Pharmaceutical Equipment Market Size and Forecast 2025-2029

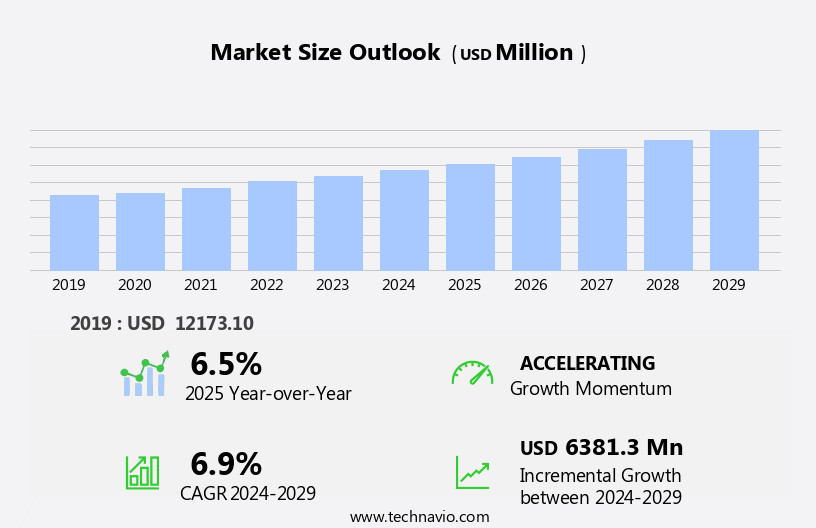

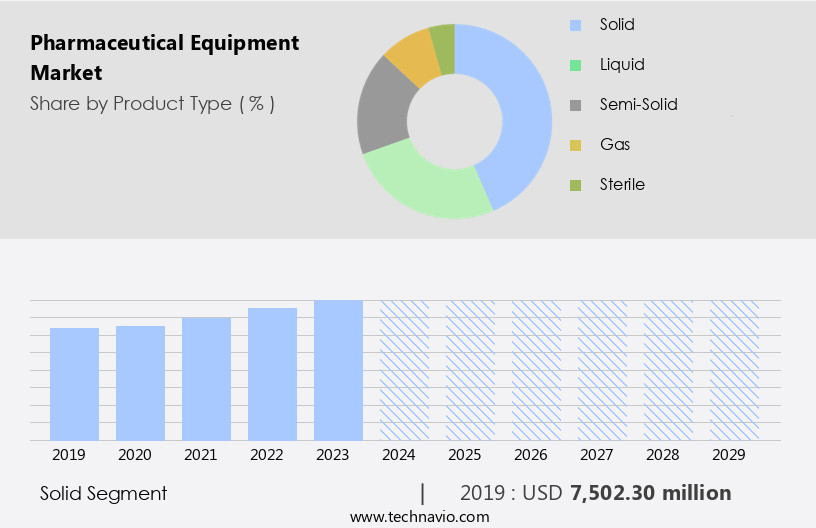

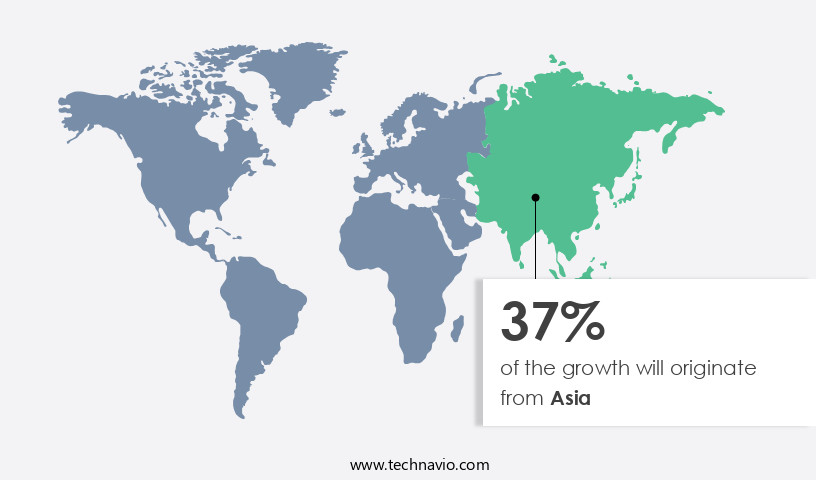

The pharmaceutical equipment market size estimates the market to reach by USD 6.38 billion, at a CAGR of 6.9% between 2024 and 2029.Asia is expected to account for 37% of the growth contribution to the global market during this period. In 2019 the solid segment was valued at USD 7.5 billion and has demonstrated steady growth since then.

- The market is driven by the escalating prevalence of diseases and the subsequent rising demand for pharmaceutical solutions. This trend is further fueled by the standardization of equipment in the biopharmaceutical industry, ensuring consistency and efficiency in production processes. However, the high cost of pharmaceutical equipment poses a significant challenge for market participants. Procurement of advanced technology and machinery necessitates substantial investment, which may deter smaller players and limit market entry.

- Despite this hurdle, opportunities exist for companies to innovate and offer cost-effective solutions that cater to the evolving needs of the pharmaceutical industry. By focusing on medicical technological advancements and collaboration with industry partners, market players can navigate these challenges and capitalize on the growing demand for pharmaceutical equipment.

What will be the Size of the Pharmaceutical Equipment Market during the forecast period?

The market continues to evolve, driven by advancements in technology and the increasing demand for efficient, automated solutions in various sectors. Powder processing equipment, such as high shear mixers, play a crucial role in producing consistent and high-quality pharmaceutical products. Automation systems, including tablet inspection machines and capsule filling machines, ensure GMP compliance and reduce the risk of contamination. Pharmaceutical mixing and granulation equipment, integrated with process analytical technology and in-line sensors, enable real-time monitoring and process validation. Contamination control is a top priority, with cleanroom technology and sterilization equipment essential for maintaining aseptic environments. Liquid filling systems, bottle filling machines, and labeling machines streamline production processes, while 3D bioprinting and bioreactor systems revolutionize the development of new drugs.

Coating equipment, fluid bed dryers, and controlled release technology enhance the efficacy of pharmaceutical products. Industry growth is expected to reach double digits in the coming years, with continuous manufacturing and single-use systems gaining popularity due to their flexibility and cost-effectiveness. For instance, a leading pharmaceutical company reported a 15% increase in production efficiency by implementing a continuous manufacturing process. Data acquisition systems and quality control systems ensure regulatory compliance and maintain product consistency. Microfluidic devices and pharmaceutical extruders cater to the growing demand for advanced drug delivery systems. Overall, the market remains dynamic, with ongoing innovations and evolving patterns shaping its future.

How is this Pharmaceutical Equipment Industry segmented?

The pharmaceutical equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Solid

- Liquid

- Semi-Solid

- Gas

- Sterile

- Type

- Packaging equipment

- Granulating equipment

- Spray drying equipment

- Filing machines

- Mixing/Blending Equipment

- Tableting Equipment

- Coating Equipment

- Sterilization Equipment

- Inspection Equipment

- Milling Equipment

- Capsule Filling Machines

- Lyophilization Equipment

- End-User

- Pharmaceutical manufacturing companies

- Contract manufacturing organizations

- Research and Development (R&D) Labs

- Biotechnology Companies

- Academic Institutions

- Hospitals/Compounding Pharmacies

- Distribution Channel

- Direct sales

- Distributors

- Online platforms

- Material

- Stainless steel

- Plastic

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The solid segment is estimated to witness significant growth during the forecast period.

These technologies play a crucial role in the biopharmaceutical industry by enabling the production of convenient, stable, and accurately dosed OSD forms, such as tablets, capsules, and powders. Key companies in this market include Syngenton, GEA Group, Romaco, and Korber. OSD forms are preferred due to their ease of administration, allowing patients to take their medication at home without the need for external assistance. The integration of advanced technologies, such as automation systems, process analytical technology, and real-time monitoring, enhances the efficiency, accuracy, and quality of OSD production processes. The market is continually evolving, with innovations in areas such as 3D bioprinting, continuous manufacturing, and single-use systems, driving growth and offering new opportunities for market participants.

As of 2019 the Solid segment estimated at USD 7.5 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, Asia is projected to contribute 37% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, particularly in the US, experiences significant growth due to the presence of numerous large-scale pharmaceutical and biotechnology companies. Pfizer Inc., a leading global pharmaceutical company headquartered in the US, is a prime example. This company utilizes an array of advanced pharmaceutical equipment for drug production, including powder processing equipment, automation systems, pharmaceutical mixing, contamination control, process analytical technology, pharmaceutical weighing, tablet inspection, liquid filling systems, cell culture equipment, granulation equipment, and process validation systems. The increasing number of biopharmaceutical and biosimilar product approvals in North America, with approximately three out of ten drugs approved by the FDA being biologics, further propels the demand for specialized equipment.

Additionally, the market is witnessing trends towards continuous manufacturing, real-time monitoring, single-use systems, and sterilization equipment to ensure GMP compliance and maintain high-quality standards. Other significant equipment includes coating equipment, fluid bed dryers, bioreactor systems, quality control systems, data acquisition systems, in-line sensors, labeling machines, drug delivery systems, pharmaceutical extruders, high shear mixers, packaging machinery, blister packaging, and 3D bioprinting technology. Microfluidic devices and controlled release technology are also gaining popularity in the market. The integration of automation systems and process analytical technology enables efficient production processes and improved product consistency. Cleanroom technology and capsule filling machines are essential for maintaining aseptic environments and ensuring product integrity. Overall, the North American the market is characterized by its dynamic nature, driven by the evolving needs of pharmaceutical and biotechnology companies and the continuous advancements in technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The pharmaceutical industry continues to evolve with the growing need for efficiency, compliance, and innovation across all manufacturing stages. Central to this transformation are comprehensive pharmaceutical equipment validation procedures, which ensure consistent product quality and regulatory compliance. With increasing adoption of pharmaceutical process automation systems and real-time monitoring system integration, manufacturers are streamlining production while maintaining strict control over process variables. Simultaneously, attention to cleanroom classification standards and gmp compliant cleanroom design ensures aseptic conditions for sensitive operations.

Emerging technologies such as 3d bioprinting applications in pharma and single-use bioreactor system validation are enabling more flexible, cost-effective production models, particularly in biologics. The implementation of process analytical technology supports in-line monitoring, aiding continuous manufacturing process optimization and minimizing batch variability. In formulation, managing granulation process parameters, maintaining tablet coating weight variation control, and optimizing high shear mixer design parameters are essential for consistency.

For solid dosage forms, high-speed tablet press maintenance and capsule filling machine calibration play critical roles in operational uptime and precision. Innovations also extend to advanced drug delivery system design, influencing how therapies are administered and absorbed. Sterility remains vital, with a focus on sterilization equipment performance, lyophilization cycle optimization, and effective powder processing system design. Furthermore, the automated liquid filling process and informed pharmaceutical packaging material selection contribute to product integrity and shelf life, ensuring safety from production through distribution.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Equipment Industry?

- The escalating incidence of diseases and subsequent demand for pharmaceutical solutions serve as the primary market drivers. The rising global prevalence of chronic and acute diseases including cardiovascular, neurological, orthopedic, and respiratory conditions is significantly driving demand for oral solid dosage (OSD) drugs. Cardiovascular diseases (CVD) account for 45% of deaths in Europe, while in the U.S., over 800,000 people experience heart attacks annually. Orthopedic conditions like osteoarthritis and rheumatoid arthritis are also rising, with arthritis expected to affect 72 million

- Americans by 2030. Globally, respiratory diseases such as COPD and asthma are increasing, especially in low- and middle-income countries. These conditions, often linked to diabetes, obesity, and smoking, are fueling the use of OSD drugs like aspirin, ibuprofen, and acetaminophen for prevention and symptom relief. Some insulin products are also available over the counter for diabetes management. This growing reliance on OSD treatments is creating a strong need for advanced manufacturing solutions, boosting the global pharmaceutical equipment market as companies work to meet the evolving therapeutic needs of chronic disease patients.

What are the market trends shaping the Pharmaceutical Equipment Industry?

- Pharmaceutical equipment standardization is an emerging market trend, necessitating uniformity in design and functionality across the industry. To adhere to this requirement, it is essential to ensure that all equipment meets specified regulatory standards and industry guidelines. The market dynamics are driven by the benefits of standardization. By establishing common norms, guidelines, and specifications for equipment design, manufacturing, and operation, standardization brings coherence to the global market. This harmonization leads to increased efficiency and productivity, as interoperability among different equipment types simplifies workflow and reduces compatibility issues. Furthermore, standardization simplifies regulatory compliance, enabling manufacturers to adhere to industry standards and facilitate faster product approvals.

- According to recent research, standardization has led to a 20% increase in productivity for some manufacturers. Additionally, industry growth is expected to reach 12% annually over the next five years, as the pharmaceutical industry continues to prioritize standardization for operational excellence and regulatory compliance.

What challenges does the Pharmaceutical Equipment Industry face during its growth?

- The escalating costs of pharmaceutical equipment represent a significant challenge to the industry's growth trajectory. The pharmaceutical industry's requirement for advanced equipment presents a substantial financial commitment for manufacturers, potentially deterring smaller players. One such category of costly equipment includes large-scale production machinery, such as tablet presses, capsule filling machines, and blister packaging systems, which can cost between USD 50,000 and USD 80,000 depending on capacity, features, and specifications. Moreover, analytical instruments are another expensive yet indispensable category for ensuring product quality and regulatory compliance. High-performance liquid chromatography (HPLC) systems, mass spectrometers, and particle size analyzers are essential tools, with prices ranging from tens to hundreds of thousands of dollars.

- This growth can be attributed to factors like increasing health consciousness, busy lifestyles, and the growing popularity of plant-based diets. For instance, a leading company reported a 25% increase in sales in 2020 due to the pandemic, as consumers sought convenient and nutritious alternatives to traditional. This trend is expected to continue, further fueling the market's growth.

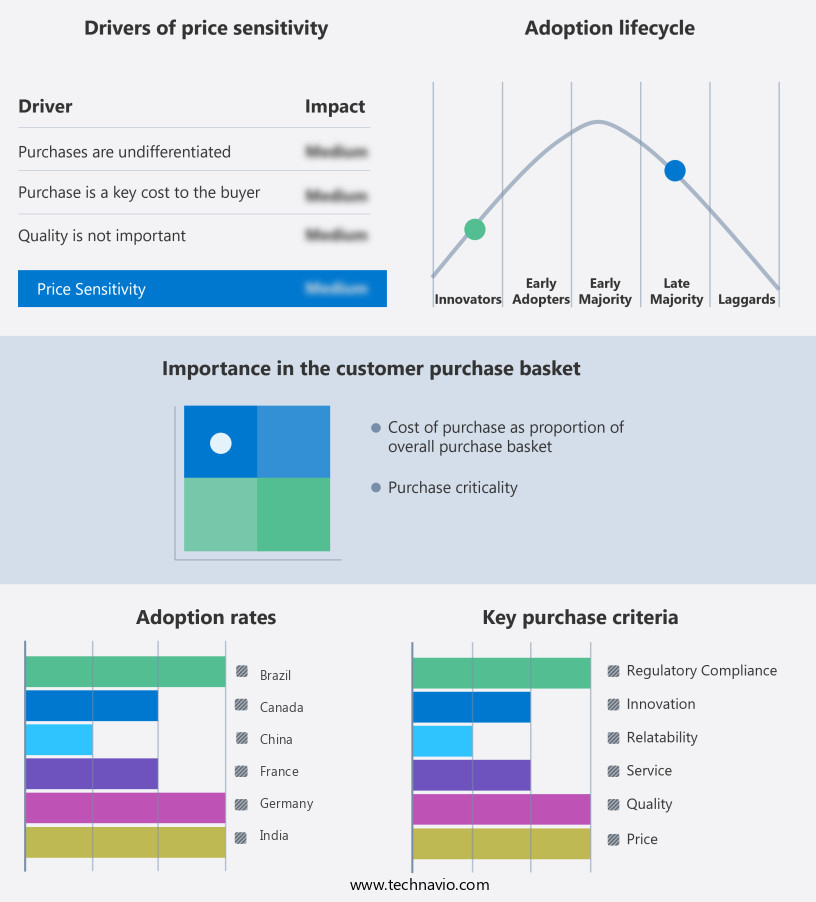

Exclusive Customer Landscape

The pharmaceutical equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACG - This company specializes in providing advanced pharmaceutical equipment solutions, including Single and Double rotary tablet compression presses, Granulation trains mixers, Capsule filling machines for powders, pellets, tablets, and liquids, and Horizontal airflow perforated pan coaters. These technologies enable efficient production processes in the pharmaceutical industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACG

- ACIC Pharmaceuticals Inc.

- Alfa Laval AB

- Antares Vision S.p.A

- Astro Machine Works Inc.

- Bausch + Strobel Maschinenfabrik Ilshofen GmbH + Co. KG SE

- Coesia SpA

- Freund Corp.

- GEA Group AG

- Hillenbrand Inc.

- IDEX Corp.

- IMA Industria Macchine Automatiche Spa

- Koerber AG

- Maquinaria Industrial Dara SL

- Marchesini Group Spa

- Merck KGaA

- Romaco Holding GmbH

- Silverson Machines Inc.

- Syntegon Technology GmbH

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Equipment Market

- In January 2024, Merck KGaA, a leading pharmaceutical and life science company, announced the acquisition of Versum Materials, a prominent supplier of specialty materials and equipment for the semiconductor and advanced materials industries. This strategic move aimed to expand Merck's portfolio in the high-growth field of advanced materials (Merck KGaA press release).

- In March 2024, Thermo Fisher Scientific, a global biotech product development and manufacturing solutions provider, launched the Avance 3000 Series Prep & Purification System. This new product line offers increased productivity and ease-of-use for protein and peptide purification processes (Thermo Fisher Scientific press release).

- In May 2024, Sartorius AG, a leading international supplier for laboratory and industrial manufacturing processes, announced a strategic partnership with Danaher Corporation's Life Sciences segment. The collaboration focuses on the development and commercialization of single-use technologies for biopharmaceutical manufacturing (Sartorius AG press release).

- In April 2025, F. Hoffmann-La Roche Ltd., a leading healthcare company, received approval from the European Medicines Agency for its new manufacturing facility in Singen, Germany. The facility, which specializes in the production of biotechnological medicines, is expected to significantly increase Roche's capacity and support its growth in the pharmaceutical industry (F. Hoffmann-La Roche Ltd. Press release).

Research Analyst Overview

- The market demonstrates continuous evolution, driven by advancements in technology and regulatory requirements. Applications span various sectors, including drug formulation, bioprocessing, and packaging. For instance, the adoption of rotary tablet presses for mass production has increased by 15% in recent years, while automated capsule fillers streamline production processes. Validation protocols remain a priority, with HVAC systems ensuring temperature and humidity control, and SCADA systems facilitating process control. Bioprocessing equipment, such as fermentation equipment and cell harvesting systems, enable the production of complex therapeutics. Automation continues to shape the market, with automated systems like vision inspection and cartoning machines enhancing quality and efficiency.

- Micro-dosing technology, UV sterilization, and near-infrared spectroscopy contribute to improved product consistency and data integrity. Continuous processing, including processes like fluid bed granulation and spray drying, enable the production of sustained-release formulations. Regulatory guidelines, such as closed-system transfer and aseptic filling, ensure product safety and efficacy. Market growth is anticipated to reach 6% annually, driven by the increasing demand for advanced pharmaceutical equipment solutions. Innovations like 3D printing, high-speed tablet presses, and precision weighing systems further expand the market's scope.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Equipment Market insights. See full methodology.

Pharmaceutical Equipment Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 6381.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, India, Germany, Canada, UK, France, Italy, Japan, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Equipment Market Research and Growth Report?

- CAGR of the Pharmaceutical Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical equipment market growth of industry companies

We can help! Our analysts can customize this pharmaceutical equipment market research report to meet your requirements.