Phone Case Market Size 2025-2029

The phone case market size is forecast to increase by USD 15.5 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing penetration of smart mobile phones worldwide. With the widespread adoption of advanced handheld devices, the demand for protective phone cases has surged. In addition, the expanding presence of e-commerce companies in tier II and tier III cities is fueling market growth, as consumers in these regions gain easier access to a broader range of phone case options. However, the lack of universal standards poses a notable challenge for market participants. This fragmentation hampers market consolidation and necessitates continuous innovation to cater to diverse consumer preferences and requirements. To capitalize on this dynamic market, companies must focus on offering high-quality, customizable phone cases that cater to the unique needs of consumers in various regions and demographics.

- By staying abreast of the latest trends and addressing the challenges presented by the absence of universal standards, market players can effectively navigate this competitive landscape and secure a strong market position.

What will be the Size of the Phone Case Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The smartphone accessories market continues to evolve, with dynamic market dynamics shaping its various sectors. Material composition is a significant factor, as sustainable materials gain traction, with biodegradable options emerging. Precise cutouts ensure optimal functionality, while product differentiation is achieved through features such as scratch resistance, shockproof cases, and military-grade protection. Consumer preferences influence the market, with an emphasis on personalized cases, color options, and design aesthetics. Anti-slip grip, ring holders, and button covers enhance user experience, while magsafe compatibility and port covers cater to specific device models. Competitive advantage is crucial, with wholesale distribution and efficient supply chain management enabling mass production and competitive pricing.

Drop test standards ensure product reliability, while technology integration, such as RFID blocking, wireless charging, and waterproof cases, adds value. Stand functionality, impact absorption, and screen protector integration offer additional benefits, while rugged cases, carbon fiber, and customization options cater to diverse consumer needs. The manufacturing process, including 3D printing and injection molding, continues to advance, driving innovation in the mobile accessories industry. Quality control and retail pricing strategies are essential for success, with retail sales and e-commerce platforms driving growth. Tablet accessories, camera lens protection, and wallet cases expand the market, catering to the diverse needs of the consumer electronics sector.

The market's continuous unfolding is marked by evolving patterns, with trends such as graphic printing, raised bezels, and tactile button covers shaping the landscape. The integration of technology and sustainable materials promises to drive future growth, as the market adapts to meet the ever-changing needs of consumers.

How is this Phone Case Industry segmented?

The phone case industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Body glove

- Pouch

- Phone skin

- Hybrid cases

- Others

- Type

- Silicone

- Plastic

- Leather

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

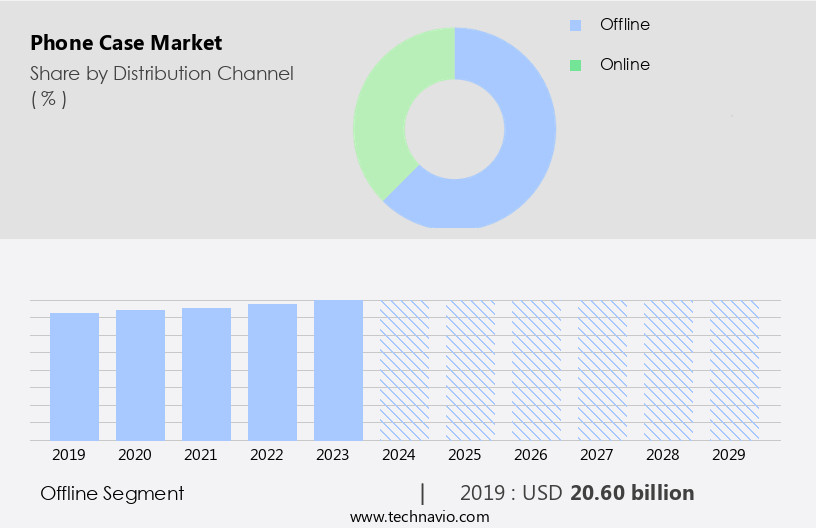

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of offerings, including antimicrobial coated cases, product lifecycle management solutions, and cases with anti-slip grips and ring holders. Consumer preferences prioritize impact absorption, personalized designs, and color options, while consumer electronics manufacturers integrate technology such as magsafe compatibility and RFID blocking into their cases. Leather cases, button covers, and waterproof options remain popular, as do rugged, shockproof cases with military-grade protection. Manufacturers employ various materials, such as sustainable ones, and utilize manufacturing processes like injection molding and 3D printing for customization. E-commerce sales and wholesale distribution expand market reach, while retail sales maintain a significant share due to consumer preferences for physical verification and consultation.

Precise cutouts ensure proper device fit, and product differentiation is achieved through scratch resistance, screen protector integration, and graphic printing. Competitive advantage is derived from factors like drop test standards, supply chain management, and stand functionality. Biodegradable materials and wireless charging capabilities add to the market's evolving trends. Wallet cases, silicone covers, and camera lens protection are among the various types of phone cases available, catering to diverse consumer needs. Retail pricing remains a crucial factor, with UV protection and rugged carbon fiber cases commanding higher prices.

The Offline segment was valued at USD 20.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

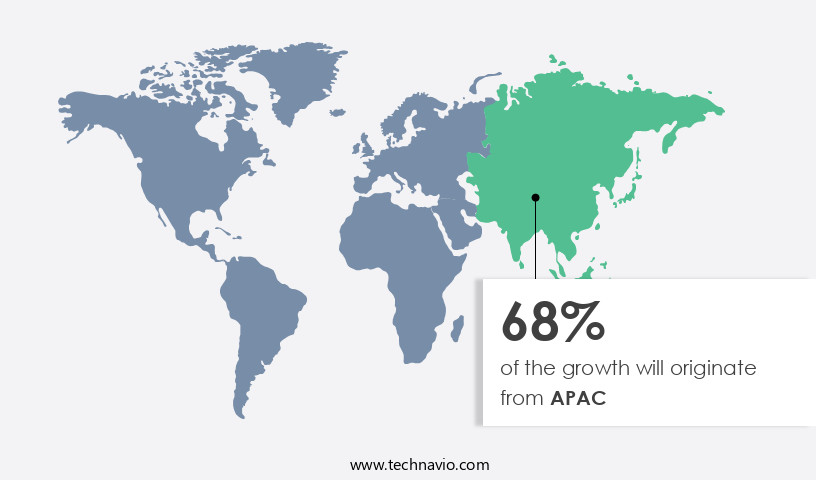

APAC is estimated to contribute 68% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the expanding mobile device user base, particularly in the Asia Pacific region. The decline in smartphone prices and rising disposable income have shifted consumer buying patterns, leading to increased demand for phone cases. The youth demographic's increasing adoption of mobile devices is further fueling market growth. Additionally, the Internet's penetration is driving the e-commerce trend in mobile accessories, with various payment options and discounts attracting consumers. Product lifecycle management is crucial for manufacturers to ensure profitability, with consumer preferences influencing design aesthetics, color options, and functionality.

Antimicrobial coatings, anti-slip grips, ring holders, port covers, raised bezels, and impact absorption are essential features in phone cases. Technology integration, such as magsafe compatibility, wireless charging, and RFID blocking, adds value to the market. Sustainable materials, precise cutouts, and product differentiation are key trends. The manufacturing process includes injection molding, 3D printing, and quality control. Competitive advantage is achieved through military-grade protection, shockproof cases, and customization options. Wholesale distribution, drop test standards, and supply chain management are essential for efficient market operations. Stand functionality, drop protection, graphic printing, and biodegradable materials are other market offerings.

Retail sales and retail pricing remain significant revenue streams, with smartphone accessories, tablet accessories, and camera lens protection being popular categories. Overall, the market is a dynamic and evolving industry, with continuous innovation and consumer demand shaping its future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and innovative the market, consumers seek protection and personalization for their devices. This market caters to various preferences, offering a wide range of materials, including silicone, leather, wood, and metal. Designs vary from minimalist to vibrant, with patterns, textures, and colors that reflect personal styles. Brands prioritize durability, providing shock-absorbing features, and scratch resistance. Slim-fit cases are popular for their sleek look, while rugged cases ensure maximum protection. Customizable cases allow users to express their individuality, with options for monograms, photos, and unique designs. The market continues to evolve, offering solutions for different phone models, screen sizes, and user needs. With new technologies and trends emerging, this market remains an essential accessory for tech-savvy consumers.

What are the key market drivers leading to the rise in the adoption of Phone Case Industry?

- The significant expansion of the smart mobile phone market is primarily attributed to the increasing penetration of these devices.

- The market has experienced significant growth due to the increasing adoption of smartphones worldwide. The proliferation of affordable smartphones, particularly in developing countries such as India, Vietnam, the Philippines, Sri Lanka, and Pakistan in APAC, and Spain and Greece in Europe, has driven the demand for mobile accessories, including phone cases. These countries have seen a surge in sales of low-priced smartphones, making phone cases an essential accessory for consumers. The market is witnessing innovation in various areas, such as button covers, waterproof cases, RFID blocking, and design aesthetics. Technology integration, including belt clips and tablet accessories, is also a growing trend.

- The manufacturing process has evolved with the advent of 3D printing and tough case materials, offering military-grade protection. E-commerce sales have been a significant contributor to the market's growth, providing consumers with easy access to a wide range of phone cases. The market is expected to continue its growth trajectory, with technology advancements and increasing consumer preferences for mobile accessories.

What are the market trends shaping the Phone Case Industry?

- Tier II and III cities are witnessing an increasing presence of e-commerce companies, representing a significant market trend. This expansion signifies a notable shift in consumer behavior towards online shopping in non-metropolitan areas.

- The global market for smartphone accessories, particularly phone cases, is experiencing significant growth due to the expanding reach of e-commerce platforms into tier II and III cities. Historically, consumers in these regions had limited access to a diverse range of phone cases, as retail outlets were scarce and product offerings were limited. However, the proliferation of e-commerce has granted consumers in these areas increased access to a wide selection of phone cases, catering to various budgets and preferences. This convenience, coupled with the ability to compare prices and make purchases online, has fueled the popularity of e-commerce shopping for phone cases, thereby driving market growth.

- Moreover, consumers' demand for sustainable materials, precise cutouts, scratch resistance, and shockproof cases provides product differentiation opportunities for manufacturers. Drop test standards ensure that phone cases offer adequate drop protection, while stand functionality adds convenience and value. Graphic printing and biodegradable materials are emerging trends, as consumers seek eco-friendly alternatives. Effective supply chain management is crucial for maintaining a competitive advantage, as manufacturers must ensure timely delivery and quality control to meet the increasing demand for phone cases.

What challenges does the Phone Case Industry face during its growth?

- The absence of universally accepted standards poses a significant challenge to the industry's growth trajectory.

- The market faces challenges due to the absence of standardization in technology and components used in production. This lack of uniformity leads to significant product and price differentiation, which could hinder market growth. Manufacturers employ disparate specifications, making it difficult for customers to compare and select accessories. To address this issue, industry collaboration is necessary to establish clear standards. This would improve quality, consumer confidence, and compatibility.

- Notable features of the market include screen protectors, rugged cases, carbon fiber, customization options, wireless charging, injection molding, quality control, wallet cases, silicone cases, camera lens protection, pattern designs, hybrid cases, and UV protection. Companies should prioritize the development of standardized specifications to ensure a harmonious and immersive customer experience.

Exclusive Customer Landscape

The phone case market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the phone case market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, phone case market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ai Paiqi Electronic Technology Co., Ltd. - This company specializes in the production of innovative phone case designs, including the MGT series and Cyan bee series. Our offerings prioritize protection and style, ensuring that consumers can safeguard their devices without compromising aesthetics. By utilizing advanced materials and manufacturing techniques, we create phone cases that not only shield against impact but also enhance the visual appeal of mobile devices. Our commitment to originality and quality sets us apart in the market, attracting tech enthusiasts and trendsetters alike. With a focus on continuous research and development, we aim to provide cutting-edge solutions that cater to the evolving needs of modern consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ai Paiqi Electronic Technology Co., Ltd.

- Apple Inc.

- Case Mate Inc.

- CG Mobile

- Cygnett

- Element Case Inc.

- Fommy.com

- Hon Hai Precision Industry Co. Ltd.

- Moshi Corp.

- Otter Products LLC

- Pelican Products Inc.

- Poetic Cases Inc.

- Rearth Inc.

- Reiko Wireless Inc.

- Samsung Electronics Co. Ltd.

- Spigen Inc.

- Urban Armor Gear LLC

- Vinci Brands LLC

- XtremeGuard

- ZAGG Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Phone Case Market

- In January 2024, tech giant Apple announced the launch of its new line of iPhone models, including the iPhone 14 series, which came with new magnetic cases that effectively integrated with MagSafe technology for seamless charging (Apple Press Release).

- In March 2024, OtterBox, a leading phone case manufacturer, entered into a strategic partnership with Samsung to produce cases specifically designed for the latest Samsung Galaxy devices, expanding OtterBox's product offerings and strengthening its market position (Samsung Newsroom).

- In May 2024, Spigen, a prominent player in the market, secured a significant funding round of USD50 million from South Korean investors, allowing the company to expand its production capacity and enhance its research and development capabilities (Business Wire).

- In April 2025, the European Union passed new regulations requiring phone manufacturers to provide repairability information and make spare parts available to consumers, potentially increasing demand for aftermarket phone cases that offer easy replacement and customization options (EU Commission Press Release).

Research Analyst Overview

- The market is characterized by a diverse range of offerings, with manufacturers integrating advanced technologies to cater to evolving customer needs. UV stabilizers, a crucial component for ensuring case durability against sun damage, are increasingly adopted. Customer service and user experience are prioritized, with manufacturing automation and digital printing streamlining production processes. Anti-yellowing technology and protective coatings enhance case longevity, while accessory compatibility and custom designs cater to a broad target audience. Sustainability initiatives, such as recycled materials and ethical sourcing, are gaining traction.

- Distribution channels and sales forecasting inform marketing strategies, with customer feedback shaping innovation pipelines. Brand loyalty is fostered through case thickness, laser engraving, and warranty claims. Pricing strategies, inventory management, intellectual property, and device compatibility are essential considerations in this competitive landscape. OEM manufacturing, returns and refunds, product reviews, and sublimation printing are additional aspects influencing market dynamics.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Phone Case Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 15.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Japan, India, South Korea, Canada, UK, Germany, France, Australia, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Phone Case Market Research and Growth Report?

- CAGR of the Phone Case industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the phone case market growth of industry companies

We can help! Our analysts can customize this phone case market research report to meet your requirements.