Pharmaceutical Glass Tubing Market Size 2024-2028

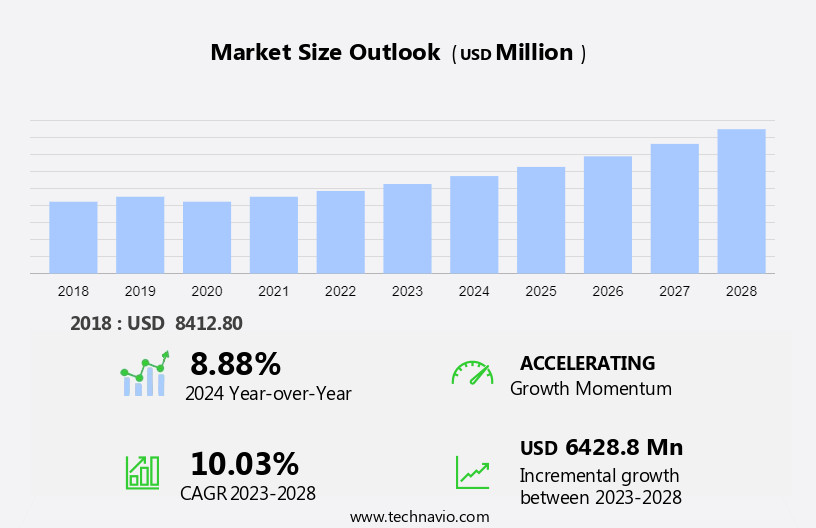

The pharmaceutical glass tubing market size is forecast to increase by USD 6.43 billion, at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing strategic initiatives of market players. These companies are investing heavily in research and development to expand their product offerings and enhance their competitive position. The increasing use of alternative materials, such as plastic and stainless steel, may impact the market dynamics of pharmaceutical glass tubing. Additionally, the surge in demand for pharmaceutical glass tubing due to the COVID-19 pandemic has accelerated market growth. However, the market faces challenges, including the risk of product recalls.

- Stringent regulations and quality control measures are essential to mitigate these risks and maintain consumer trust. Companies must prioritize innovation, compliance, and operational efficiency to capitalize on market opportunities and navigate challenges effectively. By focusing on these strategic areas, players can differentiate themselves and thrive in this dynamic market.

What will be the Size of the Pharmaceutical Glass Tubing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by the dynamic interplay of various factors. Glass tubing annealing, a crucial process in the manufacturing of pharmaceutical-grade glass tubing, undergoes constant refinement to enhance the product's hydrolytic resistance and thermal stability. This, in turn, expands the scope of applications for pharmaceutical glass tubing in injectable drug containers and drug delivery systems. Tubing length variation and diameter are essential considerations in the production process, with precision glass tubing becoming increasingly popular due to its superior dimensional accuracy. Borosilicate glass tubing, known for its chemical resistance and high thermal stability, is a preferred choice for various pharmaceutical applications.

Tubing tensile strength and tubing production capacity are critical factors influencing the market's growth trajectory. Hydrolytic resistance testing and glass tubing inspection ensure the highest quality standards, while glass tubing sterilization and cleaning processes maintain the integrity of the final product. The tubing manufacturing process continues to evolve, with advancements in neutral glass tubing, autoclavable glass tubing, and borosilicate glass properties driving innovation. Quality control systems and glass purity standards remain paramount in ensuring the reliability and safety of pharmaceutical glass tubing. Pharmaceutical glass vials and ampoules, as well as pharmaceutical containers, are major sectors where glass tubing plays a pivotal role.

The ongoing development of glass tubing and its applications in the pharmaceutical industry underscores the market's vibrant and ever-changing nature.

How is this Pharmaceutical Glass Tubing Industry segmented?

The pharmaceutical glass tubing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Vials

- Ampoules

- Cartridges

- Syringes

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

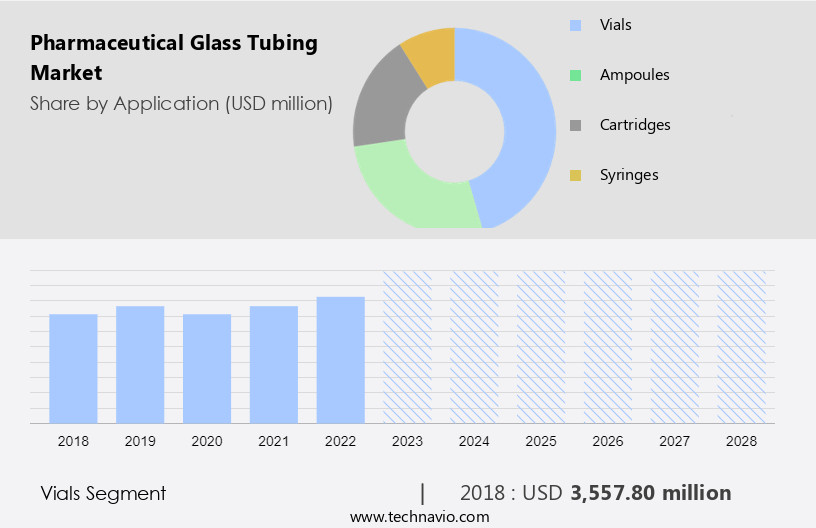

The vials segment is estimated to witness significant growth during the forecast period.

In the intricate world of pharmaceutical packaging, glass tubing has emerged as a preferred choice for storing various drugs due to its unique properties. Glass tubing is extensively used in the production of injectable drug containers and drug delivery systems. The tubing's chemical resistance and hydrolytic resistance make it an ideal choice for sensitive pharmaceutical applications. Companies in the glass tubing market provide high-quality glass tubes to primary packaging converters. These tubes undergo rigorous testing for hydrolytic resistance, tensile strength, and diameter to ensure their suitability for pharmaceutical applications. The tubing manufacturing process involves annealing to enhance its durability and thermal stability.

Borosilicate glass tubing, such as sodium borosilicate glass, is a popular choice due to its autoclavable properties, making it suitable for sterilization. Neutral glass tubing is another type used for pharmaceutical containers, requiring precise dimensional accuracy and wall thickness. Glass tubing suppliers implement quality control systems to ensure the tubing's surface quality and glass purity standards. Inspecting the tubing for defects is a crucial step in the production process, ensuring the tubing meets the required industry standards. The glass tubing manufacturing process is highly automated, with in-line vision inspection systems ensuring dimensional and cosmetic parameters are met. The tubing undergoes cleaning processes to maintain its surface quality before being used for pharmaceutical packaging.

In summary, the glass tubing market caters to the pharmaceutical industry's evolving needs, providing high-quality glass tubing that meets the stringent requirements of drug storage and delivery systems. The production process is automated, ensuring consistent quality and dimensional accuracy.

The Vials segment was valued at USD 3.56 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

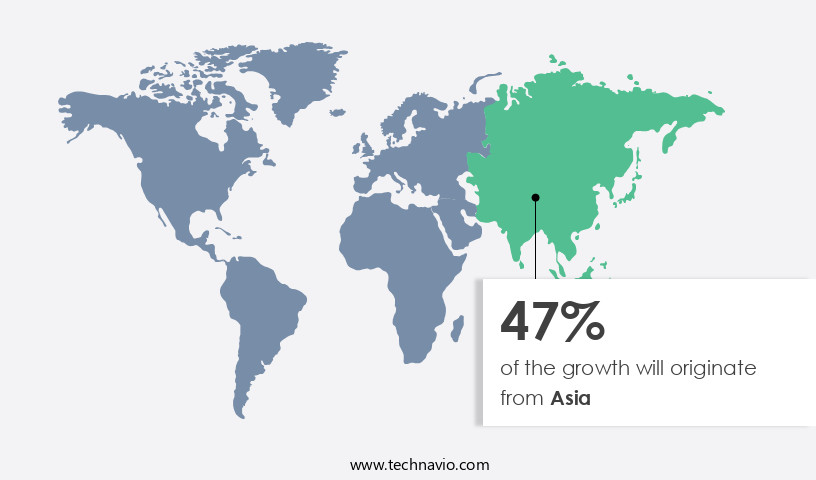

Asia is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia region, which accounted for the largest revenue share in 2023. This can be attributed to the presence of prominent glass tubing manufacturers and the increasing healthcare expenditure in the region. According to The World Bank Group, healthcare expenditure in East Asia and the Pacific increased from 5.74% of the GDP in 2007 to 6.67% in 2019. This trend is further fueled by the rising demand for injectable drug containers, drug delivery systems, and pharmaceutical ampoules. Glass tubing annealing and manufacturing processes ensure the required tubing length variation, hydrolytic resistance, and tubing thermal stability for these applications.

The tubing's chemical resistance and neutral properties make it suitable for various pharmaceutical uses. Borosilicate glass tubing, such as sodium borosilicate glass, is commonly used due to its autoclavable and high-tensile strength properties. Quality control systems, including glass tubing inspection, ensure the production of defect-free tubing. Precision glass tubing with tubing dimensional accuracy and wall thickness is essential for drug delivery systems and pharmaceutical containers. Glass tubing sterilization and cleaning processes maintain the tubing's surface quality and purity standards. Glass composition analysis is crucial to ensure the tubing's properties meet the required specifications. The market's evolving trends include the development of glass tubing with enhanced chemical resistance and tubing with improved dimensional accuracy and wall thickness.

Glass tubing suppliers cater to the growing demand for pharmaceutical packaging solutions, ensuring the timely delivery of high-quality products. The tubing's properties, such as borosilicate glass's unique properties, continue to drive innovation in the pharmaceutical industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is driven by the increasing demand for high-quality, reliable containment solutions for injectable drug products. The manufacturing process of pharmaceutical glass tubing involves optimization techniques to ensure borosilicate glass tubing meets stringent quality control and inspection methods. These methods include dimensional accuracy and surface quality control for neutral glass tubing, annealing process impact on strength, and chemical resistance and hydrolytic stability for high purity glass tubing. Annealing is a crucial process in pharmaceutical glass tubing production, as it enhances the material's thermal stability and breakage resistance. However, it's essential to maintain proper annealing conditions to avoid dimensional changes that could impact drug product stability. Automated inspection systems are employed to detect defects, such as wall thickness variation, which could compromise the drug product's quality. Quality assurance protocols are essential for pharmaceutical glass tubing production, ensuring traceability systems and regulatory compliance. Sodium borosilicate glass tubing undergoes sterilization and cleaning methods to maintain hygiene and prevent contamination. Advanced production techniques, such as automated quality control systems and process validation methods, enhance efficiency and productivity while maintaining the highest standards. Pharmaceutical grade glass tubing specifications and selection criteria depend on drug delivery system compatibility, leachables and extractables testing, and market requirements. Borosilicate glass tubing's chemical resistance, hydrolytic stability, and thermal stability make it an ideal choice for pharmaceutical applications. By adhering to market research report standards, the market continues to grow, driven by the need for safe, effective, and reliable drug delivery solutions.

What are the key market drivers leading to the rise in the adoption of Pharmaceutical Glass Tubing Industry?

- The strategic initiatives of market players are the primary catalysts driving market growth.

- The market is characterized by intense competition among companies. To expand their market presence, companies engage in strategies such as mergers and acquisitions, capacity expansions, and the development of customized solutions. The superiority and properties of glass tubing are crucial factors in pharmaceutical companies' selection of companies. International players are expanding their reach in markets like India and China in APAC. Notable developments in the market include Corning Inc.'s November 2021 investment in a new production line for borosilicate glass tubing.

- Companies prioritize glass composition analysis, tubing dimensional accuracy, tubing wall thickness, and glass tubing sterilization to meet the stringent requirements of pharmaceutical packaging and surface quality. The market's competitiveness is driving established companies to form strategic alliances and increase their production capacity to maintain their market position.

What are the market trends shaping the Pharmaceutical Glass Tubing Industry?

- The current market trend is characterized by a significant increase in demand due to the COVID-19 pandemic. This surge in demand is a notable trend that professionals must be aware of in the business world.

- The market has experienced significant growth due to the increasing demand for injectable drug containers and drug delivery systems. Glass tubing is widely used in the pharmaceutical industry due to its hydrolytic resistance and ability to maintain the sterility of drugs. The production of glass tubing involves annealing to ensure the required tubing length variation and tubing tensile strength. Manufacturers focus on enhancing their production capacity to meet the increasing demand for glass tubing in various pharmaceutical applications. The US Food and Drug Administration (FDA) has accelerated the approval process for new treatments and trials of potential COVID-19 drugs, leading to a surge in demand for glass tubing for injectable drugs and vaccines.

- As of January 2022, over 670 COVID-19 drug development programs were in the planning stage, and the FDA had reviewed more than 470 trials, with 14 treatments currently authorized for emergency use. The importance of glass tubing in pharmaceutical applications is underscored by its role in ensuring the safety and efficacy of drugs. Glass tubing's hydrolytic resistance and ability to maintain sterility make it a preferred choice for injectable drug containers and drug delivery systems. The market is expected to continue growing as the pharmaceutical industry focuses on developing new drugs and treatments, particularly in response to emerging health challenges such as COVID-19.

What challenges does the Pharmaceutical Glass Tubing Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must address safety concerns and restore consumer trust following the removal of their products from the market.

- The market experiences significant growth, yet faces challenges due to product recalls. These recalls, initiated by regulatory bodies or companies, can negatively impact sales and brand reputation. For instance, in January 2022, AuroMedics Pharma LLC recalled Polymyxin B for injection USP due to particulate matter in a vial. Similarly, in December 2021, Gilead Sciences Inc. recalled two lots of Veklury (remdesivir 100 mg for injection) due to the presence of glass particles. These incidents underscore the importance of stringent quality control systems and rigorous glass tubing inspection.

- Pharmaceutical glass tubing, primarily made of borosilicate glass and sodium borosilicate glass, must exhibit superior chemical resistance to ensure product safety and efficacy. Companies must prioritize glass tubing defect prevention to mitigate potential recalls and maintain consumer trust.

Exclusive Customer Landscape

The pharmaceutical glass tubing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical glass tubing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pharmaceutical glass tubing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AccuGlass LLC - This company specializes in manufacturing and supplying microbore tubing for various industries, leveraging advanced technology and materials for enhanced performance and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AccuGlass LLC

- Aimer Products Ltd.

- Beatson Clark

- Bormioli Pharma Spa

- Cangzhou Four-star Glass Co. Ltd.

- Corning Inc.

- DWK Life Sciences GmbH

- Jinan Snail International Co. Ltd.

- Jinan Youlyy Industrial Co. Ltd.

- Linuo Group Holdings Co. Ltd.

- Nippon Electric Glass Co. Ltd.

- Nipro Corp.

- Puyang Xinhe Industrial Development Co. Ltd.

- Richland Glass

- SCHOTT AG

- SGD Pharma

- Shandong Medicinal Glass Co. Ltd

- Stoelzle Oberglas GmbH

- TURKIYE SISE VE CAM FABRIKALARI A.S.

- West Pharmaceutical Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pharmaceutical Glass Tubing Market

- In January 2024, Pfizer Inc. announced the launch of its new, advanced pharmaceutical glass tubing product line for the production of biotech and specialty injectables at its site in Ringaskiddy, Ireland (Pfizer Press Release, 2024). This expansion aimed to cater to the growing demand for complex drug delivery systems.

- In March 2024, Schott AG, a leading international technology group in the areas of specialty glass and glass-ceramics, entered into a strategic partnership with a leading biotech company, BioMarin Pharmaceutical Inc., to supply high-quality glass tubing for their new drug product (Schott AG Press Release, 2024). This collaboration aimed to enhance the quality and reliability of BioMarin's drug delivery systems.

- In May 2024, Vitro, a leading global glass manufacturer, announced the acquisition of a significant stake in the pharmaceutical glass tubing business of Nippon Electric Glass, Inc. (Vitro Press Release, 2024). This strategic move aimed to strengthen Vitro's position in the market and expand its production capacity.

- In February 2025, Gerresheimer AG, a leading global partner for pharmaceutical and healthcare businesses, received FDA approval for its new Borosilicate Type I glass tubing production facility in the United States (Gerresheimer AG Press Release, 2025). This expansion enabled Gerresheimer to cater to the increasing demand for high-quality pharmaceutical glass tubing in the North American market.

Research Analyst Overview

- The market is characterized by stringent quality assurance protocols and rigorous testing requirements. Glass tubing recycling plays a crucial role in reducing production costs and minimizing environmental impact. Container integrity testing, utilizing advanced automated inspection systems, ensures the detection of glass defects and maintains drug product compatibility. Borosilicate glass, with its advantages in handling and sealing techniques, is a popular choice for pharmaceutical applications. Tubing material selection and dimensional tolerances are critical factors in tubing specifications, influenced by process validation methods and sterile filling processes.

- Leachables, extractables testing, particle count analysis, and material traceability systems are essential components of pharmaceutical grade glass production. Pharmaceutical regulations mandate stringent quality control procedures, driving the adoption of customized glass tubing solutions and innovative pharmaceutical packaging designs. Production efficiency metrics continue to shape market dynamics, with a focus on continuous improvement and cost optimization.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Glass Tubing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 6428.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Glass Tubing Market Research and Growth Report?

- CAGR of the Pharmaceutical Glass Tubing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, Europe, North America, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pharmaceutical glass tubing market growth of industry companies

We can help! Our analysts can customize this pharmaceutical glass tubing market research report to meet your requirements.