Immunoassay Market Size and Forecast 2025-2029

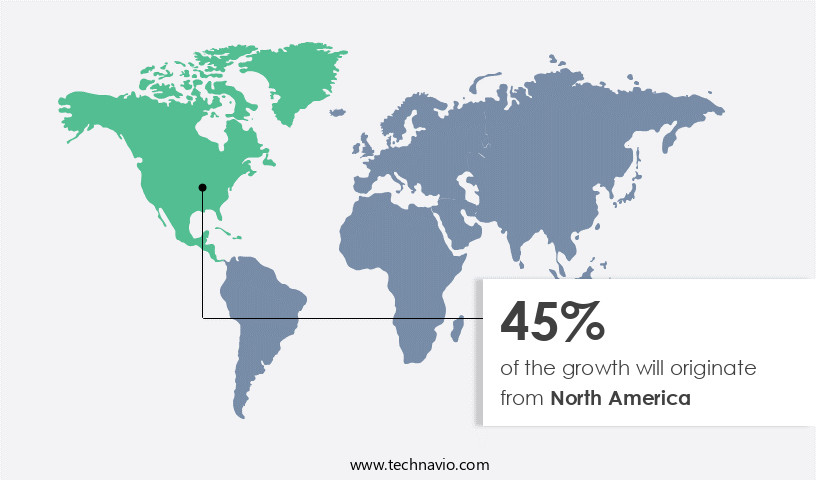

The immunoassay market size estimates the market to reach by USD 9.4 billion, at a CAGR of 4.6% between 2024 and 2029. North America is expected to account for 45% of the growth contribution to the global market during this period. In 2019 the reagents and kits segment was valued at USD 22.30 billion and has demonstrated steady growth since then.

- The immunoassay market is advancing steadily as demand for predictive and preventive medicine accelerates across sectors that rely on early detection and accurate diagnosis. Immunoassays play a central role in identifying critical biomarkers from biological samples such as blood and urine, establishing their importance in clinical diagnostics. Beyond healthcare, the technology's application in the food and beverage industry supports food safety testing and quality assurance protocols, reflecting the market's cross-sector versatility.

- Market participants are increasingly investing in automated and user-friendly testing platforms to streamline workflows and reduce reliance on specialized personnel. This push for innovation aligns with rising testing volumes and reinforces immunoassays as a foundational tool in diagnostics and quality control. A key challenge lies in the limited availability of skilled laboratory professionals, which continues to hinder operational efficiency amid growing demand. Addressing this shortage through automation and workforce development is essential. While the market's foundational capabilities remain strong, its future trajectory depends on overcoming these labor constraints while maintaining high diagnostic accuracy.

- The market is projected to expand steadily, driven by increasing test volumes and rising emphasis on rapid, reliable diagnostics. When comparing performance metrics, testing volumes and technological adoption rates reflect a consistent upward trend, whereas operational capacity faces constraints linked to workforce availability. This imbalance underscores the need for scalable, automated systems to meet expanding application needs without sacrificing reliability or throughput.

What will be the Size of the Immunoassay Market during the forecast period?

Acquire detailed market insights for investment and technology adoption on Immunoasssay Market Request Free Sample

- The global immunoassay market continues to expand as clinical diagnostics and research applications increasingly adopt advanced analytical protocols. Kinetic measurements and endpoint measurements are widely integrated into testing workflows to improve method performance, with diagnostic kits relying on enhanced calibration standards and strict incubation conditions to deliver consistent results. Receptor binding and antibody conjugation are crucial in driving assay sensitivity and specificity testing, especially for emerging molecular diagnostics and toxin detection use cases.

- The use of positive and negative controls, precise sample dilution, and optimized substrate selection have collectively contributed to reducing intra-assay variability and inter-assay variability, ensuring consistent outcomes across diverse sample types. Increased attention to food safety testing and environmental monitoring has led to improvements in wash buffer preparation, reference intervals, and hapten labeling.

- Quantification through optical density (OD) and relative light units (RLU) allows for higher signal-to-noise ratio, which is critical for pathogen identification and detecting trace-level contaminants. Current data shows that the adoption of molecular-based assays grew by 14% as testing protocols expanded across food safety and clinical trail sectors. Meanwhile, the market is expected to grow by more than 9% annually, driven by increasing demand for high-sensitivity diagnostics and evolving regulatory frameworks. This comparison illustrates a substantial upward trend, where the expanding use of advanced immunoassay techniques in multiple fields correlates directly with rising implementation rates and growing market value.

How is this Immunoassay Industry segmented?

The immunoassay industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Reagents and kits

- Analyzers

- Technology

- ELISA

- Radioimmunoassay (RIA)

- Chemiluminescence Immunoassay (CLIA)

- Fluorescence Immunoassay (FIA)

- Rapid Tests

- Western Blotting

- Specimen

- Blood

- Urine

- Saliva

- End-User

- Hospitals

- Blood Banks

- Clinical Laboratories

- Pharmaceutical and Biotech Companies

- Academic Research Centers

- Others

- Application

- Infectious Diseases

- Endocrinology

- Oncology

- Cardiology

- Autoimmune Diseases

- Therapeutic Drug Monitoring

- Bone & Mineral Disorders

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The reagents and kits segment is estimated to witness significant growth during the forecast period.

The global immunoassay market continues to evolve as reagents and kits remain indispensable to improving assay accuracy, sensitivity, and operational efficiency. These components are essential in enabling a range of immunoassay platforms to detect specific antigens with high specificity, especially in drug screening, infectious disease testing, and biomarker quantification. Advanced reagent formulations support multiple functions such as minimizing cross-reactivity in competitive immunoassays, enhancing visualization through immunofluorescence, and amplifying signals in chemiluminescent immunoassays. As diagnostic precision becomes a priority across sectors, the quality and compatibility of reagents with systems like liquid handlers and microplate readers are becoming key factors influencing procurement and lab workflows.

As of 2019 the Reagents and kits segment estimated at USD 22.30 billion, and it is forecast to see a moderate upward trend through the forecast period.

When comparing recent performance, reagents and kits currently contribute to an estimated 20% of total diagnostic market revenue, reflecting their central role in assay workflows and end-use reliability. This share is expected to increase further as demand for rapid and accurate diagnostic tests intensifies. The continuous need for high-quality assay validation and automation solutions ensures that the immunoassay market maintains forward momentum. Looking ahead, expanding use cases across clinical and industrial domains are expected to drive sustained demand. As diagnostic testing volumes increase, precision-oriented reagents are positioned as a growth catalyst, offering scalable support for both emerging and established immunoassay technologies.

Regional Analysis

During the forecast period, North America is projected to contribute 45% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing notable expansion due to the escalating elderly population and the high incidence of chronic and infectious diseases.The global immunoassay market continues to expand as healthcare systems prioritize early detection and disease management through advanced diagnostic testing. Driven by increased demand for point-of-care solutions and laboratory automation, immunoassay technologies are evolving to meet rising diagnostic volumes across clinical and research applications. The widespread adoption of immunoassays is directly linked to rising rates of chronic and infectious diseases, prompting healthcare providers to invest in more accurate and efficient testing frameworks. Notably, the shift toward patient-centric diagnostics is fueling ongoing innovation in assay development and system integration, ensuring broader accessibility and faster turnaround times.

A direct comparison of recent data reveals that the number of cancer cases rose by 24% in men and 21% in women between 2010 and 2020, leading to a parallel increase in demand for immunoassay-based diagnostics. As testing becomes more frequent across various care settings, this sustained growth trajectory signals continued reliance on immunoassays as a foundational tool for diagnostic decision-making.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global immunoassay market is continuously advancing, driven by the rising demand for precision diagnostics and enhanced disease detection capabilities. Applications such as immunoassay applications in disease diagnosis have expanded across clinical and research settings, increasing the need for high-accuracy testing methods. Recent improvements in immunoassay reproducibility and reliability have enabled consistent results across a range of complex biological matrices. The adoption of efficient immunoassay sample preparation methods for various matrices and the integration of immunoassay automation and robotics integration have significantly enhanced throughput and minimized human error, supporting high-efficiency laboratories.

Additionally, evolving data analysis methods for immunoassay results have strengthened the interpretation of findings in both qualitative and quantitative formats, especially when benchmarked against standardized immunoassay performance evaluation criteria. The market shows a clear trend toward innovation, particularly in enzyme-linked immunosorbent assay optimization, high-throughput immunoassay workflow design, and chemiluminescence immunoassay data interpretation, each contributing to faster and more sensitive diagnostics.

Techniques like fluorescence immunoassay signal enhancement strategies and electrochemiluminescence immunoassay calibration further improve analytical precision. Manufacturers are aligning with immunoassay validation parameters and regulatory guidelines to ensure product efficacy, particularly in multiplex immunoassay panel design and applications, where multiple targets are analyzed simultaneously. The industry also faces considerations such as immunoassay development cost and time considerations, while exploring scalable solutions in lateral flow immunoassay manufacturing and quality control.

Recent evaluations indicate that sandwich immunoassay sensitivity and specificity exceed that of competitive immunoassay limitations and advantages, especially within defined immunoassay detection limit and quantification range, solidifying its role in diagnostics. The rise of advanced immunoassay technologies and future trends continues to reshape expectations across the global diagnostic landscape.

What are the key market drivers leading to the rise in the adoption of Immunoassay Industry?

- The market is undergoing rapid transformation as healthcare systems increasingly prioritize early, personalized predictive and preventive medicine for early diagnosis and treatment interventions over reactive treatment. Predictive and preventive medicine now plays a critical role in reshaping care models by enabling more accurate diagnoses and tailored therapies that reduce the burden of chronic and acute conditions.

- This shift is supported by advancements in diagnostic tools that improve clinical decision-making and minimize the risks associated with misdiagnosis, aligning with broader efforts to enhance patient outcomes and operational efficiency in healthcare delivery.

- A comparison of recent performance data highlights the market's growing momentum. A study indicated that predictive diagnostics led to a 30% reduction in unnecessary hospitalizations and a 20% decrease in emergency room visits across a large healthcare network, demonstrating tangible cost savings and improved care quality. Concurrently, market forecasts show over 15% growth in the coming years, underscoring the sector's accelerating adoption and the growing reliance on data-driven, patient-specific diagnostic practices.

What are the market trends shaping the Immunoassay Industry?

- The global immunoassay market continues to evolve as an essential diagnostic platform across various sectors, particularly in food safety and quality assurance. Immunoassays are increasingly integrated into food testing workflows due to their ability to detect contaminants and residues with high precision. These assays utilize antigen-antibody interactions, enabling reliable identification of harmful substances such as antibiotic residues, which are a growing public health concern due to widespread use in animal husbandry.

- Their ease of use, minimal sample preparation, and rapid results have made them indispensable in ensuring regulatory compliance and consumer protection. Recent data highlights the performance trajectory of the market, with a documented increase of over 10% in demand for food testing applications.

- This trend demonstrates a shift toward proactive detection strategies that support public health initiatives. In comparison to traditional methods, immunoassays not only deliver faster turnaround times but also enhance detection sensitivity, making them increasingly valuable for stakeholders focused on accurate, cost-effective diagnostic solutions.

What challenges does the Immunoassay Industry face during its growth?

- The global immunoassay market continues to expand, driven by its critical role in enhancing diagnostic accuracy across healthcare and scientific applications. However, this growth is increasingly constrained by a shortage of skilled laboratory professionals. Immunoassays require precise execution to yield accurate, reproducible results, yet many facilities particularly smaller diagnostic centers face difficulties in recruiting and retaining trained personnel.

- This is especially evident in lower-resourced institutions, where the operational costs associated with specialized staff often exceed budgetary allowances, limiting adoption and accessibility in underserved regions. Despite these labor challenges, the market shows notable resilience and rising demand.

- Current projections indicate a growth of over 12% in the near term, suggesting that the need for advanced diagnostics continues to rise. When automated immunoassay systems were introduced in clinical practice, studies recorded a 30% improvement in diagnostic accuracy and efficiency for thyroid disorders. This data underscores how addressing workforce limitations could unlock significant performance gains in clinical diagnostics.

Exclusive Customer Landscape

The immunoassay market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the immunoassay market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, immunoassay market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing advanced immunoassay solutions, including Alinity, to the global market. Their offerings deliver accurate and efficient diagnostic testing, contributing significantly to the healthcare industry's progress. These innovative technologies facilitate improved patient care and enable better disease management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Abnova Corp.

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- Bio-Techne Corp.

- bioMerieux SA

- Danaher Corp.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Omega Diagnostics Group Plc

- OraSure Technologies Inc.

- PerkinElmer Inc.

- QIAGEN N.V.

- QuidelOrtho Corp.

- Seramun Diagnostica GmbH

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Siemens AG

- Sysmex Corp.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Immunoassay Market

- In January 2024, Roche Diagnostics announced the launch of its new Elecsys 2010 Immunoassay System, which offers enhanced sensitivity and specificity for the detection of various biomarkers, including cardiology and oncology markers (Roche Press Release, 2024).

- In March 2024, Abbott Laboratories and Thermo Fisher Scientific entered into a strategic collaboration to co-develop and commercialize a range of point-of-care (POC) immunoassay tests for infectious diseases and other clinical applications (Abbott Press Release, 2024).

- In May 2024, Siemens Healthineers completed the acquisition of DiaSorin S.P.A., a leading in vitro diagnostics company, significantly expanding its immunoassay portfolio and market presence in Europe and Latin America (Siemens Healthineers Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted approval for Quidel Corporation's Sofia 2 SARS Antigen FIA assay, a rapid immunoassay test for the detection of SARS-CoV-2 antigens in nasal swab samples, further expanding the company's COVID-19 diagnostic offerings (Quidel Press Release, 2025).

Research Analyst Overview

- The market continues to evolve as demand grows across clinical diagnostics and research applications, with increasing reliance on elisa technology, chemiluminescent immunoassay, and fluorescence immunoassay to improve assay precision and accuracy. Advancements in antibody-antigen binding, electrochemiluminescence detection, and signal amplification methods are enabling lower limit of detection (lod) and better limit of quantification (loq), crucial for protein quantification and hormone detection. Integration of microplate reader systems and data analysis software has enhanced assay validation methods and quality control procedures, particularly in high-throughput screening and drug screening environments.

- Immunoassay automation and liquid handling systems further reduce intra-assay variability while supporting consistent endpoint and kinetic measurements. A reported 13% increase in adoption of multiplex immunoassay platforms highlights the growing shift toward streamlined sample preparation techniques and optimized standard curve generation. With industry expectations pointing to an annual growth rate exceeding 8%, the continuous refinement of method performance and cross-reactivity assessment underscores the market's expanding capabilities in applications such as lateral flow immunoassay, Western blotting, and immunofluorescence microscopy.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Immunoassay Market insights. See full methodology.

Immunoassay Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 9.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, UK, Germany, Canada, China, France, Italy, Japan, India, South Korea, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Immunoassay Market Research and Growth Report?

- CAGR of the Immunoassay industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the immunoassay market growth of industry companies

We can help! Our analysts can customize this immunoassay market research report to meet your requirements.