Polymeric Sand Market Size 2024-2028

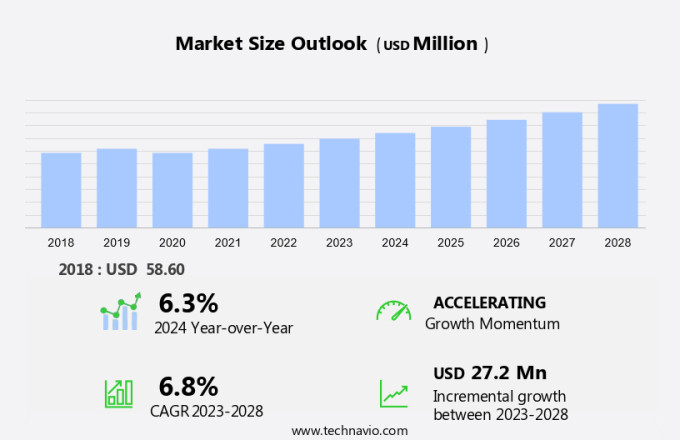

The polymeric sand market size is forecast to increase by USD 27.2 million at a CAGR of 6.8% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for strong and flexible joint stabilization solutions in the construction industry. This market is driven by the expanding residential infrastructure sector and the need for long-lasting weather protection. Polymeric sand, a blend of crushed stone or crushed concrete and a polymer resin, is activated with water to create a strong bond. This bond provides superior joint stability and excellent drainage capabilities. However, factors like pressure washing and contamination can affect the longevity, requiring regular maintenance and replacement. The use of polymeric sand in construction projects offers several advantages, including increased joint strength and flexibility, making it a preferred choice for both new and existing infrastructure.

What will be the Size of the Market During the Forecast Period?

The industry continues to evolve, with an increasing focus on creating attractive and long-lasting outdoor spaces. One essential component in this regard is the use of polymeric sand in paver joints. This sand, a blend of silica sand and polymers, offers significant advantages over traditional sand or masonry sand. Polymeric sand plays a crucial role in enhancing the performance level of paver installations. The sand's high hardness ensures that it can withstand the weight of vehicles and foot traffic without compromising joint stability. It is activated with water, forming a strong bond between the pavers and the sand, ensuring joint stability under various traffic conditions. The high-quality sand provides excellent resistance to moisture, mold, mildew, and contaminants, ensuring the longevity of the hardscape.

Moreover, the use of polymeric sand in paver joints offers several benefits. Its unique properties, such as flexibility and hardness, make it an ideal choice for both residential and commercial applications. Unlike regular sand, which can wash away or compact over time, polymeric sand maintains its shape and provides consistent joint spacing. The sand's resistance to contaminants, such as oil and grease, also makes it a preferred choice for commercial applications. Moreover, the initial set times for polymeric sand are much faster than those for traditional sand, enabling quicker installation and reduced downtime. This sand, employed to fill the gaps between ceramic materials such as brick, stone, asphalt, and concrete pavers, is particularly resilient against erosion and corrosion. The sand's flex technology allows it to expand and contract with temperature changes, ensuring the pavers remain level and stable. When it comes to base materials, crushed stone, and crushed concrete are common choices for hardscapes.

However, the use of polymeric sand in their joints enhances their overall performance. The sand's drainage properties ensure proper water flow, preventing water accumulation and reducing the risk of damage from freeze-thaw cycles. In conclusion, the market is an essential segment in the hardscape industry. Its use in paver joints offers numerous advantages, including improved joint stability, enhanced durability, and faster installation times. As the demand for attractive and long-lasting outdoor spaces continues to grow, the importance of high-quality polymeric sand will only increase.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Residential

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

The commercial segment is estimated to witness significant growth during the forecast period.In The market, the commercial sector held the largest market share in 2023. The primary reason for this is the increasing urbanization and the demand for cost-effective and dependable materials in construction projects. Polymeric sand is a popular choice due to its high water absorption capacity, which makes it ideal for the construction industry. Unlike traditional sand, it does not disintegrate into dust, making it a suitable option for infrastructure projects like highway construction, bridge building, and dams, even in wet conditions with high moisture content.

Furthermore, the superior binding qualities of polymeric sand contribute to longer-lasting pavements, making it a preferred substrate for mixing concrete or asphalt. Landscaping professionals and contractors widely use this material to secure joints and enhance the strength and longevity of their projects.

Get a glance at the market share of various segments Request Free Sample

The commercial segment accounted for USD 45.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is experiencing notable growth due to the region's increasing infrastructure development and rising construction activities. Countries like China, India, and Southeast Asian nations are witnessing a rise in residential and commercial projects, leading to heightened demand for reliable and long-lasting paver jointing solutions. Polymeric sand is a popular choice for these applications due to its superior binding capabilities, resistance to weed growth, and erosion prevention.

Furthermore, the trend towards outdoor living spaces, such as patios and walkways, is fueling the demand for polymeric sand in landscaping projects across the Asia Pacific region. Increasing disposable incomes and the adoption of modern construction techniques are also contributing factors to the market expansion.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing need for long-lasting weather protection solutions across construction industry is the key driver of the market. In the realm of hardscape construction, the use of polymeric sand has gained significant traction as an effective solution for filling the joints between various materials such as brick, stone, asphalt, and concrete pavers. Traditional sand options have proven to be susceptible to erosion and corrosion, leading to the need for more strong bonding agents. Enter polymeric sand, a game-changer in the construction industry. Polymeric sand offers several advantages over conventional sand. Its resistance to being washed away by heavy rainfall or flooding makes it a preferred choice for long-lasting construction projects.

Furthermore, it enhances pavement strength, suppresses weed growth, and withstands extreme weather conditions, including freezing temperatures and intense heat. The demand for high-quality, long-lasting protection solutions in the building and construction sectors is on the rise. Consequently, sales of polymeric sand are projected to rise throughout the forecast period. This trend is attributed to the material's superior performance level under various traffic conditions. By providing a more reliable and durable bonding solution, polymeric sand is poised to become an indispensable component of hardscape construction projects. Ensure the use of proper grammar, sentence structure, and tone to maintain a professional and formal tone.

Market Trends

Growing expansion of residential infrastructure is the upcoming trend in the market. The expansion of the global population and the subsequent need for housing have significantly contributed to the growth of the market. This market's expansion is closely linked to the residential infrastructure sector's growth. With urbanization on the rise and the increasing demand for residential infrastructure, polymeric sand has become a popular choice for construction projects due to its ability to enhance the durability and stability of paved surfaces.

Furthermore, the desire for visually appealing outdoor spaces, such as patios, walkways, and driveways, has increased the demand for this product in residential projects. As a result, sales of essential construction materials, including polymeric sand, are projected to experience substantial growth. As a result, sales of construction materials, including polymeric sand, are projected to experience substantial growth.

Market Challenge

High cost associated with production polymeric sand is a key challenge affecting market growth. In the realm of masonry projects, various types of sand are employed to fill the joints between diverse paver materials, including brick, stone, asphalt, and concrete. Among these options, polymeric sand, which incorporates Flex technology, is a preferred choice due to its enhanced properties. However, the higher cost of this sand compared to regular or masonry sand deters some users, particularly in economically-driven projects. The price of polymeric sand can fluctuate significantly based on several factors, such as the supplier, geographic location, and raw material availability. These variables contribute to the complexity of the purchasing decision for both consumers and contractors.

Moreover, the escalating production costs, driven by rising raw material and energy prices, amplify the overall expense of utilizing polymeric sand in construction projects, thereby increasing the project's total budget. Despite its advantages, such as improved hardness and resistance to moisture, mold, mildew, and contaminants, the higher cost and price volatility of polymeric sand necessitate a careful evaluation of its benefits against the project's budget.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alliance Designer Products Inc.: The company offers polymeric sand such as Gator maxx sand G2.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CRH Plc

- Lowes Co. Inc.

- Maineline Materials

- Pavers India Co.

- Quadra Chemicals Ltd.

- Sakrete

- SEK Surebond

- SGM Southern Grouts and Mortars Inc.

- Sika AG

- SRW Products Inc.

- Techniseal Inc.

- The Shaw Group Ltd.

- Unilock Ltd.

- Vimark Srl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polymeric sand is a specialized type of sand used in hardscape projects for securing the stability of joints between pavers, stones, and other base materials. This sand is a mixture of silica sand and polymers, which, when activated with water, form a strong bond between the pavers. The use of polymeric sand offers several advantages over regular sand for jointing, including improved joint stability, resistance to erosion, and enhanced resistance to moisture, mold, mildew, and contaminants. The performance level of polymeric sand is crucial for high-traffic conditions, ensuring the longevity and resilience of hardscapes. Its flexibility allows for movement under pressure washing and temperature changes, preventing hazing and staining.

Furthermore, base materials like crushed stone and crushed concrete benefit from the use of polymeric sand for drainage and joint stability. Landscaping professionals and contractors rely on high-quality polymeric sand for various hardscape projects, including driveways, walkways, and patios. The sand's ability to create an airtight seal prevents the intrusion of weeds, ants, and other pests, contributing to the aesthetics and overall appeal of the project. The color variations of the sand can also complement the pavers and stones used, enhancing the project's visual appeal. The installation process of polymeric sand requires careful preparation, including proper compaction and the use of a soft bristle broom or leaf blower to remove excess sand. Proper maintenance, such as regular sweeping and occasional reapplication, ensures the sand's long lifespan and optimal performance under various environmental conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2024-2028 |

USD 27.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.3 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

China, US, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alliance Designer Products Inc., CRH Plc, Lowes Co. Inc., Maineline Materials, Pavers India Co., Quadra Chemicals Ltd., Sakrete, SEK Surebond, SGM Southern Grouts and Mortars Inc., Sika AG, SRW Products Inc., Techniseal Inc., The Shaw Group Ltd., Unilock Ltd., and Vimark Srl |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch