Oyster Sauces Market Size 2024-2028

The oyster sauces market size is forecast to increase by USD 2.15 billion at a CAGR of 4.36% between 2023 and 2028.

- The oyster sauces market is witnessing significant growth due to several key trends. One of the major factors driving market growth is the increasing number of product launches and innovations in packaging. Manufacturers are focusing on introducing new and innovative products to cater to evolving consumer preferences. Oyster sauce is used in a wide range of dishes, including soups, marinades, and snack foods, and is available in various forms, such as canned and bottled.

- Additionally, fluctuating prices of raw materials are posing a challenge to market growth. Producers are adopting various strategies to mitigate the impact of raw material price fluctuations on their operations. Overall, the oyster sauce market is expected to experience steady growth In the coming years, with innovations in product offerings and packaging playing a crucial role in market expansion.

What will be the Size of the Oyster Sauces Market During the Forecast Period?

- The oyster sauces market encompasses the production and distribution of this savory condiment, widely used in Asian cuisine for adding depth and umami flavor to dishes. This market exhibits significant growth, driven by the increasing popularity of Asian dishes in the global food industry. Oyster sauce is a staple in various food service establishments, including restaurants, cafes, and quick-service outlets, where it is used in stir-fries, soups, marinades, and dipping sauces. Plant-based diets and the quest for healthier alternatives have led to the emergence of oyster sauce alternatives, derived from vegetarian or vegan sources. Ingredients such as mushrooms, soybean paste, and seaweed extracts are commonly used to create these alternatives.

- The organized retail sector, including hypermarkets and supermarkets, plays a crucial role In the market's distribution. The market's size is substantial, with a vast consumer base that appreciates the savory taste of oyster sauce, which complements both meats and vegetables. Consumers' taste preferences, coupled with the convenience of home-cooked food, contribute to the market's growth. However, concerns over calories and carbohydrates in traditional oyster sauce may influence the demand for low-calorie and low-carb alternatives. The market is expected to continue its upward trajectory, driven by the expanding food service industry and the enduring appeal of Asian cuisine.

How is this Oyster Sauces Industry segmented and which is the largest segment?

The oyster sauces industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Retail

- Foodservice

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- France

- South America

- Middle East and Africa

- APAC

By End-user Insights

- The retail segment is estimated to witness significant growth during the forecast period.

The retail segment of the market is projected to witness a consistent expansion during the forecast period. The growth is primarily driven by the widespread use of oyster sauces in various Asian dishes, particularly Chinese and Japanese cuisines, such as noodles and stir-fries. The increasing popularity of Asian dishes globally, fueled by cultural exchange and the adoption of diverse culinary preferences, is a significant factor propelling market growth. Oyster sauce's savory umami flavor makes it a versatile seasoning, suitable for various applications, including marinades and dipping sauces. The health-conscious trend towards home-cooked food and the food service industry's growing emphasis on natural ingredients and allergen concerns are also contributing factors.

In the context of the growing demand for plant-based alternatives, vegetarian oyster sauce is gaining traction In the market. Key players In the industry include Kikkoman Corp and other prominent players. The market is influenced by various factors, including inflation, raw material prices, and marketing campaigns. Consumers increasingly prioritize functional and healthy foods, leading to a shift towards organic, vegan, bio-based, and clean label alternatives. The market is also impacted by issues such as shellfish allergies, pollution, and overfishing.

Get a glance at the Oyster Sauces Industry report of share of various segments Request Free Sample

The retail segment was valued at USD 5.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

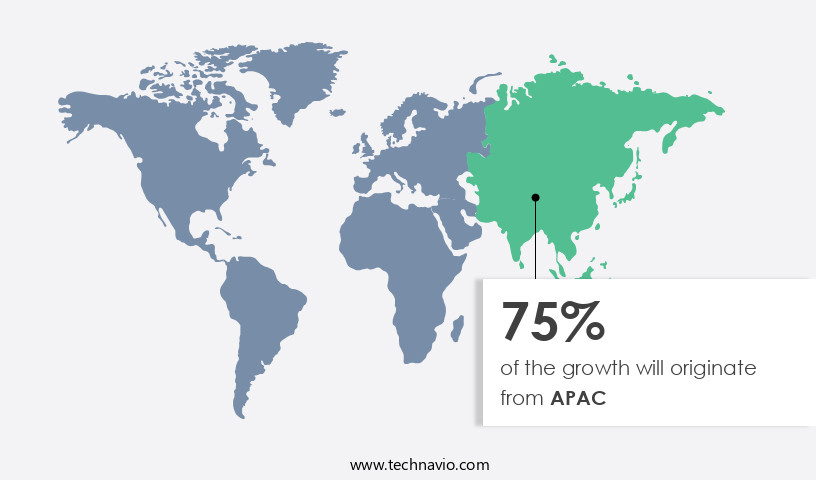

- APAC is estimated to contribute 75% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region dominated The market in 2023, with China, Japan, and other Asian countries driving the majority of revenue. Oyster sauces are a crucial ingredient in various dishes, particularly in Asian cuisine, making the foodservice industry a significant market segment. Income level growth in APAC has led to an increase In the number of restaurants, cafes, and quick-service outlets, boosting demand for oyster sauces. Key consumers in this region include China, Japan, Australia, India, and South Korea. The market's growth is influenced by health-conscious trends, marketing campaigns, and the versatility and authenticity of oyster sauces. However, concerns over shellfish allergies, pollution, and overfishing may impact raw material availability.

Alternatives, such as vegetarian oyster sauce, are gaining popularity due to dietary preferences and raw material shortages. The organized retail sector, including hypermarkets and supermarkets, also contributes to market growth. Oyster sauces are used in various dishes, including Asian restaurant chains, stir-fries, noodles, marinades, and dipping sauces. The market encompasses savory flavorings for meats, vegetables, and household applications, as well as functional and healthy food options. Online platforms, plant-based alternatives, and clean label products are emerging trends. Food safety, labeling, inflation, and raw material prices are critical factors influencing market dynamics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Oyster Sauces Industry?

Product launches is the key driver of the market.

- The market is experiencing growth due to product launches by both regional and international players. These new offerings cater to various dietary preferences, including vegetarian options, and expand the reach of manufacturers. For instance, Kikkoman Corp. Introduced a vegetarian oyster sauce in India in April 2022, catering to both vegetarians and non-vegetarians. The food service industry, including restaurants, cafes, and quick-service outlets, continues to be a significant consumer base for oyster sauces, particularly In the preparation of Asian dishes such as stir-fries, noodles, and marinades. Health-conscious trends and allergen concerns, including shellfish allergies, have led to the development of plant-based alternatives.

- The versatility and authenticity of oyster sauces make them suitable for various applications, including household use and food manufacturing. Ingredients derived from natural sources and free from additives are gaining popularity among consumers seeking healthy lifestyle choices. Manufacturers focus on marketing campaigns to increase consumer awareness and demand for their products. Oyster sauces are used in various foods, including meats, vegetables, and snack foods, as well as in savory dishes such as dipping sauces, soups, and marinades. The organized retail sector, including hypermarkets and supermarkets, contributes significantly to the market growth, with online platforms offering convenient access to consumers.

- Functional foods, healthy foods, and clean label products are gaining traction, with consumers seeking transparency in labeling and price analysis. Market dynamics, including inflation and raw material prices, impact the market's growth. Plant-based alternatives, such as mushroom-based oyster sauces, offer a sustainable solution to raw material shortages and environmental concerns related to overfishing and pollution. The market's growth is influenced by factors such as increasing demand from millennials, food safety concerns, and the expanding food industry. The market's competitive landscape is shaped by factors such as innovation, pricing strategies, and product differentiation. The market's future growth is expected to be driven by factors such as the increasing popularity of Asian cuisine, the growing trend of plant-based alternatives, and the increasing demand for natural and organic products.

What are the market trends shaping the Oyster Sauces Industry?

Innovations in packaging is the upcoming market trend.

- Oyster sauce, known for its savory flavor, is a popular condiment In the food service industry, including Asian restaurants, cafes, and quick-service outlets. With the rise of health-conscious trends, there is a growing demand for oyster sauce alternatives catering to plant-based diets and allergen concerns, particularly for those with shellfish allergies. Ingredients such as mushrooms and soy are used to create vegetarian oyster sauce. Manufacturers prioritize long shelf lives to ensure the authenticity and quality of their products. Ingredients like oysters, soy, and sugar are stored for up to three months. Advanced packaging technologies help extend the shelf life while retaining the flavor, taste, color, and texture.

- Packaging is a crucial brand extension and influences consumer purchase decisions. In the market, oyster sauce is used in various dishes, including stir-fries, noodles, marinades, and dipping sauces. It is also used in savory dishes like soups and meat marinades. The versatility of oyster sauce makes it a staple In the food industry and a popular choice for consumers seeking authentic Asian flavors. In the organized retail sector, oyster sauce is available in various forms, such as canned, raw material shortages may impact prices and availability. Consumers are increasingly seeking natural, organic, vegan, bio-based, and clean-label alternatives. Food safety and labeling regulations are essential considerations for manufacturers.

What challenges does the Oyster Sauces Industry face during its growth?

Fluctuating prices of raw materials is a key challenge affecting the industry growth.

- Oyster sauce is a popular condiment In the food service industry, particularly in Asian cuisine for dishes like stir-fries, noodles, and marinades. Traditionally made with a base of sugar, salt, and cornstarch, oyster extracts or essences are added for flavor. Additional ingredients, such as soy sauce and MSG, enhance color and deepen the savory taste. However, the cost of raw materials, including sugar, salt, and oysters, can significantly impact the market. With the growing demand for plant-based diets and allergens concerns, such as shellfish allergies, oyster sauce alternatives made from mushrooms or vegetarian oyster sauce are gaining popularity. The food industry, including restaurants, cafes, quick-service outlets, and Asian restaurant chains, is responding with marketing campaigns that focus on the versatility and authenticity of natural ingredient-based alternatives.

- In the organized retail sector, oyster sauce can be found in hypermarkets and supermarkets, alongside bacon/cured meats, beef, bread & rolls, cookies & cakes, dry mixes, dressings, snacks, and household applications. With health-conscious trends and a focus on healthy lifestyle, consumers are increasingly opting for home-cooked foods, leading to a rise in demand for oyster sauce for household use. The market dynamics include factors such as food safety, labeling, inflation, raw material prices, and the availability of plant-based alternatives on online platforms. Consumers' taste preferences for dishes like dipping sauces, soup, marinades, and snack foods, as well as functional and healthy foods, such as meat marinades, dipping sauces, fish sauce, soy sauce, and canned foods, also influence the market.

Exclusive Customer Landscape

The oyster sauces market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oyster sauces market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oyster sauces market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Associated British Foods Plc

- Bachun Food Industries Pte Ltd.

- Daesang Corp.

- Foodex Manufacturer Co. Ltd.

- Foshan Haitian Flavoring and Food Co. Ltd.

- HDR Foods Corp.

- Kakusan Foods Co. Ltd.

- Kikkoman Corp.

- Lee Kum Kee Co. Ltd.

- Malabar Food Products

- Marine Resources Development Co. Ltd.

- MGM Blendwell Corp.

- Nestle SA

- NutriAsia Inc.

- Sin Tai Hing Oyster Sauce Factory Sdn Bhd

- Thai Preeda Trading Co. Ltd.

- Wing Soon Food Manufacturer Pte Ltd.

- Yuen Chun Industries Sdn Bhd

- Zhangzhou Hang Fat Import and Export Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The oyster sauce market encompasses a savory condiment widely used in various culinary applications, particularly in Asian cuisine. This market exhibits dynamic growth, driven by the increasing popularity of Asian dishes and the food service industry's continuous quest for authentic flavors. Oyster sauce's versatility extends to stir-fries, noodles, marinades, and dipping sauces, making it a staple ingredient in Asian restaurant chains and quick-service outlets. The health-conscious trends among consumers have led to the development of oyster sauce alternatives, catering to vegetarian and allergen concerns, such as shellfish allergies. The food service industry, including restaurants, cafes, and quick-service outlets, plays a significant role In the oyster sauce market's growth.

Asian dishes, such as stir-fries and noodles, are increasingly popular, and oyster sauce is a crucial ingredient in many of these dishes. Authenticity and natural ingredients are essential factors for consumers, leading to an increased focus on using high-quality raw materials. However, raw material shortages and environmental concerns, such as pollution and overfishing, pose challenges for the industry. The organized retail sector, including hypermarkets and supermarkets, also contributes to the market's growth. Oyster sauce is available in various forms, such as canned, raw material, or ready-to-use, and is sold alongside other food items like bacon/cured meats, beef, bread & rolls, cookies & cakes, dry mixes, dressings, snacks, and household application foods.

Further, the millennial demographic's changing preferences and increased focus on healthy lifestyles have led to the development of functional foods, healthy foods, and plant-based alternatives. These alternatives cater to consumers' taste preferences while addressing concerns related to calories, carbohydrates, fat, vitamin B12, vitamin D, iron, zinc, copper, selenium, and other essential nutrients. Marketing campaigns and labeling have become essential tools for companies to differentiate their products and cater to consumers' needs. Food safety and inflation are critical factors influencing the market, with raw material prices and price analysis playing a significant role in determining product pricing. The oyster sauce market's future growth is expected to be influenced by various factors, including the increasing popularity of Asian dishes, health-conscious trends, and the development of plant-based alternatives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market Growth 2024-2028 |

USD 2.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, Japan, US, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oyster Sauces Market Research and Growth Report?

- CAGR of the Oyster Sauces industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oyster sauces market growth of industry companies

We can help! Our analysts can customize this oyster sauces market research report to meet your requirements.