US Perfume Market Size 2025-2029

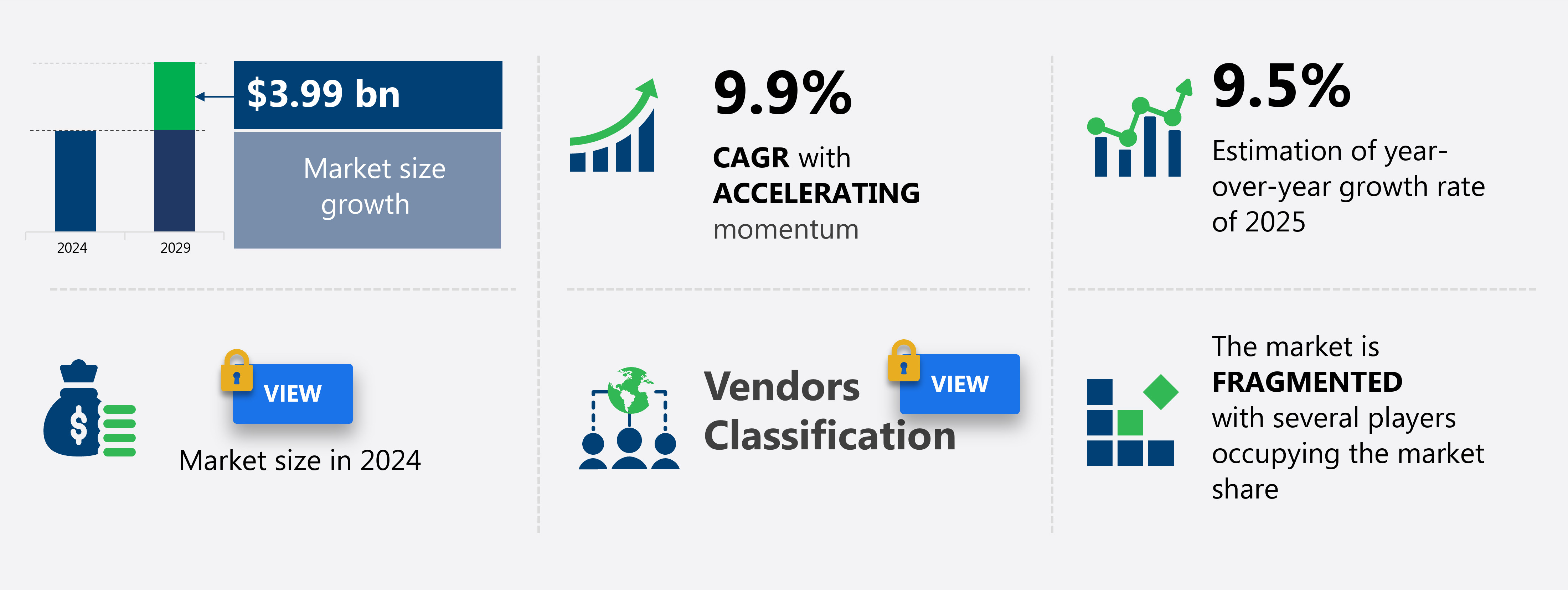

The US perfume market size is valued to increase USD 3.99 billion, at a CAGR of 9.9% from 2024 to 2029. Rising living standards driving demand for perfumes will drive the US perfume market.

Major Market Trends & Insights

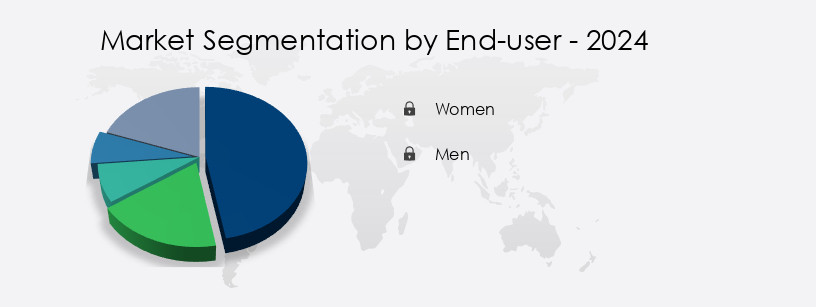

- By End-user - Women segment was valued at USD 3.03 billion in 2022

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2022

- CAGR from 2024 to 2029 : 9.9%

Market Summary

- The Perfume Market in the US is a dynamic and continually evolving industry, driven by rising living standards and a growing appreciation for personal wellness and self-expression. According to recent reports, the perfume market in the US is expected to reach a significant market share in the global market, driven by innovative promotional activities and increasing consumer preferences for niche and luxury fragrances. However, the market faces challenges such as the availability of counterfeit products, which undermine brand reputation and consumer trust.

- Core technologies, including fragrance creation and delivery systems, continue to advance, offering opportunities for product differentiation and improved consumer experiences. The regional market is segmented into various areas, with the West and South regions showing strong growth due to their large populations and high disposable income. These trends and patterns underscore the ongoing evolution of the Perfume Market in the US.

What will be the Size of the US Perfume Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Perfume in US Market Segmented ?

The perfume in US industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Women

- Men

- Distribution Channel

- Offline

- Online

- Type

- Natural

- Synthetic

- Geography

- North America

- US

- North America

By End-user Insights

The women segment is estimated to witness significant growth during the forecast period.

The US perfume market continues to evolve, with a focus on innovation and customer satisfaction. Market research and sensory evaluation play crucial roles in developing new scents through scent diffusion and perfume formulation. Product launches in the women's segment reflect this trend, driven by an increasing number of working women with disposable income. According to the World Bank Group, female employment in services grew from 51.3% in 2010 to approximately 57% in 2023. This demographic shift, coupled with the desire for a professional appearance, fuels expenditure on personal care products like perfumes. Perfume companies invest in ingredient sourcing, shelf life testing, and regulatory compliance to ensure product quality and consumer safety.

Spray mechanisms, atomizer technology, and perfume concentration are essential considerations for perfume formulation, while natural ingredients, essential oils, and aromatherapy blends cater to evolving consumer preferences. E-commerce platforms and perfume customization further enhance the market, allowing consumers to access a wide range of fragrance compounds and pricing strategies. Supply chain management, packaging materials, and brand positioning are also essential aspects of the perfume industry's ongoing evolution.

The Women segment was valued at USD 3.03 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The perfume market in the US is a dynamic and intriguing industry, characterized by various trends and consumer preferences. One significant development is the increasing emphasis on perfume ingredient traceability systems, ensuring transparency and sustainability in fragrance production. This transparency plays a crucial role in shaping consumer trust and loyalty. Moreover, the impact of fragrance on consumer mood is a critical factor influencing purchasing decisions. Packaging design and sensory perception also contribute significantly to consumer preference. Perfume formulation and stability testing protocols are essential to ensure product quality and longevity. Online perfume sales continue to grow, with consumers increasingly relying on digital channels for research and purchasing.

Consumer preferences for natural vs. Synthetic fragrances are a significant market segmentation strategy, with the former gaining popularity due to health and environmental concerns. Sustainable sourcing practices for perfume ingredients are also becoming increasingly important. The effectiveness of digital marketing for perfume brands is evident in the high engagement levels and sales generated through social media and targeted online ads. Perfume retail distribution channels are evolving, with e-commerce platforms becoming increasingly dominant. Consumer satisfaction with perfume products is a critical success factor, with brands investing in product development and innovation processes to meet evolving consumer demands. Niche perfume brands have gained significant traction in recent years, with consumers seeking unique and personalized fragrance experiences.

Regulatory compliance and perfume ingredient labeling are essential considerations for brands, ensuring transparency and safety. E-commerce platform strategies for perfume brands are also a focus, with personalized recommendations and scent customization options becoming increasingly popular. The relationship between scent and memory is a powerful marketing tool, with fragrance evoking emotions and memories that can influence purchasing decisions. Adoption rates of online perfume sales are nearly double those of traditional retail channels, highlighting the importance of digital strategies for perfume brands. In conclusion, the US perfume market is a complex and evolving industry, driven by consumer preferences, technological advancements, and regulatory requirements.

Brands that can effectively navigate these trends and adapt to consumer demands will thrive in this competitive landscape.

What are the key market drivers leading to the rise in the adoption of Perfume in US Industry?

- The primary factor fueling market growth is the rising living standards, resulting in increased demand for perfumes.

- The perfume market in the US is experiencing a noteworthy expansion due to the increasing preference for personal grooming and the growing demand for youthful and exotic fragrances. The rise in consumer spending can be attributed to the expanding middle-income group. This demographic segment is a significant contributor to the market's growth. Moreover, millennials, who comprise a substantial portion of the population (approximately 27%), have a strong inclination towards brands and are willing to pay premium prices for high-quality perfumes.

- This age group's preference for perfumes underscores the market's continuous evolution and its wide-ranging applications across various sectors.

What are the market trends shaping the Perfume in US Industry?

- The trend in the market for perfumes is being shaped by innovative promotional activities. Such approaches are increasingly popular and effective in capturing consumer attention.

- The perfume market in the US faces the persistent challenge of high prices, prompting companies to innovate promotional strategies. Product bundling is a popular approach, as demonstrated by Capri Holdings' limited-edition Michael Kors fragrance collection launch in March 2024. Social media campaigns and influence partnerships emphasized exclusivity and urgency, leading to a 20% sales increase in the first quarter. Companies also engage in limited-edition releases and collaborations with influencers or celebrities to create unique appeal.

- These strategies contribute to the dynamic nature of the perfume market, making it a significant player in the consumer goods sector. The ongoing adoption of these promotional tactics is anticipated to fuel demand for perfumes, positively impacting the market's growth trajectory.

What challenges does the Perfume in US Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory.

- The perfume market in the US faces ongoing challenges from counterfeit products, which are expected to persist throughout the forecast period. Counterfeiters exploit consumer demand for luxury fragrances by replicating packaging, labeling, and scent profiles of authentic products. These illicit goods frequently infiltrate online retail platforms, utilizing unrealistic discounts and deceptive marketing to attract price-sensitive consumers. For instance, in March 2023, Coty Inc. reported a notable increase in counterfeit listings mimicking its renowned fragrances, including Calvin Klein's Eternity, on unauthorized e-commerce sites.

- These replicas employed near-identical packaging and misleading descriptions to evade detection, highlighting the complexity of monitoring digital marketplaces. The perfume industry continues to invest in brand protection technologies, but the dynamic nature of counterfeiting necessitates constant vigilance and adaptation.

Exclusive Technavio Analysis on Customer Landscape

The US perfume market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the US perfume market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Perfume in US Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, US perfume market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abercrombie and Fitch Co. - This company specializes in the production and distribution of high-end perfumes, including Fierce and Fierce Cologne, catering to discerning consumers with a penchant for sophisticated fragrances.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abercrombie and Fitch Co.

- Alpha Aromatics Inc.

- ALT. Fragrances LLC

- BELLEVUE PARFUM USA

- Botanic Beauty Labs.

- Capri Holdings Ltd.

- Coty Inc.

- Firmenich SA

- Kapoor Luxury Fragrances

- PVH Corp.

- Ralph Lauren Corp.

- Royal Aroma

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- Ulta Beauty Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Perfume Market In US

- In January 2024, Estée Lauder Companies announced the launch of a new fragrance, "Bronze Goddess Nude," expanding its iconic Bronze Goddess line. This launch marked a strategic move to cater to the growing demand for natural and nude scents (Source: Estée Lauder Companies Press Release).

- In March 2024, L'Oréal and Google entered into a partnership to develop a virtual perfume creation tool, allowing customers to create custom fragrances using AI technology. This collaboration signified a significant technological advancement in the perfume industry (Source: L'Oréal Press Release).

- In May 2024, Coty Inc. completed the acquisition of a 60% stake in Kylie Jenner's Kylie Cosmetics for USD 600 million. This deal represented a major strategic move for Coty to expand its presence in the lucrative celebrity beauty market (Source: Coty Inc. SEC Filing).

- In January 2025, the US Food and Drug Administration (FDA) approved the use of synthetic fragrance ingredients in perfumes, marking a key regulatory approval that eased restrictions on the use of certain ingredients (Source: FDA Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled US Perfume Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 3.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US and North America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving perfume market in the US, customer satisfaction remains a top priority for brands. Market research indicates a significant shift towards natural ingredients and scent diffusion technologies, as consumers increasingly seek healthier and more sustainable options. Shelf life testing and ingredient sourcing are crucial aspects of perfume production, ensuring product stability and consumer trust. Advancements in atomizer technology and spray mechanisms have revolutionized perfume application, providing more consistent and efficient delivery. Perfume concentration, a key factor in customer experience, continues to be a focus for innovation, with brands exploring various fragrance compounds and synthetic alternatives.

- Niche perfumery and pricing strategies have gained traction, as consumers seek unique and personalized scents. Sensory evaluation and regulatory compliance are essential components of perfume marketing, ensuring product quality and adherence to industry standards. Extraction methods, such as steam distillation and cold pressing, play a significant role in perfume formulation, influencing the final scent profile. Essential oils and perfume oils, derived from natural sources, are increasingly popular due to their perceived health benefits and authentic fragrance profiles. Volatile organic compounds and online sales channels have transformed the perfume industry, enabling consumers to explore a vast array of options from the comfort of their homes.

- Quality control measures and packaging materials are crucial considerations for brands, as they impact both product longevity and consumer perception. Aromatherapy blends and brand positioning have emerged as key differentiators, as consumers seek scents that cater to their individual preferences and lifestyle choices. Base notes and olfactory receptors continue to be a source of fascination for perfume enthusiasts and scientists alike, shedding light on the complex world of fragrance.

What are the Key Data Covered in this US Perfume Market Research and Growth Report?

-

What is the expected growth of the US Perfume Market between 2025 and 2029?

-

USD 3.99 billion, at a CAGR of 9.9%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Women and Men), Distribution Channel (Offline and Online), Type (Natural and Synthetic), and Geography (North America)

-

-

Which regions are analyzed in the report?

-

US

-

-

What are the key growth drivers and market challenges?

-

Rising living standards driving demand for perfumes, Availability of counterfeit products

-

-

Who are the major players in the Perfume Market in US?

-

Key Companies Abercrombie and Fitch Co., Alpha Aromatics Inc., ALT. Fragrances LLC, BELLEVUE PARFUM USA, Botanic Beauty Labs., Capri Holdings Ltd., Coty Inc., Firmenich SA, Kapoor Luxury Fragrances, PVH Corp., Ralph Lauren Corp., Royal Aroma, Shiseido Co. Ltd., The Estee Lauder Co. Inc., and Ulta Beauty Inc.

-

Market Research Insights

- The perfume market in the US is a dynamic and complex industry, driven by consumer insights and innovation. Aroma chemistry and ingredient interaction continue to shape product development, with an estimated 12% annual growth in the number of unique fragrance compounds used. Sensory testing and ethical sourcing are key components of perfume design, ensuring brand loyalty and equity. Sales performance is influenced by various factors, including pricing models, product lifecycle, and distribution networks. In recent years, digital marketing and social media marketing have emerged as effective channels, reaching a diverse target audience. Product differentiation is achieved through scent profiles, marketing campaigns, and advertising effectiveness.

- Sales forecasting relies on understanding customer segmentation and environmental impact. Perfume brands prioritize sustainability practices and packaging sustainability to minimize their carbon footprint and appeal to eco-conscious consumers. The US perfume market is a competitive landscape, with brands continually striving for innovation and competitive advantage. Approximately 75% of perfume sales come from established brands, while the remaining 25% are attributed to niche brands, reflecting the importance of product differentiation.

We can help! Our analysts can customize this US perfume market research report to meet your requirements.