Plumbing Fixtures And Fittings Market Size 2024-2028

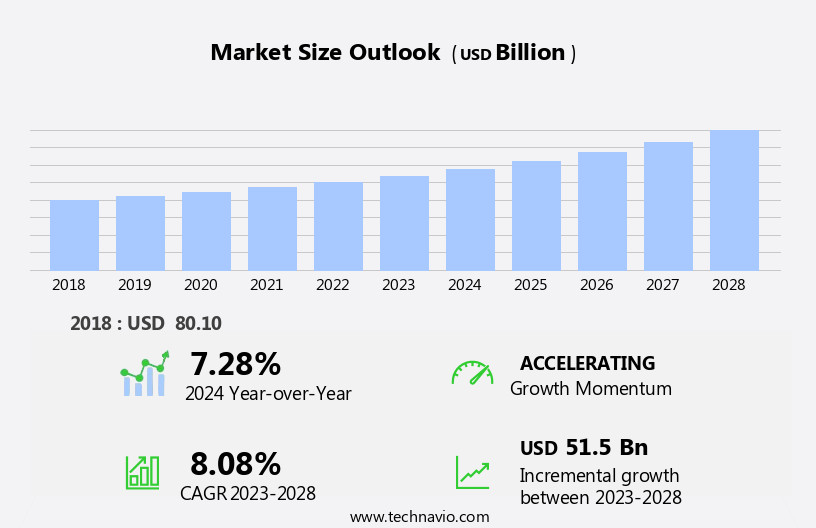

The plumbing fixtures and fittings market size is forecast to increase by USD 51.5 billion at a CAGR of 8.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The rise in construction, particularly in the residential and commercial sectors, is driving market demand. Additionally, the trend towards eco-friendly plumbing solutions is gaining momentum, as consumers and governments prioritize water conservation and sustainability.

- However, the market is also facing challenges from fluctuating raw material prices, which can impact production costs and profitability. Despite these challenges, the market is expected to continue growing, as the demand for modern, efficient, and sustainable plumbing solutions remains strong. The market analysis report provides an in-depth examination of these trends and challenges, offering valuable insights for industry stakeholders.

What will be the Size of the Plumbing Fixtures And Fittings Market During the Forecast Period?

- The market encompasses a wide range of products essential for water supply and drainage systems in residential and commercial buildings. Key market drivers include repair and remodeling projects, which often involve the replacement of outdated or damaged fixtures and fittings. Another significant trend is the emphasis on water conservation, leading to the increased adoption of water-efficient systems and plumbing fixtures. Smart plumbing technologies, such as touchless operation and sensors, are gaining popularity in both residential and commercial settings, particularly in the context of smart homes. Hygiene and sanitization concerns have also become increasingly important, driving the demand for advanced plumbing fixtures and fittings.

- Construction activities continue to fuel market growth, with an emphasis on the use of durable materials, such as CPVC piping systems and CPVC technology, known for their heat resistance, resistance to flames, and smoke pressure resistance. Both plastics and metals are used In the production of plumbing fixtures and fittings, with bathroom, kitchen, and toilet fixtures representing key product categories.

How is this Plumbing Fixtures And Fittings Industry segmented and which is the largest segment?

The plumbing fixtures and fittings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- FoTW

- BTW

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Europe

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

The FoTW segment is estimated to witness significant growth during the forecast period. Plumbing fixtures and fittings, also known as Front of the Wall (FoTW) products, refer to visible plumbing components, including water outlets and related fixtures such as showerheads, taps, sinks, and bathroom ceramics. The primary driver of demand for these products is the focus on aesthetics, influenced by consumer preferences. The market for FoTW plumbing products is poised for growth, with companies expanding their offerings to cater to diverse needs. New product innovations include stylish solutions for bidets, washbasins, and urinals, providing comprehensive options for FoTW sanitary ceramics. Water conservation and efficiency are also significant factors influencing the market, with the adoption of water-efficient systems, smart plumbing fixtures, and touchless operation gaining popularity.

Construction activities, particularly in residential and commercial sectors, contribute to the demand for these products. Key trends include the integration of sensors, water conservation regulations, and the availability of eco-friendly and customized fixtures made from sustainable materials such as plastics and metals. Online retail and e-commerce have also emerged as significant sales channels. Raw material prices and adoption barriers, including the high cost of smart homes, remain challenges for market growth.

Get a glance at the share of various segments. Request Free Sample

The FoTW segment was valued at USD 69.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing growth due to expanding company presence in emerging markets. This strategy enables companies to cater to customer needs, aligning with their growth objectives. Some companies are increasing their online presence by selling on e-commerce platforms. For example, Jaquar India introduced Atelier by Artize in Mumbai and New Delhi in December 2022, which was readily available online. Regulatory compliance is crucial in this market, with countries enforcing industry codes of practice for installations of fixtures such as showers, toilets, taps, and urinals.

Market Dynamics

Our plumbing fixtures and fittings market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Plumbing Fixtures And Fittings Industry?

Rise in construction activities is the key driver of the market.

- The market is experiencing significant growth due to various factors, including the Repair and Remodeling sector. With a focus on water conservation, there is a rising demand for water-efficient systems and smart plumbing technologies. Hygiene and sanitization have become essential considerations, leading to the adoption of eco-friendly fixtures made from sustainable materials. Construction activities in both residential and commercial sectors are driving the demand for high-quality plumbing fixtures and fittings. CPVC piping systems, utilizing CPVC technology for its heat resistance, flame resistance, and smoke pressure resistance, are increasingly popular. Smart homes, integrating smart plumbing fixtures with touchless operation and water-saving technology, are gaining traction.

- In the Residential sector, new developments and renovation projects are driving the demand for bathroom fixtures, kitchen fixtures, toilet fixtures, and customized plumbing fixtures. In the commercial sector, new buildings and renovated buildings are adopting water efficiency regulations, necessitating the use of water-efficient plumbing fixtures and fittings. The market is dynamic, with online retail and e-commerce playing a significant role. However, raw material prices and adoption barriers, such as high upfront costs and the need for professional installation, can hinder market growth. The integration of smart home technologies and the availability of customized plumbing fixtures in metals and plastics are key trends in the market.

What are the market trends shaping the Plumbing Fixtures And Fittings Industry?

Advent of eco-friendly plumbing solutions is the upcoming market trend.

- Eco-friendly plumbing solutions have gained significant attention in both residential and non-residential properties due to their cost-saving potential and environmental benefits. In the realm of plumbing fixtures and fittings, several eco-friendly options are available that cater to repair and remodeling projects, water conservation, and hygiene and sanitization needs. Toilets, for instance, have evolved with water-efficient designs, saving up to 40% of water compared to traditional models. Bathroom, kitchen, and toilet fixtures now come with smart plumbing technologies, such as touchless operation and water-saving technology, integrated sensors, and water conservation regulations compliance. CPVC piping systems, a popular choice for eco-friendly plumbing, offer heat resistance, flame resistance, and smoke pressure resistance.

- CPVC technology, made from plastics, is a sustainable alternative to traditional metal piping. Smart homes are increasingly adopting eco-friendly plumbing fixtures and fittings, integrating smart home technologies for enhanced convenience and energy efficiency. Construction activities, whether residential or commercial, are embracing water-efficient systems to minimize water wastage. Renovation projects, too, are incorporating eco-friendly plumbing solutions, including low-flow faucets and showerheads, and eco-friendly bathtubs and shower fixtures. Online retail and e-commerce platforms have made it easier for consumers to access high-quality, eco-friendly plumbing fixtures and fittings at competitive prices. However, adoption barriers, such as initial investment costs and perceived complexity, may hinder the widespread adoption of these solutions.

What challenges does the Plumbing Fixtures And Fittings Industry face during its growth?

Fluctuating raw material prices is a key challenge affecting the industry growth.

- The market encompasses various products used in both residential and commercial construction activities and renovation projects. These include CPVC piping systems, bathroom fixtures such as bathtubs, shower fixtures, and sink fixtures, as well as kitchen fixtures and toilet fixtures. The market is driven by various factors, including repair and remodeling needs, water conservation regulations, and the adoption of smart plumbing technologies. Water conservation remains a significant trend, leading to the demand for water-efficient systems and water-saving technologies, such as low-flow toilets and smart plumbing fixtures with touchless operation and integrated sensors. Hygiene and sanitization concerns have also become crucial, particularly In the wake of the COVID-19 pandemic.

- Smart homes and eco-friendly fixtures made of sustainable materials are gaining popularity. Plastics and metals are the primary raw materials used In the production of plumbing fixtures and fittings. However, price fluctuations in raw materials, such as CPVC and metals, can impact the market. The construction industry's building activity, both residential and commercial, influences the demand for plumbing fixtures and fittings. In the US, housing demand and the subsequent residential development and commercial development projects are expected to contribute to market growth. However, adoption barriers, such as high-quality fixture prices and the implementation of smart home technologies, can hinder market expansion.

Exclusive Customer Landscape

The plumbing fixtures and fittings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plumbing fixtures and fittings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plumbing fixtures and fittings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AKW Medi-Care Ltd. - The market encompasses a range of products essential for water supply and drainage systems. These include blending valves, which ensure consistent water temperature and pressure; push fit waste fittings, offering easy installation and leak-free performance; and straight rigid pan connectors, ensuring secure and durable pipe connections. These fixtures and fittings are integral components of plumbing systems, enhancing water efficiency, safety, and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AKW Medi-Care Ltd.

- American Bath Group

- Delta Faucet Co

- Elkay Manufacturing Co.

- Geberit International AG

- Gerber Plumbing Fixtures LLC

- HSIL Ltd

- Ideal Standard Gulf FZCO

- Jacuzzi Brands LLC

- LIXIL Corp.

- Masco Corp.

- Midland Industries

- neXgen Plumbing Products

- Roca Sanitario SA

- Somany Ceramics Ltd.

- Jaquar India

- Toto Ltd.

- United States Plastic Corp.

- Victorian Plumbing

- Villeroy and Boch AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products used in both residential and commercial buildings for conveying and controlling water and other liquids. This market is driven by various factors, including repair and remodeling activities, water conservation efforts, and the integration of smart plumbing technologies. One significant trend in the market is the focus on water conservation. With increasing awareness of water scarcity and the need for sustainable practices, there is a growing demand for water-efficient systems. This has led to the development and adoption of various water-saving technologies, such as low-flow toilets, faucets, and integrated sensors. Another trend is the integration of smart plumbing technologies into residential and commercial buildings.

Smart homes, which incorporate various automated systems for controlling various functions, are becoming increasingly popular. Plumbing fixtures and fittings are no exception, with touchless operation and integrated sensors becoming common features. The materials used in plumbing fixtures and fittings also play a crucial role In the market. CPVC piping systems, which offer heat resistance, resistance to flame and smoke pressure, and other advantages, have gained popularity due to their durability and cost-effectiveness. Plastics and metals are also commonly used In the production of bathroom fixtures, kitchen fixtures, and toilet fixtures. The market is influenced by various factors, including building activity, water-efficient regulations, and raw material prices.

Residential and commercial development, as well as renovation projects, create demand for new plumbing fixtures and fittings. Housing demand, particularly in urban areas, also drives growth In the market. However, there are adoption barriers to the widespread use of smart plumbing technologies and eco-friendly fixtures. These include the initial cost of implementation, the need for retrofitting existing systems, and the availability of sustainable materials. Despite these challenges, the market is expected to grow due to the increasing demand for water conservation and the integration of smart technologies into buildings. The market is also expected to benefit from the adoption of sustainable materials and customized plumbing fixtures that cater to the aesthetic appeal of modern buildings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 51.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.28 |

|

Key countries |

China, US, UK, India, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plumbing Fixtures And Fittings Market Research and Growth Report?

- CAGR of the Plumbing Fixtures And Fittings industry during the forecast period

- Detailed information on factors that will drive the Plumbing Fixtures And Fittings growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plumbing fixtures and fittings market growth of industry companies

We can help! Our analysts can customize this plumbing fixtures and fittings market research report to meet your requirements.