Orthodontic Supplies Market Size 2024-2028

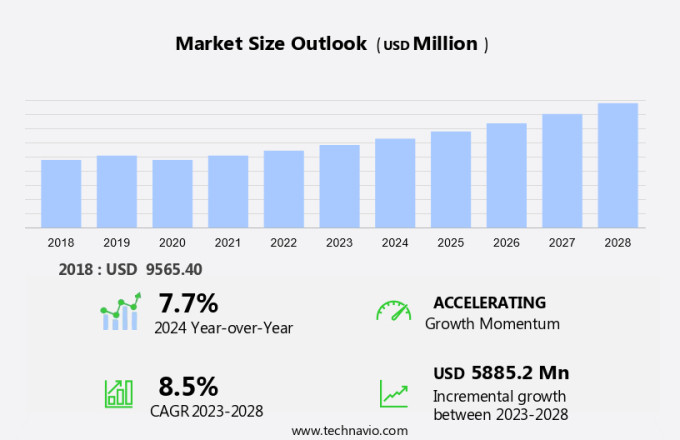

The orthodontic supplies market size is forecast to increase by USD 5.89 billion at a CAGR of 8.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of oral disorders necessitating orthodontic treatment. The high demand for orthodontic products, including fixed braces, removable braces, and invisible braces, is driven by the aesthetic benefits they offer, enhancing orofacial appearance and improving self-image. Technological advances in orthodontic treatment, such as digital impressions and 3D printing, are revolutionizing the industry, making treatments more efficient and precise. However, the risks associated with orthodontic treatment, such as tooth decay, gum damage, and root resorption, remain concerns for patients and practitioners alike. Despite these challenges, the market is expected to continue its growth trajectory, fueled by the increasing awareness of the importance of oral health and the availability of innovative solutions.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing prevalence of malocclusions and jaw diseases, tooth decay, tooth loss, and jaw pain. Malocclusions, a common dental condition, affect the alignment of teeth and jaws, leading to various dental irregularities such as crossbite, open bite, overbite, and spacing issues. Jaw diseases, including temporomandibular joint disorders (TMD), can cause pain, discomfort, and limited jaw mobility. Tooth decay and tooth loss, often caused by poor oral hygiene, can lead to various orthodontic treatments to restore dental aesthetics and functionality. Advanced orthodontic treatments, including orthodontic braces, are essential for correcting dental irregularities.

- In addition, fixed braces, a traditional orthodontic solution, use brackets and wires to apply pressure to teeth for gradual movement. Removable braces, on the other hand, can be taken out for eating, brushing, and flossing, making them more convenient for some patients. Orthodontic products, such as temporary anchorage devices (TADs) or TADs (Temporary Anchorage Devices), play a crucial role in advanced orthodontic treatments. TADs are small implants used to anchor orthodontic appliances, allowing for more precise tooth movement and shorter treatment times. CBCT (Cone-Beam Computed Tomography) is a diagnostic tool used in orthodontics to create detailed 3D images of the teeth, jaws, and surrounding structures.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fixed braces

- Removable braces

- Adhesives

- Accessories

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

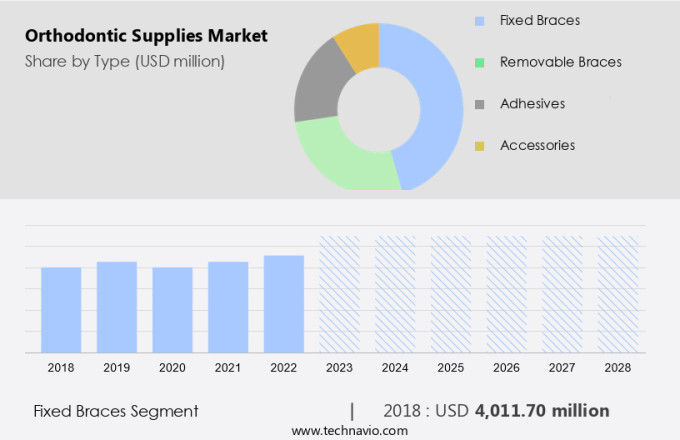

- The fixed braces segment is estimated to witness significant growth during the forecast period.

Orthodontic supplies play a crucial role in the orthodontic industry, encompassing a range of products such as temporary anchorage devices (TADs), adhesives, and accessories. TADs, like the Ultima Hook from Eon Dental or the Eon Aligner system, are essential components of orthodontic treatment, particularly in cases requiring precise tooth movement and reduced treatment time. Adhesives, such as those used to attach brackets to teeth, ensure the stability and effectiveness of orthodontic appliances.

Get a glance at the market report of share of various segments Request Free Sample

The fixed braces segment was valued at USD 4.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

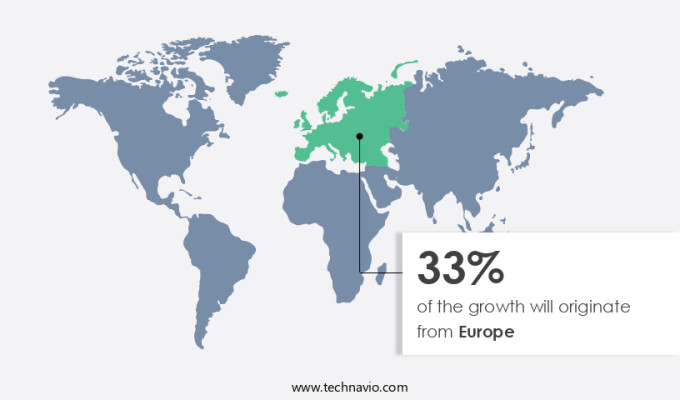

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth due to the increasing number of patients seeking orthodontic treatments. With regular dental check-ups, early diagnosis of orthodontic issues is becoming more common. Consequently, the number of patient referrals to orthodontists for corrective procedures is on the rise. Advanced orthodontic solutions, such as clear aligner systems like Invisalign, digital orthodontics, and customized orthodontic treatments, are gaining popularity among patients. These solutions offer aesthetic benefits and increased comfort compared to traditional braces. Furthermore, the adoption of 3D printing technology in orthodontics is revolutionizing the industry, enabling the production of customized orthodontic appliances.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Orthodontic Supplies Market ?

High prevalence of oral disorders requiring orthodontic treatment is the key driver of the market.

- Orthodontic supplies play a pivotal role in the dental industry, catering to the increasing demand for corrective treatments and enhancing overall oral health. These supplies include essential tools and equipment used by orthodontists to rectify various dental issues, such as overbites, underbites, crossbites, teeth spacing, overcrowding, and temporomandibular disorders (TMD). According to recent studies, more than 40% of adults are projected to experience oral pain by 2022, and over 80% have had at least one cavity by the age of 34. The annual dental care expenditure in the nation surpasses USD124 billion, with dental emergencies leading to the loss of over 34 million school hours and approximately USD 45 billion in productivity.

- In addition, intraoral scanners, a significant segment of orthodontic supplies, have gained immense popularity due to their precision and efficiency. These reports highlight the influence of technological advancements, increasing awareness, and changing consumer preferences on market trends. Orthodontic treatments not only improve dental aesthetics but also contribute to improved oral health and overall well-being. The growing demand for these treatments underscores the importance of a strong market. By providing orthodontists with advanced tools and equipment, this market enables them to deliver effective solutions to their patients.

What are the market trends shaping the Orthodontic Supplies Market?

Technological advances in orthodontic treatment is the upcoming trend in the market.

- Orthodontic treatment has witnessed notable progress, fueled by technological innovations that enhance treatment outcomes, discreetness, and patient comfort. Orthodontic supplies, including braces, have evolved to become sleeker, smaller, and gentler on gums. Clear braces, a popular choice among adults, blend seamlessly with natural tooth color, improving orofacial appearance and self-image. These aesthetic benefits have expanded the orthodontic market, making treatment more appealing to a broader demographic. Advancements in technology have led to the development of clear aligners, such as Invisalign from Align Technology and ClearCorrect (Institut Straumann AG).

- In addition, these transparent plastic dental brackets offer a more discreet alternative to traditional braces. Archwires, a crucial component of orthodontic appliances, have been refined to provide greater comfort and reduced force exertion. These improvements contribute to a more enjoyable and effective treatment experience for patients. In conclusion, the market has seen significant growth due to the introduction of clear braces, aligners, and comfortable archwires. These advancements have made orthodontic treatment more appealing, discreet, and patient-friendly.

What challenges does Orthodontic Supplies Market face during the growth?

Risks associated with orthodontic treatment is a key challenge affecting the market growth.

- Orthodontic treatment is a valuable solution for correcting various dental issues, including malocclusions, jaw diseases, tooth decay, and tooth loss. However, like any medical intervention, it comes with potential risks and complications. Toothache and discomfort are common side effects experienced by patients undergoing orthodontic treatment. Scratches and ulcers on the inner cheeks and lips may occur due to the braces' constant contact with the oral mucosa. Gum infections can develop if proper oral hygiene is not maintained. Enamel demineralization is another risk associated with orthodontic treatments, particularly those involving fixed appliances such as braces.

- In addition, consuming sugar and other food items high in sugar content can initiate the decay process in the enamel, leading to tooth decay and cavities if left untreated. Orthodontic-induced root resorption (OIRR) is a potential complication where the dentine and cementum of the tooth roots can resorb during treatment. This condition can affect the tooth's vitality and overall health. Speech problems may also arise due to the presence of orthodontic appliances, such as braces or aligners. While these risks and complications may seem daunting, proper oral hygiene, regular dental check-ups, and a balanced diet can help mitigate their impact.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A Z Orthodontics Ltd

- Align Technology Inc.

- American Orthodontics

- DB Orthodontics Ltd

- DentaKit.com LLC

- DENTAURUM GmbH and Co. KG

- Dentsply Sirona Inc.

- DynaFlex

- Envista Holdings Corp.

- G and H Orthodontics

- Great Lakes Dental Technologies Ltd.

- Henry Schein Inc.

- Institut Straumann AG

- Metroorthodontics

- Modern Orthodontics

- Morelli Ortodontia

- Planmeca Oy

- Rocky Mountain Orthodontics

- TP Orthodontics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing prevalence of malocclusions and jaw diseases, tooth decay, tooth loss, and jaw pain. Orthodontic treatments are essential for correcting dental irregularities, improving dental health, and enhancing orofacial appearance and self-image. Advanced orthodontic treatments, such as orthodontic braces, CBCT diagnosis, and Invisalign clear aligners, are increasingly popular for correcting various dental issues, including crossbite, open bite, overbite, and spacing. Orthodontic products encompass a wide range of supplies, including adhesives, accessories, temporary anchorage devices (TADs), and aesthetic dental treatments.

In addition, orthodontic solutions cater to both adult and pediatric patients, with offerings such as fixed braces, removable braces, and invisible braces. The aesthetic benefits of these treatments contribute to their popularity, particularly among adults seeking to improve their smiles. Dental clinics and hospitals are the primary consumers of orthodontic supplies, with telehealth initiatives and dental research driving market growth. Oral health, dental alignment, and oral diseases are significant factors influencing the demand for orthodontic treatments and supplies. Innovations in digital orthodontics, customized orthodontic solutions, and 3D printing technology continue to shape the market landscape, offering advanced and efficient solutions for dental healthcare professionals. Dental tourism is also driving demand for orthodontic treatments and supplies, as patients seek affordable and high-quality care.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2024-2028 |

USD 5.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.7 |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch