Poultry Eggs Market Size 2025-2029

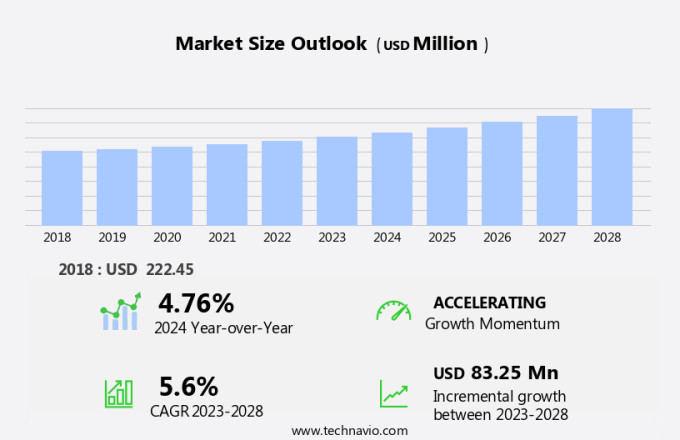

The poultry eggs market size is forecast to increase by USD 94.5 billion, at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing global consumption and production of eggs. This trend is driven by the rising demand for affordable and nutritious protein sources, and egg protein particularly in developing economies. Market players are responding to this demand by introducing new product innovations and strategic expansions. However, the market faces challenges from disease outbreaks in poultry, which can lead to significant production losses and increased costs. For instance, avian influenza outbreaks have caused significant disruptions in the poultry industry, resulting in production shortages and price volatility.

- Companies must invest in robust disease prevention and control measures to mitigate these risks and maintain a stable supply chain. Additionally, they must stay abreast of regulatory requirements and consumer preferences to remain competitive and capitalize on emerging opportunities.

What will be the Size of the Poultry Eggs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits a dynamic and ever-evolving landscape, shaped by various factors that continually influence its growth and development. The market encompasses a diverse range of products and applications, from dried eggs and egg weight to egg quality and food regulations. Egg weight and quality are crucial factors that drive market trends, with consumers increasingly seeking out specialty eggs such as free-range, organic chicken, and pasture-raised varieties. The focus on egg quality extends to egg breaking and grading, with stringent standards ensuring the highest possible albumen height, shell strength, and food safety. Manure management and disease control are essential aspects of poultry farming, with the industry continually exploring innovative solutions to minimize environmental impact and ensure the health and wellbeing of layer hens.

Feed formulations and feed conversion ratio play a significant role in optimizing egg production and reducing carbon footprint. Food regulations and consumer preferences continue to shape the market, with a growing emphasis on transparency and sustainability. Egg processing, packaging, and storage techniques have evolved to meet these demands, with liquid eggs and frozen eggs gaining popularity due to their extended shelf life and convenience. The supply chain is a critical component of the market, with efficient logistics and transportation systems ensuring the timely delivery of eggs to retail channels. Crack detection and egg grading technologies have streamlined the supply chain, ensuring the highest quality products reach consumers.

How is this Poultry Eggs Industry segmented?

The poultry eggs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Shell eggs

- Specialty eggs

- Processed egg products

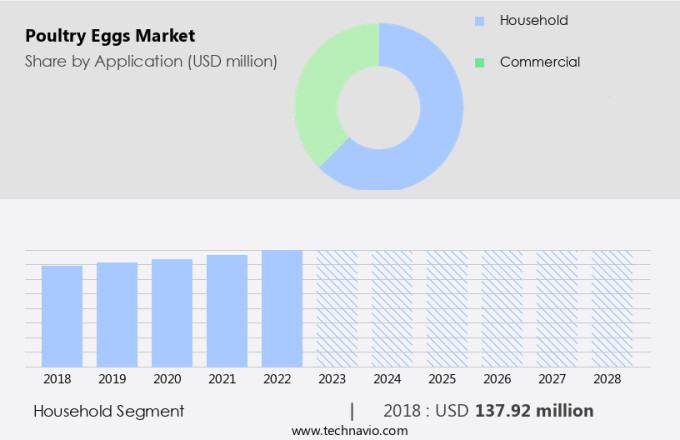

- Application

- Household

- Commercial

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- Australia

- China

- India

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The shell eggs segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including shell eggs and egg products. In 2024, the shell eggs segment, consisting of unprocessed and non-specialty eggs, holds a significant share. This growth can be attributed to the increasing demand for affordable protein sources, particularly in developing countries like India, China, Mexico, and Brazil. In 2023, global production and consumption of shell eggs reached record highs. Major producers include China, India, the US, Mexico, and Brazil. Japan, based on per-capita consumption in 2024, is among the leading consumers. Egg processing leads to the production of egg liquid, egg powder, and other egg products, catering to diverse industries.

Consumer preferences lean towards cage-free, pasture-raised, and organic eggs, driving market trends. Feed formulations, disease control, and manure management are crucial aspects of poultry farming. Egg size, color, and quality are essential factors influencing consumer choices. Food safety, salmonella control, and crack detection are critical considerations in the supply chain. Food regulations and environmental impact, including carbon footprint and waste management, are ongoing concerns. Specialty eggs, such as liquid, frozen, and dried eggs, cater to specific industries and consumer preferences. Overall, the market continues to evolve, responding to consumer demands and technological advancements.

The Shell eggs segment was valued at USD 174.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

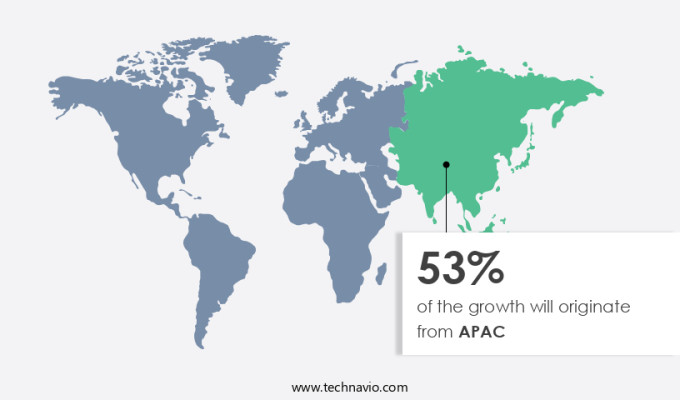

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing growth due to increasing consumer preference for healthier food options. China, Japan, and India are major markets for poultry egg consumption in the region. Major producers in APAC include China, India, Japan, and Indonesia. In 2024, China was the largest producer of poultry eggs, accounting for approximately one-third of global production. The negative publicity surrounding red meat consumption and ethical concerns regarding cattle and poultry farming have led to an increase in egg consumption in China. Eggs are a versatile and nutritious food source, with applications ranging from egg whites in baking to egg yolks in sauces and desserts.

Egg production methods include pasture-raised, cage-free, and conventional farming. Eggs undergo various processes such as liquidization, powdering, and packaging for retail sale. Egg quality is ensured through grading, crack detection, and food safety measures. The environmental impact of egg production is a concern, with focus on reducing carbon footprint and managing waste. Disease control and manure management are essential for maintaining egg production and hen health. Consumer preferences for organic, free-range, and specialty eggs continue to influence the market. The supply chain involves feed formulations, layer hen management, and retail channels. Food regulations play a crucial role in ensuring egg safety and quality.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global poultry eggs market size and forecast projects growth, driven by poultry eggs market trends 2025-2029. B2B egg supply solutions leverage smart egg production technologies for efficiency. Poultry eggs market growth opportunities 2025 include organic eggs for health-conscious consumers and eggs for foodservice, meeting demand. Egg supply chain software optimizes operations, while poultry eggs market competitive analysis highlights key producers. Sustainable egg production practices align with eco-friendly egg trends. Poultry eggs regulations 2025-2029 shapes egg demand in North America 2025. Cage-free egg solutions and premium egg market insights boost appeal. Eggs for baking industry and customized egg packaging target niches. Poultry eggs market challenges and solutions address supply, with direct procurement strategies for eggs and egg pricing strategy optimization enhancing profitability. Data-driven egg market analytics and free-range egg trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Poultry Eggs Industry?

- The increasing global demand and consumption for eggs, resulting in a rise in production, serve as the primary market drivers.

- The market has witnessed consistent growth in the last decade, fueled primarily by increasing per capita consumption in countries such as China, Japan, and the US. In the US, for instance, per capita egg consumption grew by 4.8% since 2000, reaching 278 eggs per year, according to the United Egg Producers. This growth can be attributed to the expanding population and the rising awareness of the nutritional benefits of protein consumption. Moreover, the poultry farming industry has responded by increasing production capacity to meet this demand. In 2024, the US produced approximately 93.1 billion eggs annually.

- The egg processing sector has also seen significant growth, with an emphasis on improving feed conversion ratios and waste management to minimize environmental impact. Egg products, including liquid, dried, and frozen, have gained popularity due to their versatility and convenience. Organic and free-range eggs are also in demand due to consumer preferences for sustainable and ethically produced food. Salmonella control measures are a critical concern for the industry, with strict regulations in place to ensure food safety. The environmental impact of poultry farming is under scrutiny, with a focus on reducing the carbon footprint through efficient farming practices and renewable energy sources.As the market continues to evolve, it is essential for stakeholders to stay informed about the latest trends, regulations, and best practices.

What are the market trends shaping the Poultry Eggs Industry?

- Market trends indicate a focus on strategic initiatives and new product launches by companies in the business sector. This approach is mandatory for market success and innovation.

- The market is experiencing significant growth due to increasing consumer preferences for various egg sizes and egg substitutes, as well as the rising demand for free-range eggs. Companies are responding to these trends by introducing new products and improving feed formulations for layer hens. The supply chain is also focusing on crack detection, egg grading, and food safety to meet the demands of consumers.

- In addition, frozen eggs are gaining popularity due to their extended shelf life and convenience. For instance, Cal-Maine Foods, Inc. Launched new egg products in September 2023, expanding their offerings and catering to diverse consumer needs. These strategies and new product launches are expected to drive the growth of the market.

What challenges does the Poultry Eggs Industry face during its growth?

- The poultry industry faces significant challenges from disease outbreaks, which pose a major threat to growth and sustainability.

- The market faces challenges due to disease outbreaks in poultry farms, which negatively impact animal health and lead to significant losses. These incidents disrupt the trade of livestock products and hinder sustained investments in production. Avian influenza, egg drop syndrome, and blackhead disease are some of the recent diseases that had global consequences, causing acute egg shortages and driving up egg prices. For instance, the Newcastle disease outbreak in Southern California resulted in the euthanization of approximately 54,000 birds, mostly chickens, to prevent the disease's spread. Ensuring egg quality and maintaining shell strength are crucial for producers to meet food regulations and consumer expectations.

- Specialty eggs, such as brown eggs and liquid eggs, cater to various market segments. Proper manure management and disease control measures are essential to prevent outbreaks and maintain a harmonious and immersive production environment. Additionally, albumen height is a critical factor in determining egg quality, as it impacts the overall appearance and functionality of the egg.

Exclusive Customer Landscape

The poultry eggs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the poultry eggs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, poultry eggs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avril SCA - The Matines brand showcases high-quality poultry eggs and egg products, distributed through Ovipac and 3 Valleys. Our offerings prioritize innovation and sustainability, enhancing market exposure while upholding industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avril SCA

- Cal Maine Foods Inc.

- Charoen Pokphand Foods PCL

- Granja Yabuta

- Hillandale Farms Inc.

- ISE FOODS Inc.

- Kazi Farms Group

- Noble Foods Ltd.

- Proteina Animal SA DE CV

- Rembrandt Foods

- Rose Acre Farms

- Suguna Foods Pvt. Ltd.

- Trillium Farm Holdings LLC

- Ukrlandfarming PLC

- Vencomatic Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Poultry Eggs Market

- In January 2024, Rose Acre Farms, a leading U.S. Egg producer, announced the launch of its new, cage-free egg production facility in Missouri. This expansion aimed to meet the growing demand for cage-free eggs and increase the company's production capacity by 25% (Rose Acre Farms Press Release, 2024).

- In March 2024, Hormel Foods Corporation, a major food processing company, entered into a strategic partnership with Cal-Maine Foods Inc., the largest egg producer in the U.S. The collaboration focused on co-manufacturing and marketing of value-added egg products (Hormel Foods Corporation Press Release, 2024).

- In May 2025, Noble Foods, a leading UK-based egg producer, completed the acquisition of a significant stake in Dutch egg company, De Hoogstraat Groep. This move expanded Noble Foods' European footprint and strengthened its position in The market (Noble Foods Press Release, 2025).

- In the same month, the European Union approved the use of a new vaccination program for poultry against avian influenza. The decision was expected to help prevent future outbreaks and maintain the stability of the European the market (European Commission Press Release, 2025).

Research Analyst Overview

- The market exhibits dynamic trends, with key indicators such as the Albumen Index and Haugh Unit influencing production and quality. Food processing technology advances, including freeze drying and spray drying, transform egg white protein into versatile ingredients for various industries. Boiled, scrambled, and fried eggs remain popular consumer choices, while baked goods and other food applications continue to expand. Egg washing machines, cold chain logistics, and egg grading machines ensure food safety and quality, aligning with consumer expectations. Fair trade and animal welfare standards gain traction, driving sustainable egg production. Nutritional value, particularly dietary protein content, fuels innovation in egg packaging materials and shell strength testers.

- Innovations in incubator technology and local sourcing enhance egg production efficiency. Consumer education on health benefits, such as the role of egg yolk lecithin in brain development, further boosts demand. Egg candling and organic certification maintain transparency and trust in the market. Overall, the market adapts to evolving consumer preferences and technological advancements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Poultry Eggs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 94.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

China, US, India, Indonesia, Brazil, Canada, Japan, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Poultry Eggs Market Research and Growth Report?

- CAGR of the Poultry Eggs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the poultry eggs market growth of industry companies

We can help! Our analysts can customize this poultry eggs market research report to meet your requirements.