Outdoor Sports Apparel Market Size 2025-2029

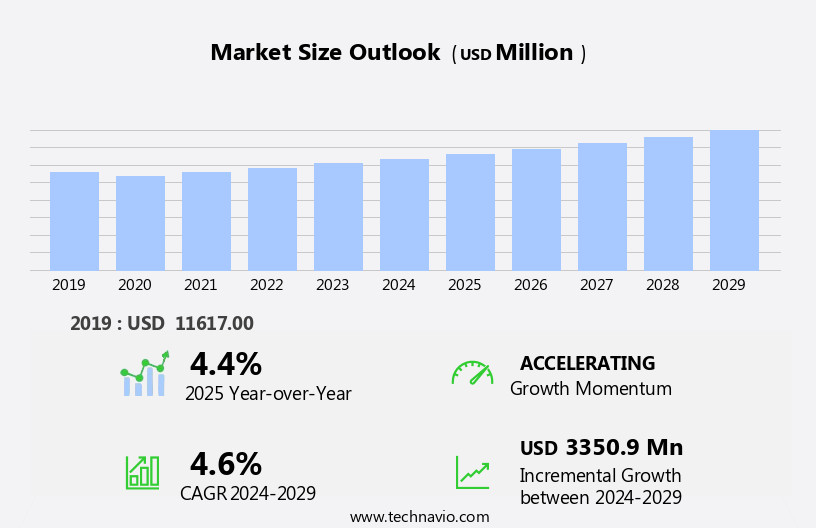

The outdoor sports apparel market size is forecast to increase by USD 3.35 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of outdoor sports and activities among consumers worldwide. This trend is particularly prominent in the US market, where the number of active participants in outdoor activities has been on the rise. A key factor fueling this growth is the increasing number of private-label brands entering the market, offering affordable alternatives to established players. However, this market is not without challenges. The high cost of raw materials, such as advanced fabrics and insulation, poses a significant barrier to entry and puts pressure on profit margins. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, cost optimization, and strategic partnerships.

- By leveraging advanced technologies, such as wearable tech and sustainable materials, they can differentiate themselves and cater to the evolving needs of consumers. Additionally, collaborations with outdoor retailers and sports organizations can help expand reach and build brand awareness. Overall, the market presents significant growth opportunities for companies that can effectively address the needs of cost-conscious consumers while delivering high-quality, innovative products.

What will be the Size of the Outdoor Sports Apparel Market during the forecast period?

- The market in the US is experiencing significant growth, driven by the increasing popularity of active lifestyles and personal well-being. Eco-conscious consumers are seeking sustainable and responsible tourism options, leading to a demand for sun protection, waterproof coatings, and removable sleeves. Camping equipment, multi-day trips, and conservation efforts are also gaining traction, as are urban exploration and adventure travel. Products such as bike shorts, climbing shoes, rash guards, and ski jackets are in high demand, with features like zippered vents, synthetic insulation, and wicking technology being key differentiators. Hydration systems, hiking boots, and kayaking gear are essential for outdoor recreation, while navigation tools and compression garments cater to the needs of competitive sports and fitness activities.

- Reflective accents, insect repellent, and extreme sports gear are also popular, reflecting the trend towards adventure and exploration. The market is further fueled by the rise of digital natives, who are using online resources to plan hiking trails, rock climbing routes, and skiing adventures. Overall, the market is a dynamic and evolving space, driven by consumer preferences and technological innovations.

How is this Outdoor Sports Apparel Industry segmented?

The outdoor sports apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Men

- Women

- Kids

- Distribution Channel

- Offline

- Online

- Activities

- Hiking

- Running

- Cycling

- Camping

- Product Type

- Jackets

- Footwear

- Pants

- Accessories

- Material Type

- Synthetic

- Wool

- Down

- Waterproof Fabrics

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

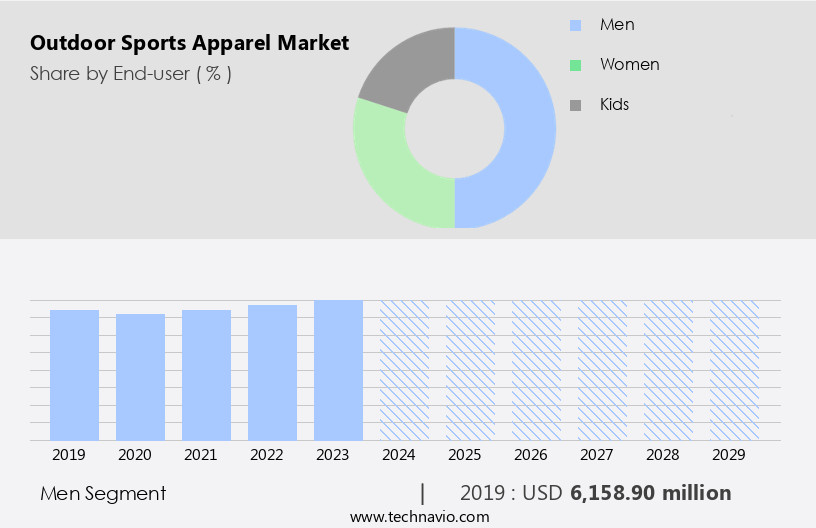

The men segment is estimated to witness significant growth during the forecast period.

The men's segment of the market is projected to experience significant growth during the forecast period, with a higher Compound Annual Growth Rate (CAGR) compared to the women's and kids' segments. In 2023, men represented approximately 57% of tennis players in the US, a slight increase from the previous year's global figure of 55%. In the past, traditional items such as cardigans, shirts, and long flannel pants were popular among male players. However, the evolving fashion trends among men and the increasing appeal of the aesthetics of sports apparel have led companies to introduce a diverse range of outdoor sports apparel for men, offering a vast selection of colors, fabrics, and styles.

Performance tracking and data analytics are integral components of the customer experience in the market. Brands are leveraging digital marketing and content marketing strategies to engage consumers and promote their products. Social media marketing plays a crucial role in brand storytelling and influencer marketing, helping to build brand loyalty among outdoor enthusiasts. Sustainability initiatives, such as the use of recycled fabrics and eco-friendly materials, are gaining traction in the market. High-performance apparel, including moisture-wicking, windproof, thermal, and insulated garments, is in high demand. Functional clothing, such as base layers, mid layers, and outer layers, is essential for various outdoor activities, including hiking, trail running, skiing, and snowboarding.

The outdoor lifestyle market encompasses a wide range of apparel categories, including camping apparel, cycling apparel, climbing apparel, and water sports apparel. Wearable technology, such as smart apparel and UV protection apparel, is increasingly integrated into outdoor sports apparel to enhance functionality and convenience. Ethical sourcing and social responsibility are essential considerations for brands in the market. Brands are focusing on sustainable practices, circular economy principles, and transparent supply chains to meet the growing demand for eco-friendly and socially responsible products. The market is characterized by continuous product innovation and technology integration, with a focus on creating functional, durable, and weatherproof garments that cater to the needs of adventure athletes and outdoor enthusiasts.

The Men segment was valued at USD 6.16 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

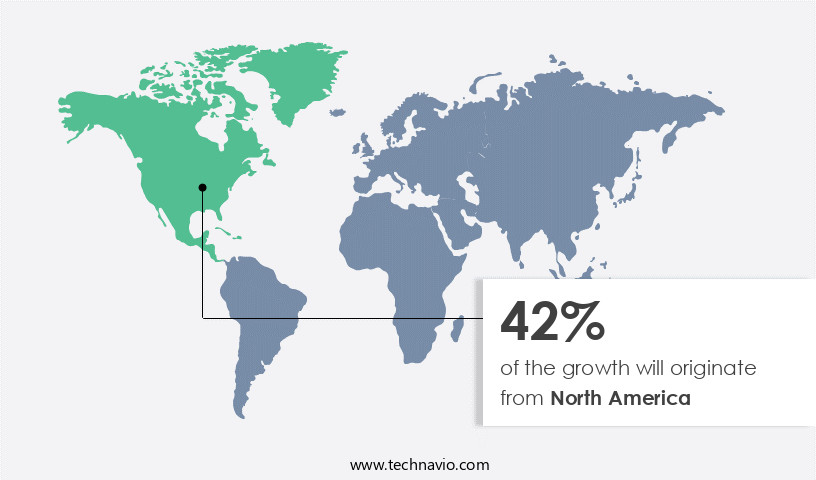

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the thriving outdoor sports industry and increasing health consciousness among consumers. The prevalence of chronic diseases such as diabetes has driven many individuals to engage in outdoor activities like climbing and hiking as part of their fitness regimens. In 2023, the Centers for Disease Control and Prevention (CDC) reported that approximately 38 million Americans had diabetes, with an estimated 1 in 5 cases remaining undiagnosed. To cater to this growing market, companies are focusing on various trends, including performance tracking, supply chain transparency, and sustainable apparel.

Performance tracking allows athletes to monitor their progress and optimize their training, while supply chain transparency ensures ethical sourcing and social responsibility. Sustainable apparel, made from recycled fabrics and natural materials, is gaining popularity due to eco-friendly initiatives and consumer demand for eco-friendly products. Moreover, technology integration is a significant factor in the market, with wearable technology, moisture-wicking apparel, and insulated apparel enhancing the customer experience. Brands are also investing in influencer marketing, content marketing, and data analytics to build brand loyalty and reach a wider audience. Product innovation, such as windproof and thermal apparel, and functional clothing for specific activities like trail running and skiing, is also driving growth in the market.

The market for outdoor sports apparel is diverse, encompassing various categories like casual wear, outer layer, base layer, mid layer, and protective apparel. These categories cater to different needs and preferences, from breathable apparel for adventure tourism athletes to durable apparel for extreme conditions. As the market continues to evolve, companies must stay attuned to consumer preferences and trends to remain competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Outdoor Sports Apparel Industry?

- The popularity of outdoor sports serves as the primary market driver, as a significant number of individuals engage in activities such as hiking, camping, cycling, and water sports, leading to substantial demand for related products and services.

- Outdoor recreational activities, such as climbing, hiking, and trekking, have witnessed significant growth in participation worldwide. The US, in particular, saw a record 177 million participants in 2023, equating to 56% of the population aged six and above. This represented a 4% increase from the previous year, underlining the rising trend of outdoor activities. Demographics contributing to this growth included both genders and various age groups, with hiking, biking, camping, and fishing being popular choices. Notably, more than half of American women participated in outdoor recreation for the first time, and there was a significant increase in participation among the LGBTQ+ community.

- These trends underscore the expanding appeal of outdoor activities, reflecting a shift towards healthier lifestyles and a growing appreciation for nature.

What are the market trends shaping the Outdoor Sports Apparel Industry?

- The increasing prevalence of private-label brands represents a significant market trend in today's business landscape.

- The market faces increasing competition from the rise of private-label brands. These brands, which are often affiliated with retailers, are offering products at lower prices than major brands. The quality of private-label offerings has also improved, making them a viable alternative for consumers. Developed markets, including the US, Germany, Japan, and the UK, have a high penetration of private labels, limiting the growth of major brands. However, the entry of private labels fosters affordability in the market, enabling consumers to purchase outdoor sports apparel at competitive prices.

- As private labels continue to innovate and enhance their product offerings and marketing strategies, they are expected to capture a larger market share, driving diversity and innovation within the outdoor sports apparel sector.

What challenges does the Outdoor Sports Apparel Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- The market experiences fluctuations due to the cost of raw materials, including synthetic fibers, natural fibers, and blended fabrics. The manufacturing process involves procuring and utilizing various fabrics based on the apparel type. Aramid fibers, known for their lightweight and high tensile strength, are commonly used in the production of outdoor sports apparel. These fibers are essential for creating heat-resistant and durable clothing for activities such as hunting, trekking, wildlife exploration, mountaineering, and climbing. The manufacturing process includes fabric procurement, processing, designing, and sewing.

- Aramid fibers' use in outdoor sports apparel ensures enhanced performance and protection for consumers. Despite the challenges, the market continues to grow, offering opportunities for companies to innovate and cater to the increasing demand for functional and stylish outdoor apparel.

Exclusive Customer Landscape

The outdoor sports apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the outdoor sports apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, outdoor sports apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The North Face - This company specializes in innovative outdoor sports apparel. Our product range includes the Terrex Swift R2 GTX Hiking Shoes, engineered for optimal performance on rough terrain, and the Terrex Trail Running Wind Jacket, delivering lightweight shielding against wind and precipitation. These items cater to the needs of adventurous individuals seeking reliable gear for their outdoor pursuits.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- The North Face

- Columbia Sportswear Company

- Patagonia Inc.

- Arc'teryx Equipment Inc.

- Mammut Sports Group

- Salomon

- Montura

- Asics Corporation

- Mizuno Corporation

- Yonex Co. Ltd.

- Li Ning Company Ltd.

- Anta Sports Products Ltd.

- Peak Sport Products Co. Ltd.

- 361 Degrees International Ltd.

- Kathmandu Holdings Ltd.

- Macpac

- Paddy Pallin

- Haglöfs

- Berghaus Limited

- Peak Performance

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Outdoor Sports Apparel Market

- In February 2025, Patagonia, a leading player in the market, announced the launch of its new Worn Wear Re-Rocker Flannel Shirt. This product is made from 100% recycled materials and is part of the company's commitment to reducing its environmental footprint (Patagonia Press Release, 2025).

- In October 2024, The North Face and Google collaborated to develop a new line of smart jackets, integrating Google's Advanced Sensing System technology. This innovation allows real-time weather updates and location tracking, enhancing the outdoor experience for consumers (The North Face Press Release, 2024). In March 2024, Columbia Sportswear Company acquired Mountain Hardwear, a leading outdoor apparel and equipment brand.

- This acquisition strengthened Columbia's position in the high-performance outdoor apparel market and expanded its product offerings (Columbia Sportswear Company Press Release, 2024).

- In January 2024, Decathlon, the largest sporting goods retailer in the world, announced its expansion into the US market. With over 1,500 stores in more than 50 countries, Decathlon aims to bring its affordable and innovative outdoor sports apparel to a wider audience (Decathlon Press Release, 2024). These developments underscore the dynamic nature of the market, with companies focusing on sustainability, technology, and expansion to cater to the growing demand for high-quality, functional, and eco-friendly outdoor apparel.

Research Analyst Overview

The market continues to experience significant growth, driven by the increasing popularity of outdoor activities among consumers. Performance tracking and data analytics have become essential tools for athletes and enthusiasts to monitor their progress and optimize their training. This trend has led to an increased demand for technical synthetic leather fabrics and innovative apparel solutions. Social media marketing plays a crucial role in promoting outdoor gear and apparel. Brands are leveraging digital platforms to engage with their audience, build brand loyalty, and showcase their products in real-life scenarios. The use of influencer marketing and content marketing strategies has become a common practice to reach a wider audience and create authentic brand stories.

The supply chain transparency movement is gaining momentum in the outdoor apparel industry. Consumers are increasingly demanding eco-friendly and sustainable production methods, ethical sourcing, and social responsibility. Brands are responding by integrating recycled sustainable fabrics, sustainable sourcing practices, and circular economy initiatives into their operations. Outdoor enthusiasts seek functional clothing that caters to their specific needs. Performance apparel, such as cycling, running, and trail running apparel, is designed to enhance the wearer's experience and improve their performance. Protective apparel, including UV protection and windproof garments, is essential for outdoor activities in various weather conditions. Brand loyalty is a significant factor in the market.

Adventure athletes and extreme sports enthusiasts often develop strong attachments to their preferred brands, which can lead to repeat purchases and positive word-of-mouth marketing. Wearable technology is becoming increasingly integrated into outdoor apparel. Smart apparel, such as moisture-wicking and breathable garments, is designed to optimize the wearer's comfort and performance. Water sports apparel and insulated apparel are other categories that benefit from technology integration. The outdoor lifestyle market is expanding beyond traditional outdoor activities to include casual wear and lifestyle apparel. Brands are catering to this trend by offering versatile and functional clothing that can be worn both on and off the trail.

The market for outdoor sports apparel is dynamic and evolving, with a focus on innovation, sustainability, and customer experience. Retail stores and online platforms are adapting to meet the demands of consumers, offering a wide range of products and seamless shopping experiences. In conclusion, the market is a growing and diverse industry, driven by the increasing popularity of outdoor activities and the evolving needs of consumers. Brands that can offer functional, sustainable, and innovative solutions while prioritizing customer experience and social responsibility are well-positioned for success.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Outdoor Sports Apparel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 3350.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Outdoor Sports Apparel Market Research and Growth Report?

- CAGR of the Outdoor Sports Apparel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the outdoor sports apparel market growth of industry companies

We can help! Our analysts can customize this outdoor sports apparel market research report to meet your requirements.