Te, Davidsons Organics, Divinitea, East West Tea Company LLC, ECOTONE, Halssen and Lyon GmbH, Harney and Sons Fine Teas, Numi Inc., ORGANIC India Pvt. Ltd., PepsiCo Inc., R. Twining and Co. Ltd., Tata Sons Pvt. Ltd., The Coca Cola Co., The Hain Celestial Group Inc., The Republic of Tea Inc., Tielka Pty Ltd , and Unilever PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch