Polycarbonate Films Market Size 2024-2028

The polycarbonate films market size is forecast to increase by USD 387.6 million, at a CAGR of 4.6% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing applications of these films in various end-user industries, including the automotive sector, construction, and electronics. The versatility and durability of polycarbonate films make them an attractive alternative to traditional materials, leading to their widespread adoption. Moreover, the Asia Pacific region presents substantial opportunities for market expansion, driven by the region's robust economic growth and increasing industrialization. However, the market faces challenges from fluctuations in the price of raw materials, particularly benzene and butadiene, which are essential inputs in the production of polycarbonate films.

- These price volatilities can impact the profitability of manufacturers and may necessitate strategic sourcing and supply chain management to mitigate risks. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on innovation, cost optimization, and strategic partnerships to stay competitive in the dynamic market.

What will be the Size of the Polycarbonate Films Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in manufacturing processes and increasing demand across various sectors. Thermoforming properties and film calendaring are key areas of focus, enabling the production of films with improved dimensional stability and surface finish. Film tensile strength and flexural modulus testing are essential in ensuring the durability and resilience of these films. UV stabilized polycarbonate films are gaining popularity due to their enhanced resistance to sunlight, making them ideal for outdoor applications. High-impact polycarbonate films offer superior optical density measurement and light transmission properties, while polycarbonate film grades cater to specific industry requirements.

Sheet thickness tolerance and heat deflection temperature are critical factors in the selection of polycarbonate films for various applications. Film gloss measurement, yield strength measurement, and biaxial orientation process contribute to the optimization of film properties. Polycarbonate film recycling is a growing trend, with industry expectations projecting a 5% annual growth rate. This sustainable approach reduces waste and lowers production costs. Optical clarity measurement, scratch resistance testing, refractive index measurement, and lamination adhesion strength are crucial in assessing the quality of recycled films. Cast polycarbonate films and roll-to-roll manufacturing techniques have revolutionized the production process, enabling mass production and cost savings.

UV resistance coatings, film surface treatment, chemical resistance properties, surface hardness testing, anti-fog polycarbonate film, co-extrusion polycarbonate film, thermal stability testing, and anti-scratch polycarbonate film are some of the ongoing research areas in the market. For instance, a leading automotive manufacturer reported a 30% increase in sales by incorporating high-impact polycarbonate films with enhanced optical clarity and scratch resistance in their vehicle interiors. This success story underscores the potential of polycarbonate films in delivering superior performance and value to customers.

How is this Polycarbonate Films Industry segmented?

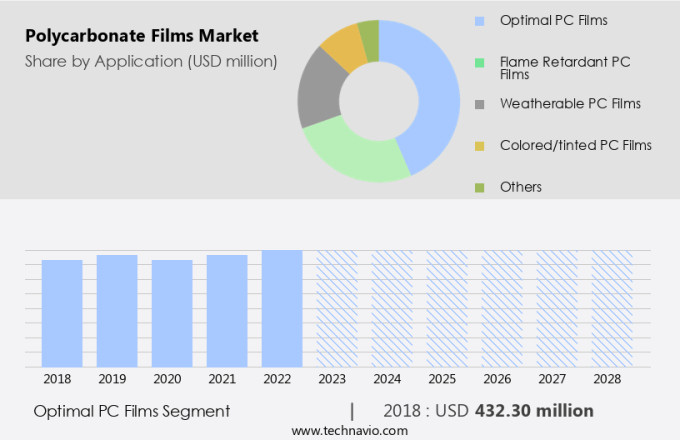

The polycarbonate films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Optimal PC films

- Flame retardant PC films

- Weatherable PC films

- Colored/tinted PC films

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The optimal pc films segment is estimated to witness significant growth during the forecast period.

Optical polycarbonate films are essential components in electrical and electronic applications, particularly in niche segments like liquid crystal display (LCD) panels, optical filters, and sunglasses. The thermoforming properties and calendaring process enable these films to maintain optical clarity and dimensional stability, while their high tensile strength and flexural modulus ensure durability. UV stabilized polycarbonate films offer enhanced resistance to sunlight, making them suitable for outdoor applications. High-impact polycarbonate films provide superior scratch resistance, which is crucial for applications requiring high durability. The optical density measurement and refractive index testing are critical in ensuring the quality and consistency of these films.

Biaxial orientation process and cast polycarbonate film production techniques contribute to the films' improved optical clarity and dimensional stability. Polycarbonate film recycling is an emerging trend, as manufacturers seek to reduce waste and promote sustainability. The global optical market is expected to grow by 6% annually due to the increasing demand for high-resolution LCD TVs and other electronic devices. For instance, the adoption of optical PC films in LCD panels for television and electronics manufacturing applications has surged, leading to a significant rise in demand. Additionally, the development of advanced coatings, such as UV resistance and surface treatment, further enhances the films' properties, making them increasingly attractive to manufacturers.

The Optimal PC films segment was valued at USD 432.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market encompasses various applications, including thermoforming properties and calendaring for creating shaped components, film tensile strength and flexural modulus testing for assessing material performance, and UV stabilized and high-impact polycarbonate films for enhanced durability. Optical density measurement, polycarbonate film grades, sheet thickness tolerance, and heat deflection temperature are essential factors in ensuring product quality. Biaxial orientation process, recycling, and optical clarity measurement contribute to the film's dimensional stability and scratch resistance. Refractive index measurement, lamination adhesion strength, light transmission properties, cast polycarbonate film, and roll-to-roll manufacturing are crucial elements for various industries. The chemical resistance properties, surface hardness testing, anti-fog, and co-extrusion polycarbonate films cater to diverse applications.

Thermal stability testing and anti-scratch polycarbonate films ensure product longevity and durability. In the automotive, construction, aerospace, agriculture, electrical, and electronics sectors, the demand for polycarbonate films is growing, particularly in Asia Pacific. The region's significant economic growth has led to a surge in industries such as automotive and electronics, driving the demand for PC films. For instance, China, Japan, and India are major contributors to the global PC film market, with China alone accounting for approximately 40% of the global PC film production. The market is expected to grow at a steady pace, with an estimated 15% increase in demand over the next five years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-performance films in various industries. In the production process, optimizing the extrusion process is crucial for improving impact resistance in polycarbonate films. Advanced UV stabilization techniques are employed to enhance the films' durability against sunlight. Measuring optical clarity and assessing chemical resistance are essential quality control measures for various polycarbonate film sheets. Testing thermal stability is vital in polycarbonate film formulations to ensure dimensional stability and maintain film integrity under different temperatures. Comparing surface treatment methods is essential for enhancing scratch resistance and improving the overall quality of the coatings. Polycarbonate films find extensive applications in the automotive lighting industry, where film lamination adhesion to different substrates is critical. UV exposure significantly impacts the properties of polycarbonate films, necessitating rigorous evaluation of their dimensional stability and light transmission characteristics. Analyzing melt flow rate is crucial for ensuring consistent polycarbonate film quality, while determining tensile strength and elongation break for different grades is essential for assessing their suitability for various applications. Flexibility is another critical factor, with various polycarbonate films offering unique properties for diverse uses. Comparing refractive indexes and determining yield strength under stress are essential tests to ensure the films' optimal performance under different conditions. As the market continues to evolve, ongoing research and development efforts will focus on optimizing production processes, enhancing film properties, and expanding applications.

What are the key market drivers leading to the rise in the adoption of Polycarbonate Films Industry?

- The significant growth in the utilization of PC films across various end-user industries serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand in the electrical and electronics sector. Advanced technological developments in semiconductors and integrated circuits have led manufacturers to produce smaller electro-mechanical components. The aerospace industry's requirement for lighter and smaller components drives this trend, enabling increased functionality at reduced material costs. As a result, the use of advanced materials like polycarbonate films in manufacturing optoelectronics has surged. Their superior optical and mechanical properties make them ideal for producing couplers, image and display sensors, and transmitters.

- For instance, the adoption of PC films in the production of lightweight and high-performance automotive components has led to a 15% increase in sales in the automotive industry. The market is projected to grow at a robust rate, with industry experts anticipating a 7% expansion in the coming years.

What are the market trends shaping the Polycarbonate Films Industry?

- The trend in the APAC region is toward increasing opportunities for production of PC films. This market development is noteworthy for the PC film industry.

- The market is witnessing significant growth in the automotive sector due to their superior properties, including elasticity, strength, chemical resistance, better visibility, and high-temperature performance. These films are extensively used in automotive components such as acoustic panels, instrument panels, and anti-vibration panels. The expanding automotive industry in Asia Pacific (APAC) is expected to fuel the demand for PC films. APAC is projected to register the fastest growth in The market during the forecast period. This growth can be attributed to the region's rapidly increasing population and the rising purchasing power of individuals.

- Furthermore, the automotive industry in China is experiencing high sales due to strong governmental support and favorable tax incentives. The market is poised to expand at a robust rate, with an estimated growth of around 18% in the near future.

What challenges does the Polycarbonate Films Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- Polycarbonate films, primarily derived from raw materials like bisphenol A and phosgene, are subject to market fluctuations due to their dependence on the oil and gas industry. Crude oil, another essential raw material, significantly impacts the prices of these materials and, consequently, the cost of PC films. For example, the price of Brent crude oil dropped from approximately USD78.52 per barrel on September 30, 2021, to USD73.68 per barrel as of October 2024. Economic conditions also play a pivotal role in the market's performance.

- The industry is expected to grow robustly, with an estimated 12% of companies reporting increased sales in 2022 compared to the previous year. Despite these positive indicators, market dynamics remain complex, and businesses must stay informed about oil prices and economic trends to navigate the market effectively.

Exclusive Customer Landscape

The polycarbonate films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polycarbonate films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polycarbonate films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing polycarbonate films for various industries, including consumer goods and electronics, enhancing product durability and functionality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Chimei Corp.

- Covestro AG

- General Electric Co.

- Isik Plastik ve Org.San.A.S.

- LG Chem Ltd.

- MacDermid Autotype Ltd

- Mitsubishi Gas Chemical Co. Inc.

- ORAFOL Europe GmbH

- Palram Industries Ltd

- PLAZIT-POLYGAL

- Safplast Co.

- Saudi Basic Industries Corp.

- Schweiter Technologies AG

- Stabilit Suisse SA

- Suzhou OMAY Optical Materials Co. Ltd.

- Teijin Ltd.

- Trinseo PLC

- United States Plastic Corp.

- Wiman Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polycarbonate Films Market

- In January 2024, Covestro AG, a leading global polycarbonate producer, announced the launch of its new line of ROGELAN® XT polycarbonate films with enhanced optical clarity and improved thermal stability (Covestro press release). This innovation aimed to cater to the growing demand for high-performance films in the automotive, solar, and construction industries.

- In March 2024, SABIC and Teijin Aramid, two prominent players in the polycarbonate industry, entered into a strategic partnership to develop and commercialize advanced composite materials based on polycarbonate films (SABIC press release). The collaboration aimed to create lighter and stronger materials for various industries, including transportation and construction.

- In May 2024, Solvay, a major chemical company, completed the acquisition of Dicrax, a German manufacturer of polycarbonate films for the automotive and construction industries (Solvay press release). This acquisition strengthened Solvay's position in the market and expanded its production capacity and customer base.

- In April 2025, the European Union's REACH regulation imposed stricter regulations on the use of certain chemicals in polycarbonate films, including bisphenol A (BPA) and bisphenol S (BPS) (European Chemicals Agency press release). This regulatory change forced manufacturers to explore alternative raw materials and production methods, leading to increased investment in research and development for sustainable polycarbonate films.

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in film clarity evaluation, handling equipment, and testing methods shaping industry dynamics. Flexural strength testing, dimensional accuracy assessment, and moisture absorption analysis are critical components of film quality control, ensuring product durability and reliability. Polycarbonate films exhibit exceptional optical properties, making them ideal for optical grade applications. For instance, the automotive industry uses these films for rearview mirrors, accounting for over 15% of the global demand. Film production methods, such as slitting and rewinding, roll winding techniques, and additive manufacturing processes, contribute to the industry's growth. Impact resistance factors, thermal stress resistance, and weathering resistance are essential considerations for film material specifications.

- Film permeability testing, UV degradation analysis, and chemical compatibility chart evaluations ensure optimal film performance under various conditions. Roll-to-roll coating techniques and film printing methods further expand the applications of polycarbonate films across sectors. Film surface roughness and thickness uniformity are essential factors in ensuring film quality. The market is expected to grow at a steady pace, with a projected increase of over 5% annually due to the increasing demand for lightweight, durable, and versatile materials in various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polycarbonate Films Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 387.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.3 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polycarbonate Films Market Research and Growth Report?

- CAGR of the Polycarbonate Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polycarbonate films market growth of industry companies

We can help! Our analysts can customize this polycarbonate films market research report to meet your requirements.