Polyquaternium Market Size 2024-2028

The polyquaternium market size is forecast to increase by USD 33.88 thousand at a CAGR of 4.9% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for plant-based raw materials in the green industry. One notable trend is the utilization of by-products from the sugar industry, such as white beet molasses, as sustainable sources for cationic polymers (CPs) in hair care formulations. This shift towards biodegradable and eco-friendly ingredients aligns with the broader trend of sustainability in the cosmetics sector. Strict regulations in the personal care industry also drive the demand for CPs, as they provide superior conditioning and styling benefits while meeting stringent safety and environmental standards. These factors contribute to the continued growth and innovation in the market.

What will the size of the market be during the forecast period?

Polyquaternium compounds, a type of quaternary ammonium compound, have gained significant attention in the cosmetic industry due to their unique properties. These compounds, which include polymers and polyquats, offer various benefits for hair care products. Polyquaternium compounds provide an anti-static effect, making hair look smoother and more manageable. They help reduce the occurrence of knots and tangles in both wet and dry hair, making combing easier. Additionally, these compounds offer resistance to frizz, providing a sleek and shiny appearance to the hair. Moreover, polyquaternium compounds contribute to the suppleness of hair by improving its elasticity and reducing hair breakage. They are commonly used in shampoos, conditioners, body washes, and face washes to enhance their overall performance. The cosmetic industry's increasing focus on natural sources and biodegradable raw materials has led to an increased interest in polyquaternium compounds derived from renewable resources.

For instance, some companies have explored the use of raw materials such as white beet molasses from the sugar industry to produce biodegradable polyquaternium compounds. Polyquaternium compounds' efficacy in hair care products has made them a popular choice among consumers. They offer various benefits, including managing frizz, improving combability, and providing resistance to hair damage. As a result, cosmetic companies continue to invest in research and development to create innovative hair care products using these compounds. In conclusion, the use of polyquaternium compounds in the cosmetic industry is on the rise due to their unique properties and benefits for hair care products. Their ability to provide an anti-static effect, manageability, resistance to frizz, and reduce hair breakage makes them a valuable addition to various hair care products. Furthermore, the increasing focus on natural and biodegradable raw materials has led to the exploration of renewable sources for producing these compounds.

Market Segmentation

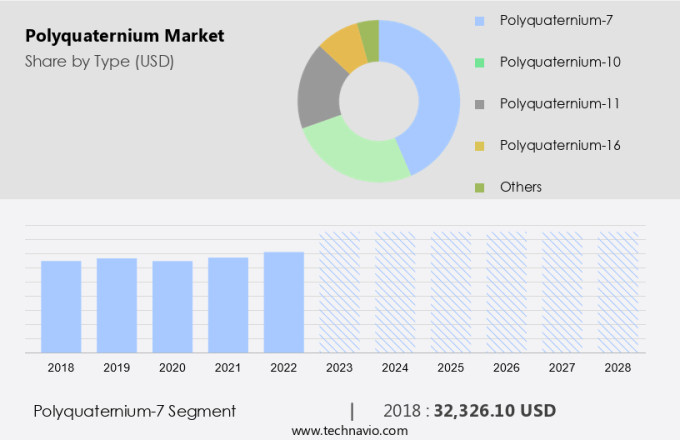

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Polyquaternium-7

- Polyquaternium-10

- Polyquaternium-11

- Polyquaternium-16

- Others

- Application

- Personal care and cosmetics

- Home and fabric care

- Industrial

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

The polyquaternium-7 segment is estimated to witness significant growth during the forecast period. The market encompasses a significant segment with polyquaternium-7 as a key player, renowned for its diverse applications in personal care products. BASF SE's SALCARE SUPER 7 AT 1, a conditioning polymer comprised of polyquaternium-7, is widely adopted due to its advantageous properties. This colorless to slightly yellowish polymer enhances the texture and feel of personal care formulations, making it a preferred choice across various applications. In the realm of baby care and cleansing products, polyquaternium-7 offers gentle conditioning, ensuring the tender skin remains soft and hydrated. Ecotoxicity is a critical concern in the market, with a focus on the impact on aquatic organisms.

Originating from the sugar industry, raw materials like white beet molasses are increasingly being used to produce biodegradable polymers, including polyquaternium-7. The green industry's focus on sustainability and eco-friendly practices has boosted the demand for such biodegradable ingredients. As a result, the market is expected to grow, with an increasing number of applications in hair care formulations. Polyquaternium-7's versatility and beneficial properties make it a popular choice in the personal care industry. Hence, such factors are fuelling the growth of this segment during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Polyquaternium-7 segment accounted for USD 32,326.10 in 2018 and showed a gradual increase during the forecast period.

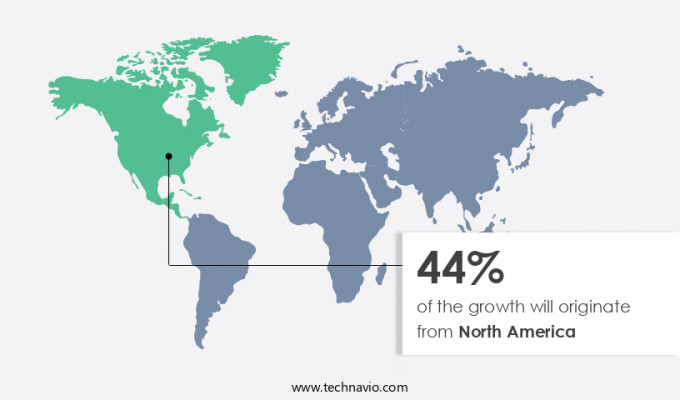

Regional Insights

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market for polyquaternium compounds in hair care products is witnessing significant expansion due to the rising consumer trend toward natural and high-performing personal care items. In response to this demand, leading cosmetic companies, such as Ashland, based in the United States, are introducing product lines that prioritize natural ingredients. For instance, Ashland's new The Natural Line highlights the use of easily identifiable, natural ingredients, as denoted by their names and International Nomenclature of Cosmetic Ingredients (INCI) descriptions. This focus on transparency and consumer trust aligns with the growing preference for clean and natural beauty products. As a result, manufacturers are increasingly incorporating natural and sustainable ingredients into their formulations, driving the growth of the market in North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased sales of cosmetic and personal care products is the key driver of the market. The market is witnessing notable expansion due to the increasing sales of cosmetics and personal care products. This trend is reflected in the financial reports of major industry players. Widely employed for its conditioning and film-forming properties, polyquaternium is a vital component in various cosmetic applications. Its ability to provide an anti-static effect, enhance combability, and improve the appearance of both wet hair and dry hair makes it an indispensable ingredient in the industry. The continuous growth in sales signifies the burgeoning market for superior cosmetic components, further boosting the market potential for polyquaternium.

Market Trends

New personal care ingredient launches is the upcoming trend in the market. The market is experiencing notable expansion due to the increasing demand for plant-based, eco-friendly raw materials in the green industry. One such promising development is the utilization of white beet molasses as a sustainable source for cationic polymers (CPs) in hair care formulations. These biodegradable CPs derived from white beet molasses offer several advantages, including improved conditioning and manageability of hair. BASF SE, a leading player in the market, recently introduced an innovative CP derived from this renewable resource. This new ingredient caters to the growing consumer preference for natural and sustainable personal care products. By employing white beet molasses as a raw material, BASF SE's CP effectively addresses the environmental concerns associated with traditional synthetic CPs. The introduction of CPs derived from renewable sources, such as white beet molasses, is a significant development that addresses both environmental concerns and consumer preferences. BASF SE's recent launch of a CP formulated from white beet molasses is a testament to this trend and is expected to drive market growth.

Market Challenge

Stringent regulations is a key challenge affecting the market growth. The market encounters regulatory hurdles due to stringent guidelines aimed at ensuring consumer safety and environmental protection. Quaternium-15, a formaldehyde-releasing chemical used in some polyquaternium formulations, is a significant concern due to its potential health risks. This chemical, which can cause skin toxicity and allergic reactions, is subject to strict regulations. The global market for emulsion polymers, specifically polyquats, used in the cosmetics industry for their anti-static effect, hair manageability, and ability to make wet and dry hair smoother hair, faces regulatory challenges.

Shiny hair is another desirable attribute, making these compounds essential in the personal care industry. Despite these challenges, the market continues to grow due to the demand for suppleness and resistance to hair breakage. Manufacturers are continually researching and developing alternative quaternium compounds to address regulatory concerns and meet consumer demands.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ashland Inc: The company offers Polyquaternium products like Gafquat 755 N, Gafquat 440, and Gafquat HS-100 for conditioning and styling in personal care formulations.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF

- Carillon Green

- Chemical Bull Pvt. Ltd.

- Clariant International Ltd

- Croda International Plc

- Dadia Chemicals Industries

- Dow Inc.

- Guangzhou Tinci Advanced Materials Co. Ltd.

- Innospec Inc.

- KCI Manufacturing Ltd.

- Making Cosmetics Inc.

- Nouryon Chemicals Holding B.V.

- Sigma Aldrich Chemicals Pvt Ltd

- Sihauli Chemicals Pvt. Ltd.

- Stepan Co.

- Sugam Chemicals

- The Lubrizol Corp.

- Trulux Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyquaternium compounds, a type of cationic polymers or polyquats, have gained significant attention in the cosmetic industry due to their unique properties. These compounds are widely used in hair care formulations, including shampoos and conditioners, to provide various benefits such as anti-static effect, manageability, and resistance to frizz and hair breakage. The raw materials for producing polyquaternium compounds can originate from natural sources like white beet molasses in the sugar industry or synthetic materials. The efficacy of these compounds is attributed to their ability to bind to hair fibers and impart smoother, manageable hair, and shinier hair. They are also used in body wash and face wash for their suppleness benefits.

The green industry is increasingly focusing on the use of biodegradable and plant-based raw materials for the production of these compounds, aligning with the growing demand for eco-friendly products. Despite their benefits, there are concerns regarding the ecotoxicity of certain polyquaternium compounds, particularly when it comes to their impact on aquatic organisms. Regulatory reviews are ongoing to assess the toxicity of these compounds and identify those of low concern. Freshwater green microalgae, such as Raphidocelis subcapitata, are being explored for toxicity mitigation through algal agglomeration and the use of humic acid. Cationic polymers of concern, including cationic polyquaternium, have a charge density and molecular weight that influence their behavior in biological cell membranes and their sorption and bioavailability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2024-2028 |

USD 33.88 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 44% |

|

Key countries |

US, China, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ashland Inc., BASF, Carillon Green, Chemical Bull Pvt. Ltd., Clariant International Ltd, Croda International Plc, Dadia Chemicals Industries, Dow Inc., Guangzhou Tinci Advanced Materials Co. Ltd., Innospec Inc., KCI Manufacturing Ltd., Making Cosmetics Inc., Nouryon Chemicals Holding B.V., Sigma Aldrich Chemicals Pvt Ltd, Sihauli Chemicals Pvt. Ltd., Stepan Co., Sugam Chemicals, The Lubrizol Corp., and Trulux Pty Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch