Poland Ceramic Tile Market Size 2024-2028

The Poland ceramic tiles market is forecast to increase by USD 2.77 billion and is estimated to grow at a CAGR of 10.21% between 2023 and 2028. The market is experiencing significant growth, driven by the expanding construction sector, particularly in residential and commercial projects. This trend is fueled by increasing urbanization and rising disposable income, leading to a higher demand for aesthetically pleasing and durable floor solutions. Additionally, the evolution of smart tiles, which offer advanced features such as temperature control, waterproofing, Crash sensor and integrated LED lighting, is disrupting the market and attracting tech-savvy consumers. However, the negative impacts of the COVID-19 pandemic, including supply chain disruptions and decreased construction activity, pose challenges to market growth. Overall, the ceramic tiles market is poised for continued expansion, driven by a combination of structural and technological trends.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market is witnessing significant growth due to the expansion of offices and workspaces, rapid urbanization, and population expansion. Ceramic tiles are increasingly being used as wall and floor coverings in both residential and commercial spaces. Consumer trends towards colorful and textured tiles, as well as the demand for anti-bacterial, stain, and water-resistant, low-maintenance, and highly durable flooring, are driving market growth. Construction spending and economic development are also key factors. Inkjet technology is being used to create decorative flooring with intricate designs, while natural stones and marble-styled tiles continue to be popular choices. The merger of various players in the industry is expected to further propel market growth. The market is a dynamic and evolving industry that caters to diverse consumer preferences and construction sector needs. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The expanding construction sector is the key factor driving the ceramic tiles market growth in Poland. The region's construction sector is growing rapidly, mainly thanks to investment subsidized by the government. Oil industry markets are rapidly diversifying their economies to reduce dependence on oil. Fluctuations in world oil prices make the Polish construction market very unstable.

However, the construction industry is growing at a rate of more than 5% year-over-year (YoY), despite the regional political instability, which has upset investor confidence. Thus, the construction industry is the foremost driving force for the ceramic tiles market in Poland. Thus, such events and promotional activities will have a positive impact on the growth of the ceramic tiles market in Poland during the forecast period.

Significant Market Trend

The evolution of smart tiles is the primary trend in the ceramic tiles market growth in Poland. Demand for fossil fuels grew rapidly. This suggests that in a few years, the consumption of energy from non-renewable sources will decrease due to their scarcity and exhaustion. Energy-harvesting smart tiles use the smart energy generated by the footsteps of pedestrians/people walking on floors or other paths covered by these tiles. The plates work with piezoelectric technology. They were first used on a small path in London, where the energy collected from the steps of people walking on the tiles played with small chirping birds and lit the path at night.

Moreover, smart tiles can also be used in anti-theft systems. Ceramic flooring and wall tiles could have small sensors embedded in them to record personal data, such as the badge number, of people who are walking nearby. This can prevent the theft of equipment in factories as well as the theft of valuables from public buildings like museums. Thus, the rising prices of fossil fuels have been increasing the demand for such innovative ceramic tiles manufacturing, which will augment the growth of the ceramic tiles market in Poland during the forecast period.

Major Market Challenge

Volatility and instability in the supply and prices of key inputs are major challenges to the ceramic tiles market growth in Poland. Volatility and instability in the supply and prices of key production inputs have significant negative consequences that primarily affect manufacturing organizations. In addition, there is greater instability in the price of raw materials used in the manufacture of ceramic tiles. Price fluctuations of raw materials such as silica sand, kaolin, feldspar, and bentonite are variable.

Moreover, the volatile raw material prices increase the capital investments needed in the entire manufacturing process of ceramic tiles. Rising costs and unexpected fluctuations in raw material price levels destabilize the entire supply chain and render it difficult for manufacturers to sustain themselves in the highly competitive ceramic tiles market in Poland. Thus, the demand for ceramic tiles from the construction industry is expected to be hampered during the forecast period.

Market Customer Landscape

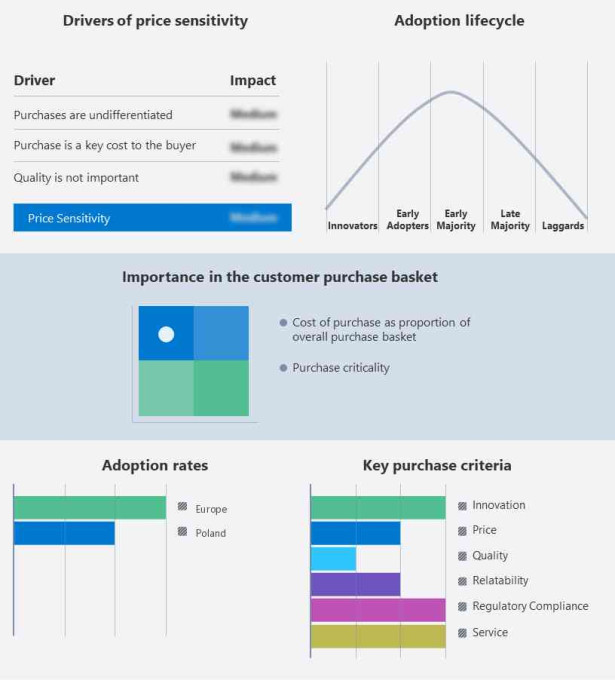

The report includes the adoption lifecycle of the market, covering from the innovatorâs stage to the laggardâs stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ceracasa SA - The company offers ceramic tiles through various collections such as Absolute, Agatha, Aston, Antic, and Arezzo tiles. Also, the company offers various tiles such as white body, porcelain, Pulido alto brillo, and Pulido gloss.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market vendors, including:

- CERAMICA SALONI SAU

- Ceramika Konskie SP zo.o.

- Ceramika Paradyz Sp. Zo.o.

- Cerrad Sp. Zo.o. Co.

- Cersanit SA

- Fea Ceramics

- Grespania SA

- Huss Tile and Stone Inc.

- Kajaria Ceramics Ltd.

- Mohawk Industries Inc.

- Opoczno SA

- SONNEN METAL Co.

- Tubadzin Management Group Sp. Zoo

- Villeroy and Boch AG

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segment in the Market?

The market share growth by the ceramic floor tiles segment will be significant during the forecast period. The use of ceramic tiles for flooring is the most common application in the ceramic tiles market, both in Poland and globally. These tiles offer versatility in terms of the designs and colors available, and they are generally preferred for indoor applications, such as in halls, offices, kitchens, bathrooms, and others. Their strong and durable characteristics make them perfect for use in places where there are high footfalls, which will increase segment growth during the forecast period.

Get a glance at the market contribution of various segments Request a PDF Sample

The ceramic floor tiles segment was valued at USD 2.26 billion in 2018 and continue to grow by 2022. Ceramic floor tiles are generally large and stronger than wall or ceiling tiles. These tiles are classified according to their wear resistance. The rating is given according to the Porcelain Enamel Institute (PEI). Ceramic tiles with ratings PEI 2, 3, 4, and 5 can be used for flooring. As the rating increases, the wear resistance of the tiles also rises. PEI 1-rated tiles are only used for walls and ceilings and not for flooring. The ability of ceramic tiles to withstand scratches from a variety of minerals is determined as per the Mohs scale. The use of ceramic tiles for floors is preferred due to advantages such as frost resistance, water absorption, stain resistance, chemical resistance, strength, dirt resistance, heat resistance, fire resistance, and slip resistance. Thus, the wide range of product offerings from market vendors will drive the growth of the segment in the ceramic tiles market in Poland during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Application Outlook

- Ceramic floor tiles

- Ceramic wall tiles

- Others

- End-user Outlook

- Commercial

- Residential

Market Analyst Overview

The Market is witnessing significant growth due to the increasing demand for wall and floor coverings in various sectors. Consumer trends, such as the expansion of offices and workspaces, consumer lifestyle, and rapid urbanization, are driving the market. Ceramic wall tiles, including anti-bacterial, stain, Repair service and water-resistant options, Sensor are popular choices due to their durability and low-maintenance properties. Colors and textures are essential factors influencing consumer preferences in the market. Construction spending and economic development, coupled with population expansion, are boosting the construction sector's demand for ceramic tiles. The market for floor tiles, including rubber, glass, and quarry tiles, is also growing due to their highly durable and decorative nature. Inkjet technology, natural stones, steel, marble-styled tiles, and mergers in the industry are key trends shaping the market. Regulations by organizations like the Organization for Standardization and stringent environmental regulations impact the market's raw materials and production processes. End-user concentration on direct channels and intermediaries, as well as the availability of various flooring options like marble and stone floors, further influence market growth. Digital printing processes are also gaining popularity in the ceramic tiles market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

124 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.21% |

|

Market growth 2024-2028 |

USD 2.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ceracasa SA, CERAMICA SALONI SAU, Ceramika Konskie SP zo.o., Ceramika Paradyz Sp. Zo.o., Cerrad Sp. Zo.o. Co., Cersanit SA, Fea Ceramics, Grespania SA, Huss Tile and Stone Inc., Kajaria Ceramics Ltd., Mohawk Industries Inc., Opoczno SA, SONNEN METAL Co., Tubadzin Management Group Sp. Zoo, and Villeroy and Boch AG |

|

Market dynamics |

Parent market analysis, Market trends, market growth analysis, market research and growth, market forecasting, market report, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the ceramic tiles market between 2023 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across Poland

- Thorough analysis of the marketâs competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of ceramic tiles market companies in Poland

We can help! Our analysts can customize this report to meet your requirements. Get in touch