Pet Scanners Market Size 2024-2028

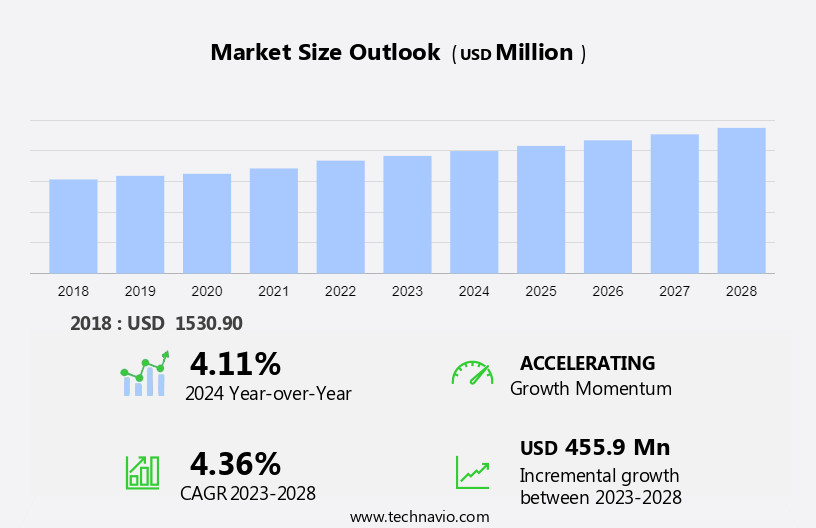

The pet scanners market size is forecast to increase by USD 455.9 million, at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing prevalence of chronic diseases in companion animals. As pets age, they become more susceptible to various health conditions, necessitating advanced diagnostic tools like PET scanners. These c offer accurate and detailed information on animal anatomy and physiology, enabling early detection and effective treatment of diseases. Technological advancements in PET scanner technology are further fueling market growth. Innovations such as improved resolution, faster scan times, ultrasounds equipments and enhanced image quality are making PET scanners increasingly indispensable in veterinary medicine. However, the high cost of these advanced imaging systems remains a significant challenge for market expansion.

- Veterinary clinics and hospitals must carefully weigh the benefits against the substantial investment required to acquire and maintain a PET scanner. Despite this hurdle, the potential for improved patient outcomes and increased diagnostic capabilities make PET scanners a valuable investment for veterinary practices seeking to provide top-tier care.

What will be the Size of the Pet Scanners Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and applications across various sectors. Precision medicine and treatment response assessment are key areas of focus, with pet scanners playing a crucial role in nuclear medicine and cancer detection. Technology development is ongoing, with innovations in artificial intelligence and machine learning enhancing image analysis capabilities. Regulatory compliance, such as CE marking and FDA approval, are essential considerations. Image quality is paramount, with ongoing efforts to improvec reduce noise levels, and correct for motion, scatter, and attenuation. Dose optimization is another critical aspect, as healthcare costs rise and radiation safety becomes increasingly important.

Big data and data analytics are transforming the industry, enabling quantitative analysis and personalized medicine. Emerging technologies, such as deep learning and image fusion, are gaining traction, offering new possibilities for disease monitoring and diagnostic imaging. Insurance reimbursement and dose optimization are also key concerns, as pet scanners become more widely used in healthcare. The ongoing unfolding of market activities and evolving patterns underscores the dynamic nature of this industry.

How is this Pet Scanners Industry segmented?

The pet scanners industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Diagnostic centers

- Others

- Application

- Oncology

- Neurology

- Cardiology

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

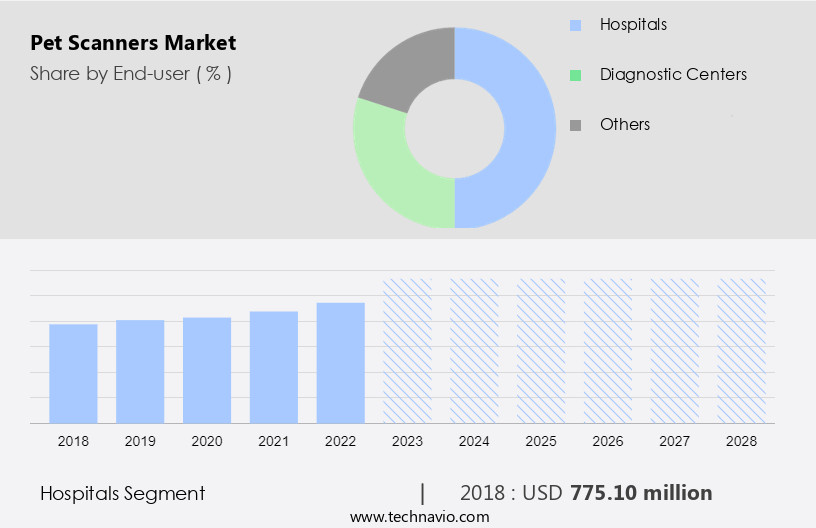

The hospitals segment is estimated to witness significant growth during the forecast period.

The market for PET scanners witnesses significant demand from hospitals due to their effectiveness in diagnosing and staging various medical conditions, particularly cancer, heart diseases, and neurological disorders. PET scans offer detailed images of the body's metabolic and functional processes, enabling early detection of abnormalities. In a hospital setting, PET scans are essential for treatment planning by providing valuable information about tumor or lesion location, size, and activity. This data aids physicians in selecting the most appropriate treatment modality, such as surgery, radiation therapy, or chemotherapy. PET imaging holds immense importance in clinical research, particularly in oncology, neurology, and cardiology.

It contributes to disease monitoring, tumor staging, and treatment response assessment. Regulatory compliance, including CE marking and FDA approval, ensures the safety and efficacy of PET scanners. Emerging technologies, such as cloud computing, big data, and artificial intelligence, enhance image quality, contrast resolution, and data processing. Additionally, machine learning and deep learning algorithms facilitate quantitative analysis, noise level reduction, and attenuation correction. PET scanners' integration with diagnostic imaging and image-guided surgery enables personalized medicine and precision treatment. Nuclear medicine, positron emission tomography, and gamma cameras are integral components of PET scanning technology. Motion correction, scatter correction, and dose optimization are crucial aspects of ensuring image quality and radiation safety.

Infectious diseases, such as tuberculosis and HIV, can also be diagnosed using PET scans. In summary, the PET scanner market is driven by its role in diagnostic imaging, treatment planning, and clinical research. Technological advancements, including emerging technologies, regulatory compliance, and data analytics, contribute to the market's growth and evolution.

The Hospitals segment was valued at USD 775.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

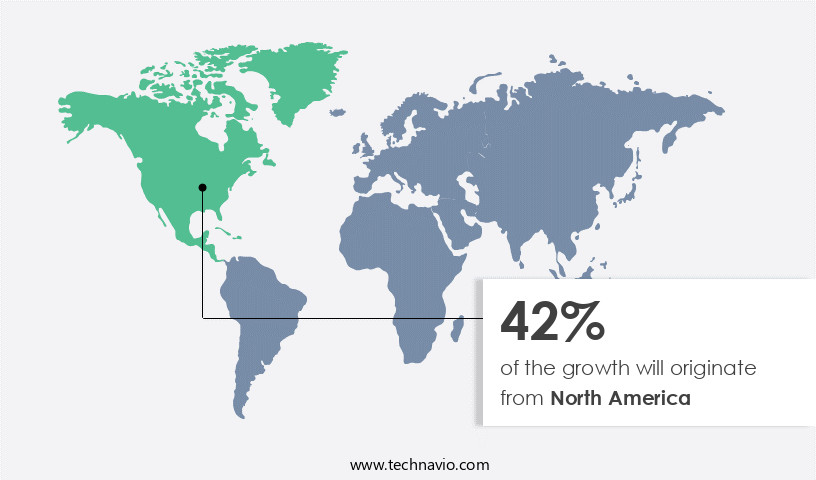

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing moderate growth, fueled by several factors. The rising prevalence and incidence of cancer, an aging population, and the adoption of advanced diagnostic devices are primary drivers. Regulatory approval processes are becoming more streamlined, enabling the surge in PET scanner procedures. Favorable reimbursement policies in Europe, particularly in countries with well-developed healthcare systems, further boost demand. Healthcare expenditure is increasing, and the presence of established companies strengthens market growth. Emerging technologies, such as cloud computing, big data, and artificial intelligence, are transforming the industry, improving image quality, contrast resolution, and diagnostic accuracy. Regulatory compliance, motion correction, and dose optimization are crucial aspects of the market, ensuring patient safety and effective disease monitoring.

Infectious diseases, tumor staging, and personalized medicine are other significant applications of PET scanners. The market's evolution is marked by advancements in image reconstruction, attenuation correction, and image fusion, leading to precise diagnosis and treatment response assessment. The integration of deep learning and machine learning in PET scanning technology is revolutionizing diagnostic imaging, enabling faster, more accurate diagnoses. The European market for PET scanners is expected to continue growing, driven by these trends and the ongoing development of technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a burgeoning sector in the veterinary technology industry, offering advanced diagnostic solutions for pet owners. These innovative devices employ technologies such as X-rays, ultrasounds, and CT scans to detect various health issues in pets, ensuring timely and accurate diagnoses. Pet scanners enable veterinarians to identify conditions like bone fractures, tumors, heart diseases, and gastrointestinal problems. Portable scanners offer convenience for house calls and emergency situations, while advanced imaging software facilitates easier interpretation of scan results. The market is driven by factors like increasing pet ownership, rising veterinary expenditures, and technological advancements. Additionally, growing awareness about pet health and wellness, and the availability of pet health insurance further fuel market growth. Pet scanners offer significant benefits, ensuring better pet care and improved animal welfare.

What are the key market drivers leading to the rise in the adoption of Pet Scanners Industry?

- The rising prevalence of chronic diseases serves as the primary market driver, significantly expanding the market scope.

- PET scanners, as sophisticated medical imaging devices, play a crucial role in the healthcare industry by enabling the visualization and measurement of metabolic processes within the body. The rising incidence of chronic diseases, including cancer, cardiovascular disorders, neurological conditions, and metabolic disorders, necessitates accurate diagnosis and monitoring. PET scans provide detailed functional information, contributing to early detection, precise localization, and effective disease management. Advancements in PET scanner technology offer valuable insights into the biological characteristics of diseases, enabling personalized treatment plans. Technologies such as contrast resolution, clinical trials, radiation safety, and image fusion, including motion correction and nuclear medicine, enhance the diagnostic capabilities of PET scanners.

- Furthermore, artificial intelligence and machine learning algorithms facilitate automated analysis, improving efficiency and accuracy. PET scanners adhere to stringent regulatory requirements, such as CE marking, ensuring patient safety and clinical efficacy. The integration of these advanced technologies and regulatory compliance positions PET scanners as indispensable tools in the healthcare sector, improving patient outcomes and overall quality of care.

What are the market trends shaping the Pet Scanners Industry?

- The trend in medical imaging technology is leaning towards advancements in PET scanners. These innovations are mandatory for improving diagnostic accuracy and patient care.

- PET scanner technology has experienced continuous advancements, focusing on enhancing image quality, reducing scanning times, and improving patient comfort. Technological innovations, such as time-of-flight (TOF) technology, digital detectors, and hybrid systems combining PET with other imaging modalities like CT or MRI, have gained significant attention. These advancements aim to increase diagnostic accuracy and provide a superior patient experience. Improvements in image quality have been a key focus for PET scanner technology. Advanced reconstruction algorithms and iterative reconstruction techniques have been developed to enhance image resolution, minimize noise, and improve overall image clarity. These advancements enable more precise diagnoses and better visualization of small lesions.

- Moreover, the integration of big data and quantitative analysis into PET scanning has led to personalized medicine and tumor staging. Deep learning algorithms have been employed to analyze large datasets, allowing for more accurate diagnoses and better understanding of infectious diseases. Regulatory compliance remains a crucial aspect of the industry, ensuring the safety and effectiveness of these advanced technologies. In conclusion, the PET scanner market continues to evolve, driven by advancements in technology and the integration of big data and quantitative analysis. These innovations aim to improve diagnostic accuracy, patient comfort, and overall experience, while maintaining regulatory compliance.

What challenges does the Pet Scanners Industry face during its growth?

- The exorbitant costs of PET scanners represent a significant challenge to the growth of the industry. This financial hurdle poses a substantial impediment to the expansion and accessibility of advanced diagnostic services.

- PET scanners are essential tools in precision medicine, enabling treatment response assessment and disease monitoring. However, their high cost poses a significant challenge for healthcare providers. The initial investment for purchasing and maintaining a PET scanner, including radiopharmaceuticals and equipment servicing, can be prohibitive. For instance, the cost of a PET scan in certain regions ranges from USD75 to USD339 USD. This expense can increase the financial burden on healthcare facilities and patients. Technology development in image analysis, data analytics, and data processing aims to improve spatial resolution and dose optimization, potentially reducing costs and enhancing diagnostic accuracy.

- Despite these advancements, the high cost of PET scanners remains a barrier to widespread adoption. Insurance reimbursement policies and regulatory requirements also influence the market dynamics. As healthcare continues to evolve, the importance of cost-effective and efficient medical imaging technologies, such as PET scanners, will become increasingly significant.

Exclusive Customer Landscape

The pet scanners market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pet scanners market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pet scanners market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Blue Earth Diagnostics Ltd. - The company specializes in providing advanced PET scanning technology, featuring the Celesteion Pure ViSION Edition PET model. This state-of-the-art equipment delivers high-resolution, accurate images for effective diagnosis and treatment planning in nuclear medicine. Its innovative design enhances image clarity, enabling medical professionals to detect and analyze diseases with precision. The company's commitment to research and development ensures continuous advancements in PET scanning technology, providing superior solutions for healthcare providers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blue Earth Diagnostics Ltd.

- Canon Inc.

- CellSight Technologies Inc.

- CMR Naviscan Corp.

- GE Healthcare Technologies Inc.

- General de Equipment for Medical Imaging S A

- Koninklijke Philips N.V.

- Mediso Ltd.

- MinFound Medical Systems Co. Ltd.

- Modus Medical Devices Inc.

- Neusoft Corp.

- Novartis AG

- Perkin Elmer Inc.

- PETsys Electronics SA

- Positron Corp.

- Radiology Oncology Systems Inc.

- RefleXion Medical Inc.

- Shimadzu Corp.

- Siemens Healthineers AG

- Yangzhou Kindsway Biotech Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pet Scanners Market

- In January 2024, PetVet Technologies, a leading pet healthcare solutions provider, announced the launch of its innovative PetScan Pro, an advanced pet scanner designed to detect various health conditions in pets (PetVet Technologies Press Release, 2024). This new product, equipped with AI technology, offers high-resolution images and faster scanning times, setting a new standard in pet healthcare (PetVet Technologies Press Release, 2024).

- In March 2024, Hill's Pet Nutrition, a global pet care company, entered into a strategic partnership with PetScan Technologies, a leading pet scanner manufacturer, to integrate their scanning technology into Hill's veterinary clinics (Hill's Pet Nutrition Press Release, 2024). This collaboration aims to improve diagnostic capabilities and enhance the overall pet healthcare services offered by Hill's (Hill's Pet Nutrition Press Release, 2024).

- In May 2024, PetScan Technologies secured a USD15 million Series B funding round led by Sequoia Capital and Sofinnova Investments to expand its production capacity and accelerate research and development efforts (PetScan Technologies Press Release, 2024). This investment will enable the company to meet the growing demand for its pet scanners and further advance its technology (PetScan Technologies Press Release, 2024).

- In January 2025, the European Union approved the use of PetScan Technologies' pet scanners in all EU member states, marking a significant geographic expansion for the company (European Commission Press Release, 2025). This approval will allow PetScan Technologies to serve a larger customer base and contribute to the advancement of pet healthcare in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses various aspects of nuclear medicine, including data management, patient safety, and advanced imaging technologies. Nuclear medicine physicians and radiopharmaceutical chemists play pivotal roles in radiotracer development and radiation dosimetry. Ethical considerations, such as informed consent and patient education, are essential in this field. Image interpretation, driven by advancements in PET/CT fusion and PET/MRI, requires specialized skills and expertise. Biomarker discovery and public awareness are fueling clinical trials design and patient recruitment. Quality assurance and industry partnerships ensure regulatory compliance and technological innovation.

- Academic institutions and imaging centers receive government funding to advance research and healthcare delivery. Health policy and reimbursement models significantly impact market growth. Pet technicians are integral to the daily operations of imaging centers. FDG PET remains a cornerstone of diagnostic applications, while innovation continues in the development of novel tracers and imaging techniques.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pet Scanners Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 455.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, France, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pet Scanners Market Research and Growth Report?

- CAGR of the Pet Scanners industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pet scanners market growth of industry companies

We can help! Our analysts can customize this pet scanners market research report to meet your requirements.