Paper Edge Protectors Market Size 2024-2028

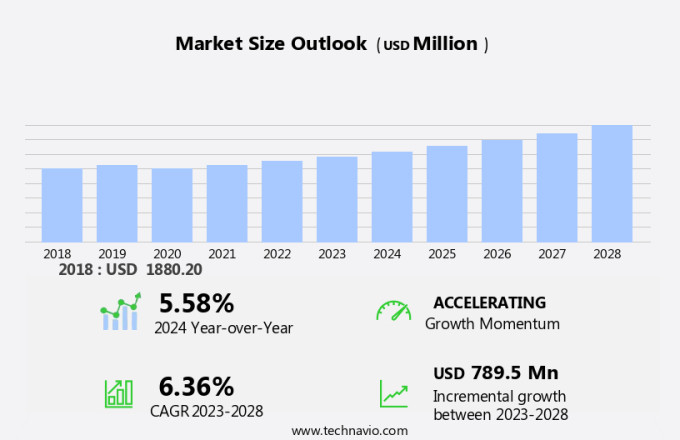

The paper edge protectors market size is forecast to increase by USD 789.5 million at a CAGR of 6.36% between 2023 and 2028. The market is experiencing significant growth due to increasing industrialization and the rising demand from industries such as pharmaceuticals and consumer goods. The use of paper edge protectors enhances brand visibility and provides effective protection during transportation via roadways, railways, and seaborne trade. However, the market faces challenges such as volatility in raw material prices and increasing environmental concerns. To mitigate these challenges, there is a growing trend towards the use of eco-friendly edge protectors made from recycled materials. The consumer goods industry and e-commerce sectors are major contributors to the market's growth, as they require efficient supply chain capabilities to ensure the timely delivery of their products. The escalating manufacturing output necessitates efficient product warehousing and storage solutions, thereby fueling the demand for paper edge protectors. Overall, the market for paper edge protectors in the United States is expected to continue its expansion, driven by these trends and challenges.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for protective packaging solutions in various industries. These edge protectors, also known as corner protectors, play a crucial role in safeguarding the edges and corners of products during transportation and handling. One of the primary drivers for the market is the growing environmental awareness among consumers and businesses. Recycled paperboard is increasingly being used as a raw material for manufacturing edge protectors due to its eco-friendly nature. This trend is particularly prominent in the consumer goods and industrial goods sectors, where sustainability is a key concern.

Moreover, another factor fueling the market growth is the hazardous effects of plastic packaging on the environment. Paper edge protectors offer a viable alternative to plastic, as they are biodegradable and do not contribute to pollution or ecological hazards. International trade is also a significant contributor to the market growth. With the increasing urbanization and industrialization, there is a growing need for efficient and effective supply chain capabilities. Paper edge protectors help ensure that products reach their destinations undamaged, reducing the need for costly replacements and returns. The pharma industry is another major consumer of paper edge protectors.

Furthermore, the industry requires stringent packaging regulations to ensure product safety and integrity during transportation. Paper edge protectors offer a sustainable and cost-effective solution for meeting these regulations while minimizing the risk of external damage. Innovative packaging solutions, such as trays and custom-designed edge protectors, are also gaining popularity in the market. These solutions offer enhanced protection and brand visibility, making them an attractive option for businesses looking to differentiate themselves from competitors. However, it is essential to note that the use of recycled materials in paper edge protectors should meet specific standards to ensure their quality and effectiveness.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Angular

- Round

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

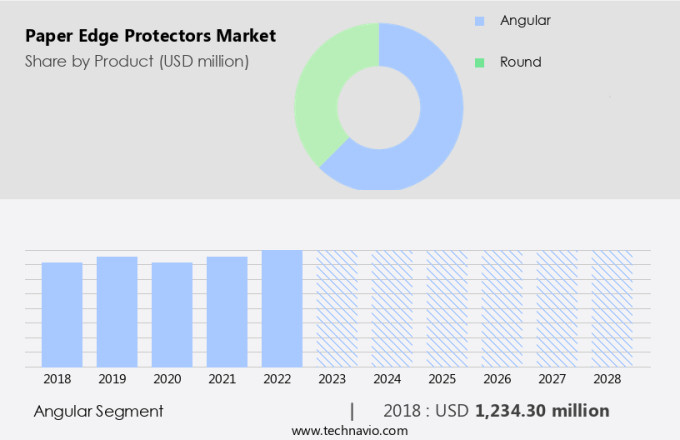

The angular segment is estimated to witness significant growth during the forecast period. Angular paper edge protectors serve a crucial role in safeguarding boxes on pallets from sliding and damaging sensitive corners during transportation and storage in various industries, including pharma and consumer goods. These protectors, which come at a 90-degree angle, are referred to as angular paper edge protectors. They offer several benefits, such as: Firstly, angular paper edge protectors ensure the safety of packages by providing resistance against shocks due to their burst strength. Secondly, their superior resistance to high mechanical tension enables them to protect goods from the pressure exerted by plastic or metallic strapping. Lastly, these edge protectors help maintain load stability and keep goods compact and securely anchored to the base.

Furthermore, the use of angular paper edge protectors is prevalent in industries undergoing industrialization, such as the pharma industry and consumer goods industry, where brand visibility and supply chain capabilities are essential. In the United States market, seaborne trade and transportation via road and railways are significant contributors to the demand for these protectors. Additionally, the increasing popularity of e-commerce and the growing environmental concerns have further boosted the market for edge protectors. By using these protectors, businesses can reduce their carbon footprint by minimizing the use of plastic.

Get a glance at the market share of various segments Request Free Sample

The angular segment accounted for USD 1.23 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

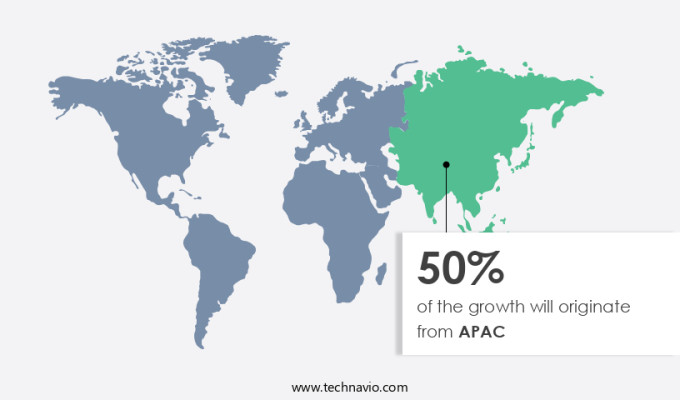

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The importance of protecting goods during storage and transportation has gained significant attention, especially with the rise of international trade. As manufacturing growth continues to increase in developing and emerging industrial countries, such as China and India, the need for reliable packaging solutions has become essential. These countries have become major exporters of various commodities, including rice, refined petroleum, and electronic components, which are transported in large quantities across continents. To ensure the safety and integrity of these goods, edge protectors have become an indispensable component of packaging functions. Edge protectors, also known as round covering or support, serve multiple purposes.

Moreover, they provide safety by preventing damage during handling, stacking, and palletizing. They enhance load stability and stacking strength, ensuring pallet load unification and breakage resistance. Edge protectors come in various sizes and configurations, catering to different industry requirements. They can be used for edge guarding and pallet guarding, making them a versatile solution for various packaging needs. By investing in edge protectors, businesses can safeguard their products from potential damage, ultimately reducing costs associated with replacements and returns.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rapid industrialization is the key driver of the market. The market in the US is witnessing significant growth due to the increasing industrialization and globalization trends. Industrialization refers to the expansion of industries and businesses, leading to an increase in the production of goods. This growth is observed in various countries, including the US and other economies with rising Gross Domestic Product (GDP), such as China and India. Moreover, the rise in international trade has intensified, with an increasing number of products being exported and imported between countries. Paper edge protectors play a crucial role in safeguarding these products during transportation and storage, contributing to the market's growth.

Furthermore, these protectors come in various forms, including side protection boards, vertical protection boards, end protection boards, U profiles, flat boards, angle boards, ID protectors, and OD protectors. They offer benefits such as easy installation, durability, recyclability, and low costs, making them an ideal choice for businesses seeking cost-effective and eco-friendly solutions.

Market Trends

The growing popularity of plastic-based paper edge protectors is the upcoming trend in the market. Paper edge protectors have long relied on paper as their primary material due to its availability and affordability. However, the use of paper in edge protectors has become a concern due to the release of fiber and other particulates during production and disposal. In response, companies have begun exploring alternative materials, such as plastics, to create more durable and sustainable paper edge protectors. Plastics, specifically polymer-based composites, offer improved resistance to heat and other hazardous effects compared to paper. These materials, which include polypropylene, are widely accessible and supplied by numerous companies.

Consequently, the adoption of plastic-based paper edge protectors is increasing among end-users, who value their durability and eco-friendly attributes. The shift towards recycled materials, driven by growing environmental awareness and urbanization, is also influencing the market for paper edge protectors. Despite the benefits, it is essential to consider the potential pollutants and ecological hazards associated with plastic production and disposal. Therefore, sustainability remains a crucial factor in the production and use of paper edge protectors. International trade plays a significant role in the market, with companies sourcing raw materials and manufacturing in various regions to meet the demands of diverse industries and consumers.

Market Challenge

Volatility in raw material prices is a key challenge affecting the market growth. The market faces volatility due to price fluctuations in the major raw material, recycled craft paper. This paper is manufactured using recycled fiber, which is the primary component in producing edge protectors. The cost of recycled craft paper is influenced by the price of fiber, which experiences annual and intra-year variations.

Consequently, companies experience increased production expenses, negatively impacting their business performance and financial outcomes. This pricing challenge is more pronounced in regions such as the Americas and APAC.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CORDSTRAP BV - The company offers paper edge protectors that include cord strap cargo edge protection products to protect shipped goods and plays an integral part in bundling and palletizing cargo.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cascades Inc.

- CORDSTRAP BV

- Crown Holdings Inc.

- Dongguan ZhongYueDa paper Co. Ltd.

- Eltete TPM Ltd

- Inter-Pack LTD.

- Konfida Ambalaj Tekstil San. Tic. AS

- Kunert Group

- Napco National

- North American Laminating and Converting Co.

- PACFORT

- Packaging Corp. of America

- Primapack

- RAJAPACK Ltd.

- Romiley Board Mill

- Smurfit Kappa Group

- Sonoco Products Co.

- TRANSFORMACAO DE PAPEL E COMERCIO DE EMBALAGENS SA

- VPK Group

- Yamaton Paper GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Paper edge protectors are essential components of protective packaging solutions, providing safety and support to various industries dealing with the transportation and storage of boxed paper products and industrial goods. These protective solutions are increasingly gaining popularity due to growing environmental awareness and the use of recycled materials. Recycled paperboard is a common choice for manufacturing edge protectors, contributing to sustainability efforts. International trade and industrialization have led to an increase in the demand for edge protectors in industries such as consumer goods and pharma, where product safety and damage prevention are paramount. However, the use of plastic edge protectors, although effective, raises concerns regarding hazardous effects and pollutants released into the atmosphere.

Furthermore, E-commerce and urbanization have further fueled the demand for edge protectors, with the need for efficient and sustainable packaging solutions becoming increasingly important. Innovative packaging solutions, such as corner protectors, side protection boards, and u profiles, offer various sizes, configurations, and functions, including edge guarding, pallet guarding, and load stability. The warehousing industry also benefits significantly from edge protectors, ensuring the structural integrity of pallet loads and reducing the risk of breakage during transportation via road and railways or seaborne trade. The use of paper edge protectors offers several advantages, including easy installation, durability, recyclability, and low costs.

However, despite their benefits, unfavorable factors such as impact resistance and abrasion resistance may limit the suitability of paper edge protectors in certain applications. Metal and plastic edge protectors are alternatives, but their environmental impact and costs must be considered. Regardless, the market for edge protectors continues to grow, driven by consumer demand for sustainable packaging and the need for efficient and cost-effective damage prevention solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market growth 2024-2028 |

USD 789.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Cascades Inc., CORDSTRAP BV, Crown Holdings Inc., Dongguan ZhongYueDa paper Co. Ltd., Eltete TPM Ltd, Inter-Pack LTD., Konfida Ambalaj Tekstil San. Tic. AS, Kunert Group, Napco National, North American Laminating and Converting Co., PACFORT, Packaging Corp. of America, Primapack, RAJAPACK Ltd., Romiley Board Mill, Smurfit Kappa Group, Sonoco Products Co., TRANSFORMACAO DE PAPEL E COMERCIO DE EMBALAGENS SA, VPK Group, and Yamaton Paper GmbH |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch