Paper Straw Market Size 2024-2028

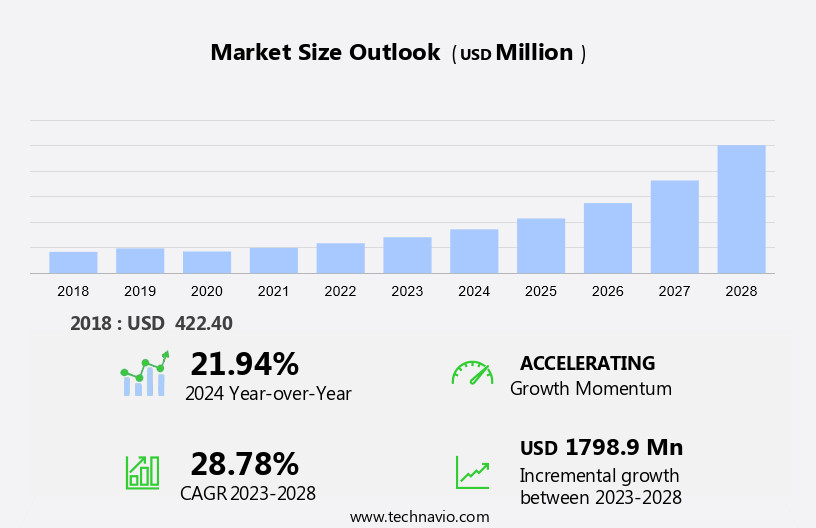

The paper straw market size is forecast to increase by USD 1.8 billion at a CAGR of 28.78% between 2023 and 2028.

- In the commercial foodservice industry, the shift towards eco-friendly packaging solutions has gained significant traction. One such alternative is the use of paper straws, which have emerged as a viable substitute to traditional plastic and glass straws. The global commercial beverage dispenser market's growth is a key driver for the market. Moreover, the increasing awareness and concerns regarding the environmental impact of plastic straws have led to the adoption of paper straws. However, raw material prices, particularly pulp, can be volatile, posing a challenge to the market. Additionally, the use of adhesives in manufacturing paper straws for commercial beverage dispensers is another factor to consider. Overall, the market is expected to witness steady growth In the coming years, driven by these market trends and challenges.

What will be the Size of the Paper Straw Market During the Forecast Period?

- The market is experiencing significant growth as consumers and businesses increasingly prioritize sustainability and seek alternatives to single-use plastic straws. Renewable resources, such as paper, are gaining favor due to their environmental benefits in mitigating plastic pollution. Paper straws, a tube-like structure made from paper, are becoming a popular choice for beverages, with both printed and non-printed options available in straight and u-shaped designs. The manufacturing process of paper straws involves the use of water-based adhesives, ensuring a sustainable production method. Corporate sustainability initiatives have further fueled the demand for paper straws, with many establishments replacing plastic straws with their paper counterparts.

- Paper straws offer a viable alternative to plastic straws, aligning with the global trend towards reducing reliance on plastic materials. The market encompasses a wide range of applications, from households to commercial establishments. The market's growth is driven by the increasing awareness of environmental issues and the desire for more sustainable options. The manufacturing process of paper straws is continually evolving, with innovations in material and production methods contributing to the market's expansion. Wooden utensils and other plastic alternatives are also experiencing growth, as consumers and businesses seek eco-friendly alternatives to traditional plastic products.

How is this Paper Straw Industry segmented and which is the largest segment?

The paper straw industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Virgin paper straw

- Recycled paper straw

- Geography

- North America

- US

- Europe

- Germany

- Italy

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

By Material Insights

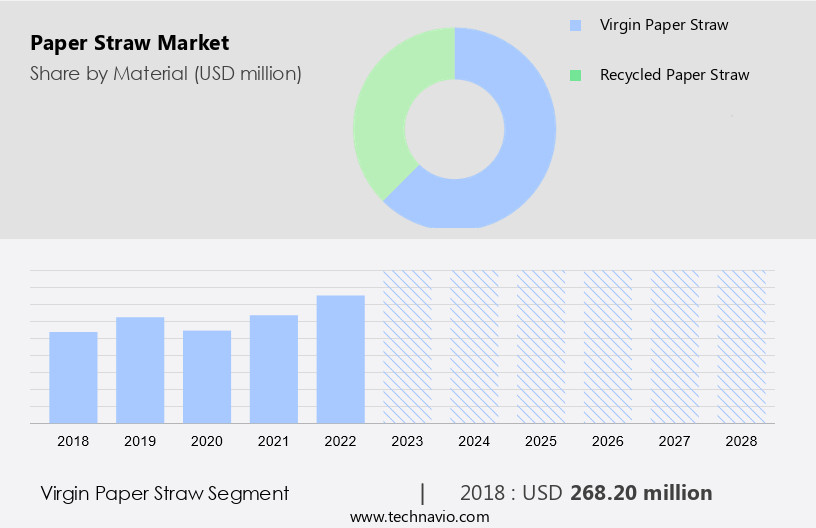

- The virgin paper straw segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing preference for sustainable alternatives to conventional plastic straws. Virgin paper straws, made exclusively from virgin paper material, are gaining popularity due to their superior printability, brightness, and opacity. The food and beverage industry's demand for virgin paper straws is increasing, driven by urbanization and growing environmental concerns. The detrimental impact of plastic straws on the environment, particularly plastic pollution, has led consumers to seek eco-friendly alternatives. Paper straws, as renewable resources, offer a sustainable solution to this issue. The manufacturing process of paper straws involves the use of water-based adhesives and tube-like structures, making them a more environmentally responsible choice.

Paper straws come in various shapes, including straight and u-shaped, and sizes, catering to both households and businesses. Beverage companies are also embracing paper straws as part of their sustainable packaging initiatives, replacing single-use plastic straws with bio-based products. The market for paper straws is expected to continue growing as more businesses adopt sustainable choices to address environmental issues.

Get a glance at the market report of share of various segments Request Free Sample

The virgin paper straw segment was valued at USD 268.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

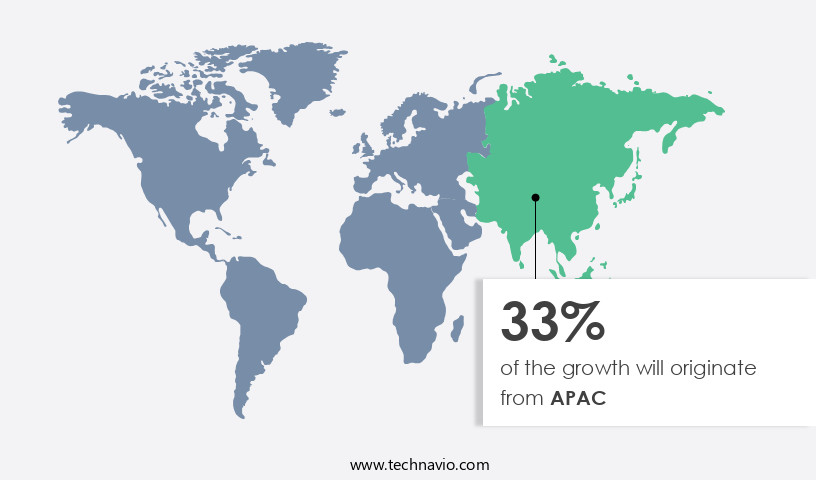

- APAC is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market has gained momentum due to increasing environmental concerns and corporate sustainability initiatives. Renewable resources, such as paper, are being prioritized as alternatives to conventional plastic straws, which contribute significantly to plastic pollution. Paper straws, with their tube-like structure, are suitable for various beverages, including those in printed or non-printed forms. Straight, u-shaped, and different sizes are available to cater to diverse consumer preferences. The manufacturing process involves water-based adhesives, slot machines, and core winding machines, making it an eco-friendly choice. Recycled paper and biomass sources are increasingly being used, contributing to the bioeconomy. Beverage companies are embracing bio-based products as part of their environmental initiatives, addressing climate change and the plastic waste problem.

Sustainable packaging solutions, such as paper straws, are gaining popularity in foodservice outlets and among households. Other alternatives like edible straws, metal, and glass straws are also available, but paper straws offer a balance between sustainability and affordability. The market for paper straws is expected to grow in both B2B and B2C segments, with increasing demand for sustainable choices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Paper Straw Industry?

Growth of global commercial beverage dispenser market is the key driver of the market.

- The market is gaining traction as renewable resources become increasingly prioritized in response to environmental concerns. Plastic straws, a significant contributor to plastic pollution, are being replaced by sustainable alternatives such as paper straws. Corporate sustainability initiatives and environmental responsibility are driving the shift towards paper straws, which have a tube-like structure suitable for beverages. Paper straws come in printed and non-printed versions, available in various lengths and diameters, catering to both B2B and B2C markets. The manufacturing process uses water-based adhesives, tube winding machines, and can be made from recycled paper or sustainable biomass sources. The bioeconomy is a growing sector that values valorization of sustainable biomass, and beverage companies are increasingly investing in bio-based products as alternatives to conventional plastic straws.

- Climate change and the plastic waste problem are pressing environmental issues, leading to a demand for sustainable choices such as paper straws. While paper straws have their advantages, they may face challenges such as soggy structures and carbon pollutants from the drying process. However, ongoing material innovation and environmental initiatives are addressing these challenges. Sustainable packaging solutions, including paper straws, are increasingly adopted by fast food chains and foodservice outlets as they offer a more environmentally responsible alternative to single-use plastic straws. Wooden utensils and other sustainable alternatives, such as edible straws, metal straws, and glass straws, are also gaining popularity. The market dynamics for paper straws are influenced by environmental concerns, consumer preferences, and technological advancements, making it an exciting space for innovation and growth.

What are the market trends shaping the Paper Straw Industry?

The adoption of eco-friendly materials to manufacture straws is the upcoming market trend.

- The market is experiencing growth due to the rising demand from various industries, particularly food and beverage. This trend is driven by the increasing focus on environmental responsibility and sustainability initiatives. In response, manufacturers are turning to renewable resources, such as paper, as an alternative to conventional plastic straws. The production process for paper straws involves the use of virgin paper or recycled paper, water-based adhesives, and tube-like structures. These sustainable alternatives to plastic straws offer a solution to the environmental issues caused by single-use plastic straws, including pollution and carbon pollutants. Beverage companies are embracing this shift towards sustainable packaging, with paper straws being a popular choice.

- Paper straws come in various shapes, such as straight or u-shaped, and sizes, including different lengths and diameters. They are also available in printed and non-printed versions. Households and foodservice outlets, including fast food chains, are also making the switch as part of their sustainability initiatives. The manufacturing process involves the use of slot machines and core winding machines, which are more environmentally friendly than the production of plastic straws. Additionally, the use of sustainable biomass sources, such as trees, In the production contributes to the bioeconomy. The valorization of these resources through the biorefinery process further enhances the sustainability.

- Thus, the market is expected to grow during the forecast period due to the increasing demand for sustainable alternatives to single-use plastic straws. The use of renewable resources, such as paper, and sustainable production processes is driving the growth of this market. Paper straws offer a sustainable choice for consumers and food and beverage companies looking to reduce their environmental impact and promote climate change initiatives.

What challenges does the Paper Straw Industry face during its growth?

Volatility of raw material prices is a key challenge affecting the industry growth.

- The market is driven by the growing environmental concerns and corporate sustainability initiatives to reduce the use of single-use plastics, such as conventional plastic straws, which contribute significantly to plastic pollution and environmental issues. Renewable resources, like paper, are increasingly being adopted as sustainable alternatives to plastic straws. The market faces challenges from the volatility of raw material prices, particularly for paper and recycled paper, which impact the cost of production and profitability of companies. Energy and freight costs, as well as raw material availability, pose further challenges. The market includes various types of paper straws, such as printed and non-printed, straight and u-shaped, and tubular structures, catering to diverse consumer preferences and requirements in households and foodservice outlets.

- Sustainable biomass sources, such as trees, are essential for the manufacturing process, which includes water-based adhesives, slot machines, and core winding machines. The bioeconomy and valorization of sustainable biomass sources through biorefineries are key trends In the market. Beverage companies are increasingly adopting bio-based products as sustainable packaging solutions, further boosting the market growth. However, challenges such as soggy paper straws, carbon pollutants from the drying process, and competition from edible straws, metal straws, and glass straws persist. companies must innovate and offer sustainable alternatives to address these challenges while maintaining environmental responsibility and sustainability choices.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BioPak Pty Ltd.

- Bygreen

- Canada Brown Eco Products Ltd

- Footprint

- GP Alliance Sdn Bhd

- Hello Straw B.V

- Hoffmaster Group Inc.

- Huhtamaki Oyj

- Jinhua Suyang Plastic Production Co. Ltd.

- Karat by Lollicup

- MPM Marketing Services

- Novolex

- OkStraw Paper Straws

- Sharp Serviettes

- Shenzhen Grizzlies Industries Co. Ltd.

- Soton Daily Necessities Co., Ltd. Y.W.

- Tetra Laval SA

- The Paper Straw Co.

- Transcend Packaging Ltd.

- YuTong Eco Technology SuQian Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has emerged as a significant alternative to traditional plastic straws, driven by growing environmental concerns and corporate sustainability initiatives. Renewable resources, such as paper, have gained prominence as sustainable alternatives to single-use plastics, which contribute to environmental issues like plastic pollution. Paper straws, with their tube-like structure, are increasingly being used as eco-friendly options for beverages. These straws come in both printed and non-printed varieties, catering to diverse consumer preferences. The manufacturing process involves the use of water-based adhesives and various machinery, such as slot machines and core winding machines. The shift towards paper straws is driven by several factors.

Firstly, the environmental impact of plastic straws is a pressing issue. Conventional plastic straws contribute significantly to single-use plastic waste, which poses a major pollution problem. Moreover, the production of plastic straws involves the use of fossil fuels, contributing to carbon pollutants. In response to these concerns, beverage companies and foodservice outlets have started adopting paper straws as sustainable alternatives. These businesses are recognizing the importance of environmental responsibility and sustainable choices, aligning with broader environmental initiatives. The market is not limited to households but also caters to the institutional sector, including B2B and B2C markets. The demand varies based on factors like straw length and diameter. The manufacturing process involves the use of virgin paper and, increasingly, recycled paper. The bioeconomy is a key driver of innovation In the market, with a focus on sustainable biomass sources and biorefinery technologies for valorization. The market is not without its challenges. Soggy paper straws can be a drawback, necessitating improvements In the drying process. Additionally, the use of ink in printed paper straws raises questions about the environmental impact of the production process. Despite these challenges, the market is poised for growth, with a range of alternatives, including edible straws, metal straws, and glass straws, also gaining popularity.

The market dynamics are shaped by various factors, including consumer preferences, environmental concerns, and technological innovations. Thus, the market represents a significant shift towards sustainable alternatives to single-use plastics. Driven by environmental concerns and corporate sustainability initiatives, the market is poised for growth, with various players innovating to address challenges and meet consumer demands. The use of renewable resources, such as paper, is a key driver of this trend, with a focus on sustainable biomass sources and biorefinery technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.78% |

|

Market growth 2024-2028 |

USD 1.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

21.94 |

|

Key countries |

US, China, Germany, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.