Portable Pressure Washers Market Size 2024-2028

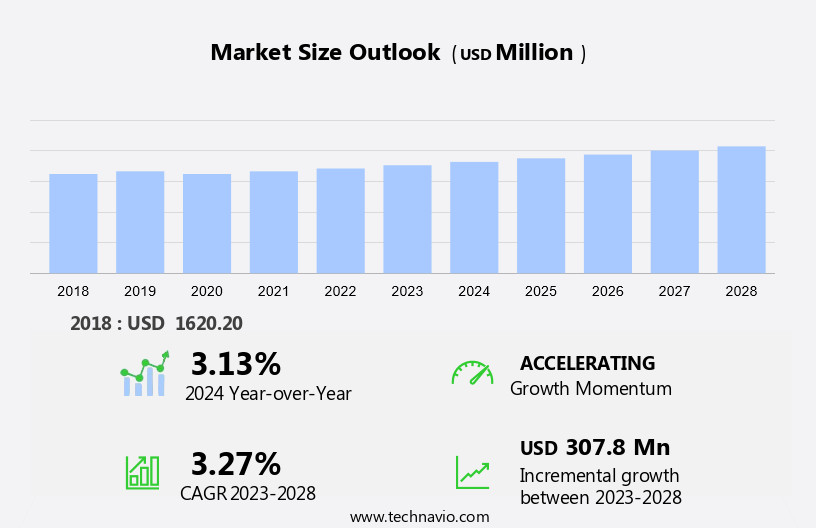

The portable pressure washers market size is forecast to increase by USD 307.8 million at a CAGR of 3.27% between 2023 and 2028.

- The portable pressure washer market is experiencing significant growth due to several key trends. Firstly, there is a rising consumer awareness of the importance of maintaining cleanliness and hygiene in both residential and commercial settings. This has led to an increase in demand for portable pressure washers, which offer the convenience of being easily transportable and versatile, alongside a growing interest in outdoor furniture and motor vehicles, as people seek more efficient and convenient solutions for both leisure and maintenance activities. Additionally, advancements in technology have resulted in more efficient and effective pressure washing equipment, making it an attractive option for consumers. However, the high cost of pressure washing equipment remains a challenge for some consumers, limiting the market's growth potential. Despite this, the market is expected to continue expanding as more consumers recognize the benefits of portable pressure washers for maintaining their properties and ensuring a cleaner environment.

What will be the Size of the Portable Pressure Washers Market During the Forecast Period?

- The portable pressure washer market experiences continuous growth due to the increasing demand for efficient and convenient cleaning solutions across various industries. Construction sites, municipalities, and urban areas are primary consumers, utilizing these devices for removing dust, dirt, debris, and grime buildup from surfaces. Non-portable pressure washers, while effective, are often bulky and immobile, making portable alternatives increasingly popular. HVAC coils and heat transfer systems benefit significantly from regular cleaning, enhancing system efficiency and reducing energy consumption. Environmental concerns drive the market towards more eco-friendly cleaning solutions and equipment with longer lifespans. Safety remains a priority, with users encouraged to follow safety tips such as proper storage, after-use care, and regular inspections.

- Portability, user-friendly designs, and safety features continue to shape the market's direction. Nozzle selection, after-sales service, and user manuals are essential considerations for consumers. Proper use, including safe distance and the application of cleaning solutions, ensures optimal performance and minimal repairs or replacements. The market is seeing growth as they are increasingly used to clean bicycles, remove dirt from concrete surfaces, and restore the appearance of facades with ease and efficiency.

How is this Portable Pressure Washers Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Electric

- Engine-driven

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Distribution Channel Insights

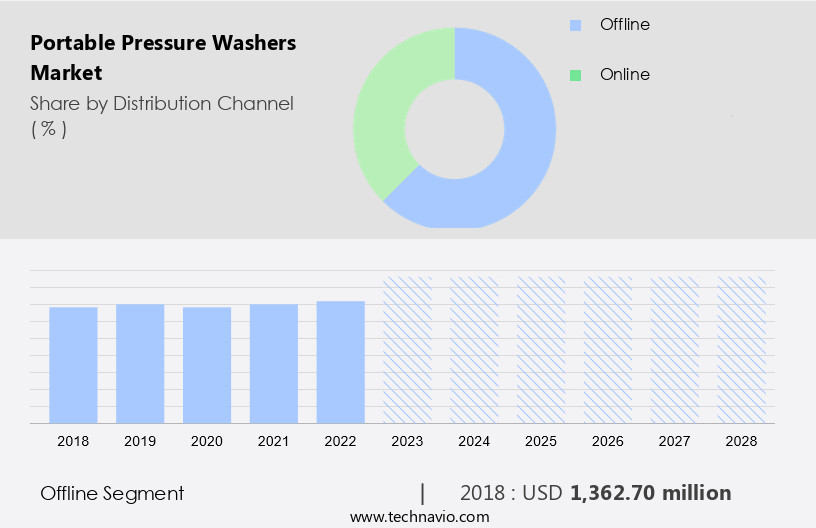

- The offline segment is estimated to witness significant growth during the forecast period.

The market caters to various industries, including Construction, Municipal, Urbanization, and HVAC, among others. These machines are essential for maintaining cleanliness in diverse applications, such as degreasing, descaling, and spraying surfaces. Portable pressure washers offer user-friendly, versatile, and cost-effective maintenance solutions for HVAC coils, HVAC systems, and indoor environments. They help eliminate grime buildup, improve heat transfer capabilities, and enhance energy efficiency. However, environmental concerns, such as energy consumption and equipment life, are crucial factors influencing market growth. Regular inspections, proper storage, and safety tips are essential for ensuring the longevity and optimal performance of these machines.

Portable pressure washers are also effective in removing dust, dirt, debris, mold, bacteria, and allergens, contributing to better indoor air quality and overall health. The market caters to a wide range of customers, including HVAC professionals, property managers, and DIY-savvy homeowners. companies are focusing on implementing marketing strategies, such as strategic alliances with industrial machinery retail chains and local retail entities, to boost sales In the offline distribution channel.

Get a glance at the Portable Pressure Washers Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 1.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

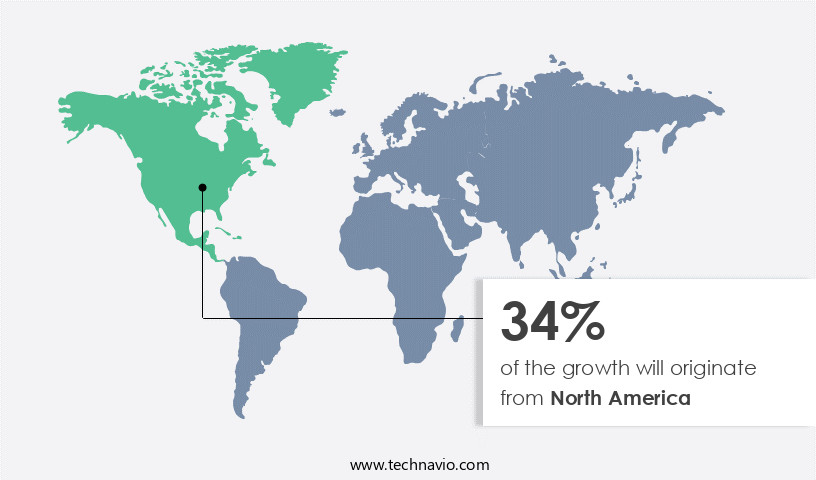

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is currently leading due to the growing gardening industry and increasing demand for user-friendly, environmentally conscious products. Companies, such as Snow Joe, are addressing customer needs by introducing versatile portable pressure washers. These innovative devices effectively remove various types of grime, including road tar, tree sap, insect splats, grease deposits, heavy mildew, oil and rust stains, caked-on mud, and other stubborn yard and garden debris. Additionally, these pressure washers offer cost-effective maintenance, with easy repairs, replacements, and after-use care. They are also lightweight and portable, making them suitable for various applications, such as floor cleaning, car washing, gardening, pool hygiene, and vehicle cleaning.

Proper storage and regular inspections are essential for ensuring equipment longevity and safety. Safety tips, including the use of protective gear and maintaining a safe distance, are crucial when operating these machines. The market is expected to grow steadily, with an increasing focus on system efficiency, heat transfer capabilities, and energy consumption. The market also caters to commercial, industrial, and residential sectors, offering gas and electric models for diverse applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Portable Pressure Washers Industry?

Rising consumer awareness of hygiene is the key driver of the market.

- Portable pressure washers have gained significant popularity in addressing hygiene concerns and maintaining cleanliness in various sectors, including construction, municipal, and urbanization. These devices effectively remove dust, dirt, debris, and grime buildup from surfaces, enhancing system efficiency and improving indoor air quality. Environmental concerns have led to the increased use of pressure washers for cleaning HVAC coils, reducing energy consumption and prolonging equipment life. They are versatile and cost-effective for maintenance, repairs, and replacements. They are user-friendly and can be used for various applications such as cleaning HVAC coils, car washing, floor cleaning, gardening, pool hygiene, and vehicle cleaning.

- After-use care, regular inspections, proper storage, and safety tips are essential for maintaining the longevity and performance of these machines. The presence of harmful contaminants, mold, bacteria, and allergens in unclean environments can lead to health issues, particularly for vulnerable populations. They offer a cost-effective and efficient solution for addressing these concerns. For property managers, HVAC professionals, and DIY-savvy homeowners, portable pressure washers are valuable mechanical gadgets for managing energy bills and repair costs and ensuring clean air and energy efficiency In the indoor environment. They are available in both gas and electric models, catering to commercial, industrial, and residential applications.

What are the market trends shaping the Portable Pressure Washers Industry?

Advancement in technology and increased product efficiency is the upcoming market trend.

- The market is witnessing significant advancements as companies prioritize technology and fuel to address regulatory concerns. Electric pressure washers are gaining popularity due to their lightweight design, smaller size, environmental friendliness, reduced maintenance requirements, and ease of use. companies are also introducing versatile products that can clean various surfaces using different nozzles. These machines offer system efficiency by removing dust, dirt, debris, and grime buildup, enhancing indoor air quality, and eliminating harmful contaminants like mold, bacteria, and allergens.

- Electric pressure washers are cost-effective for maintenance, with fewer repair and replacement needs compared to non-portable models. Proper after-use care, regular inspections, and proper storage are essential for maintaining equipment life. Safety tips, such as wearing protective gear and maintaining a safe distance, should be followed during use. Portable pressure washers are suitable for various applications, including HVAC coil cleaning, floor cleaning, car washing, gardening, pool hygiene, and vehicle cleaning. By focusing on energy consumption, heat transfer capabilities, and user-friendliness, these machines contribute to energy efficiency and the reduction of energy bills.

What challenges does the Portable Pressure Washers Industry face during its growth?

The high cost of pressure washing equipment is a key challenge affecting the industry growth.

- Pressure washers are essential cleaning tools used in various industries, including Construction, Municipal, and Urbanization, for removing dust, dirt, debris, and grime buildup from surfaces. The market caters to diverse segments, including the Commercial, Industrial, and Residential sectors. The price range of pressure washers is broad, from affordable electric models to high-performance, engine-driven units. Despite the price drop over the years, the high cost of these machines may hinder market expansion, particularly in emerging markets. In some regions, manual car washing or labor-intensive methods may be more cost-effective than purchasing a pressure washer. Moreover, environmental concerns have emerged as a significant factor influencing the market.

- HVAC coils, which require regular cleaning for optimal system efficiency, are a significant application area for pressure washers. However, the use of these machines consumes energy and contributes to water usage, raising concerns about their environmental impact. Property managers, HVAC professionals, and DIY-savvy homeowners increasingly focus on cost-effective maintenance, repairs, and replacements. Portability, user-friendliness, versatility, and after-use care are essential factors in selecting pressure washers. Regular inspections, proper storage, safety tips, and protective gear are crucial for ensuring the longevity and safe operation of these machines. These washers can clean a range of surfaces, including air conditioners, HVAC coils, floors, vehicles, pools, and gardening equipment.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.R. North America, Inc

- Alfred Karcher SE and Co KG.

- ANDREAS STIHL AG and Co. KG

- ARPO BV

- Briggs and Stratton LLC

- Carigar Tools

- Caterpillar Inc.

- Cheston

- Deere and Co.

- FNA Group

- Generac Holdings Inc.

- Husqvarna AB

- Hyundai Heavy Industries Group

- Lokpal Industries

- Nilfisk AS

- Positec Tool Corp.

- Robert Bosch GmbH

- Snow Joe LLC

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of equipment designed to effectively clean various surfaces using high-pressure water streams. These devices offer several advantages over their non-portable counterparts, making them increasingly popular in various industries and applications. Urbanization and municipal projects have led to an increased focus on hygiene and environmental concerns. These washers play a crucial role in maintaining cleanliness in construction sites, ensuring that dust, dirt, debris, and other contaminants do not adversely impact the environment or the health of workers. HVAC coils are essential components in heating, ventilation, and air conditioning systems.

Moreover. regular cleaning of these coils using portable pressure washers can significantly enhance system efficiency and reduce energy consumption. The buildup of grime and debris on HVAC coils can hinder heat transfer capabilities, leading to increased energy bills and repair costs. Indoor air quality is another critical factor driving the demand for these washers. These devices can help eliminate harmful contaminants such as mold, bacteria, and allergens, ensuring clean air and a healthier indoor environment. These washers offer several benefits for HVAC professionals, property managers, and DIY-savvy homeowners. Their versatility and cost-effective maintenance make them an indispensable tool for regular inspections and after-use care.

Furthermore, proper storage and safety tips are essential to ensure the longevity and safe operation of these mechanical gadgets. The market is vast and diverse, catering to various industries and applications. Heavy industries rely on these devices for cleaning large surfaces, while HVAC professionals use them for maintaining system efficiency. Commercial and industrial applications require strong and durable pressure washers, while residential users prefer more user-friendly and cost-effective options. Portable pressure washers can be powered by gas or electricity, with each option offering unique advantages. Gas-powered models provide more power and mobility, while electric models offer lower emissions and ease of use.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market Growth 2024-2028 |

USD 307.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

US, Germany, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Portable Pressure Washers Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.