Rice Market Size 2023-2027

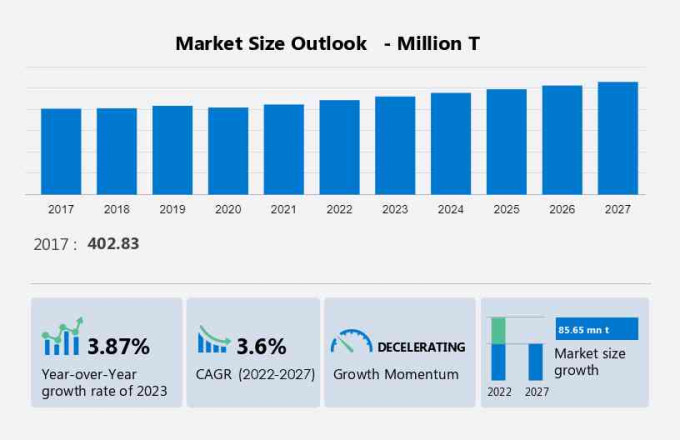

The rice market size is projected to increase by 85.65 million T, at a CAGR of 3.6% between 2022 and 2027.

- Market growth in the rice industry is driven by several key factors. Firstly, increased consumption of rice as a staple food globally is a significant factor. Secondly, the diverse range of rice varieties available from producers caters to various consumer preferences and market demands. Thirdly, rising demand for rice flour from emerging markets, particularly in the food processing and cosmetics industries, is another crucial factor. These elements collectively fuel market growth, emphasizing rice's importance as a vital food source.

- As consumption patterns evolve and dietary trends shift, producers are expected to continue innovating to meet diverse consumer preferences. Brown rice, in particular, is gaining popularity due to its health benefits and environmental sustainability. Producers must adapt to changing market dynamics to ensure continued growth and sustainability in the rice industry. This trend underscores the significance of brown rice as a crucial food source and the need for producers to stay competitive and responsive to market demands.

What will be the Size of the Rice Market During the Forecast Period?

To get additional information about the rice market report, Request Free Sample

How is the Rice Market Segmented?

The rice market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "Million ton" for the period 2023 to 2027, as well as historical data from 2017 to 2021 for the following segments

- Product Outlook

- Long grain

- Medium grain

- Short grain

- Distribution Channel Outlook

- Offline

- Online

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

By Product

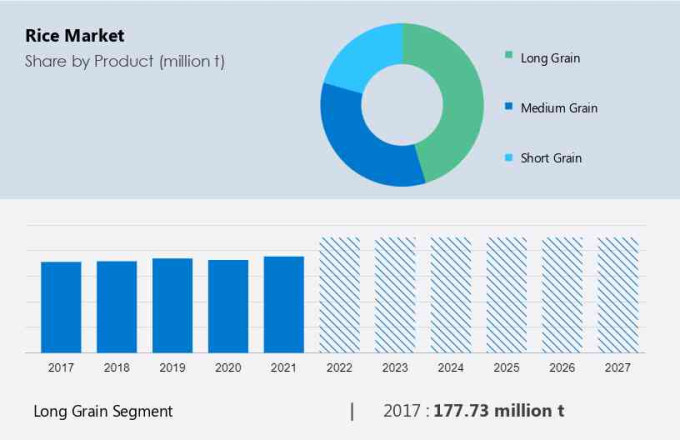

- The market share growth by the long-grain segment will be significant during the forecast period. Long-grain rice is slim and lengthy, having a length that is three to five times its width. This segment has a range of rice varieties such as basmati and jasmine.

For a detailed summary of the market segments, Get Sample Report

- The long-grain segment was valued at 177.73 million T in 2017. Long-grain rice is widely produced and consumed across Asian countries. These countries are some of the largest consumers of rice in the world. Thus, the popularity of long-grain rice in leading rice-consuming countries in the world is driving the growth of the long-grain segment of the global market. Furthermore, long-grain rice is believed to be healthier than other rice varieties.

- For instance, basmati rice is low in carbohydrates and cholesterol, making it suitable for consumption by people with chronic disorders such as diabetes, cardiac diseases, and obesity. Such health benefits of long-grain rice increase its popularity among consumers, which, in turn, will drive rice market growth during the forecast period.

By Distribution Channel

- The offline distribution channel segment generates revenue from the sales of products through hypermarkets, supermarkets, department stores, and independent retailers. Retailers are introducing new business and retail strategies, for example, better pricing strategies and wider assortments, owing to the declining preference for offline shopping and the need to survive in a competitive market. As a part of the marketing and offline sales strategy, resellers place attractive displays that generate strong sales. companies push their offline sales by widening their store operations across locations.

- Companies can increase sales and cater to each consumer category through expansions in large geographies. With the growth in retail channels in cities and regions, customers have access to different varieties of rice, such as brown rice, basmati rice, and jasmine rice. This is expected to increase the sales of rice through offline channels during the forecast period.

By Region

Get a glance at the market share of various regions. View PDF Sample

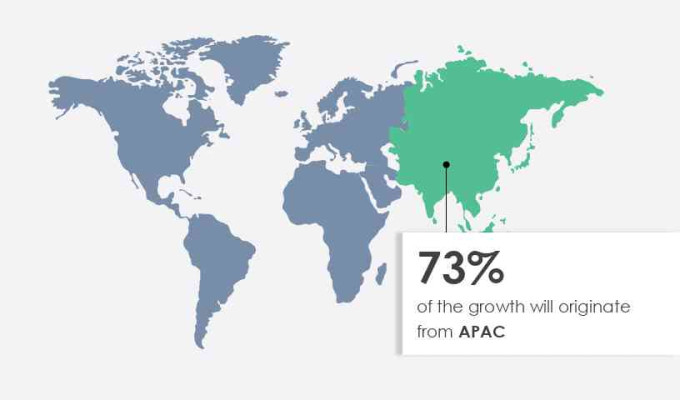

- APAC is estimated to contribute 73% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC is the biggest producer and consumer of rice in the world. The region consumes about two-thirds of the total rice produced globally. Thus, rice is available in plenty across the region. Countries including China, Thailand, and India use rice in the preparation of a wide range of daily-use food items such as rice wine. This keeps the demand for rice high in the region.

- Growing urbanization and economic growth over the years have influenced the lifestyle of people living in APAC and changed their consumption habits, tastes, and preferences, thereby driving the demand for convenience and ready-to-eat foods in the region. In recent years, the demand for wheat in APAC has increased marginally, but growing awareness about health is expected to witness a growth in the use of rice. People in APAC are, therefore, expected to move to healthier, rice-based gluten-free diets amid growing consciousness about the ill effects of gluten. Such consumer patterns in APAC are expected to drive regional rice market growth during the forecast period.

What are the Rice Market Dynamics Shaping Growth?

- The rice market plays a vital role in the fast food sector market as a staple cereal grain. Cultivated during the Kharif season, it offers a range of varieties including white rice, wild rice, and specialty rice. Rich in fibre and salt, rice is also available in organic and whole grain forms, catering to health-conscious consumers. However, challenges like soil degradation and biodiversity loss impact rice cultivation. The market is evolving with the rise of online distribution channels, facilitating easier access for consumers. Additionally, rice is often cultivated alongside sugarcane, contributing significantly to the agricultural commodity sector.

- Rice is a staple food for over half of the world's population, with significant consumption in Asian, African, and Latin American countries. The primary reasons for this trend are the growing population and increasing per capita income. According to the World Bank and United Nations, countries such as Syria (4.4%), Niger (3.8%), and Angola (3.2%) experienced the highest population growth rates in 2021. Meanwhile, Asian economies, including Macao (20.4%), Hong Kong (6.4%), and Singapore (6.0%), recorded the highest per capita GDP growth rates in the same year.

- Consequently, the expanding population and rising income levels in developing economies are expected to fuel rice consumption and market growth during the forecast period. Our research team examined the data, taking 2022 as the base year, and identified key trends and challenges to provide a comprehensive analysis. This in-depth analysis of drivers, trends, and challenges will enable stakeholders in the rice value chain to refine their marketing strategies and secure a competitive advantage.

Major Market Trends

- Increasing awareness about gluten-free food is a major trend driving rice market growth. The rising awareness about gluten and celiac disease among consumers has increased the demand for non-gluten or gluten-free food. Gluten is found in grains such as wheat, rye, and barley. However, rice is gluten-free and has witnessed a rise in demand among consumers. This can positively impact the growth of the global market during the forecast period.

- The consumption of gluten can cause problems among individuals with a gluten intolerance. If left undiagnosed, it can lead to celiac disease, a severe form of gluten intolerance. Nearly 1% of the population in the UK has celiac disease, out of which only around 24% is diagnosed. It is estimated that nearly three million people in the US have celiac disease. The disease causes bloating of the small intestine, headache, constipation, diarrhea, and weight loss.

- Gluten sensitivity also leads to digestive issues, inflammation in the small intestine, and attention deficit hyperactivity disorder (ADHD). Currently, there is no cure for this disease, and the only way to avoid it is to switch to a gluten-free diet. As a result, customers are avoiding foods that have gluten or gluten-containing ingredients. Thus, the increasing preference for gluten-free food products is expected to drive rice market growth during the forecast period.

Significant Market Challenge

- The price volatility of grains due to weather conditions is a major factor hindering rice market growth. Fluctuations in the availability of rice can impede the growth of the market. Lower rice harvests trigger an increase in the price of rice due to increasing demand. This can also cause a decline in the demand for rice and reduce the customer base. The dependency of companies on climate increases volatility both in the price and quality of rice, causing a demand-supply imbalance for major rice-consuming countries. Climate change and unfavorable weather conditions can affect the volume and quality of crop yield.

- Globally, climatic conditions are changing rapidly, giving rise to severe droughts and floods. Short supplies lead to higher rice prices, which increases the price for the end customer. Such factors will affect the sales in the rice market during the forecast period.

Customer Landscape

The rice market research report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rice market forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Which are the Major Rice Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- ITC Ltd.- The company offers rice such as long grain parboiled rice and brown rice.

- Adani Wilmar Ltd.- The company offers rice such as Fortune biryani special basmati rice.

- Bunge Ltd.- The company offers rice such as long grain rough rice, medium grain rough rice and long grain brown rice.

The rice market research and growth report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Aashirvad International

- Amir Chand Jagdish Kumar Exports Ltd.

- Anheuser Busch InBev SA NV

- California Family Foods

- Cargill Inc.

- Ebro Foods SA

- Farmers Rice Cooperative

- Gautam General Trading LLC

- GRM Overseas Ltd.

- Kohinoor Foods Ltd.

- KRBL Ltd.

- Louis Dreyfus Co. BV

- LT Foods Ltd.

- Riceland Foods Inc.

- Shriram Food Industry Pvt. Ltd.

- Sri Sai Nath Agri Industries Pvt. Ltd.

- Tamaki Rice Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What are the Latest Market Developments and News?

-

In November 2024, India's largest rice exporter, KRBL Limited, launched a new organic rice product line aimed at the growing demand for healthier and eco-friendly food options. The company's move seeks to expand its market share in the global rice export sector, especially in Western markets that prioritize organic food.

-

In October 2024, Olam Group introduced an innovative rice packaging solution that uses biodegradable materials, aiming to reduce plastic waste in the packaging of rice products. This move comes as part of the company's broader sustainability initiative to appeal to environmentally conscious consumers.

-

In September 2024, Thailand's largest rice exporter, Thai Rice Exporters Association, partnered with a global e-commerce platform to increase direct-to-consumer sales of premium Thai rice. This collaboration aims to tap into the growing demand for high-quality rice in international markets through online channels.

-

In August 2024, the U.S. Department of Agriculture (USDA) announced a new initiative to support domestic rice farmers by introducing advanced irrigation technologies. The initiative aims to improve crop yields and water efficiency, helping to strengthen the U.S. rice market and meet rising domestic and international demand.

Will Consumer Demand Drive Market Growth?

- The rice market is a complex and intricate sector, encompassing a diverse range of products to cater to various food patterns and dietary habits. This includes specialty rice varieties, such as aromatic and long grain rice. External factors significantly influence this market, with monsoons impacting seasonal crops and rice cultivation. Pests and diseases pose challenges to rice production, necessitating the use of efficient rice mill machinery and effective land and labor management. In recent years, there has been a growing emphasis on health and wellness, leading consumers to seek out organic rice and whole grain rice. These options are rich in essential vitamins, minerals, and fiber. This trend intersects with various sectors, including the food and restaurant industry and the food and agriculture sectors, providing essential nutrients to consumers.

- Monsoons and other external factors can disrupt rice production, making efficient and effective management practices crucial for maintaining a stable rice supply. Organic and whole grain rice cater to the increasing demand for healthier food options, highlighting the importance of sustainable farming practices and innovative rice milling technologies.

- The shift towards online distribution channels has complemented traditional offline stores, offering consumers convenient access to a staple food source despite seasonal challenges. Producers of maize are also turning to online distribution channels to expand their market reach and streamline their sales process. Despite the challenges posed by seasonal rains and other external factors, the rice market remains a vital sector, intersecting with various industries and providing essential nutrients to consumers. Utilizing online distribution channels and platforms, consumers can access rice consistently, ensuring a steady supply of this staple food. The market's resilience and adaptability in the face of external challenges make it a dynamic and exciting sector to watch.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 3.6% |

|

Market growth 2023-2027 |

85.65 mn t |

|

Market structure |

USD Fragmented |

|

YoY growth 2022-2023(%) |

3.87 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 73% |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading companies, Market Positioning of companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aashirvad International, Adani Wilmar Ltd., Amir Chand Jagdish Kumar Exports Ltd., Anheuser Busch InBev SA NV, Bunge Ltd., California Family Foods, Cargill Inc., Ebro Foods SA, Farmers Rice Cooperative, Gautam General Trading LLC, GRM Overseas Ltd., ITC Ltd., Kohinoor Foods Ltd., KRBL Ltd., Louis Dreyfus Co. BV, LT Foods Ltd., Riceland Foods Inc., Shriram Food Industry Pvt. Ltd., Sri Sai Nath Agri Industries Pvt. Ltd., and Tamaki Rice Corp. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our rice market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Buy Full Report and Discover more

What are the Key Data Covered in this Rice Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this rice market growth analysis report to meet your requirements. Get in touch