APAC Potato Protein Market Size 2024-2028

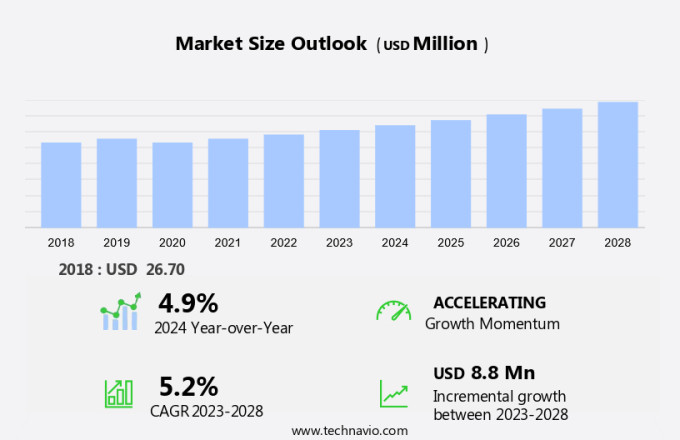

The APAC potato protein market size is forecast to increase by USD 8.8 million at a CAGR of 5.2% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for protein powders. This trend is driven by the growing health consciousness among consumers, particularly in urban areas, who are seeking high-protein diets for muscle gain and weight loss. Additionally, the rising popularity of e-commerce platforms for sales is providing a boost to market growth. However, the market faces challenges such as the risk and side effects of protein supplements, including gastrointestinal issues and kidney damage, which may hinder market growth. Consumers' increasing awareness of these risks and the availability of alternative protein sources may limit the market's expansion. Overall, the market presents significant opportunities for growth, but players must address consumer concerns and ensure product safety and quality to succeed.

What will be the size of the APAC Potato Protein Market during the forecast period?

- The potato protein market In the Asia-Pacific (APAC) region is experiencing significant growth due to the increasing demand for plant-based proteins and functional foods. It is extracted using techniques such as ion exchange and expanded bed absorption, which hydrolyze peptide chains to enhance functional abilities. The starch content of potatoes is a challenge in protein extraction, but advancements in technology have led to improved solubility and taste. Potato protein offers nutritional benefits, including fiber, vitamins, and organic acids, making it a popular alternative to traditional proteins like soy and egg. With a focus on clean-label products, the gluten-free and environmental sustainability attributes are also driving demand.

- Furthermore, the market is expanding into various applications, including sports nutrition, dietary supplements, and functional foods, as consumers seek nutrient-dense ingredients. Public funding and food technology innovations continue to fuel research and development In the market. The market is expected to grow further as health awareness and animal welfare concerns continue to shape consumer preferences.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Form Factor

- Powder

- Liquid

- Geography

- APAC

- China

- India

- Japan

- APAC

By Form Factor Insights

- The powder segment is estimated to witness significant growth during the forecast period.

Potato protein powder is a promising alternative In the plant-based protein industry, particularly In the APAC region. Its advantages include a high protein concentration, desirable amino acid profile, and low ash levels. Compared to soy protein concentrate, powder has higher levels of essential amino acids such as lysine, threonine, methionine, leucine, phenylalanine, and total essential amino acids. This makes it an effective source of protein for both animals and humans, supplying necessary amino acids for muscle growth and providing a sparing effect for optimal utilization. With the increasing trend towards plant-based diets, sustainable food consumption, and veganism, the demand is anticipated to increase. Its non-GMO, allergen-free, and sustainable production aligns with consumer preferences and industry trends. The powder segment is expected to dominate the market due to its versatility and ease of use in various food applications.

Get a glance at the market share of various segments Request Free Sample

The powder segment was valued at USD 17.10 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of APAC Potato Protein Market?

Growing demand for protein powders is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for plant-based protein sources. Extraction techniques such as ion exchange and expanded bed absorption are used to extract proteins from potato peels and pulp, resulting in high-quality concentrates. These proteins, which contain peptide chains with functional abilities, have a starch content that is lower than soy or egg proteins, making them a desirable option for those following plant-based diets or veganism. The nutritional benefits, including fiber, vitamins, organic acids, and essential amino acids, make it an attractive alternative to animal proteins. The protein supply from the plant-based protein industry is expected to increase, driven by biotechnological innovations and the development of soluble and stable formulations.

- Furthermore, the market is also being fueled by the growing awareness of sustainable food consumption and the environmental sustainability of production. Potato protein is used in various applications, including meat substitutes, animal feed, and as a sustainable alternative to meat analogues. Its emulsifying properties make it suitable for use in functional foods, sports nutrition, and dietary supplements. The amino acid profile is similar to that of animal protein, making it an excellent source of essential amino acids for feed efficiency. The market is expected to continue growing due to its numerous advantages, including its allergen-free, non-GMO, and gluten-free properties.

What are the market trends shaping the APAC Potato Protein Market?

Increasing popularity of e-commerce platforms for sales of potato protein is the upcoming trend In the market.

- The market is experiencing significant growth due to the increasing demand for plant-based protein sources In the region. Extraction techniques such as ion exchange and expanded bed absorption are used to extract potato proteins from peptide chains, which possess functional abilities and a desirable amino acid profile. The starch content in potatoes is minimized during the extraction process, enhancing the nutritional benefits of the protein. Functional foods, sports nutrition, and dietary supplements are key sectors driving the market's growth. Solubility, taste, and environmental sustainability are crucial factors influencing the preference for potato proteins over traditional animal proteins. Soluble formulations and stable formulations are gaining popularity due to their ease of use and long shelf life.

- In addition, plant-based protein sources, including potato protein, are increasingly being adopted due to ethical, health, and sustainability concerns. Veganism and plant-based diets are on the rise, leading to an increase in demand for alternative proteins. Biotechnological innovations In the plant protein sector are also contributing to the market's growth. Potato protein concentrates are used as meat substitutes, animal feed, and sustainable alternatives to animal protein. They have emulsifying properties and a high nutritional value, making them ideal for use in functional foods. The market is expected to grow due to its low cholesterol content, making it a popular choice for sports drinks and weight management supplements.

What challenges does APAC Potato Protein Market face during the growth?

Risk and side effects of protein supplements is a key challenge affecting the market growth.

- The market is witnessing significant growth due to the increasing demand for plant-based protein sources In the region. Extraction techniques such as Ion exchange and Expanded bed absorption are used to extract potato proteins from food crops, resulting in soluble and stable formulations. Hydrolyzing proteins leads to the formation of peptide chains, enhancing the functional abilities. Potato protein concentrates offer nutritional benefits, including fiber, vitamins, organic acids, and essential amino acids, making them suitable for use in functional foods, sports nutrition, and dietary supplements. The non-GMO, allergen-free, and gluten-free nature of potato proteins adds to their appeal.

- In addition, biotechnological innovations have led to the development of high-value-added products such as texturized potato protein, meat substitutes, and animal feed. The potato protein industry's sustainable food consumption trend aligns with ethical considerations, including veganism and plant-based diets. The amino acid profile of potato proteins is comparable to that of soy and egg proteins, making them a viable alternative In the plant protein sector. Potato protein's environmental sustainability, solubility, taste, and clean-label properties make it an attractive option for consumers seeking low cholesterol, weight management supplements, and muscle protein synthesis products. The European market for potato proteins is expanding, with companies like Solanic leading the way.

Exclusive APAC Potato Protein Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGRANA Beteiligungs AG

- Agridient BV

- AMINOLA BV

- Bioriginal Food and Science Corp.

- Colin Ingredients

- Cooperatie Koninklijke Cosun UA

- Creative Enzymes

- Eco Agri GmbH

- Emsland Starke GmbH

- Finnamyl Oy

- Kemin Industries Inc.

- KMC amba

- Mahalaxmi Agro

- Meelunie BV

- Nutragreenlife Biotechnology Co. Ltd.

- PEPEES SA

- PPZ SA

- Roquette Freres SA

- Royal Avebe

- Tereos Participations

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The potato protein market In the Asia Pacific (APAC) region is experiencing significant growth due to the increasing demand for plant-based protein sources. This trend is driven by various factors, including health awareness, ethical considerations, and sustainable food consumption. Plant-based proteins, such as potato protein, offer numerous benefits. They are rich in essential amino acids, fiber, vitamins, and minerals. The nutritional value of potato protein makes it an attractive alternative to animal-derived proteins, particularly for individuals following vegan or plant-based diets. The production of potato protein involves several extraction techniques, including ion exchange, expanded bed absorption, and hydrolyzing proteins.

In addition, these methods help to isolate and concentrate the peptide chains, which are then used to create functional abilities for various applications. The starch content of potatoes is a crucial factor In the production of potato protein. The process of extracting the protein from the potato involves removing the starch, leaving behind the protein-rich material. This material can then be further processed to create soluble and stable formulations. The functional abilities of potato protein make it an ideal ingredient for a wide range of applications. In the food industry, it is used as a meat substitute, an animal feed supplement, and a sustainable alternative to traditional protein sources.

Moreover, in the sports nutrition and dietary supplements sectors, potato protein is used to create high-value-added products, including protein concentrates and texturized protein. The plant-based protein industry is experiencing significant innovation, with biotechnological advances leading to the development of new and improved protein sources. Soluble and stable formulations of potato protein are being developed to improve its solubility, taste, and environmental sustainability. The growing demand for plant-based protein sources is also driving innovation In the food technology sector. Clean-label products, free from allergens and genetically modified organisms (GMOs), are becoming increasingly popular. Potato protein, as a non-GMO and allergen-free alternative, is well-positioned to meet this demand.

Furthermore, the market is expected to grow significantly In the coming years, driven by the increasing popularity of plant-based foods, health and well-being, and ethical and environmental considerations. The market is also being supported by public funding and innovation programs aimed at developing sustainable and high-value-added plant protein sources. Therefore, the market is experiencing significant growth due to the increasing demand for plant-based protein sources. The functional abilities, nutritional value, and sustainability of potato protein make it an attractive alternative to animal-derived proteins. The market is being driven by various factors, including health awareness, ethical considerations, and sustainable food consumption, and is expected to continue growing In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2024-2028 |

USD 8.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch