Home Renovation Market Size 2025-2029

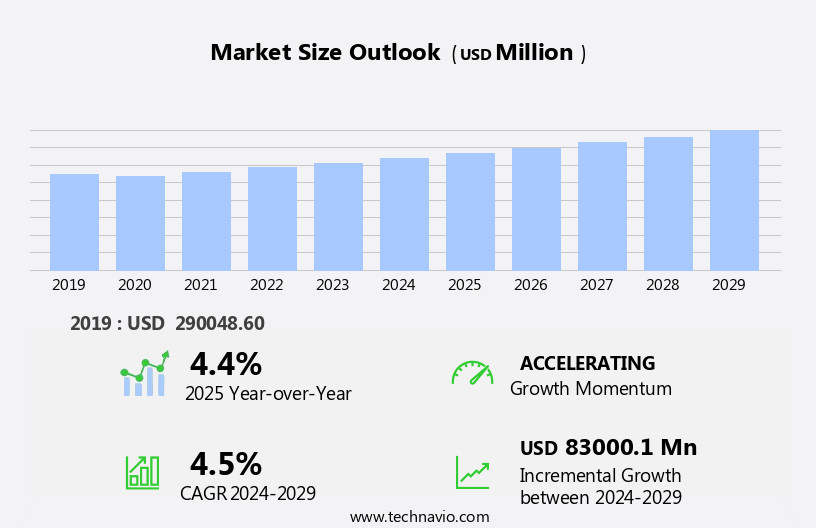

The home renovation market size is forecast to increase by USD 83 billion at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the global trend of rapid urbanization and the increasing focus on enhancing living spaces through technology. One of the most notable trends shaping this market is the adoption of Artificial Intelligence (AI) in home improvement projects. This technological advancement offers numerous benefits, including energy efficiency, personalized living experiences, and improved home security. However, the market faces a major challenge In the form of a shortage of skilled labor, which can lead to project delays and increased costs for homeowners. To capitalize on this market opportunity, companies must focus on innovative solutions that address the labor shortage, such as pre-fabricated renovation kits or partnerships with local training programs. This market continues to experience steady growth, driven by the desire for modern living standards, improved environmental performance, and the integration of smart home technologies.

- Additionally, investing in AI-powered tools and services can provide a competitive edge, enabling companies to offer more efficient and personalized renovation services to meet the evolving demands of consumers. Overall, the market presents a promising landscape for growth, with opportunities for companies that can effectively navigate the challenges and leverage technological advancements to meet the needs of the urbanizing population.

What will be the Size of the Home Renovation Market during the forecast period?

- The residential remodeling market encompasses various activities repairing broken structures, and weather sealing. Sustainable trends, such as the use of green remodeling products and sustainable building materials, are gaining traction as consumers become increasingly environmentally aware and conscious of their carbon footprints. New trends In the market include the adoption of 3D rendering software for virtual home design, structural glazing for enhanced temperature control, and the integration of solar panels for energy efficiency.

- Economic slowdowns and reduced disposable income have led to project budgets being carefully considered, resulting in increased focus on labor costs and supply chain disruptions. Old buildings are being repurposed and renovated, with a focus on preserving their historical character while incorporating modern amenities. New flooring, lighting systems, insulating glass, and electrical & insulation upgrades are popular choices for homeowners seeking to enhance their living spaces. Government incentives and homeowner budgets are also driving the market, with a particular emphasis on energy-efficient windows and green buildings. Despite these trends, the market faces challenges, including labor shortages and rising material costs, which can impact construction expenditure.

- The novel coronavirus pandemic has also disrupted the supply chain, leading to delays and increased costs for many projects. Overall, the residential remodeling market is expected to continue growing, driven by a combination of consumer demand and government incentives, as well as advancements in technology and sustainable building materials.

How is this Home Renovation Industry segmented?

The home renovation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Professional renovation

- Do-It-Yourself (DIY) renovation

- Application

- Kitchen renovation

- Bathroom renovation

- Exterior renovation

- Bedroom renovation

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

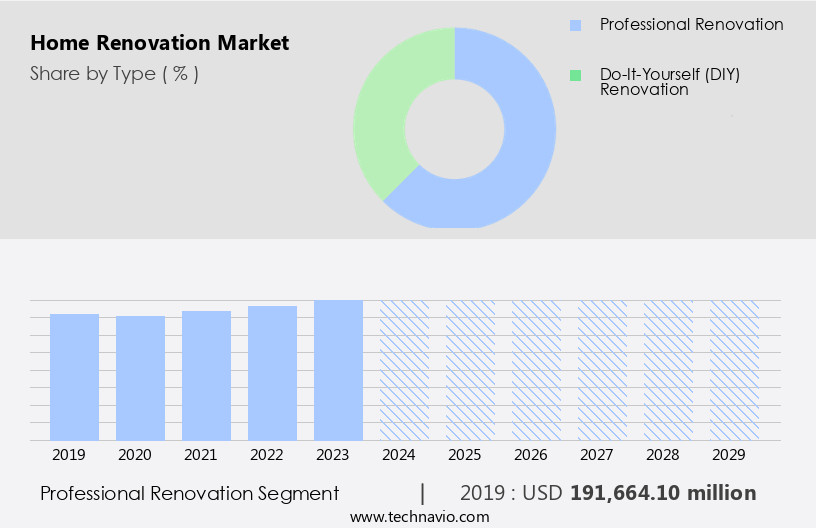

By Type Insights

The professional renovation segment is estimated to witness significant growth during the forecast period.

Professional home renovation services offer homeowners customized solutions for complex projects, ensuring high-quality results that meet specific aesthetic and functional requirements. These services encompass a range of tasks, from structural changes to intricate design solutions, executed with precision and care. Key features include specialized skills, custom design solutions, time efficiency, and regulatory compliance. Professionals manage tasks such as HVAC upgrades, electrical rewiring, plumbing system improvements, and energy efficiency upgrades using sustainable materials and modern home design trends. Safety enhancements and smart home technology installations are also common, along with home renovation inspiration and remodeling project planning. Renovation financing and home design software are utilized for budgeting and timeline management.

Green building certifications and sustainable living solutions are increasingly popular, with a focus on eco-friendly home upgrades, modern home renovations, and sustainable renovations. Homeowners can personalize spaces with energy-efficient home improvements and energy-saving home upgrades, while ensuring compliance with building codes and obtaining necessary permits. Home security systems and home automation solutions provide added convenience and peace of mind.

Get a glance at the market report of share of various segments Request Free Sample

The professional renovation segment was valued at USD 191.66 billion in 2019 and showed a gradual increase during the forecast period.

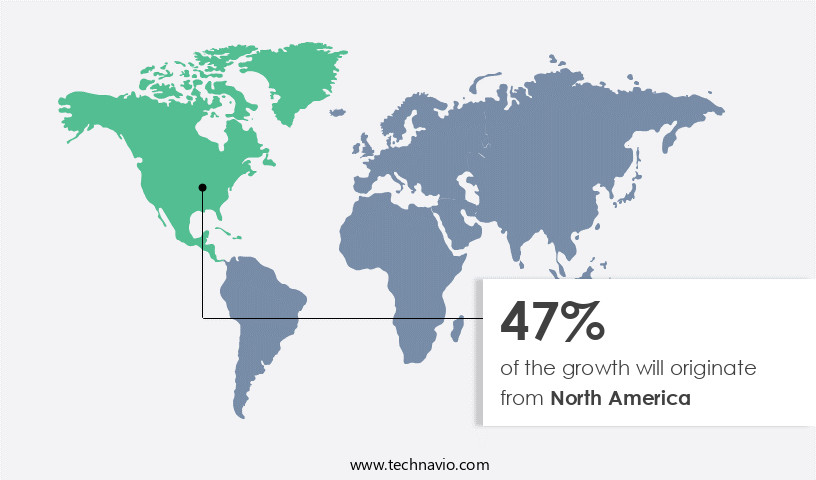

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is witnessing considerable growth, fueled by urbanization, increasing disposable income, and aging housing infrastructure. Urban populations in Canada and the US reached 82% and 83%, respectively, in 2023, leading to a heightened demand for home improvements in densely populated areas. Economic factors, such as a GDP per capita of USD 53,430, also contribute to the market's growth. Homeowners are investing in various projects, including kitchen remodels, bathroom upgrades, energy efficiency upgrades, and adding space. Green building practices, modern home design, and sustainable renovations are popular trends. Homeowners are also seeking safety enhancements, home automation, and smart home technology.

Home renovation permits, remodeling contractors, and financing options are readily available. Homeowners are personalizing spaces with eco-friendly home upgrades, energy-efficient windows, and energy-saving home improvements. The construction industry outlook remains positive, with a focus on sustainable building materials, universal design, and building codes. Homeowners are also considering home security systems and home insurance. Home renovation inspiration is abundant, with numerous home design trends and professional services available. Despite production halts due to the pandemic, the market is expected to recover and continue growing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Home Renovation Industry?

- Rapid urbanization is the key driver of the market. The market is experiencing significant growth due to the increasing urban population. According to the World Bank, by 2024, approximately 56% of the world's population, which was 4.4 billion people, resided in cities. This trend is projected to continue, with the urban population expected to more than double its current size by 2050, at which point nearly 70% of people will live in cities. This shift toward urban living has led to a heightened demand for improved living conditions and modernized housing infrastructure.

- Homeowners and renters alike are seeking to enhance their urban dwellings through renovations that increase functionality, comfort, and aesthetic appeal. The need for efficient and comfortable living spaces is increasingly important as cities expand and populations grow. This trend is expected to continue driving the market. This substantial increase in disposable income has led to a growing interest in home renovations among Indian homeowners. The demand for modern, energy-efficient systems and smart home solutions is on the rise, as homeowners look to improve their living standards and adopt contemporary design trends. Similarly, in Brazil, household per capita income increased by 11.5% in 2023, reaching a record high of approximately USD373, as reported by the Brazilian Institute of Geography and Statistics (IBGE). This increase in disposable income is encouraging Brazilian homeowners to invest in home improvements.

What are the market trends shaping the Home Renovation Industry?

- Focus on AI-powered home improvement is the upcoming market trend. The market is witnessing the integration of artificial intelligence (AI) technology to improve customer experiences and streamline home improvement processes. An illustrative instance of this trend is the launch of Mylow, an AI-driven virtual advisor by Lowe's on March 5, 2025. Collaboratively developed with OpenAI, Mylow utilizes the industry expertise of Lowe's to deliver real-time project guidance, product recommendations, and instructional advice to customers.

- Mylow offers clear, conversational responses to a broad spectrum of home improvement queries, encompassing topics from gardening to energy-efficient appliance selection. This virtual assistant not only assists customers in identifying appropriate products according to their budget and location but also elevates the overall customer support experience. These trends are particularly evident in cities with high population densities and limited available land for new construction. In summary, rapid urbanization is a key driver in the global home renovation market, influencing the demand for improved living conditions, sustainable solutions, and space-efficient designs. As urban populations continue to grow, the need for modernized and efficient housing infrastructure will remain a critical factor in shaping the future of home renovations.

What challenges does the Home Renovation Industry face during its growth?

- Shortage of skilled labor is a key challenge affecting the industry growth. The market encounters a substantial challenge with the persistent shortage of skilled labor. This issue is most evident among qualified contractors, electricians, and plumbers, leading to project delays and increased labor costs. According to industry reports, approximately 30% of union electricians are nearing retirement age, further exacerbating the labor shortage.

- As experienced electricians retire, the pool of available workers capable of handling complex renovation projects decreases. This labor shortage significantly impacts the efficiency and affordability of home renovation projects, making it a critical concern for the industry. Moreover, the limited availability of skilled workers can result in higher labor costs, as contractors and tradespeople are able to command higher wages due to the supply-demand imbalance. In summary, the skilled labor shortage is a significant challenge faced by the global home renovation market. The impending retirement of a large portion of the workforce, combined with increasing demand for skilled trades, is creating a critical gap in the availability of qualified contractors, electricians, and plumbers. This shortage is resulting in project delays and rising labor costs, impacting the efficiency and affordability of home renovation projects. Addressing this challenge will require concerted efforts to attract and train new talent in these essential trades.

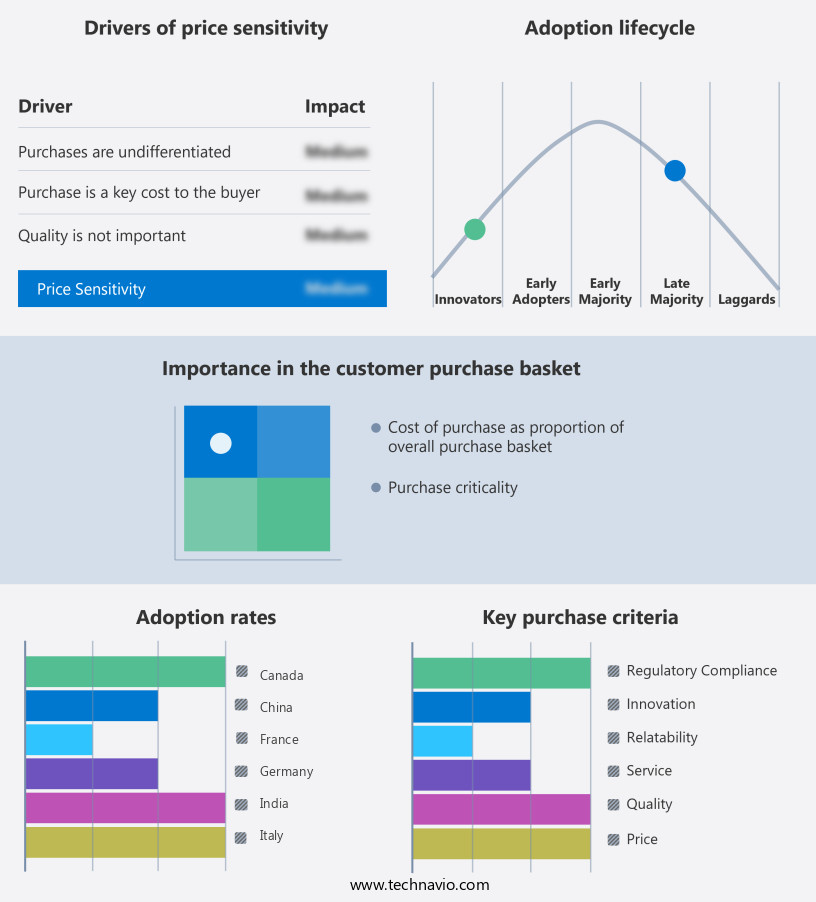

Exclusive Customer Landscape

The home renovation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home renovation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home renovation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- American Exteriors Inc.

- AWI Licensing LLC

- Crane Renovation Group

- Henkel AG and Co. KGaA

- JELD WEN Holding Inc.

- Kohler Co.

- Lowes Co. Inc.

- Masco Corp.

- Mr. Handyman

- Neil Kelly Inc.

- NIPSEA Group

- Owens Corning

- Pella Corp.

- PPG Industries Inc.

- Refresh Renovations

- The Home Depot Inc.

- The Sherwin Williams Co.

- USA Home Remodeling Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth as property owners seek to enhance the value and appeal of their residences. Home improvement projects, driven by factors such as home equity and personal preferences, have become increasingly popular. This trend is evident In the increasing demand for full-scale capacity renovations, energy efficiency upgrades, and green building solutions. DIY home improvement projects have gained traction in recent years, with many homeowners opting to take on smaller renovations themselves. However, for larger-scale projects, remodeling contractors remain a preferred choice due to their expertise and resources. Homeowners are also turning to home renovation inspiration from various sources to fuel their creativity and inform their decisions.

Adding space to a home through renovations is a common goal for many property owners. Home renovation permits are necessary to ensure that all construction adheres to building codes and regulations. Safety enhancements, such as home security systems and home automation, are also becoming increasingly popular as homeowners prioritize the well-being of their families and the protection of their investments. The construction industry outlook remains positive, with smart home technology and sustainable building practices leading the way. Energy efficiency upgrades, such as energy-efficient windows and appliances, are a priority for homeowners seeking to reduce their carbon footprint and save on energy costs.

Modern home design trends favor eco-friendly and sustainable home upgrades, with a focus on personalizing spaces and creating functional, aesthetically pleasing living environments. Renovation budgets vary widely depending on the scope of the project and the preferences of the homeowner. Affordable home upgrades, such as universal design features and energy-saving home improvements, offer significant value for those on a tighter budget. Eco-conscious home renovations are also gaining popularity, with many homeowners seeking to minimize their environmental impact and reduce their long-term costs. Home renovation trends favor sustainable living solutions, with a focus on green building materials and practices. Building codes and regulations continue to evolve to reflect these trends, with many jurisdictions offering incentives for homeowners who choose to adopt sustainable building practices.

Home design software and home automation services are also becoming essential tools for homeowners seeking to plan and execute their renovation projects efficiently and effectively. The home improvement financing landscape offers a range of options for homeowners, from traditional loans and lines of credit to innovative solutions such as home equity loans and renovation financing. Home improvement cost remains a significant consideration for many homeowners, with a focus on maximizing the return on investment and minimizing the disruption to their daily lives. In summary, the market is driven by a diverse range of factors, from personal preferences and home equity to energy efficiency and sustainability. The market is characterized by a strong focus on innovation, efficiency, and sustainability, with a growing emphasis on green building practices and smart home technology. Homeowners are seeking to create functional, aesthetically pleasing living environments that meet their unique needs and preferences, while minimizing their environmental impact and maximizing their investment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 83. billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Germany, Canada, China, France, Japan, UK, India, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.