Personal Lubricants Market Size 2024-2028

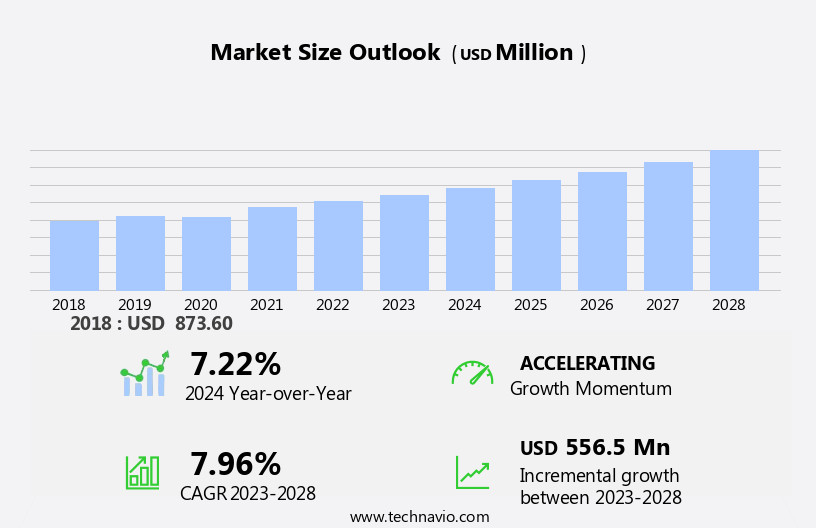

The personal lubricants market size is forecast to increase by USD 556.5 million at a CAGR of 7.96% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One major trend driving market growth is the increasing demand for high product visibility, as consumers seek out lubricants that cater to their specific needs and preferences. Another factor is the growing preference for organic and natural products, as consumers become more health-conscious and seek alternatives to synthetic lubricants. Additionally, concerns over side effects and allergies have led to a rise in demand for hypoallergenic and fragrance-free lubricants. E-commerce, drug stores, retail pharmacy chains, hypermarkets, and retail grocery stores are key sales channels. These trends are expected to continue shaping the market in the coming years. Despite these growth opportunities, the market faces challenges such as regulatory compliance and competition from alternative sexual wellness products. Overall, the market is expected to remain dynamic and competitive, with ongoing innovation and consumer education playing crucial roles in its development.

What will be the Size of the Personal Lubricants Market During the Forecast Period?

- The market in the United States is experiencing significant growth due to various factors. Aging demographics, particularly the geriatric women population, are driving demand as life expectancy increases and menopausal symptoms such as vaginal dryness become more prevalent. This trend is further fueled by the rising prevalence of erectile dysfunction among older men, leading to increased use of lubricants during sexual activity. The market is also witnessing a shift towards silicone-based lubricants due to their long-lasting properties and ability to reduce friction during sexual engagement. Additionally, the use of personal lubricants with latex condoms is becoming more common to enhance sexual experience and alleviate vaginal discomfort.

- Key players in the market include Reckitt Benckiser, Durex Condoms, KY Lubricants, and others. Middle-aged and older demographics are increasingly recognizing the importance of maintaining sexual health and engagement, leading to continued growth in product demand. Silas Capital, Cake, Playground, and other investors are recognizing this trend and investing in the market.

How is this Personal Lubricants Industry segmented and which is the largest segment?

The personal lubricants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Water-based lubricants

- Silicon-based lubricants

- Oil-based lubricants

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Product Insights

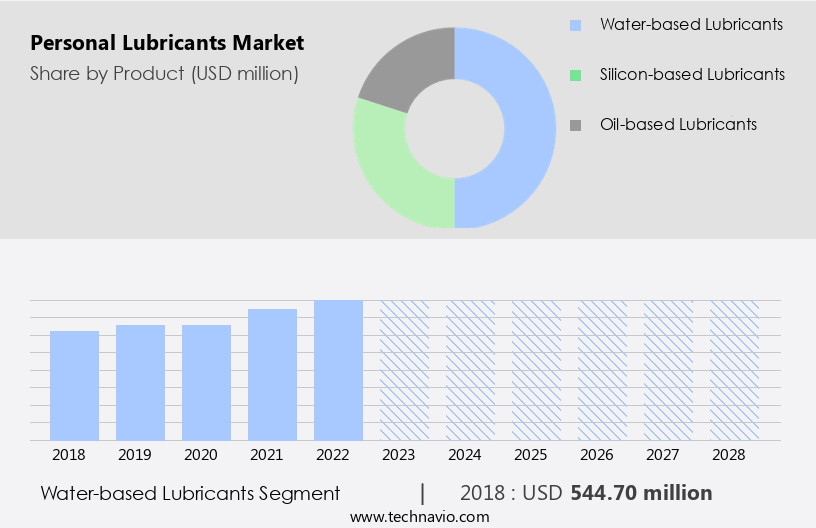

- The water-based lubricants segment is estimated to witness significant growth during the forecast period.

Personal lubricants are essential sexual health products used to reduce friction and enhance sexual pleasure during intimacy. Water-based lubricants, a popular type, offer smooth consistency and easy clean-up, making them suitable for use with latex condoms. However, their quick absorption and requirement for frequent reapplication can be drawbacks. The growing population of older adults, particularly geriatric women, experiencing menopausal symptoms like vaginal dryness and the increasing acceptance of sexual health discussions drive the market demand. Men, too, use lubricants to alleviate erectile dysfunction and improve sexual engagement. The market caters to various age brackets, with offerings including silicone-based and oil-based lubricants, as well as topicals like the O-Shot Women and those derived from plant-derived oils, such as aloe vera, lactic acid, and hemp clear extract.

Sex workers, sedentary lifestyles, stress, and changing lifestyles and attitudes contribute to the market's growth. Sexual health products, including lubricants, are essential for addressing vaginal discomfort and enhancing the overall sexual experience.

Get a glance at the market report of share of various segments Request Free Sample

The Water-based lubricants segment was valued at USD 544.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

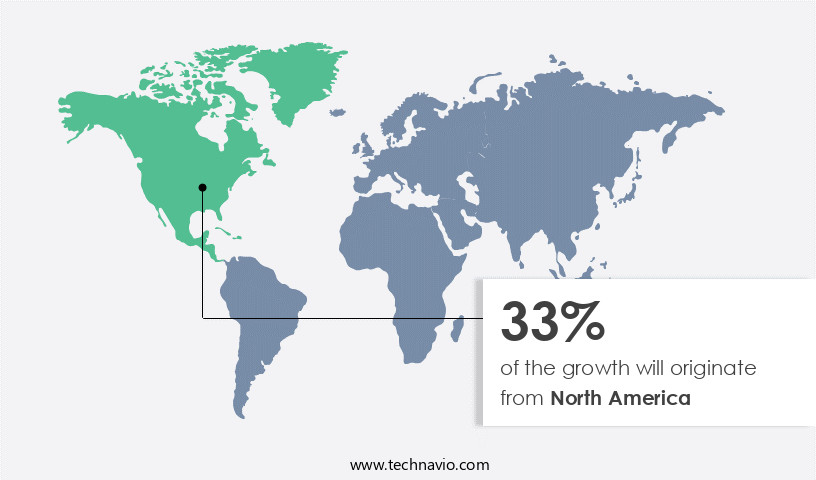

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In North America, the market for personal lubricants is driven by the large population of middle-aged demographics and older individuals in the US and Canada. The increasing geriatric women population, with associated menopausal symptoms such as vaginal dryness, and the growing awareness of sexual health and wellness have fueled the demand for these products. The presence of retail pharmacy chains, supermarkets, and e-commerce platforms as distribution channels further enhances market accessibility. Sexual wellness products, including lubricants, are increasingly used to enhance sexual pleasure, reduce friction, and provide pain relief during intercourse. Condoms, sex toys, and various topicals are popular sexual health products.

Silicone-based, water-based, and oil-based lubricants cater to diverse consumer preferences. Latex compatibility, long-lasting attributes, and plant-derived oils like aloe vera, lactic acid, hemp clear extract, and glycerin are significant factors influencing consumer choice. Sedentary lifestyles, stress, and changing attitudes towards sexuality have led to increased demand for these products. Sex workers and individuals with erectile dysfunction also use lubricants to enhance their sexual experiences. The market in North America is expected to grow due to the aging population, increasing awareness of sexual health, and the availability of innovative product offerings. The market caters to various consumer segments, including men and women, and offers a range of products to address diverse needs.

The market is competitive, with various companies offering a wide range of products to cater to the evolving consumer demands.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Personal Lubricants Industry?

High product visibility is the key driver of the market.

- The market in the US has witnessed significant growth due to various factors. The increasing geriatric women population and the associated menopausal symptoms, such as vaginal dryness, have led to a rise in demand for these products. Moreover, the increasing life expectancy and sedentary lifestyles have resulted in an increase in the number of older individuals seeking sexual engagement. Both men and women, across various age brackets, are turning to personal lubricants to enhance their sexual experiences and alleviate vaginal discomfort. The market offers a range of lubricants, including water-based, silicone-based, and oil-based, each with its unique benefits. Water-based lubricants are popular due to their ability to mimic natural lubrication, while silicone-based lubricants offer long-lasting attributes and are ideal for massage applications.

- Oil-based lubricants, derived from plant-derived oils like aloe vera, lactic acid, and hemp clear extract, provide additional benefits like pain relief and friction reduction. The market caters to various consumer preferences and needs, including those using latex condoms, sex toys, and those seeking alternative avenues for sexual pleasure. The market also offers innovative product offerings like the O-Shot Women, which is a platelet-rich plasma therapy used to enhance sexual pleasure. The Internet has played a significant role in the growth of the market. E-commerce platforms and drug stores have made these products easily accessible to consumers. Consumers can now purchase these products from the comfort of their homes, eliminating the need for physical stores.

- The market is also witnessing a shift towards retail pharmacy chains, supermarkets, and hypermarkets as consumers increasingly seek these products alongside their daily shopping. Factors like changing lifestyles, attitudes, and social stigma surrounding sexual health products have also influenced market growth. The market is expected to continue growing as consumers become more open about their sexual health needs and seek products to enhance their sexual experiences.

What are the market trends shaping the Personal Lubricants Industry?

Demand for organic products is the upcoming market trend.

- The market in the US is experiencing significant growth due to various factors. One of the key drivers is the increasing geriatric women population, as menopause and its associated symptoms, including vaginal dryness, lead to an increased demand for lubricants. Additionally, the rising life expectancy and changing lifestyles have resulted in older individuals, both men and women, seeking products to enhance their sexual experiences. Moreover, the increasing prevalence of erectile dysfunction among men and the popularity of sex toys have also contributed to the market's expansion. The demand for lubricants is not limited to sexual intercourse but also extends to masturbation and massage applications.

- Organic lubricants are gaining popularity due to their natural ingredients and fewer side effects. Aloe Vera, lactic acid, hemp clear extract, and glycerin are some of the plant-derived ingredients used in organic lubricants. These products offer benefits such as friction reduction, pain relief, and long-lasting attributes. Latex compatibility is a crucial factor in the selection of lubricants, especially for those using condoms. Silicone-based lubricants are not recommended for use with latex condoms as they can cause condom breakage, leakage, and unintended pregnancies. Water-based and oil-based lubricants are suitable alternatives. The market for lubricants is diverse, with e-commerce and drug stores being major retail channels.

- Innovative product offerings, such as the O-Shot Women procedure, have also emerged, providing additional avenues for growth. Sedentary lifestyles, stress, and social stigma surrounding sexual health products have influenced consumer attitudes toward lubricants. However, the increasing acceptance of open discussions about sexual health and the normalization of sexual pleasure as a part of overall wellness have led to a shift in market dynamics. Retail pharmacy chains, supermarkets, and hypermarkets are other significant retail channels for lubricants. The market is expected to continue growing as consumers seek to enhance their sensory experiences through lubricants, catering to their five senses and women's mood and libido.

What challenges does the Personal Lubricants Industry face during its growth?

Side effects and allergies is a key challenge affecting the industry growth.

- Personal lubricants are essential sexual health products used to enhance sexual pleasure and reduce friction during sexual activities. The market for these products caters to various age brackets, including the middle-aged demographic and older individuals. Factors such as vaginal discomfort due to menopausal symptoms, vaginal dryness, and erectile dysfunction drive the demand for personal lubricants. However, the use of lubricants, especially those with high cellular weight, can lead to skin reactions and irritations. The human genitalia contains mucous membranes that are sensitive and require gentle care. The manufacturing capacity of personal lubricants has increased to cater to the growing demand from various segments, including men, women, and sex workers.

- The ingredients used in these products can vary, with some using petrochemicals that may cause hyperosmolarity and lead to cell damage. Alternative avenues, such as plant-derived oils like aloe vera, lactic acid, hempclear extract, and glycerin, are gaining popularity due to their natural properties and fewer side effects. The market offers various types of lubricants, including water-based, silicone-based, and oil-based, each with its unique attributes. Latex compatibility, long-lasting attributes, and pain relief are some of the factors considered when choosing a lubricant. Sedentary lifestyles, stress, and changing lifestyles and attitudes have led to an increase in the use of personal lubricants.

- Retail pharmacy chains, supermarkets, e-commerce platforms, and hypermarkets are some of the primary retail outlets for these products. The market is continuously evolving, with innovative product offerings and changing consumer preferences shaping its future.

Exclusive Customer Landscape

The personal lubricants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal lubricants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal lubricants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansell Ltd.

- Bijoux Indiscrets SL

- BioFilm Inc.

- Bodywise Ltd.

- Church and Dwight Co. Inc.

- Cupid Ltd.

- Doc Johnson Enterprises

- Elbow Grease

- Good Clean Love Inc.

- LELOi AB

- Lovehoney Group Ltd.

- Okamoto Industries Inc.

- Reckitt Benckiser Group Plc

- Sliquid LLC

- TENGA Co. Ltd.

- The Aneros Co.

- The Yes Yes Co. Ltd.

- Toaster Labs Inc.

- Trigg Laboratories Inc.

- WOW Tech International GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Personal lubricants have become an essential component of sexual health and wellness for individuals of all ages. This market caters to the needs of various demographics, including men and women, older adults, and the middle-aged population. The demand for personal lubricants is driven by several factors, including vaginal discomfort, menopausal symptoms, and erectile dysfunction. One significant factor influencing the market is the growing geriatric women population. With increasing life expectancy, more women are experiencing menopause and the associated symptoms, such as vaginal dryness. These symptoms can lead to discomfort during sexual activity, making personal lubricants an essential solution. Another factor contributing to the market's growth is the changing lifestyles and attitudes towards sexual health.

Sedentary lifestyles, stress, and the increasing use of sex toys have led to an increased demand for personal lubricants. These products are used not only for sexual intercourse but also for masturbation and massage applications. The market offers a range of products, including liquid and gels, with varying consistencies. Some prefer a gel-like consistency, while others opt for oil-based or water-based lubricants. Silicone-based lubricants are known for their long-lasting attributes, making them a popular choice among consumers. Plant-derived oils, such as sweet almond, sunflower seed, and coconut oil, are also gaining popularity in the market. These natural alternatives offer a more organic and eco-friendly option for consumers.

However, it is essential to note that not all natural oils are compatible with latex condoms, so consumers must be aware of this when making their purchases. The market for personal lubricants also caters to the needs of sex workers and individuals with specific requirements, such as those with latex allergies or those seeking pain relief. Innovative product offerings, such as the O-Shot for women and topicals infused with ingredients like aloe vera, lactic acid, hempclear extract, and glycerin, have entered the market, catering to the diverse needs of consumers. The market for personal lubricants is vast and diverse, with various distribution channels, including e-commerce, drug stores, retail pharmacy chains, hypermarkets, and retail grocery stores.

Consumers can also find these products in adult stores and specialized sexual health clinics. The market is a growing industry that caters to the sexual health and wellness needs of individuals. With a focus on innovation, natural ingredients, and consumer convenience, this market is poised for continued growth. The market dynamics, including changing lifestyles, attitudes, and social stigma, continue to shape the demand for personal lubricants, making it an exciting space to watch.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.96% |

|

Market growth 2024-2028 |

USD 556.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.22 |

|

Key countries |

US, UK, China, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Lubricants Market Research and Growth Report?

- CAGR of the Personal Lubricants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal lubricants market growth of industry companies

We can help! Our analysts can customize this personal lubricants market research report to meet your requirements.