PCB Solder Paste Stencil Market Size 2024-2028

The PCB solder paste stencil market size is forecast to increase by USD 213.1 million, at a CAGR of 5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expansion of PCB manufacturing plants and increased investment in this sector. The increasing demand for advanced electronic devices, particularly in the consumer electronics and automotive industries, is fueling the need for more efficient and high-quality PCB manufacturing processes. This, in turn, is leading to increased adoption of PCB solder paste stencils for precise and consistent soldering. However, the market also faces challenges, primarily due to the high production costs associated with PCB manufacturing. The complexity and intricacy of modern PCB designs require advanced manufacturing technologies and skilled labor, which can significantly increase the cost of production.

- Additionally, the need for continuous innovation to keep up with the evolving technology landscape presents another challenge for market participants. To remain competitive, companies must invest in research and development to create more efficient and cost-effective manufacturing processes and solutions. This will require a strategic focus on innovation, operational efficiency, and cost management to capitalize on the market's growth opportunities while navigating the challenges effectively.

What will be the Size of the PCB Solder Paste Stencil Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The solder paste stencil market continues to evolve, driven by the dynamic nature of PCB assembly and electronic packaging. Solder paste composition plays a crucial role in ensuring optimal product design and stencil aperture size for thermal cycling and fine pitch components. The ongoing development of high-density interconnect technology necessitates stringent process control and stencil accuracy to maintain solder joint integrity. Environmental testing and safety regulations are increasingly important considerations, influencing solder paste chemistry and viscosity. Stencil life and material selection are critical factors in ensuring yield enhancement and cost optimization. Solder paste technology advancements, such as stencil imaging and process automation, continue to shape the industry.

Manufacturing standards and solder paste qualification are essential for reliability testing and component placement. Lead time, moisture sensitivity level, and supply chain management are also key areas of focus. Component sourcing and solder paste printing require careful consideration to maintain component life and solder joint quality. Stencil cleaning, inspection, and maintenance are vital for maintaining process efficiency and ensuring consistent solder paste performance. Thermal management and yield enhancement are ongoing concerns in the SMT process. The industry continues to adapt to new industry standards and automated assembly techniques, while also addressing challenges such as vibration testing, shock testing, and component reliability.

Solder paste application methods, including wave soldering and reflow soldering, require ongoing optimization to meet the demands of lead-free soldering and cost-effective manufacturing. Stencil fabrication, alignment, measurement, and registration techniques continue to evolve to meet the needs of the electronics manufacturing industry.

How is this PCB Solder Paste Stencil Industry segmented?

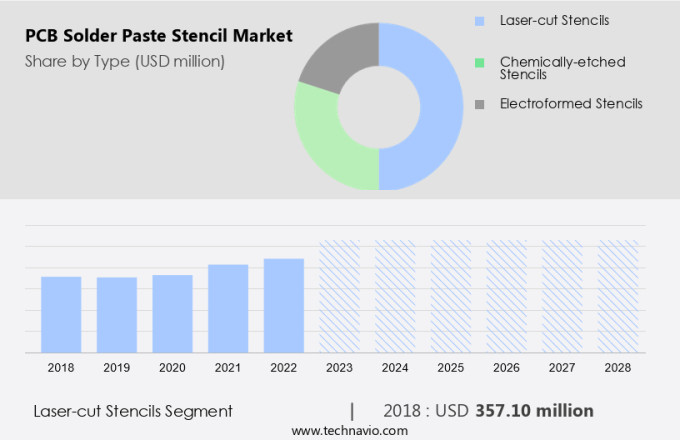

The PCB solder paste stencil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Laser-cut stencils

- Chemically-etched stencils

- Electroformed stencils

- Application

- Consumer electronics

- Automotive electronics

- Telecommunications

- Industrial electronics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Taiwan

- Rest of World (ROW)

- North America

.

By Type Insights

The laser-cut stencils segment is estimated to witness significant growth during the forecast period.

In the dynamic world of printed circuit board (PCB) assembly, solder paste stencils play a pivotal role in ensuring consistent and reliable soldering processes. The solder paste composition, a crucial element in this process, undergoes rigorous testing for optimal performance under various conditions, including thermal cycling and moisture sensitivity level. Product design, with its increasing focus on high-density interconnect and fine pitch components, necessitates stencils with high accuracy and precision. Laser-cut stencils, a preferred manufacturing method, offer superior edge definition and exceptional accuracy, making them indispensable for such applications. These stencils provide clean, burr-free edges, ensuring uniform solder paste deposit and reliable solder joint integrity.

The process's high precision and repeatability are essential for modern electronic manufacturing, where exacting standards are the norm. Laser cutting's ability to create complex aperture shapes and sizes caters to diverse component types and configurations. This versatility, coupled with the stencil's long life and compatibility with various soldering technologies like wave soldering and reflow soldering, makes laser-cut stencils a cost-effective solution for various industries. Environmental regulations and safety standards necessitate stringent process control, with stencil imaging and inspection playing a vital role. Stencil cleaning and maintenance are equally important for maintaining stencil accuracy and longevity. Industry standards and manufacturing best practices continually evolve, requiring ongoing optimization of stencil design, fabrication, and application processes.

Automated assembly and process efficiency are key trends in the market, with stencil machining, stencil alignment, and registration techniques advancing to meet these demands. Solder paste technology continues to innovate, with new chemistries and properties offering enhanced yield and reliability. The market's focus on cost optimization and component reliability ensures a steady demand for high-quality stencils and related services.

The Laser-cut stencils segment was valued at USD 357.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 90% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The APAC region is a significant market for the market, fueled by substantial investments and technological advancements in manufacturing. In October 2024, Amber Group's subsidiary, Ascent Circuits, revealed a USD76 million investment to build a new PCB manufacturing facility in Hosur, Tamil Nadu. This state-of-the-art facility will produce a wide array of PCBs, from simple single-sided to intricate multilayer and specialized circuits. This investment underscores the APAC region's growing influence in the market. The region's strong industrial foundation and commitment to innovation make it a key player. Product design and high-density interconnect drive the need for advanced solder paste stencils, ensuring precise stencil apertures and accurate component placement.

Thermal cycling and environmental testing are crucial for solder paste performance and reliability, as is process control and solder joint integrity. Safety regulations and lead-free soldering further complicate the process, necessitating optimization and cost reduction through automation and process efficiency. Fine pitch components and stencil imaging require high-precision stencils, while stencil fabrication and alignment ensure consistent registration. Solder paste chemistry and technology are continually evolving to meet the demands of electronic packaging and PCB assembly. Environmental regulations and defect analysis necessitate rigorous testing and quality control, from solder paste viscosity and stencil life to component sourcing and stencil maintenance.

Manufacturing standards and solder paste qualification are essential for yield enhancement and production optimization. Shock testing and vibration testing ensure the reliability of components and solder joints. The market is a dynamic and evolving landscape, driven by technological innovation and the demands of the electronics manufacturing industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of PCB Solder Paste Stencil Industry?

- The expansion of PCB manufacturing plants serves as the primary catalyst for market growth in this sector.

- The market is experiencing significant growth due to the increasing demand for advanced electronic devices and the expansion of PCB manufacturing facilities. The production of ultra-high-density interconnect PCBs, which cater to the military and semiconductor industries, necessitates precise and reliable solder paste application. This requirement drives the demand for high-quality PCB solder paste stencils. Component sourcing and surface mount technology (SMT) processes rely heavily on solder paste printing for efficient and accurate assembly. The importance of thermal management and yield enhancement in the SMT process further emphasizes the need for high-quality stencils. Industry standards for automated assembly and manual processes necessitate consistent stencil design and maintenance.

- Stencil machining techniques, such as laser cutting, ensure the production of accurate and durable stencils. The focus on process efficiency and quality control in the electronics industry necessitates the use of high-performance solder paste stencils. The market is expected to continue growing as the demand for advanced electronic devices and complex PCBs increases.

What are the market trends shaping the PCB Solder Paste Stencil Industry?

- The trend in the market is leaning towards increased investment in PCB manufacturing. This sector is poised for significant growth and professional development.

- The market is experiencing notable growth due to escalating investments in printed circuit board (PCB) manufacturing. This trend is driven by strategic initiatives and substantial funding from various organizations. For instance, on October 1, 2024, the Department of Defense allocated a USD30 million award to TTM Technologies Inc., based in Santa Ana, California. This investment, facilitated through the Defense Production Act Purchases (DPAP) office, is aimed at upgrading TTM's manufacturing capabilities by acquiring advanced equipment and developing prototype designs for high-density interconnect (HDI) PCBs. This investment underscores the industry's focus on enhancing production capabilities and fostering technological innovation.

- Key factors influencing market growth include the increasing demand for fine pitch components, the need for high solder joint integrity, and the importance of process control and stencil accuracy. Solder paste composition, viscosity, and chemistry play crucial roles in ensuring successful stencil printing and maintaining stencil life. Thermal cycling and environmental testing are essential for ensuring solder joint reliability and safety regulations compliance. Stencil imaging technology and stencil material selection are also critical aspects of the market. In conclusion, the market's growth is driven by the need for advanced PCB manufacturing capabilities, technological innovation, and the increasing demand for high-reliability electronic devices.

What challenges does the PCB Solder Paste Stencil Industry face during its growth?

- The high production costs represent a significant challenge impeding the growth of the industry.

- The market faces substantial challenges due to high production costs, which pose barriers to entry and influence market growth. Advanced manufacturing equipment, such as high-precision laser cutting systems and electroforming facilities, necessitate significant capital investment and drive up operational expenses. Moreover, the increasing costs of raw materials, particularly high-grade stainless steel and specialized nickel alloys, add to the financial burden on manufacturers. The need for skilled technicians, comprehensive quality control systems, and specialized maintenance further increases overhead expenses. These elevated production costs can lead to higher prices for end-users, particularly small- and medium-sized electronics manufacturers who may struggle to justify the investment in premium stencils.

- Environmental regulations also impact the market, as manufacturers must adhere to strict guidelines for stencil fabrication, stencil alignment, stencil measurement, and stencil registration to minimize waste and ensure the environmental sustainability of their processes. Solder paste performance is a critical factor in PCB assembly, with vibration testing and moisture sensitivity level playing essential roles in ensuring reliable component placement during wave soldering and reflow soldering processes. Process automation is another key trend, as manufacturers seek to improve efficiency, reduce labor costs, and minimize human error. In conclusion, the market is characterized by high production costs, stringent environmental regulations, and a focus on solder paste performance and process automation.

- These market dynamics create both opportunities and challenges for manufacturers and end-users in the electronic packaging industry.

Exclusive Customer Landscape

The PCB solder paste stencil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the PCB solder paste stencil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pcb solder paste stencil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASMPT Ltd. - The company specializes in providing advanced PCB solder paste stencils, including laser-cut, multi-level, and electroform options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASMPT Ltd.

- BlueRing Machining

- INDIC EMS Electronics Pvt Ltd

- LaserJob GmbH

- LPKF Laser and Electronics SE

- MechWareTronik Inc.

- Metal Etch Services Inc

- MicroScreen LLC

- PCB Prototype Manufacturing and Assembly Services

- Stencils Unlimited LLC

- StenTech

- Suntronic Inc

- Tecan Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PCB Solder Paste Stencil Market

- In February 2023, Indium Corporation, a leading materials supplier for the electronics manufacturing industry, introduced their new NexusPrint Solder Paste Stencil Cleaner. This innovative product is designed to improve print quality and increase productivity by reducing the need for frequent stencil cleaning (Indium Corporation Press Release, 2023).

- In May 2024, Panasonic Corporation and Juki Automation Systems announced a strategic partnership to jointly develop advanced solder paste stencil printers. This collaboration aims to enhance the production capacity and efficiency of electronic components manufacturing (Panasonic Corporation Press Release, 2024).

- In October 2024, KYZEN, a leading provider of precision cleaning chemistries, completed a significant investment in its production facility to expand its capacity for producing solder paste stencil cleaning solutions. This expansion is expected to support the growing demand for high-reliability electronics (KYZEN Press Release, 2024).

- In January 2025, the European Union announced new regulations regarding the use of lead-free solders in electronic components manufacturing. This policy change is expected to drive the demand for advanced solder paste stencil technologies, as lead-free solders require more precise application techniques (European Union Press Release, 2025).

Research Analyst Overview

- The solder paste stencil market is a critical component of the electronics industry, serving contract manufacturers and consumer electronics companies in their quest for efficient and reliable PCB assembly. Solder paste screening and failure analysis are essential processes to ensure the quality of stencils and prevent defects in SMT assembly lines. Industrial automation plays a significant role in enhancing the production process, with manufacturing execution systems and automated placement machines streamlining operations. Process simulation and design for testability are vital tools for supply chain optimization, enabling component database management and statistical process control. Solder paste companies and stencil manufacturers provide solutions to meet the varying needs of the industry, from high-performance computing to medical devices.

- Component manufacturers and electronics distributors collaborate to ensure a steady supply of components, while wave soldering machines and reflow ovens are integral to the assembly process. Lean manufacturing and six sigma methodologies further improve efficiency and reliability, with finite element analysis and CAD software providing valuable insights into design for manufacturing and design for testability. Stencil cleaning equipment and inspection systems are essential for maintaining stencil quality, ensuring consistent performance in the manufacturing process. The electronics industry continues to evolve, with data centers and the increasing demand for miniaturization driving innovation in the solder paste stencil market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PCB Solder Paste Stencil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2024-2028 |

USD 213.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

China, Taiwan, South Korea, Japan, US, Germany, Canada, UK, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PCB Solder Paste Stencil Market Research and Growth Report?

- CAGR of the PCB Solder Paste Stencil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pcb solder paste stencil market growth of industry companies

We can help! Our analysts can customize this pcb solder paste stencil market research report to meet your requirements.