Sunflower Market Size 2024-2028

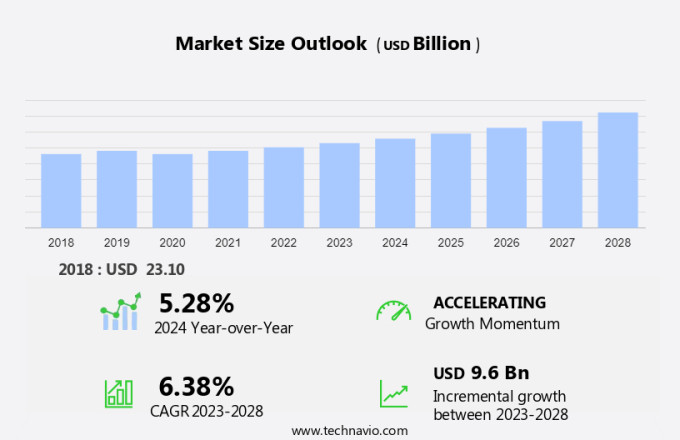

The sunflower market size is forecast to increase by USD 9.6 billion at a CAGR of 6.38% between 2023 and 2028. The market exhibits significant growth, driven by the increasing demand for health products derived from sunflower oil. This demand is fueled by consumers' preference for edible oils that offer various health benefits, such as essential fatty acids and vitamin E. Furthermore, advancements in agriculture have led to the production of high-yielding sunflower hybrids increasing supply. However, the market faces challenges due to the volatility in oilseed crop prices, which can be attributed to the limited availability of arable land and seasonal weather conditions. This financial support facilitates access to high-quality seeds, advanced farming techniques, and efficient processing technologies. Additionally, the market for sunflower products extends beyond oil, with growing trends in snacks, bakery items, and autumn beauty products utilizing sunflower seeds and oil. Companies are capitalizing on this trend by offering a range of sunflower-based products, from black oil sunflower seeds to medical-grade sunflower oil. The market is poised for continued growth, as consumers seek out healthier alternatives and innovative uses for this versatile crop.

What will be the Size of the Market During the Forecast Period?

The market in North America is a significant player in the agricultural and industrial sectors. The market encompasses various applications, including sunflower oil production, sunflower seeds for edible and decorative purposes, and biofuel production. Sunflowers, scientifically known as Helianthus annuus, are popular for their large, vibrant yellow flowers that symbolize autumn beauty and the Aztec sun. They offer numerous benefits, from edible uses to cosmetics and industrial applications. Sunflower oil, derived from sunflower seeds, is rich in essential fatty acids, including linoleic acid and oleic acid.

Moreover, these healthy fats contribute to the oil's high smoke point, making it a popular choice for cooking and food service providers. Additionally, sunflower oil is rich in vitamin E, an antioxidant that benefits both human health and the cosmetics industry. Sunflower seeds are consumed for their nutritional value, particularly their high protein and healthy fat content. They are also used for decorative purposes, such as bird feed and sunflower seed packets for gardening. Magnetic seed treatment, a modern innovation, enhances sunflower seed germination and growth. This technology improves the overall yield and quality of sunflower crops, making it an essential investment for farmers.

Furthermore, the food industry segment is a significant consumer of sunflower seeds and oil. Sunflower oil is used in various food applications, from baking and frying to salad dressings and sauces. Sunflower seeds are consumed as snacks, added to trail mixes, and used in baking and cooking. The cosmetics industry sector also benefits from sunflower derivatives. Sunflower oil and sunflower seed extracts are used in skincare and haircare products due to their moisturizing and antioxidant properties. Sunflower seeds and oil are also used as biofuel feedstocks. The production of biodiesel from sunflower oil is a sustainable alternative to traditional fossil fuels, contributing to the reduction of greenhouse gas emissions.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Oilseed

- Non-oilseed

- Geography

- Europe

- APAC

- China

- South America

- Argentina

- North America

- Middle East and Africa

- Europe

By Type Insights

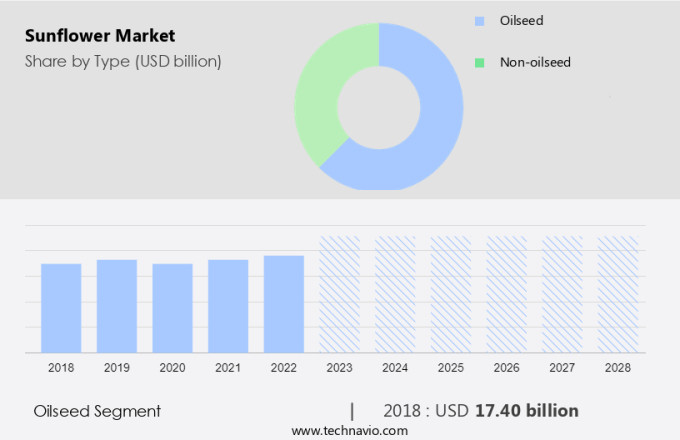

The oilseed segment is estimated to witness significant growth during the forecast period. Sunflower oil, a popular health product derived from sunflower seeds, holds a significant market share in the health foods sector, particularly in countries like China and India. The Food Safety and Standards Authority of India (FSSAI) ensures the safety and authenticity of sunflower oil by regulating the use of organic ingredients. This region's preference for organic edible oils, including sunflower, canola, coconut, and soybean, is driven by their numerous health benefits. The increasing concern over oil adulteration has led consumers to opt for approved organic options, thereby fueling the demand for these products. As a result, the sales of organic edible oils are projected to grow substantially in the Asia Pacific (APAC) region during the forecast period.

In addition to their edible uses, sunflowers are also popular for their ornamental value and as snacks. For instance, the Chianti Hybrid sunflower is a decorative variety, while Arnika sunflower seeds are a popular snack. Sunflower oil's versatility extends to the bakery industry, where it is used as a cooking and frying oil due to its high smoke point. Furthermore, black oil, a type of sunflower oil, is used for medicinal purposes. The Aztec Sun, a popular brand of sunflower oil, is known for its high-quality products and commitment to sustainability. Sunflower oil's health benefits, versatility, and increasing consumer awareness of organic products are driving its demand in the APAC market.

Get a glance at the market share of various segments Request Free Sample

The oilseed segment was valued at USD 17.40 billion in 2018 and showed a gradual increase during the forecast period.

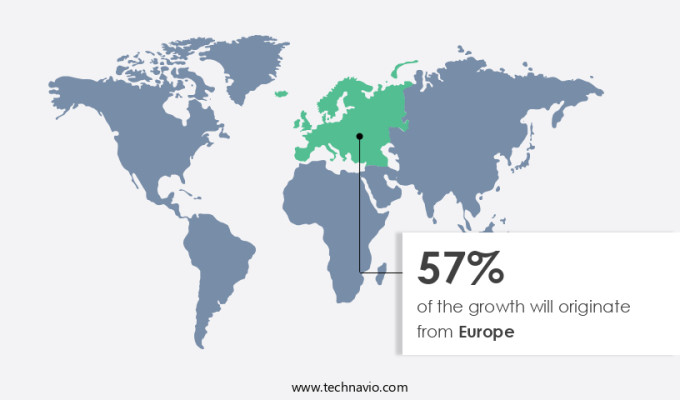

Regional Insights

Europe is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market experienced growth in 2023, with a projected processing volume of 12.4 million tons. Several European countries, including Germany, France, the UK, Spain, Italy, and Belgium, significantly contributed to this market expansion. The sunflower cultivation area in Europe expanded by approximately 1% to 4.5 million hectares, surpassing the five-year average by 7%. Favorable weather conditions during the growing season resulted in larger harvests, offsetting the challenges faced in previous years due to insufficient rainfall during the yield-forming period and excessive rainfall during harvest time in Bulgaria and Romania. Key edible oils derived from sunflower seeds, such as biodiesel, canola oil, olive oil, coconut oil, soybean oil, palm oil, groundnut oil, linoleic oil, safflower oil, and grape seed oil, are in high demand in Europe.

Furthermore, these oils are essential for various industries, including food processing, cosmetics, pharmaceuticals, and biodiesel production. The European market's growth is driven by the increasing demand for these oils and the expansion of sunflower cultivation in the region. Mid oleic oil, a high-quality sunflower oil with a monounsaturated fatty acid content of approximately 80%, is gaining popularity due to its health benefits. Refined sunflower oil is another important product derived from sunflower seeds, widely used in cooking and industrial applications. The European market's growth is expected to continue, driven by the increasing demand for these oils and the expansion of sunflower cultivation in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Demand for sunflower oil is the key driver of the market. Sunflower oil, derived from sunflowers, is a popular choice for various industries, including the food and cosmetics sectors. In the food industry segment, sunflower oil, specifically Linoleic Sunflower Oil, is widely used for frying, stir-frying, steaming, and grilling due to its high smoke point and neutral taste.

Furthermore, the food service providers category also utilizes this oil for commercial food preparation. In the cosmetics industry sector, unrefined sunflower oil is used in the production of skincare products, haircare products, and massage oils due to its rich nutrients and moisturizing properties. The demand for these products is increasing as consumers seek natural alternatives to synthetic ingredients. This resulted in the depletion of global stocks and a subsequent increase in sunflower seeds and oil prices. Despite this, sunflower oil remains a valuable commodity in both the food and cosmetics industries.

Market Trends

Advancement in agriculture is the upcoming trend in the market. The agricultural industry has experienced significant advancements through the adoption of modern technologies, such as precision farming and the utilization of drones. Precision farming is a crop and livestock management system that leverages global positioning systems to monitor and control field equipment, including irrigation systems, agrochemical applicators, and weed control systems.

This technology offers various benefits, including equipment guidance, yield assessment, and variable rate input applications. By automating a substantial portion of agricultural operations, precision farming enables farmers to minimize input costs and enhance productivity.

Market Challenge

Fluctuation in oilseed crop prices due to lack of land is a key challenge affecting market growth. The markets have gained significance due to the health benefits associated with sunflower oil. Unsaturated fats, which are abundant in sunflower oil, contribute to heart health by reducing bad cholesterol levels without increasing good cholesterol. Additionally, sunflower oil is rich in antioxidants, which help prevent cardiovascular diseases by neutralizing free radicals. Sunflower oil is cholesterol-free and has a neutral flavor, making it a versatile choice for various culinary applications. The nutritious oil is free from animal fats, aligning with government-led campaigns promoting healthy eating habits and the consumption of nutritious foods. Despite the numerous benefits, sunflower oil production levels have been decreasing due to several factors.

Furthermore, volatile oilseed crop prices, such as sunflower, are influenced by variable weather conditions and political instability, affecting the output of oil crop producers and limiting oil supply to manufacturers. Moreover, restricted access to funding and a lack of information about contemporary agricultural practices and farm management skills further hinder production levels. However, the volatile sunflower oil market, influenced by weather conditions and political instability, affects the supply and price of this nutritious oil.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co. - The company offers sunflower that includes sunflower oil, mid-oleic sunflower oil, dewaxed mid-oleic sunflower oil, expeller pressed high-oleic sunflower, dewaxed expeller pressed high-oleic sunflower oil which is used in nutrition bars, nutritional beverages, snack food frying, popcorn, spray oils, baked goods, cereals and dry mixes and bring specific functional benefits.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Bunge Ltd.

- Cargill Inc.

- Colorado Mills

- Conagra Brands Inc.

- Corteva Inc.

- Giant Snacks Inc.

- GoldenSun

- Groupe Limagrain

- Kaissa Oil

- Kenko Trading Co. Ltd.

- MACJERRY SUNFLOWER OIL COMPANY Co. Ltd.

- Mahyco Pvt. Ltd.

- Nufarm Ltd.

- Nuziveedu Seeds Ltd.

- PANNAR Ltd.

- Parakh Group

- REIN Oil

- Syngenta Crop Protection AG

- UPL Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sunflowers, with their large, vibrant yellow blooms, have captured the attention of various industries due to their versatility. Sunflower seeds, rich in essential nutrients like linoleic and oleic acids, vitamin E, and antioxidants, are popular in the health-conscious sector. Sunflower oils, such as refined and unrefined, are preferred for their neutral flavor and culinary versatility in salad dressings, marinades, and processed foods. They are used in edible oils, such as refined and unrefined sunflower oil, for cooking oil, snacks, bakery items, and confectionery products. The modern lifestyle has led to an increase in demand for sunflower oil in the food industry segment, particularly in the production of functional foods and processed food. Sunflower oil is also used in the cosmetics industry sector for skincare, haircare, and massage oils due to its rich nutrient profile.

Furthermore, sunflowers are not just used for their seeds but also their ornamental value during autumn. The market includes various hybrids like the Chianti hybrid, which is known for its autumn beauty. Sunflower oil is also used as a biofuel and in the industrial sectors for the production of biodiesel. The health benefits of sunflower oil extend beyond edible uses. It is cholesterol-free and rich in unsaturated fats, making it an ideal choice for those with cardiovascular diseases. Sunflower oil is also used in medical applications and personal care solutions due to the presence of ceramide molecules and its neutral flavor. The market also includes the production of decorative sunflowers for various purposes, including the use of sunflower seeds in aromatherapy and the use of sunflower petals in floral arrangements. The market is expected to grow significantly due to government-led campaigns promoting healthy eating habits and the increasing popularity of nutritious foods.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.38% |

|

Market growth 2024-2028 |

USD 9.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Regional analysis |

Europe, APAC, South America, North America, and Middle East and Africa |

|

Performing market contribution |

Europe at 57% |

|

Key countries |

Russia, Ukraine, Argentina, China, and Romania |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Archer Daniels Midland Co., Bunge Ltd., Cargill Inc., Colorado Mills, Conagra Brands Inc., Corteva Inc., Giant Snacks Inc., GoldenSun, Groupe Limagrain, Kaissa Oil, Kenko Trading Co. Ltd., MACJERRY SUNFLOWER OIL COMPANY Co. Ltd., Mahyco Pvt. Ltd., Nufarm Ltd., Nuziveedu Seeds Ltd., PANNAR Ltd., Parakh Group, REIN Oil, Syngenta Crop Protection AG, and UPL Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, South America, North America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch