Point Of Care (Poc) Hiv Testing Market Size 2024-2028

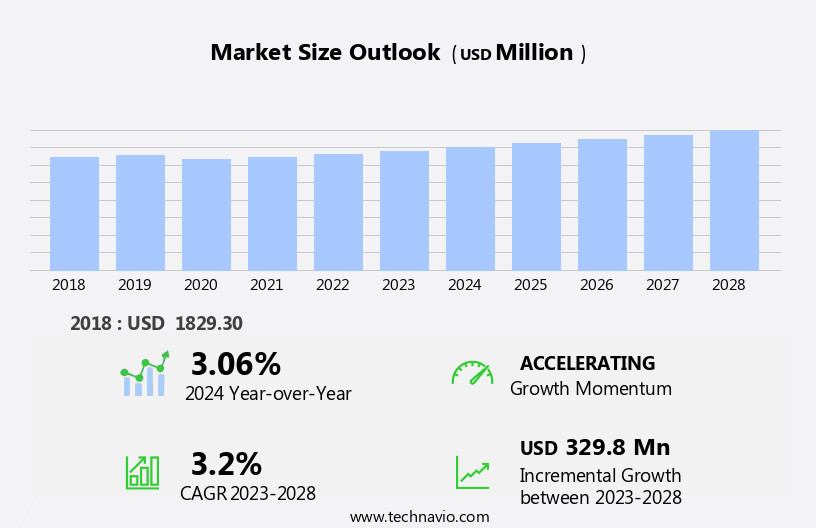

The point of care (poc) hiv testing market size is forecast to increase by USD 329.8 million at a CAGR of 3.2% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. The increasing prevalence of HIV/AIDS worldwide continues to drive market demand, as early and accurate diagnosis is crucial for effective treatment and management of the disease. Additionally, rising awareness programs for HIV testing, particularly in developing and underdeveloped nations, are expanding access to testing services and boosting market growth. Limited healthcare infrastructure In these regions necessitates the use of PoC HIV testing devices, which offer rapid results and ease of use. These trends are expected to continue shaping the market dynamics In the coming years.

What will be the Size of the Point Of Care (Poc) Hiv Testing Market During the Forecast Period?

- The market encompasses diagnostic devices and kits designed for rapid HIV testing at patient locations outside of centralized laboratories. With the global HIV/AIDS prevalence rate continuing to rise, there is a growing demand for convenient and quick HIV testing solutions. POC HIV testing is particularly relevant to scenarios involving blood transfusions and donations, as well as in healthcare institutions and home healthcare settings. These tests provide immediate results, enabling timely treatment decisions and improved patient outcomes. The market is also influenced by the increasing prevalence of chronic diseases such as HIV, tuberculosis, and influenza, which necessitate early detection and personalized medicine.

- Additionally, demographic trends, including an aging population and increased patient autonomy, are driving the growth of the POC HIV testing market. Despite the advantages, challenges such as turnaround time and cost remain, necessitating ongoing innovation and competition withIn the market.

How is this Point Of Care (Poc) Hiv Testing Industry segmented and which is the largest segment?

The point of care (poc) hiv testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- POC HIV testing equipment

- POC HIV testing reagents

- End-user

- Diagnostic labs

- Hospitals and clinics

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

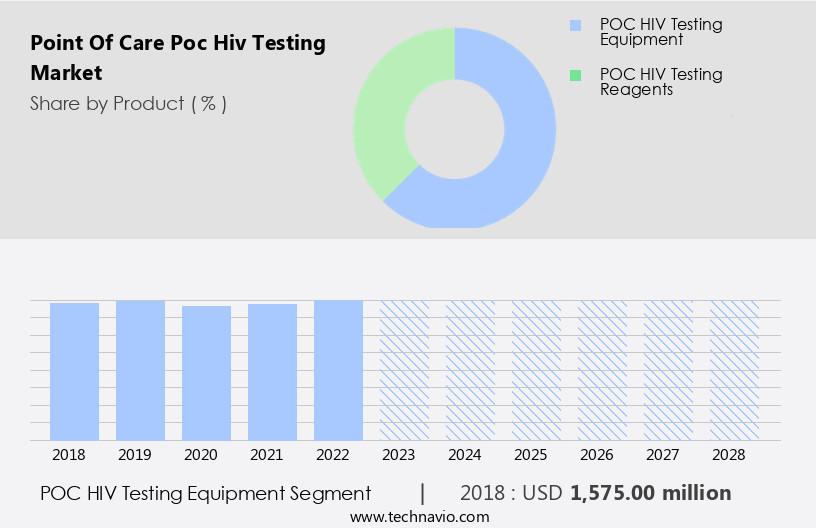

- The poc hiv testing equipment segment is estimated to witness significant growth during the forecast period.

POC HIV testing equipment refers to devices and tools used for HIV testing at or near the patient's care location. This includes rapid HIV test kits, POC HIV viral load testing systems, and POC CD4 count devices. POC testing plays a crucial role in expanding HIV testing access, improving early diagnosis, and increasing linkage to care, particularly in underdeveloped nations and community-based programs. Early diagnosis and swift treatment initiation are essential strategies to combat HIV spread. POC HIV testing equipment advances diagnostics and clinical services, enabling healthcare institutions to provide ART supplies and minimize turnaround time. UNAIDS reports that HIV-related mortality and new infections can be reduced through widespread testing, pre- and post-test counselling, and timely interventions.

Key dynamics driving the POC HIV testing market include chronic diseases, lifestyle-borne diseases, real-time diagnosis, miniaturization of devices, and advanced technologies like biosensors and nanotechnology. Cost-effective, rapid testing is essential for patient management of target diseases, including blood-related disorders and infectious diseases like influenza, HIV, and tuberculosis.

Get a glance at the Point Of Care (Poc) Hiv Testing Industry report of share of various segments Request Free Sample

The POC HIV testing equipment segment was valued at USD 1575.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

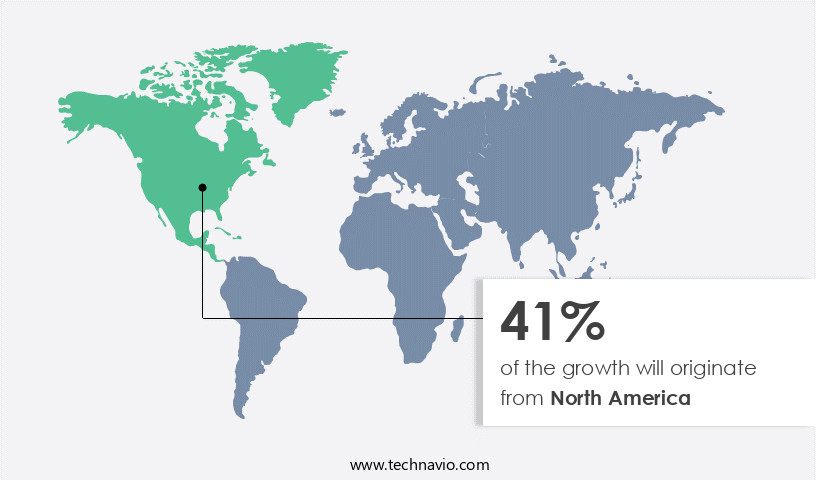

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America has experienced notable growth due to advancements in medical research, enhanced healthcare infrastructure, and heightened awareness regarding HIV/AIDS. The market caters to the US, Canada, and Mexico, with the region's well-developed healthcare system and thriving industry fueling demand for HIV treatment solutions. Government initiatives and collaborations with private organizations have significantly supported market expansion. In the US, routine health checks are incorporated into wellness programs, leading to increased POC HIV testing requirements. Key dynamics include early detection, rapid results, and immediate treatment decisions, which are crucial for managing chronic diseases such as HIV/AIDS, diabetes, cardiovascular diseases, cancer, and blood-related disorders.

POC HIV testing utilizes various sample types, including serum, saliva, and urine, and employs techniques like antibodies, antigens, RNA, and nucleic acid testing. The market is driven by factors like widespread testing, rapid antigen tests, portable PCR devices, telehealth, remote patient monitoring, and miniaturization of devices. Cost-effective and rapid testing, along with timely interventions, are essential for improving patient outcomes and reducing HIV-related mortality and new infections. The industry adheres to standard operating practices and offers pre- and post-test counselling to ensure patient autonomy and optimal care.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Point Of Care (Poc) Hiv Testing Industry?

Increasing prevalence of HIV aids worldwide is the key driver of the market.

- The market is witnessing significant growth due to the increasing prevalence of HIV/AIDS, particularly in underdeveloped nations. HIV is a viral infection that attacks the human immune system, leading to Acquired Immunodeficiency Syndrome (AIDS). The rising number of new HIV infections and expanding high-risk populations are key drivers of the POC HIV testing market. Home use HIV testing kits have gained popularity due to their convenience and ease of use. These tests can be performed using various sample types, including serum, saliva, and urine, and can detect HIV antibodies, antigens, RNA, or nucleic acid. POC HIV testing is crucial for early detection, which is essential for timely interventions and improving patient outcomes.

- HIV can be transmitted through blood transfusions and blood donations, making HIV diagnostic procedures a priority in healthcare institutions. The availability of ART supplies and UNAIDS initiatives to reduce HIV-related mortality and new infections further fuels the demand for POC HIV testing. Standard operating practices, such as pre-test and post-test counselling, confirmation tests, and lab confirmation, ensure accurate and reliable results. Rapid results enable immediate treatment decisions, which is particularly important for chronic diseases like HIV, diabetes, cardiovascular diseases, infectious diseases, and cancer. Advanced technologies, such as biosensors, nanotechnology, and miniaturization of devices, are revolutionizing POC HIV testing.

- Cost-effective rapid testing, widespread testing, and telehealth are also contributing to the growth of the POC HIV testing market. The industry dynamics of POC HIV testing are influenced by various factors, including the prevalence of infectious diseases like influenza and tuberculosis, the need for personalized medicine, home healthcare, and patient autonomy, and the aging population with chronic conditions. The market is expected to continue growing due to the increasing awareness campaigns, testing processes, and the importance of early detection and timely interventions in patient management.

What are the market trends shaping the Point Of Care (Poc) Hiv Testing Industry?

Rise in awareness programs for HIV testing is the upcoming market trend.

- The market involves the use of HIV testing kits for home-based and healthcare institution applications. The prevalence of HIV/AIDS continues to be a significant concern, with new infections and HIV-related mortality rates remaining high, particularly in underdeveloped nations. HIV diagnostic procedures are crucial for early detection and timely interventions to manage chronic diseases such as diabetes, cardiovascular diseases, infectious diseases, cancer, and blood-related disorders. Home use HIV testing kits offer convenience and privacy, allowing individuals to test themselves In the comfort of their homes. These tests use various sample types, including serum, saliva, and urine, to detect HIV antibodies, antigens, or RNA through techniques like Nucleic Acid Testing.

- UNAIDS and other organizations emphasize the importance of pre- and post-test counseling In the testing process. Industry dynamics include the development of simple, quick assays, visual testing, and rapid results for immediate treatment decisions. Centralized laboratories face challenges in terms of turnaround time and patient outcomes, leading to the widespread use of rapid antigen tests and portable PCR devices. Telehealth, remote patient monitoring, and personalized medicine are emerging trends In the POC HIV testing market. Cost of testing, miniaturization of devices, and advanced technologies like biosensors and nanotechnology are key dynamics shaping the market. The market caters to various target diseases, including influenza, tuberculosis, and HIV, and serves healthcare professionals, patients with chronic conditions, and the elderly.

- The POC HIV testing market is expected to grow due to the increasing awareness campaigns, routine health checks, and the need for real-time diagnosis.

What challenges does the Point Of Care (Poc) Hiv Testing Industry face during its growth?

Limited healthcare services in developing and underdeveloped nations is a key challenge affecting the industry growth.

- The market encompasses the production and distribution of HIV testing kits for home use and healthcare institutions. With the increasing HIV/AIDS prevalence, there is a growing need for quick and accurate HIV diagnostic procedures. This is particularly important In the context of blood transfusions and donations, where the risk of HIV transmission is a significant concern. The market dynamics are driven by various factors, including the high HIV-related mortality rate, new infections, and the importance of standard operating practices in healthcare institutions. Key players In the industry focus on developing advanced technologies, such as Nucleic Acid Testing (NAT) and biosensors, for real-time diagnosis.

- In underdeveloped nations, there is a significant need for simple, quick assays and visual testing methods due to limited resources and infrastructure. Pre- and post-test counselling are crucial components of POC HIV testing, ensuring patient outcomes are optimized through timely interventions and immediate treatment decisions. The market for POC HIV testing is vast and diverse, with applications in chronic diseases such as diabetes, cardiovascular diseases, infectious diseases, and cancer. The miniaturization of devices and the integration of advanced technologies, such as nanotechnology, are key trends In the industry. However, the cost of testing remains a significant barrier to widespread testing, particularly in developing countries.

- Rapid testing and portable PCR devices, as well as telehealth and remote patient monitoring, are emerging solutions to address this challenge. The industry is also influenced by the prevalence of other diseases, such as influenza, tuberculosis, and personalized medicine. Home healthcare and elderly care are growing sectors, with a focus on patient autonomy and chronic conditions. Overall, the POC HIV testing market is a dynamic and evolving industry, driven by the need for early detection and timely interventions to improve patient outcomes and reduce the impact of HIV/AIDS on global health.

Exclusive Customer Landscape

The point of care (poc) hiv testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the point of care (poc) hiv testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, point of care (poc) hiv testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - Point-of-Care (POC) HIV testing is a critical segment in diagnostic healthcare, enabling rapid identification and treatment of HIV infection. This approach offers several advantages, including quick results, reduced need for specialized equipment, and increased patient convenience. POC HIV tests, such as the Determine HIV 1 or 2 AG Combo, deliver accurate results in a matter of minutes, contributing significantly to early intervention and disease management. These tests employ advanced immunoassay technology, ensuring high sensitivity and specificity. By bringing HIV testing closer to patients, POC solutions facilitate earlier diagnosis and improved patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AltraTech Ltd.

- Becton Dickinson and Co.

- binx health inc.

- bioLytical Laboratories Inc.

- bioMerieux SA

- Cochrane

- Community Pharmacy England

- CVS Health Corp.

- Danaher Corp.

- DrSafeHands

- F. Hoffmann La Roche Ltd.

- Island Health

- J. Mitra and Co. Pvt. Ltd.

- MH Sub I LLC

- OraSure Technologies Inc.

- Orchard Healthcare Pvt. Ltd.

- SHINE SA

- Walter de Gruyter GmbH

- Yashoda Hospitals

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses diagnostic solutions that enable healthcare professionals to identify the presence of the Human Immunodeficiency Virus (HIV) at the patient's location, eliminating the need for lengthy laboratory tests. This market holds significant importance due to the increasing prevalence of HIV and the necessity for early detection and treatment. The PoC HIV testing landscape is characterized by the development of advanced technologies, miniaturization of devices, and real-time diagnosis. These innovations have led to the emergence of various testing methods, including serum, saliva, and urine samples. The utilization of nucleic acid testing and the detection of HIV antibodies and antigens have revolutionized the diagnostic process.

The market dynamics driving the growth of the PoC HIV testing market include the increasing prevalence of HIV, the importance of early detection, and the need for immediate treatment decisions. Chronic diseases such as diabetes, cardiovascular diseases, cancer, and infectious diseases, including HIV, require timely interventions for effective patient management. The PoC HIV testing market is influenced by several factors, including the cost of testing, widespread testing, and the adoption of advanced technologies. Rapid antigen tests, portable PCR devices, and telehealth have gained popularity due to their affordability, ease of use, and convenience. The market is also influenced by the increasing awareness of HIV and the importance of regular testing, especially for high-risk populations.

Routine health check-ups, awareness campaigns, and pre and post-test counseling are essential components of the testing process. The PoC HIV testing market is expected to grow significantly due to the increasing demand for rapid results and the importance of patient outcomes. Centralized laboratories, with their long turnaround times, are being replaced by PoC testing, enabling healthcare professionals to make immediate treatment decisions. The market is also influenced by the miniaturization of devices and the adoption of advanced technologies such as biosensors and nanotechnology. These innovations have led to the development of simple, quick assays, visual testing, and personalized medicine, making HIV testing more accessible to patients.

The PoC HIV testing market is not limited to healthcare institutions but also includes home healthcare, elderly care, and remote patient monitoring. The importance of patient autonomy and the convenience of home testing have led to the growth of this segment. In conclusion, the PoC HIV testing market is a dynamic and growing industry, driven by the need for early detection, immediate treatment decisions, and the adoption of advanced technologies. The market is expected to continue growing due to the increasing prevalence of HIV, the importance of patient outcomes, and the convenience of PoC testing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 329.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

US, Germany, China, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Point Of Care (Poc) Hiv Testing Market Research and Growth Report?

- CAGR of the Point Of Care (Poc) Hiv Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the point of care (poc) hiv testing market growth of industry companies

We can help! Our analysts can customize this point of care (poc) hiv testing market research report to meet your requirements.