Pneumonia Testing Market Size 2024-2028

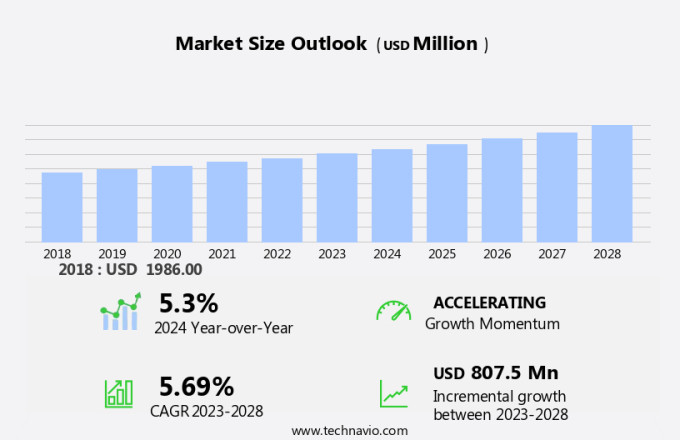

The pneumonia testing market size is forecast to increase by USD 807.5 million at a CAGR of 5.69% between 2023 and 2028.

The market is expanding due to the rising incidence of pneumonia and the growing emphasis on early diagnosis to enhance patient outcomes. As highlighted by the American Thoracic Society (ATS) and the Infectious Diseases Society of America (IDSA), Streptococcus pneumoniae remains a primary contributor to community-acquired pneumonia.CAP guidelines recommend rapid diagnostic testing for this bacterium to enable the timely initiation of appropriate antibiotic therapy. Antibiotics and antifungals are commonly used to treat pneumonia, and rapid diagnosis allows for the timely administration of these medications, improving patient outcomes. Antibiotics and antifungals are commonly used for treating pneumonia caused by various microbial pathogens like streptococcus pneumoniae, Legionella, Chlamydophilla, Mycoplasma, and others. Companies like Curetis and GE Healthcare are focusing on developing advanced technologies, such as the Unyvero A50 and Thoracic Care Suite, respectively, to address the market need for accurate and rapid pneumonia diagnostics. The growing importance of promotional activities and concerns regarding pneumonia mortality are also fueling market growth.

What will be the Pneumonia Testing Market Size During the Forecast Period?

- The pneumonia testing industry is witnessing significant growth due to the increasing prevalence of pneumonia, particularly among the geriatric population and children. According to the Centers for Disease Control and Prevention (CDC), pneumonia is one of the leading causes of death in the United States, with over 50,000 deaths reported annually. Traditional methods for diagnosing pneumonia, such as cultures, have limitations. These methods are time-consuming and have a high error rate, leading to misdiagnosis and delayed treatment. The need for faster and more accurate diagnostic tools is driving the growth of the pneumonia testing industry.

- Moreover, nucleic acid detection techniques, such as Polymerase Chain Reaction (PCR), are gaining popularity in the pneumonia testing industry. These techniques can detect the presence of specific pathogens, including Streptococcus pneumoniae, within a few hours. The healthcare expenditure on pneumonia testing is expected to increase due to the growing awareness of the importance of early diagnosis and treatment. Reimbursements for pneumonia testing are also becoming more favorable, with organizations such as the American Thoracic Society (ATS) and Infectious Diseases Society of America (IDSA) issuing guidelines that recommend the use of point-of-care (POC) testing for pneumonia diagnosis.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Consumables

- Analyzers

- Method

- Immunodiagnostics

- Molecular diagnostics

- Point-of-care testing

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Type Insights

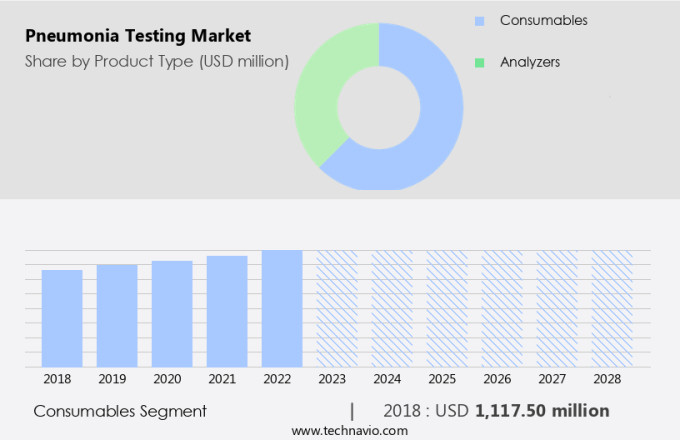

- The consumables segment is estimated to witness significant growth during the forecast period.

In the realm of pneumonia diagnostics, various testing methods are employed to identify lung infections caused by microbial pathogens. Among these, the Streptococcus-based segment holds a significant share in the market. The morbidity rate and fatality rate of pneumonia are high, making the need for accurate and timely diagnosis crucial. Molecular diagnostic assays, such as PCR assays and nucleic acid detection kits, have gained popularity due to their ability to detect specific pathogens. These consumables include staining materials, elimination kits and reagents, standards, and controls. Leading companies, like Meridian Bioscience Inc. (Meridian), provide test kits with reliable assays for the detection of pneumonia in cell cultures.

Get a glance at the market report of share of various segments Request Free Sample

The consumables segment was valued at USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

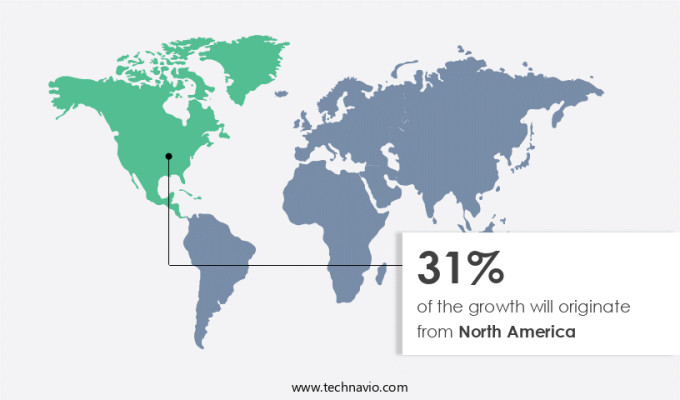

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In North America, the market holds a significant share of the global market, with the United States and Canada being the primary contributors to the revenue. The increasing need for precise and prompt diagnosis of respiratory infections and the presence of numerous pharmaceutical companies in these countries focusing on drug development are the major factors fueling the demand for pneumonia testing in the region. Notable pharmaceutical companies, including Beckman Coulter, bioMerieux, Pfizer, and Roche, are engaged in the research and development of drugs and vaccines, leading to an increased requirement for pneumonia tests for medication screening and other applications. Physicians face challenges in diagnosing pneumonia due to the presence of false positive results, superinfections, and medication complications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Pneumonia Testing Market?

Rising prevalence of pneumonia and concerns associated with pneumonia mortality is the key driver of the market.

- Pneumonia is a common respiratory infection that affects both children and the geriatric population. According to UNICEF, there are approximately 1,400 cases per 100,000 people worldwide each year. The prevalence is particularly high in South Asia and West and Central Africa, with 2,500 and 1,620 cases per 100,000 children, respectively. The high incidence of pneumonia results in significant healthcare expenditure and the need for effective diagnostics. When a patient is critically ill with pneumonia, hospitalization is necessary, and further microbiological testing ensues. These tests include the use of antibiotics and antifungals, as well as nucleic acid detection methods, to identify the specific pathogen causing the infection.

- Moreover, reimbursements for these tests are crucial for healthcare providers and insurers, making them essential growth drivers for the pneumonia diagnostics market. Key market players include Antibiotics, Antifungals, Nucleic acid detection, and other companies that offer innovative solutions for pneumonia testing. Traditional methods, such as cultures, continue to be used but are being gradually replaced by more advanced and efficient diagnostic techniques. The market is expected to grow steadily due to the increasing burden of the disease and the need for accurate and timely diagnosis. In conclusion, the high prevalence of pneumonia in children and the elderly, coupled with the need for effective diagnostics and timely treatment, is driving the growth of The market.

What are the market trends shaping the Pneumonia Testing Market?

Growing importance of promotional activities is the upcoming trend in the market.

- In the specialized field of pneumonia diagnostics, companies face unique challenges in marketing their products due to the narrow end-user base and the technical nature of the tests. Unlike other assays, brand recognition and advertising play a minimal role in sales. Instead, expanding distribution networks and ensuring product accessibility to healthcare providers are key priorities. The prevalence of pneumonia, particularly by pathogens like Streptococcus pneumoniae, necessitates early detection to improve patient outcomes.

- Furthermore, the American Thoracic Society (ATS) and Infectious Diseases Society of America (IDSA) have established guidelines for the diagnosis and treatment of pneumonia, which further prioritizes the importance of accurate and timely testing. Adhering to these guidelines and ensuring the availability of these tests to healthcare providers is crucial for improving patient care.

What challenges does Pneumonia Testing Market face during the growth?

Poor healthcare infrastructure in developing economies is a key challenge affecting market growth.

- In the Pneumonia Testing Industry, timely and accurate diagnosis is crucial for effective treatment and better patient outcomes. However, the process of pneumonia testing can be time-consuming and error-prone, particularly in developing economies with limited healthcare infrastructure. These regions often rely on traditional methods such as chest X-rays and manual analysis, which can lead to misdiagnosis and delayed treatment. Advancements in medical technology have led to the development of more sophisticated tools like analyzers and consumables for pneumonia testing. Technologies such as Immunofluorescence and Point-of-care (POC) testing have gained popularity due to their speed, accuracy, and convenience. However, the high cost of these devices and the need for specialized training limit their widespread adoption in developing regions.

- Moreover, sedentary lifestyles, unhealthy food habits, and environmental factors contribute to the increasing prevalence of respiratory disorders, including pneumonia. According to recent studies, The market is expected to grow significantly in the coming years due to the increasing burden of respiratory diseases and the growing demand for rapid and accurate diagnostic tools. Despite the potential benefits of advanced pneumonia testing technologies, their high cost and limited availability remain major challenges in developing regions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Acumen Diagnostics Pte Ltd.

- Becton Dickinson and Co.

- bioMerieux SA

- Bio Rad Laboratories Inc.

- Danaher Corp.

- Diamedica SIA

- DiaSorin SpA

- F. Hoffmann La Roche Ltd.

- Hologic Inc.

- Laboratory Corp. of America Holdings

- LGC Science Group Holdings Ltd.

- Meridian Bioscience Inc.

- OpGen Inc.

- Pfizer Inc.

- Quest Diagnostics Inc.

- Quidelortho Corp.

- Siemens AG

- Thermo Fisher Scientific Inc.

- Trinity Biotech Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The pneumonia testing industry is witnessing significant growth due to the increasing prevalence of pneumonia, particularly among the geriatric population and children. The high morbidity and mortality rates associated with this medical condition necessitate early and accurate diagnosis. Traditional methods, such as cultures, have a time-consuming process and high error rate, leading to the adoption of advanced diagnostic products like nucleic acid detection and molecular diagnostic assays. The use of these medications, however, comes with the risk of superinfection and medication complications.

Moreover, key market players are focusing on developing point-of-care (POC) testing solutions using analyzers and consumables for quick and accurate diagnosis. Immunofluorescence and sensor-based technologies are gaining popularity due to their ability to detect multiple pathogens in a single test. The prevalence of pneumonia is influenced by sedentary lifestyles, unhealthy food habits, and environmental factors. According to the World Health Organization, pneumonia is the leading cause of death among infectious diseases, accounting for 15% of all deaths. Early detection and preventive care are crucial for reducing the fatality rate. The American Thoracic Society (ATS) and Infectious Diseases Society of America (IDSA) have established guidelines for diagnosing and treating pneumonia.

In addition, these guidelines recommend a combination of clinical assessment, microscopy, culture, immunoassay, antigen detection, and serology. However, the difficulty in diagnosing viral pneumonia and the risk of false positive results in bacterial pneumonia necessitates the use of advanced diagnostic products. Healthcare expenditure and reimbursements play a crucial role in the growth of the pneumonia testing industry. The increasing awareness of infectious diseases and acute lung infections, along with the availability of advanced diagnostic products, is expected to drive market growth in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.69% |

|

Market growth 2024-2028 |

USD 807.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch